Industry at a Glance

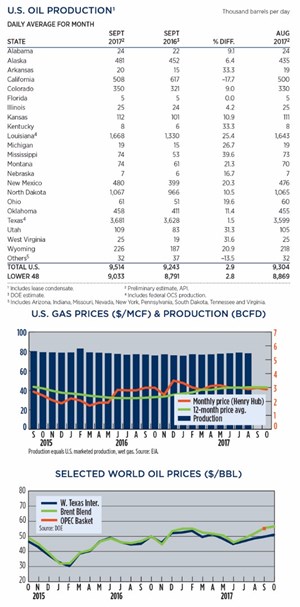

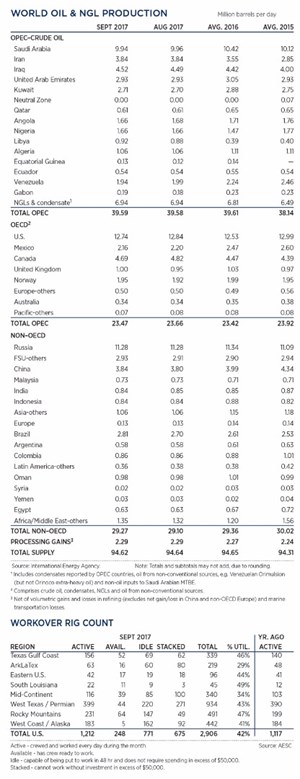

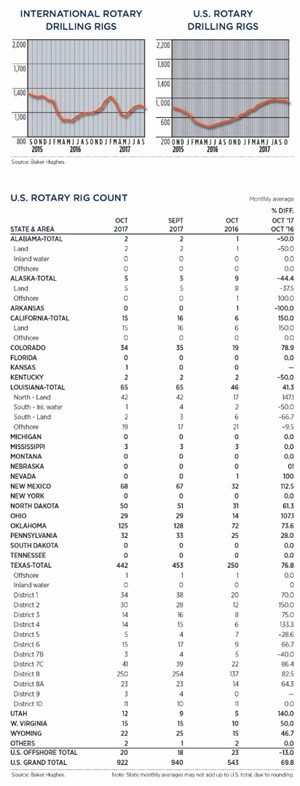

Brent crude futures (Dec) traded at their highest level in two years ($59.30/bbl) after officials from Russia and Saudi Arabia signaled that their respective countries were willing to prolong production cuts beyond March 2018. Their announcements virtually ensured that OPEC members would agree to extend the output reductions, when the cartel meets this month. The IEA said that meaningful increases in demand, the first since the price crash of 2014, also will help reduce stockpiles this year. WTI futures hit a six-month high on the NYME ($52.64/bbl), while spot prices held steady around $51.00/bbl. However, stubborn U.S. oversupply, exacerbated by Hurricane Harvey, caused the Brent/WTI spread to widen 48% month-on-month. The U.S rig count dropped by 18, averaging 922 in October. International activity declined 16 units, to average 1,151 in September.