Energy issues

The unwinding of 2017 promises lots of change. Sure, there will be a new face in the White House, one who appears to be pro-oil-and-gas. And some Cabinet members, such as Rex Tillerson (Secretary of State), Rick Perry (Secretary of Energy) and Ryan Zinke (Secretary of the Interior), are known oil and gas advocates. How the new political establishment might impact the energy industry is, however, largely unknown. But, that is just one of many unknowns.

Strength of resolve. Perhaps the foremost unknown is the resolve of OPEC and non-OPEC producers to make good on their commitment, made at a Vienna meeting in late November, to cut oil production by 1,758,000 bpd. Of that figure, 1.2 MMbopd will be cut by OPEC producers. Of the remaining 558,000 bopd to be cut, Russia has agreed to take the largest hit, with a pledge to cut 300,000 bopd within about six months. Oman has pledged to cut 45,000 bopd, and Kazakhstan will try to reduce production by some 20,000 bopd in 2017. Many other non-OPEC countries, such as Mexico and Azerbaijan, have made pledges to reduce production when, in fact, they are experiencing natural drops in oil output that analysts say should not be counted as voluntary reductions.

“With the deal finally signed after almost a year of arguing within the Organization of the Petroleum Exporting Countries, and mistrust in the willingness of non-OPEC Russia to play ball, the market's focus will now switch to compliance with the agreement. This agreement cements and prepares us for long-term cooperation,” Saudi Energy Minister Khalid al-Falih told reporters after the meeting, according to Reuters.

But there are plenty of skeptics. "They are all enjoying higher prices, and compliance tends to be good in the early stages. But then, as prices continue to rise, compliance will erode," veteran OPEC watcher and founder of Pira Energy consultancy Gary Ross told Reuters.

Deepwater factor. A second unknown is the strength of the return to deepwater development that many think will be kicked off by BP’s decision to move forward with the $9-billion Mad Dog Phase II project in the deepwater Gulf of Mexico. BP has said that the initiation of the project is due to implementation of cost-savings amounting to more than 50% of project costs, and to reservoirs that are fairly tame, compared to many GOM assets. The facility will have 140,000-bopd capacity.

However, “the return to U.S. deepwater (and African and Brazilian deepwater) is likely to be slow,” according to Nansen Saleri, CEO of Quantum Reservoir Impact and former head of reservoir management for Saudi Aramco, speaking to Reuters. The slow return to deep water is echoed by Atwood Oceanic’s decision to delay delivery of two, new ultra-deepwater drillships, the Atwood Admiral and the Atwood Archer. Delivery dates were extended to 2019 and 2020.

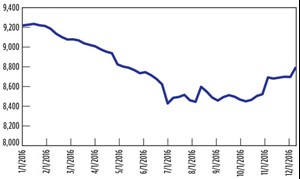

U.S. output habits. A third unknown is whether U.S. shale oil producers can reign in their output as the price of oil rises. All indications are that they cannot. Between mid-2015 and mid-2016, U.S. shale oil producers shut in some 700,000 bpd, due to uneconomic oil prices. But, as modest price increases began in mid-2016, U.S. shale oil production began to rise, shooting 350,000 bpd upward between early July and early September.

And, then came the Nov. 30 OPEC/non-OPEC agreement. In response, the number of active U.S. rigs drilling for oil climbed 21, to 498 for the week, according to the Baker Hughes Rig Count. The company also reported that the total active U.S. rig count, which includes oil and natural-gas rigs, jumped 27 to 624. Also, U.S. shale oil production shot up almost 100,000 bpd in the week following the meeting.

And, that’s the problem. An increase of some 450,000 bopd in less than six months may presage even more dumping of crude on the market by U.S. shale producers. But it is not just U.S. shale plays that hold the potential to tank the oil price again. As of this writing, Libya had reopened one of its biggest oil fields and was preparing the first crude shipment in two years from its largest export terminal, Es Sider. Libya is exempt from cuts under the November OPEC deal.

So here’s to 2017. I haven’t seen a year start with this many major unknowns in a few decades. Analysts and operators seem to agree on oil prices in the $30-to-$60/bbl range, with one producer predicting $70/bbl in 2017.

It’s going to be an amusement park year. We may be on the giant roller coaster, on the sedate merry-go-round or at a prize booth, trying to win something to make the visit worthwhile. In any of the “unknown” scenarios above, at least it won’t be boring. ![]()

- Oil and gas in the Capitals (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- U.S. producing gas wells increase despite low prices (February 2024)

- U.S. drilling: More of the same expected (February 2024)

- U.S. oil and natural gas production hits record highs (February 2024)

- Management issues- Dallas Fed: Activity sees modest growth; outlook improves, but cost increases continue (October 2023)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)