Shaletech: Niobrara Shale

As the smattering of firmly entrenched operators makes concessions to deal with a ceaseless urban backlash, leaseholds in the sparsely populated peripheries of the Denver-Julesburg (DJ) basin’s Niobrara shale play have become especially prized commodities these days.

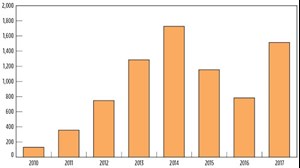

Nevertheless, citing wellhead break-even costs as low as $26/bbl, Rystad Energy Partner Espen Erlingsen estimates that operators will spud 1,522 horizontal Niobrara wells in 2017 (Fig. 1), compared to only 800 wells drilled last year. To that end, the September rig count jumped nearly 75%, averaging 28 active rigs, compared to a 16-rig average in September 2016, according to Baker Hughes. Most of those active rigs are drilling increasingly longer laterals, as established operators continue to block up acreage through swaps and outright acquisitions.

The self-sourcing unit of alternating chalk and shale, the triple-bench Niobrara is recognized most widely as the source rock for the prolific Wattenberg and Silo fields of Colorado and Wyoming, respectively. There, the Niobrara is often stacked with the underlying Codell, a highly prospective target in its own right.

The overwhelming majority of activity remains concentrated in, and around, the nearly 48-year-old Wattenberg of Weld County, Colo. A considerable swath of the prolific field also is ground zero for the simmering clash between operators and neighborhoods along the populous Front Range, which reached a boiling point on April 17 with a deadly house explosion in Firestone, 30 mi north of Denver. Allegedly linked to a severed flow line on an Anadarko Petroleum Corp. legacy gas well, the explosion prompted the Colorado Oil and Gas Conservation Commission (COGC) to set a late-June deadline for operators to provide test documentation on all flowlines located near structures.

In response, Anadarko says it pressure-tested more than 4,000 active flowlines “with a 99.6% success rate,” and has permanently disconnected 3,600 1-in. return lines from its Colorado vertical wells. Premier leaseholder Noble Energy Inc., for another, has “successfully completed approximately 7,500 flowline integrity tests,” says Vice President of Operations Gary Willingham.

Meanwhile, Colorado Gov. John Hickenlooper’s (Democrat) Aug. 22 call for a sweeping regulatory review, ostensibly related mostly to flowline mapping and testing, has raised the specter of increased restrictions in what is an already tightly controlled operating environment. Whether increasing setbacks will figure in any revised regulatory regime remains to be seen. “We don’t anticipate, because he (the governor) has not talked about it publicly, and I am not aware of any comments he’s made, or others have made, related to setbacks being a part of that agenda,” said Anadarko President and CEO Robert A. Walker

PRODUCTION ON RISE

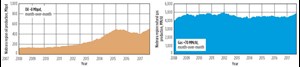

Regulatory concerns notwithstanding, the U.S. Energy Information Administration (EIA) guesstimates the Niobrara region will deliver an average 511,000 bopd and 4.911 Bcfgd in October (Fig. 2), up month-over-month by 13,000 bopd and 77 MMcfd. A considerable chunk of 2017’s production will flow from Weld County, where as of September, operators had delivered an aggregate 53,767,446 bbl of oil and 347,614,706 Mcf of gas, according to the COGC. In 2016, the state agency pegged Weld County as producing a total of 103,992,369 bbl of oil and 641,698,398 Mcf of gas.

Immediately across the border, Laramie County, to a much lesser degree, is to Wyoming what Weld County is to Colorado. According to the Wyoming Oil and Gas Conservation Commission (WOGCC), the home base of Silo field produced a cumulative 4,919,883 bbl of oil and 3,973,682 Mcf of gas in 2016. Between January and August, Laramie operators in 2017 have delivered an aggregate 3,434,474 bbl of oil and 3,121,650 Mcf of gas.

Meanwhile, a dissection of WOGCC data shows the state’s chief regulator issuing roughly 1,593 new horizontal Niobrara or Codell drilling permits between January and Sept. 13, compared to an estimated 1,762 for the like period of 2016. Most of the new well authorizations were issued to either Anadarko or EOG Resources Inc., which is credited with kick-starting the Niobrara unconventional play in 2009 with its celebrated Jake well.

