Shaletech: Argentina

Argentina’s largely undeveloped Vaca Muerta shale is said to conservatively hold 16 Bbbl of oil, but it’s the 308 Tcf of technically recoverable gas that is bringing out the pro-business disposition of the country’s nascent bureaucracy.

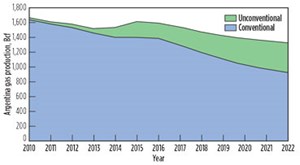

To reverse a steady decline in natural gas production, and reduce budget-busting imports, the two-year-old administration of President Mauricio Macri has unwrapped an incentive gift bag that includes a new round of price subsidies, proposed infrastructure enhancements and labor union concessions, all aimed at reducing the costs and increasing the margins for unconventional wells, Fig. 1. Since early this year, a who’s who of major international oil companies and domestic players—most in partnership with state-owned and publicly-traded YPF SA—have announced new investments of nearly $5 billion, earmarked for developing the organic-rich Vaca Muerta, concentrated mostly in the windswept Neuquén basin of west-central Argentina.

“In terms of IOC investments, MOUs (memorandums of understanding), and promises of investments, it has definitely stepped up this year,” says IHS Energy Senior Consultant Caldwell Bailey. “The rock is definitely there, but they need to get to a tipping point of committed investment and feel they will get a return.”

Despite the increased fiscal commitments, Wood Mackenzie estimates the tab for full-play development will require at least 15 times the current annual capital expenditure levels. Up to now, high well costs—compounded by powerful unions, logistical restrictions and tight currency controls—have stymied the transition from pilot projects to full-scale development of the Vaca Muerta (Spanish for “Dead Cow”). The myriad issues are reflected, in part, by the latest available Baker Hughes tally, which counts an average 65 active rigs onshore Argentina in July, down from 72 rigs year-over-year.

The Macri government is determined to turn the tables and exploit what the U.S. Energy Information Administration (EIA) estimates are the world’s second-largest shale gas reserves. Along with the Vaca Muerta, the EIA’s updated 2015 assessment shows Argentina’s untested unconventional prospects, including the underlying Los Molles black shale, containing a cumulative 801.5 Tcf of technically recoverable wet gas and 27 Bbbl of tight oil.

In hopes of shoring up shale gas production, earlier this year the federal government enacted Resolution 46, a subsidized pricing schedule that provides a $7.50/MMbtu price beginning in 2018, declining sequentially to a minimum $6/MMbtu in 2021. Propped-up oil prices, meanwhile, have held this year between $53/bbl and $55/bbl.

“Honestly, we are more concerned about natural gas prices than oil prices,” Minister of Energy and Mining Juan Jose Aranguren told S&P Global Platts on May 19. “Of course, we are producing oil, but you need to take into account that our energy mix in Argentina is dominated by natural gas—54% of our primary energy mix is gas.”

SETTING THE STAGE

Owing to current operator commitments—bolstered by the new price and union agreements—Vaca Muerta production is predicted to increase 43% this year, to 77,000 boed, and top 113,000 boed by 2018, doubling 2016 output, according to Wood Mackenzie. Results of the “Vaca Muerta Development Study,” which was released in May, cover seven of the most advanced unconventional developments in the remote Neuquén basin, which together comprise only 8% of the play’s total aerial reach, the consultancy said. “Since January 2017, new pilot and development agreements in the Vaca Muerta have been announced with increased frequency, demonstrating a significant uptick in interest in the play, especially in the gas window,” the study concluded.

In line with expectations, grand poobah YPF, which sets the tone for the broader industry trajectory, said the 22 new wells connected to production in the second quarter contributed to net shale production reaching a new company high of 35,300 boed (67,400 boed, gross). Notably, in its second-quarter earnings report, YPF cited 12 wells in its pacesetting Loma Campana shale asset, which were completed with 4,921-ft laterals and 18 frac stages, put online at an average total cost of $8.2 million/well.

