Industry at a glance

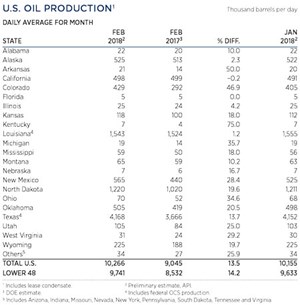

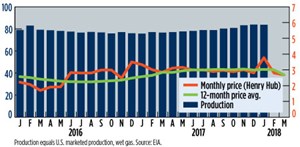

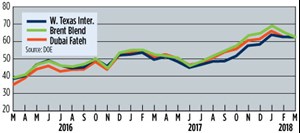

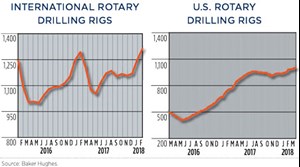

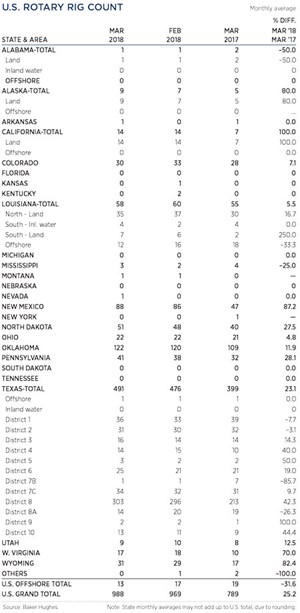

In March, downward pressure on oil prices was applied by consecutive gains in U.S. inventory, capped by a weekly surge of 5.32 MMbbl in late March. European stockpiles also increased. U.S. production rose 1.1%, to 10.27 MMbpd, while setbacks in equity markets and the threat of a global trade war also weighed on markets. These factors were offset by a ballistic missile attack by Yemen on Saudi Arabia, and changes in U.S. policy toward Iran that could remove a significant amount of oil from the market. In spite of the volatile combination, crude prices remained surprisingly resilient, with WTI unchanged at $62.57/bbl and Brent averaging $66.32/bbl (+1.3%). Drilling in the U.S. increased 2%, up 19 rigs to average 988 units in March. International activity totaled 1,310 in February, a gain of 6%.

- U.S. producing gas wells increase despite low prices (February 2024)

- U.S. drilling: More of the same expected (February 2024)

- U.S. oil and natural gas production hits record highs (February 2024)

- Management issues- Dallas Fed: Activity sees modest growth; outlook improves, but cost increases continue (October 2023)

- U.S. upstream muddles along, with an eye toward 2024 (September 2023)

- Machine learning-assisted induced seismicity characterization of the Ellenburger formation, Midland basin (August 2023)