Today, EOG controls 81,000 net acres in Laramie County, where it primarily targets the Codell. In the second quarter, EOG completed 10 wells at average treated lateral lengths of 9,000 ft, with 30-day initial production rates averaging 885 boed/well. The Houston operator, which said all of its second-quarter completions met its $4.5-million total well-cost target for 9,000-ft laterals, plans to complete 15 wells throughout 2017, down from 30 completions in 2016.

STILL TOP TIER

Fresh off record quarterly production attributed largely to an enhanced completion strategy, Noble Energy puts the 352,000 net acres that it controls in the Wattenberg near the top of its 2017 drilling program. After consolidating its leasehold with a number of asset swaps, the company was running two rigs as of August, with early 2017 guidance calling for the drilling of around 150 Niobrara wells, representing two-thirds of Noble’s planned U.S. onshore well count. The 29 wells drilled in the second quarter averaged lateral lengths of 9,220 ft.

“Our onshore drilling priority will be the high-return DJ and Delaware (Permian) basin programs that are in sync with the Noble Midstream position,” CEO David Stover told analysts on Aug. 3.

During the second quarter, the 33 wells put online in the principal Wells Ranch and East Pony assets helped boost average DJ production to a record 107,000 boed, up 13% from the prior quarter. Though lateral lengths across its leasehold average 8,400 ft, the 11 wells commencing production in Wells Ranch were drilled with average 10,500-ft laterals and completed with proppant loadings of 1,800 lb/lateral ft.

Half of the wells planned this year will be drilled in Wells Ranch, with the remainder slated for the East Pony and Mustang areas. Noble’s midstream entity is building out central gathering facilities and associated gathering lines to support its Mustang development.

As for Anadarko, post-explosion shut-ins are blamed for a second-quarter production decline to 226,000 boed (76,000 bopd) from 243,000 boed produced in the like 2016 period. On the flip side, after being down to a single rig a year ago within its core, 350,000-net-acre Wattenberg leasehold, The Woodlands, Texas, independent rebounded sharply this year, with six rigs and four completion crews.

The company spudded 90 wells in the first half of the year, with 46 put into production. Anadarko says it established record cycle times for mid- and long-length laterals of 4.1 and 4.7 days, respectively, and is concentrating on upsized completion strategies, comprising more fluid and proppant, and tighter cluster spacing, with preliminary results showing a 35% uplift in production, says Brad Holly, vice president for the Rockies Region.

Denver’s PDC Energy Corp. retains its standing as one of the play’s most active operators with a 155-well drilling program on tap this year within the 96,000 net acres that it controls in the Wattenberg. With improved drilling times for its standard (SRL), medium (MRL) and extended-reach (XRL) wells, the company plans to lay down one rig by the fourth quarter and operate a three-rig fleet. “With current drill times of six days for an SRL (4,200 ft), eight days for an MRL (6,900 ft) and 10 days for an XRL (9,500 ft), we expect a three-rig pace to deliver close to the same lateral footage as the four-rig pace,” said COO Scott Reasoner.

PDC spudded 44 wells and put 32 online during the second quarter, with production averaging 75,621 boed at medium lifting costs of $2.22/boe. The company forecasts 30% production growth at year-end 2017, with guidance calling for 133 wells, at an average lateral length of 7,300 ft, to be turned-in-line.

Wattenberg-centered Extraction Oil & Gas Inc. of Denver, likewise, will run three rigs. along with a trio of completion crews, throughout 2017 to meet a year-end production target of between 48,000 and 54,000 boed. Second-quarter production averaged a higher-than-expected 44,172 boed (23,088 bopd). During the quarter, 62 net (67 gross) wells were put on production, with average lateral lengths of approximately 7,100 ft, while another 46 net (51 gross) operated wells were completed with average laterals of 7,300 ft.

After paying $255 million earlier this year to acquire some 30,000 net acres in a rural area of northern Weld County, Extraction now holds 242,000 net acres, where it targets the Niobrara A, B and C benches, as well as the Codell.

