Regional Report: India

As the world’s second-most populous country—along with a rising income rate and growing urbanization—India has the potential to blossom into a socioeconomic powerhouse. Nevertheless, the country’s mounting dependence on fossil fuel imports has hindered its own E&P development and has raised concern regarding energy security. According to the International Energy Agency’s (IEA) India Energy Outlook, the country’s energy demand is expected to more than double over the next 25 years.

In March, however, the country took steps toward a more secure and sustainable energy future by joining the IEA as an association country. “We can’t talk about the future of the global energy markets without talking with India,” explained Dr. Fatih Birol, the IEA’s executive director. “This is a major milestone in the development of global energy governance.”

INCREASING DEMAND

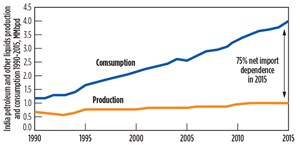

India’s energy demand continues to grow with its population, forcing the country to import the majority of its supply, Fig. 1. Presently, it is importing about 80% of its crude requirement. What’s more, conditions are not expected to change, as India’s economy is projected to continue to rapidly grow.

Prime Minister Narendra Modi has announced plans to reduce India’s oil imports as much as 10% by 2022. At this year’s CERAWeek in Houston, Dharmendra Pradhan, India’s minister of petroleum, explained that, in order to achieve this objective, India will be focusing on energy access by providing new connections; the expansion of its national gas grid network and PNG; energy sufficiency; and increasing production in its upstream energy sector. Additionally, a number of progressive reforms have been passed to further support Modi’s goal.

INVESTMENT

One policy that India’s government introduced was its Hydrocarbon Exploration and Licensing Policy (HELP). Through open acreage licensing, implementation of the policy reportedly will open India’s entire sedimentary basin to domestic and foreign investors. According to the ministry, the policy’s core foundation is based on a uniform license for E&P of conventional and unconventional hydrocarbons; an open acreage policy; an easy-to-administer revenue sharing model; and freedom to price and market produced oil and gas. Moreover, the policy aims to grant investors open access to an ample amount of seismic data through the National Data Repository.

Attracting investors. According to the IEA, investment in India’s oil and gas fields fell approximately 24% in 2016. Consequently, India moved to attract investors to the region, when it approved its first auction in six years. Rights to regional oil and gas fields were put up for bid. The auction resulted in 15 new players, out of 22 companies that were awarded rights to develop the fields. Sun Petrochemicals and Megha Engineering & Infrastructure Ltd. were among the newcomers. “These fields hold potential for [a lot] of investments in India over the next decade,” Atanu Chakraborty, head of the Directorate General of Hydrocarbons (DGH), told Bloomberg. “It will open new avenues for jobs and create entrepreneurs.”

The auction included 67 small oil and gas fields, with estimated oil in-place reserves of approximately 625 MMbbl. The fields reportedly were discovered by Oil and Natural Gas Corp. (ONGC) and Oil India Ltd., but development of the fields was not made a priority, based on their size.

It was reported in September that India’s government is planning more oil auctions. This time, however, the country is preparing to offer much larger areas with more reserves. “The next round would be meatier, bigger and players can expect even better fields,” Chakraborty said. “The reserves are twice of that we offered in the first auction round, on a very conservative estimate.”

Development of the auctioned oil and gas assets is expected to play a fundamental role in the Prime Minister’s plan to cut back on oil imports. The awarded blocks reportedly could boost regional oil production by as much as 15,000 bpd. Likewise, gas output could increase by 2 MMscmd. The DGH reported that estimated revenue from the awarded blocks was approximately $7 billion.

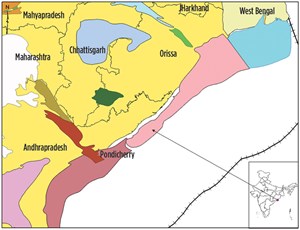

Deep water. In March, it was reported that ONGC has plans to spend about $10 billion on deepwater projects in the Krishna-Godavari basin in Andhra Pradesh, on India’s southeastern coast. The resource-rich area is home to India’s largest natural gas reserves. “The east coast is our future, because western offshore fields are in a heavy declining trend,” Tapas Kumar Sengupta, ONGC’s director of offshore operations, told Bloomberg. “To keep India’s gas production alive, the east coast needs to make a tremendous contribution in the next two decades.”

Although it has been confirmed as a high-volume area, it also has proved to be a very difficult reservoir to produce from. KG-D6, situated in the Bay of Bengal, has seen a significant decline (more than 85%) in output since 2010, when it hit its peak. Reliance Industries Limited and BP reportedly were forced to shut most of the wells in the block, due to low pressure and natural deterioration of deposits in the wells.

Despite this, ONGC is investing in the prolific basin, with the belief that it will help boost natural gas production and raise crude flows. According to Sengupta, the company expects the area—which lies in water depths comparable to those of the Gulf of Mexico—to add approximately 40 MMscm to daily gas output in as little as five years. He says that oil production potentially could rise by 77,000 bpd. He explained, “We have confidence [that our] technology can mitigate the risks of developing such high-risk areas.”

BP (Fig. 2) and Reliance Industries still haven’t given up on the basin either. In June, the companies reported that approximately $6 billion would be invested in the development of about 3 Tcf of resources in the Krishna-Godavari basin’s D6 block between 2020 and 2022. BP CEO Bob Dudley claimed that the investment would result in the production of an additional 30 to 35 MMcmgd. The project reportedly will underwrite approximately 10% of India’s projected gas demand by 2022, replacing about $20 billion of LNG imports.

