Canada looks to recover amid mixed signals

Like a sleeping giant, the Canadian E&P industry has taken a while to awaken from a deep slumber. In fact, it was December 2016 when it first began to stir from the malaise that has afflicted it for the last four years.

But now there is some hope. It is muted at best, and a wounded oil patch is guarded and wary. There remains much uncertainty in the political arena, as looming climate change policies at the federal level have created controversy, driving some provinces, like Alberta, to move ahead with their own models, and others, like Saskatchewan, to reject the federal program outright.

In early 2017, the industry’s unwillingness to commit to a possible turnaround was well-founded. It took most of last year for oil prices to slowly climb back up to the C$70 level, while gas prices remained more or less flat until an upward spurt in early 2018. But there were enough encouraging signs to prompt a significant uptick in land sale spending last year, which bodes well for short-term development, and drilling totals, which recovered to levels similar to 2015, but still just over half of the number drilled in 2014.

ECONOMICS

Despite the upswing in oil prices, Canadian producers are still often selling their oil at a significant discount between the Western Canada Select benchmark price and West Texas Intermediate, due primarily to ongoing market access constraints. While the outlook for oil prices remains bullish, due to last November’s agreement between OPEC, Russia and others to maintain production cuts through 2018, some prognosticators are far more bearish on natural gas prices, despite the price spike early this year.

The Canadian dollar continues to hover in the 80-cent range compared to the American greenback, slightly higher than the 76/77-cent level that it was at a year ago. The low Canadian dollar benefits the export-driven oil and gas industry, which still ships substantial volumes south to U.S. customers. But as oil patch fortunes rise, so does the Canadian dollar, which negates some of the benefits accrued from improved pricing.

PIPELINES

The outlook on the pipeline front also has improved substantially over the past year, with TransCanada’s Keystone XL pipeline no longer mired in the political quagmire of the former U.S. administration. And in Canada, the National Energy Board (NEB) ruled in December that Kinder Morgan could bypass excessive constraints placed on the company’s Trans Mountain expansion process by a small British Columbia city that opposes the development, and has held off granting necessary municipal permits.

Still, Keystone XL must sort out the recent approval that it secured from Nebraska regulators last November, the last remaining U.S. hurdle the project faced. TransCanada continues to assess the ruling and has requested clarification from the Nebraska Public Service Commission. However, its detractors are expected to challenge the ruling in the courts. And, the company didn’t help its own cause, when the nearby Keystone pipeline experienced a 5,000-bbl leak in mid-November, in Marshall County, South Dakota.

And despite its recent favorable ruling from the NEB, Kinder Morgan still faces a court challenge, seemingly endless delays, and rampant political opposition in British Columbia. The company recently announced that it now expects the expansion to begin service in late 2020, a year later than originally scheduled.

The extent of the opposition to the expansion project in British Columbia has prompted the NEB to roll out a dedicated process to resolve disputes over permits required from the province and municipalities. The issue stems from a condition that the NEB placed on the approval, which states the company must obtain all necessary permits before it can proceed, even though the federal approval would not normally supersede any other by-laws or other requirements at the provincial level. Under the new process, each request will be reviewed, and a decision rendered, within three to five weeks.

POLITICS

Politics continue to cloud the horizon for producers. The federal government’s climate change policy states that every province may implement its own emissions reduction plan, provided that it meets the targets set forth by the feds.

In Alberta, the provincial government has announced plans to reduce methane emissions in the province by 45% by 2025 (using 2012 levels as the baseline); cap oil sands emissions at 100 megatonnes of carbon dioxide; and implement a large-emitters carbon tax, and generic provincial carbon tax (already in place), while committing hundreds of millions to R&D and energy efficiency initiatives, and C$440 million to an oil sands innovation fund. The innovations fund is supposed to help companies increase production while reducing emissions.

Suncor Energy already has announced plans to add two cogeneration units to its oil sands base plant, designed to power its operations and produce some 700 megawatts of surplus electricity, which can, in turn, be supplied to the Alberta electricity grid. This also is considered an emissions reduction benefit under the provincial government’s climate change plan.

The ongoing negotiations over the North American Free Trade Agreement are a further source of uncertainty for the Canadian market, as both administrations often seem more intent on posturing than negotiating in good faith. Hope remains that a deal can be reached without creating further economic turmoil.

CAPEX

Uncertainty is always unwelcome when companies are setting capital expenditure budgets, and so far, there is little or no indication that spending will increase measurably in 2018.

Suncor has announced a capital program of C$4.5–5.0 billion, down some $750 million from 2017 spending. However, the company expects to see about a 10% increase in production, to 740,000 to 780,000 boed.

Canadian Natural Resources Limited (CNRL) plans to spend about C$4.3 billion this year, down $500 million from 2017, but like Suncor, the firm also expects to see a bump in production. CNRL says it could see output as high as 1.17 million boed, a 17% increase.

Husky Energy projects that it will spend C$2.9–3.1 billion this year, compared to C$2.9 billion in 2017. However, Husky notes that last year’s total includes its $700-million acquisition of the Superior refinery, indicating an increase of almost $900 million in its 2018 capital program.

Crescent Point Energy Corp. will increase spending in 2018 by almost 16%, to C$1.8 billion, versus last year’s C$1.55 billion. The company expects production to increase 5%. And Encana Corporation also pegged its capital expenditures at C$1.8 billion, virtually unchanged from last year’s totals. The company expects a production increase, but by 25% to 35%.

M&A ACTIVITY

The slow recovery in 2017 also meant that some companies were better positioned sooner than others, and some that had waited patiently for purchase opportunities were rewarded. The result was just under $42 billion worth of mergers and acquisitions (M&A) activity in Canada last year, highlighted by two massive oil sands deals worth a combined $29 billion. In 2016, there was just under $14 billion in M&A activity, according to CanOils data.