Taking a page out of the U.S. shale playbook, CFO Daniel Gonzalez said YPF is testing longer laterals with advanced geosteering. “We have started to test longer-lateral-length wells and have excluded, from the well cost comparison, those that have a design with longer laterals than our 1,500-m (4,921-ft) type wells. Additionally, we have drilled, in El Orejano, a well with a longest lateral length in Vaca Muerta of more than 2,700 m (8,858 ft).”

“We have tested geosteering technology while drilling two wells in Loma Campana. This will allow us to drill and navigate within the best quality zone of the rock, improving productivity and lowering the risk of casing information during the stimulation process,” the former interim CEO told investors on Aug. 9.

Singularly, and with joint venture partners, YPF says it plans to further de-risk the Vaca Muerta through no less than 10 new pilot projects to be launched this year. The company has said it intends to invest as much as $4 billion/year by 2020, in order to develop the Vaca Muerta.

“Our cost structure is evolving well below inflation, and we are yet to see additional cost reductions derived from rebidding of contracts at lower rates and derived also from the full application of savings coming from the amended labor agreements. In addition, the recent improvements in our completion works in Vaca Muerta should result in further cost reductions and efficiencies, in line with this objective,” Gonzalez said.

RAMPING UP

Providing incoming operators can replicate YPF’s “cost achievements,” Wood Mackenzie Latin American Research Analyst Elena Nikolova said Argentina players conceivably could unlock scale comparable with their U.S. shale counterparts. “Vaca Muerta operators are still in the early stages of the learning curve. Production gains driven by drilling speed and completion intensity in the U.S. will materialize in Argentina, as more and more operators enter the play,” she said.

The rush to get an early seat in the aspiring super play intensified this year, adding to hefty previous investments by early-mover heavyweights like ExxonMobil, Chevron and other supermajors, many of which also were slow getting out of the gate the juggernaut of U.S. shale.

Most recently, YPF on July 18 joined Total, Wintershall, and Pan American Energy (a unit of BP Plc) in a $1.15-billion joint venture, targeting Vaca Muerta gas development, according to Reuters. As part of the agreement, Total (41% interest) will operate the eastern segment of the recently-split Aguada Pichana area of the Neuquén basin, while Pan American, with a 45% stake, will operate the western part. No information on near-term activity and planned well count was made available.

Meanwhile, Germany’s Wintershall said in mid-August that it is drilling the second of three wells planned, as part of a horizontal pilot program in its wholly-controlled Bandurria Norte Block. The wells are targeting the Vaca Muerta at depths between 8,858 and 9,843 ft. The Vaca Muerta early-mover also has wrapped up a four-well pilot project launched in 2015, in the nearby Aguada Federal Block (Fig. 2), which it operates with minority partner Gas y Petróleo del Neuquén S.A. (GyP). Production results from both the Bandurria and Aquada pilots are expected in 2018, a spokesperson said.

Also in August, Wintershall and 50/50 partner GeoPark Ltd. unveiled a light oil discovery in the CN-V Block of the Neuquén basin’s Mendoza province, with “upside potential in the developing Vaca Muerta unconventional play.” GeoPark, as operator, drilled and completed the discovery well in the Grupo Neuquen formation at 5,500 ft, TD, where it identified 15 different potential reservoir sands. Initial production rates were not disclosed.

Elsewhere, in July, operator Pan American Energy—with partners Madalena Energy Inc. of Calgary and GyP—completed the first Vaca Muerta horizontal re-entry at the Coiron Amargo Sur Este (CASE) asset, at an estimated total well cost of $8.72 million. Drilled to roughly 13,780 ft, including a 3,281-ft lateral, the re-entry was completed without a rig and with 37 frac stages, consuming approximately 6.5 million lb of proppant and 90,000 bbl of frac fluid, and testing an average 430 bopd through four weeks, according to Madalena. The re-entry “tested the Vaca Muerta shale structured concept, offering new insights into the play extension within the fracture trend,” Madalena said in a release.

In March, home-grown Tecpetrol said it will direct $2.3 billion to increase Vaca Muerta gas production. The domestic operator plans to drill 150 shale wells over the next three years in the Neuquén’s Fortin de Piedra Block, where it is eying production of up to 494 MMcfgd by 2019.