In addition to the Krishna-Godavari basin, BP and Reliance are planning development of a block in the gas-rich Mahanadi basin (Fig. 3), also found off India’s eastern coast. The NEC-25 Block is situated near the Chandipur missile test base, a military missile launch site in the Bay of Bengal. A development plan was submitted in March 2013; however, work never commenced, due to objections from the defense ministry.

“When you make a first move into a basin, it normally takes time,” said Atanu Chakraborty, head of the DGH. “The issues related to [the] closeness to Chandipur missile area had to be adjusted, and now the Mahanadi basin fields are maturing slowly towards development. We will see investments coming there sooner than later.”

Plans for development are said to reflect those of the original submission from 2013. According to Wood Mackenzie, the original development plan included up to 10 subsea wells connected to a shallow-water processing platform. Gas would reportedly be transported to an onshore terminal via a subsea pipeline.

INDIAN OIL GIANT

To compete with international companies in the industry, and to help withstand crude price volatility, India announced a plan to combine its state-run oil companies in February. “Creating an integrated oil major will help achieve the goal of increasing India’s energy security,” explained ONGC Chairman Dinesh Kumar Sarraf. “A bigger entity will have bigger resources, and a bigger appetite for acquisitions.”

While presenting the federal budget, Finance Minister Arun Jaitley explained that, through consolidation, mergers and acquisitions, companies will be given “the capacity to bear high risk, avail economies of scale, take higher investment decisions and create more value for stakeholders.”

While India’s upstream market is led by ONGC Corp., its downstream sector includes refiners Indian Oil Corp., Bharat Petroleum Corp. and Hindustan Oil Corp. State-owned companies also include GAIL India Ltd., the country’s primary pipeline operator, and producer Oil India Ltd, Fig. 4. According to Bloomberg, the country’s combined market capitalization is approximately $105 billion, which would rank the energy giant as one of the top seven global oil companies.

India took its first steps toward fulfilling this plan in July, when ONGC acquired a stake in Hindustan Petroleum Corp. (HPCL) for $4.6 billion. According to details reported by Bloomberg, the deal pushed ONGC up to the nation’s third-largest refiner, after Indian Oil Corp. and Reliance Industries. “This deal will make both ONGC and HPCL stronger, as the benefits of synergy are huge,” ONGC’s Sarraf said. “It will add value to shareholders of both companies.”

DRILLING/EXPLORATION

In an effort to gain access to untapped reserves, India is extending its areas of exploration to cover the country’s entire sedimentary zone, which is an area of approximately 1.2 million mi2 that includes 26 basins. Additionally, in September, Prime Minister Modi reportedly approved spending more than $452 million for the appraisal of new areas with limited available data.

At present, much of India’s onshore output comes from Rajasthan, its largest state in the northwestern region of the country. According to Cairn India, its oil and gas fields in the Rajasthan block, in India’s Barmer District, represent its biggest assets. So far, the block has yielded 38 discoveries in all. Its gross proved and probable hydrocarbons-in-place reportedly stand at 6 Bboe. The company says that the majority of production is coming from Mangala, Aishwariya, Raageshwari and Saraswati (MARS) fields. Mangala field, in particular, is reportedly the largest onshore hydrocarbon find in India, in the last 20 years. As operator, Cairn holds a 70% participating interest in the block, while ONGC holds the remaining 30%.

Cairn also holds interest in several blocks in the Krishna-Godavari basin. The majority of its production in the area comes from Ravva field, off the eastern coast of Andhra Pradesh. The field, which lies in water depths of up to 263 ft, is considered one of the world’s most economical fields in terms of cost. It reportedly was profitable even when crude prices were as low as $12/bbl. According to Cairn, Ravva field has produced more than 269 MMbbl of crude and more than 337 Bcf of gas.

Cairn’s Cambay assets, in Western India, also have contributed to the company’s overall production rate. Its operations in CB/OS-2 Block are primarily focused on Lakshmi and Gauri oil and gas fields, which reportedly have produced some 22 MMbbl of crude and more than 223 Bcf of gas since the inception of Cambay in 2002. According to Cairn, the block is being developed in partnership with ONGC and Tata Petrodyne Limited.

Drilling activity continues to push forward, as well. ONGC’s chairman said that the company drilled approximately 500 wells last year, and it is expected to maintain, or exceed, that rate into next year. He said, “While the investment figure would be similar to that of last year, we will be able to do more jobs because cost of services is declining.”

According to Wood Mackenzie, however, the country will not be able to raise its production alone. WoodMac President Neal Anderson said last month that the country needs to consider partnering with other international producers, to increase recovery from mature fields more quickly. “Opening up exploration has such a long lead time,” he explained. “And it will not meet [Modi’s] five-year timeline.”

Between policy changes, increased E&P, and a newly-formed energy giant, India is continuing its efforts toward a more self-reliant energy future. “We want to create a lot of E&P companies in India,” Chakraborty said. “One mustn’t forget Cairn was created out of India, and we want more of them.” ![]()

- Advancing offshore decarbonization through electrification of FPSOs (March 2024)

- The reserves replacement dilemma: Can intelligent digital technologies fill the supply gap? (March 2024)

- What's new in production (February 2024)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- U.S. operators reduce activity as crude prices plunge (February 2024)

- U.S. producing gas wells increase despite low prices (February 2024)