Both deals occurred in March 2017. On March 29, Cenovus Energy acquired a 50% interest in the Foster Creek Christina Lake oil sands partnerships from ConocoPhillips. The deal also included some Deep Basin natural gas assets. And on March 9, CNRL picked up a 60% stake in the Athabasca Oil Sands Partnership from Royal Dutch Shell.

Looking ahead, Calgary-based Sayer Securities is predicting that M&A totals will be in the C$15 billion-to-C$24 billion range, with significantly less focus on oil sands assets, but more corporate deals.

OIL SANDS

Despite the (often negative) international attention that Alberta’s oil sands draw, they remain a significant oil deposit on the globe, and a massive driver of the Canadian economy. Targeted by well-meaning, if misinformed environmentalists, and jet-setting celebrities alike, they generate massive wealth, growth, employment, and economic security.

Alberta government stats indicate that despite the prolonged economic slump, oil sands producers will likely average more than 3.0 MMbpd of production in 2018 for the first time. Highlighted by first oil this January at the 194,000-bpd Fort Hills project, the year has kicked off on a positive note. Fort Hills is operated by Suncor (53.06%).

CNRL also expects to see a 30,000-to-40,000-bpd production increase at its Horizon mining project, due to the application of technology that it picked up last March in its acquisition of the Athabasca Oil Sands Project.

Regardless, the rising star continues to be smaller, steam-assisted gravity drainage (SAGD) projects, that produce less, but also represent much smaller environmental footprints and legacy clean-up costs. Technology continues to evolve quickly, and innovations like solvent-assisted SAGD, non-condensable gas con-injection, and others demonstrate the industry’s ability to adapt and overcome.

DRILLING/PRODUCTION

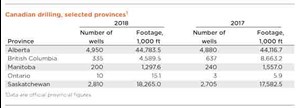

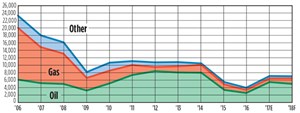

Drilling numbers recovered to modest levels last year, but in comparison to 2016’s dismal numbers, the turnaround has been substantial. According to Daily Oil Bulletin records, of the total 7,091 wells drilled last year that they recorded, more than 74%, or 5,250, are estimated to be oil wells, compared to about 69% of the total in 2016. Overall, drilling rose almost 75%, from 4,057 wells drilled in 2016, and over 32% higher than the 5,259 drilled in 2015. Exploratory drilling increased to 305 wells in 2017, or 4.3%, compared to 257 the year before.

In Alberta, drilling increased 86% in 2016, with 3,708 wells drilled, compared to 1,990 the year before. In Saskatchewan, drilling was up some 55%, with 2,519 wells drilled, versus 1,623 in 2016. In British Columbia, operators drilled 609 wells in 2017, up 75% from 348 wells in 2016. And in Manitoba, drilling rose almost 200%, to 240 wells in 2017.

For the year ahead, the Canadian Association of Oilwell Drilling Contractors is predicting a modest recovery, calling for a 1.8% increase in drilling activity, to 6,138 wells drilled, with an average rig fleet utilization of just 23%, still far better than 2016’s utilization rate of 17%. Meanwhile, the Petroleum Services Association of Canada is more bullish, calling for a total of 7,900 wells drilled, an increase of 4.6%.

World Oil’s survey results show a more modest outlook, with drilling forecast to be up by just under 2% across Canada, led by 4,950 wells to be drilled in Alberta (up 1.8%), according to the Alberta Energy Regulator. Saskatchewan’s provincial officials are predicting 2,810 wells (up 3.9%), and Manitoba’s government is calling for a 17% drop to 200 wells. However, the forecast from the Canadian Association of Petroleum Producers is more bearish, showing a 5.6% decline nationally, to 6,800 wells. Officially, World Oil is calling for a minor dip in drilling, from 7,200 wells in 2017 to 7,000 this year.

CAPP said that crude and condensate production averaged 4.10 MMbpd during 2017, up 5.8% from 2016’s level. The number of active oil-producing wells was 77,064, of which 92.4% were on artificial lift. Natural gas output averaged 15.5 Bcfd, and the number of active gas wells was 163,536. Oil reserves stand at 169.4 Bbbl. Gas reserves total 71.0 Tcf.

LAND SALES

Land sales saw a big recovery in 2017. Companies spent C$793.3 million in western Canada, up 265% from the $217.5 million collected in 2016. Despite the turnaround, it is still far from the record high of $5 billion in 2008.

Alberta once again drew most of the action, with $556.4 million spent, representing a 274% increase from $148.6 million in 2016, which was the lowest total recorded in Alberta in more than 20 years.

British Columbia also rebounded significantly, pulling in $173.3 million, up 1,040% over last year’s all-time low of $15.2 million.

Saskatchewan saw a more modest increase, to $62.8 million, increasing just over 17% from $53.5 million in 2016. And Manitoba took in $1.46 million last year, compared to $262,000 last year. Land inventories are a consistent indicator of future drilling activity, so this increase in land sale volumes is a welcome portent that better times may lie ahead. ![]()

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- Executive viewpoint: TRRC opinion: Special interest groups are killing jobs to save their own (February 2024)

- Management issues: New U.S. House Speaker is strong supporter of oil and gas industry (December 2023)

- Management issues- Dallas Fed: Activity sees modest growth; outlook improves, but cost increases continue (October 2023)

- Oil and gas in the Capitals (October 2023)

- Canada's upstream soldiers on despite governmental interference (September 2023)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)