YPF’s 2017 Vaca Muerta pilot projects also include operating agreements with Schlumberger Production Management (SPM) and Shell, comprising an aggregate $690-million investment.

On April 12, YPF and SPM announced plans to combine for a multi-well Vaca Muerta pilot project in the Bandurria Sur Block. The agreement calls for a phased $390-million investment by SPM, for a 49% stake in the pilot project, which will include 26 Vaca Muerta pilot wells, assorted technical studies and new infrastructure.

In February, Shell paid $300 million for a 50% interest in a pilot project underway in the Bajada de Añelo field. Meanwhile, in April, Shell commissioned its 10,000-bpd Vaca Muerta oil and gas treatment plant to handle production from its wholly-operated Sierras Blancas, Cruz de Lorena, and Coiron Amargo Sur Oeste Blocks in the Neuquén basin.

ExxonMobil, through its XTO Energy subsidiary, holds varying interests in roughly 900,000 net acres of Vaca Muerta pay, where it has said upwards of $10 billion could be invested over the next three decades. Though no specifics have been made available, XTO says it is drilling ahead on a five-well pilot project on the combined Bajo del Choique/La Invernada Block in the Neuquén basin. In a related development, the governor of Neuquén province told S&P Global Platts on April 18 that the supermajor was poised to begin full-scale gas production on its Los Toldos I Sur Block this year.

In its Feb. 23 Form 10-K filing, Chevron reported 2016 net production of 26,000 boed from its non-operated and operated concessions in Argentina. The company participated in the drilling of 58 Vaca Muerta wells last year in the YPF-operated Loma Campana asset, and said the joint drilling program will continue this year, though no specifics were disclosed.

INFRASTRUCTURE WOES

Before Argentina’s shale sector can rightfully hope to reach the lofty scale that Nikolova envisions, it must first rectify what everyone agrees is a sorely lacking infrastructure network, Fig. 3. “The logistics piece is huge, and I’m not sure how much groundwork they’ve laid to alleviate the potential bottlenecks, should or when they crop up,” Bailey from IHS said.

The federal transportation ministry took note late last year, releasing plans for a reported $1.2-billion makeover of an aging cargo railway, that would link the Bahía Blanca port in Buenos Aires province to the Neuquén basin. No anticipated timeline has been released for completion of the proposed Roca Cargas railway rehabilitation project, which would be used to transport proppant and other oilfield payload.

The project, which reportedly entails the renovation of nearly 808 mi of an existing rail line, as well as the laying of new track, would go a long way in reducing Vaca Muerta’s well costs, says Pablo Bizzotto, executive manager of YPF’s unconventional resources unit. “It’s much needed. It will lower logistical costs for things that should not be transported via truck, like sand and tubes,” he told Reuters on June 23.

Lowering logistical costs would help drive the long-awaited acceleration of Vaca Muerta gas production, suggests Kietil Solbraekke, head of Rystad Energy’s Rio de Janeiro office. “Many turn their eyes to Argentina and Vaca Muerta, but lack of equipment and infrastructure (i.e., roads, rails and pipe for water, in particular) means that the resources in Vaca Muerta will take time to be developed. It will certainly not cover the local gap in Argentina, and not in the region within any reasonable timeframe either,” Solbraekke wrote in a May 10 release.

Historically, when it was one of the few players in the game, YPF was entirely responsible for building infrastructure—a responsibility that is now being shared, says CFO Gonzalez. “I think that some of that infrastructure, going forward, is going to be shared by many of us, which makes it more economic and, obviously, less heavy on us in terms of our capex deployment. We’re working with some of the players that have announced the largest investments in Vaca Muerta to share some of that infrastructure going forward.”

“There aren’t any significant midstream players in Argentina. I think there’s plenty of room for some of them to appear, and to start consolidating natural gas infrastructure,” he told analysts. ![]()

- Coiled tubing drilling’s role in the energy transition (March 2024)

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- The reserves replacement dilemma: Can intelligent digital technologies fill the supply gap? (March 2024)

- What's new in production (February 2024)

- Using data to create new completion efficiencies (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)