Meanwhile, along with its ongoing Windsor enhanced completions program, Extraction expects by year-end to spud the first wells in its 10,000-acre Broomfield development along the contentious Front Range. As part of a neighborhood-appeasement program, Extraction has agreed to consolidate the 12 previously permitted drilling sites to four locations, incorporating 140 aggregate wells, along the Northwest Parkway and farther away from neighborhoods. The operator also will remove and reclaim some 30 legacy conventional wells scattered throughout Broomfield.

Elsewhere, Bill Barrett Corp. is running two rigs, targeting stacked Niobrara-Codell horizons within its 71,900 net acres, spread across rural northeastern Weld County and southeastern Wyoming. Production averaged 14,456 boed in the second quarter, which saw the Denver independent spud nine wells and place four extended-reach and 10 medium-reach wells on initial flowback.

A cumulative 30 extended-reach and 10 medium-reach wells are being variously drilled or completed within five drilling spacing units (DSU), featuring proppant concentrations of 1,500 lb/lateral ft and 100-140-ft spacing between stages, the company said. Drilling and completion costs for extended-reach wells average roughly $4.5 million/well.

Bill Barrett also operates in Utah’s Unita basin, but suggests it eventually will place all its eggs in the DJ basket. “We still think that the primary focus of the company is the DJ basin, and we like the results that we’re getting there and think that’s the best use of our capital. Probably at some point, it’s still going to be in the best interest of the company to exit Utah and put the capital into the DJ,” said CEO Scot Woodall on Aug. 5.

REGAINED FOOTING

Having emerged from Chapter 11 bankruptcy, newly reorganized Bonanza Creek Energy, Inc., is going full-bore in restarting activity on a 67,000-net-acre position, targeting both the Niobrara and Codell. Bonanza Creek completed the first pad of four drilled-but-uncompleted (DUC) wells in the second quarter, and recorded quarterly production of 12,600 boed. At the end of July, the company also jump-started its 2017 drilling program by spudding a three-well pad, comprising one 9,600-ft extended-reach lateral and two 4,100-ft-lateral wells.

The Denver independent plans to drill 19 gross (13 net) and complete 19 gross (14 net) wells this year. In addition, the company is formalizing a development agreement with an offset operator to delineate the greenfield French Lake acreage acquired in 2014. Plans call for the drilling and completion of up to eight extended-reach appraisal wells this year and into early 2018.

With drilling activity centered in the Bakken Shale, Whiting Petroleum Corp. is fixed squarely on whittling down the 105 DUC wells across its core, 134,771-net-acre Niobrara-Codell-Redtail asset in the northeastern Wattenberg. Whiting’s inventory represents 15% of the 711 Niobrara DUC wells that the EIA documented in August. “We’ll continue completing our DUC inventory into 2018, and we should work most of that off by the end of the first quarter,” says Senior Vice President of Exploration and Development Mark R. Williams, who added that Whiting plans to exit the year with 38 DUC wells.

The home-grown independent delivered average second-quarter production of 6,610 boed. By early in the third quarter, the company had begun flowing back its seven-well Razor 12-H pad and eight-well Razor 12-G pad, both of which produce from the three Niobrara benches and the lower Codell-Fort Hayes zones.

Pure-play operator SRC Energy Inc. (formerly Synergy Resources) delivered an average 25,224 boed over the first half, a 123% jump over the 11,304 boed produced in the first six months of 2016. SRC says the strong production growth was unpinned by the 30 gross (26 net) wells put online on the Evans and Weideman pads, with an additional 36 gross (32 net) wells slated to be put online in the mid-to-late third quarter.

SRC drilled 32 and completed 36 wells in the second quarter, with laterals ranging from 7,500 to around 12,000 ft. The company also expects to close a 4,000-net-acre asset swap in the third quarter, bolstering its contiguous 60,000-net-acre leasehold.

Outside the Weld County fairway, newcomer UK-based Highlands Natural Resources plans to complete its first two Niobrara wells in October on the 3,840 acres that it acquired in a 2016 farm-in agreement in Arapahoe County, Colo. The Wildhorse and Powell wells were drilled from a single pad in August (Fig. 3) to 18,500 ft, with 9,800-ft laterals. The London operator holds a 51.25% working interest, “which increases to 70% following a payback event for one of the third-party investors,” according to a spokesman.

Highlands’ longer-range plans call for drilling upwards of 24 extended-reach wells in its newly designated East Denver Niobrara project. ![]()

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)