Output losses in some regions cancel out gains in other areas

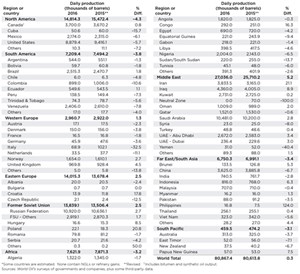

The year 2016 will go down in the record books as a time of incredible highs and pitiful lows. On the positive side of the ledger, Middle Eastern oil production gained about 1.3 MMbpd, while Russian output climbed 284,000 bpd higher. But on the reverse side of the coin, U.S. production lost about 537,000 bopd, or nearly 6%. This loss, combined with reductions in South America, Africa, the Far East and South Pacific, nearly canceled out the gains in the Middle East and Russia. When all was said and done, global oil production was up just 254,000 bpd, a paltry 3%. And now the worldwide industry will have to see how OPEC’s last-minute quote deal in December will alter the playing field, although it has helped oil prices to stabilize at somewhat higher levels in the short term.

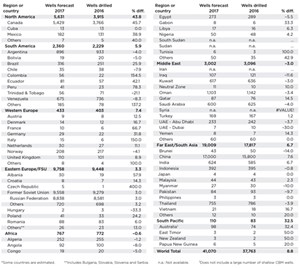

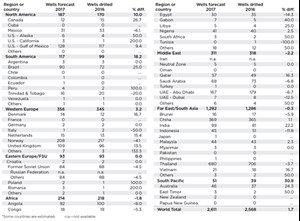

Meanwhile, drilling outside the U.S. took a major tumble, falling 11.1%, from 42,466 wells in 2015 to just 37,763 in 2016. This year, we forecast a drilling recovery in six out of eight regions, for an 8.8% gain to 41,070 wells outside the U.S. Ironically, the Middle East will be one of two regions with declines, down 3.0%. Africa continues to have its problems with logistics, politics, corruption and civil unrest. And here’s another somewhat sobering thought—if Canada is left out of the tabulations, then the rest of the world, exclusive of the U.S., is up only 4.8%, or roughly half the global growth rate if Canada is included. Areas outside North America were the last to be affected by the oil price drop.

Global offshore drilling, including the U.S., will be up 1.7%, at 2,611 wells. There will be greater offshore activity in four of eight regions this year, including North America, South America, Western Europe and the South Pacific. In the case of South America, the increase is due almost exclusively to a significant pick-up in drilling offshore Brazil.

NORTH AMERICA

Canada has seen activity drop to less than a third of its level in 2014, but rising oil prices are prompting a turn-around. The Canadian Association of Petroleum Producers predicts that Canadian drilling will jump 44.2% higher, to 5,429 wells. We should point out that the Petroleum Services Association of Canada in late Canada raised its estimate to 5,150 wells. Indeed, our own tally of data supplied by the individual provincial governments adds up to 5,147 wells, as opposed to 4,408 in 2016, up 16.7%.

Improvement will be seen in most categories, including conventional oil and gas drilling, as well as shale plays. Offshore the East Coast, activity will remain relatively steady, as work progresses on the Hebron mega-development, as well as on incremental additions to existing fields. The decision on Jan. 24 by U.S. President Donald Trump to go ahead and approve construction of the Keystone XL pipeline should provide a major boost to oil sands activity in Alberta. For more information on Canada, please turn to the article on page 59.

Mexico’s plans to reinvigorate its energy sector were interrupted by the industry downturn, which prompted a steady decline in production and a rigorous spending reduction. However, the country did conduct its much-anticipated deepwater auction in December 2016. This fourth public tender offered 10 blocks, four in the Perdido belt and six in the frontier area of the Salina del Istmo basin. The auction proved successful, as eight of the 10 blocks were awarded to companies including Total, CNOOC, Chevron and Exxon Mobil. Looking broadly at the Mexican upstream sector, as well as considering state firm Pemex’s plans, we expect drilling nationwide to jump 38.9% higher, to 182 wells.

SOUTH AMERICA

This region’s drilling is a mixed bag, with some countries up, and others down. Like their neighbors in North America, the South American countries had a poor drilling year, with wells down 35.4%, at 2,229. This year, a moderate rebound of 5.9%, to 2,360 wells, is forecast. Meanwhile, regional oil output fell 3.8% last year, to 7.21 MMbpd.

Brazil. Amid the global surplus, Petrobras’ average oil production reached an historical record in 2016, at 2.51 MMbpd, or 1.8% above the prior year’s average. If Petrobras’ gas production, which reached 77 MMcmd, is included, total production in the country reached 2.63 MMboed, or 1% more than 2015’s levels, which also was a new record for Petrobras. According to Petrobras, the main factor contributing to the increase was significant production growth in Lula field and Sapinhoá field, in the Santos basin’s pre-salt layer, in addition to the Parque das Baleias area in the Campos basin. On Dec. 20, Petrobras announced that the BM-S-9 consortium led by Petrobras had started production at Lapa field, the third pre-salt producing field in the Santos basin. Overall, we predict that Brazilian drilling will gain 25.9%, to 316 wells.

Argentina. While it wasn’t impacted as badly by the downturn as its North American counterparts, Argentina has, nonetheless, felt the pressures. However, a report by IHS Markit laid bare the potential of the Vaca Muerta shale. According to the consultancy, the unconventional play could deliver about 560,000 bpd of liquids and 6 Bcfgd by 2040. However, this would require a significant investment amounting to some $8 billion in drilling and completion costs, alone. Argentina’s drilling should amount to 896 wells, down 4%.

Guyana. Exxon Mobil has brought Guyana to the fore with the announcement of sizeable discoveries, Fig. 1. In January 2017, Exxon announced positive results from its offshore Payara-1 well. Payara, which encountered more than 95 ft of high-quality, oil-bearing sandstone reservoirs, is the company’s second oil find on the Stabroek Block and was drilled in a new reservoir. Exxon Mobil also reported that its Liza-3 appraisal well has identified an additional high-quality, deeper reservoir directly below Liza field, which contains between 100 MMboe and 150 MMboe. This additional resource is being evaluated for development.

WESTERN EUROPE

Building on gains made in 2015, regional oil output gained 1.3%, to average 2.96 MMbpd. Drilling was off about 22%, to 403 wells, including 345 offshore. This year, drilling is forecast to improve 7.4%, to 433 wells, of which 356 will be offshore.

Norway. Oil production on the Norwegian Continental Shelf increased for a third consecutive year in 2016, and gas output held steady from the year prior, which was, in itself, a record year. According to the Norwegian Petroleum Directorate, investments on the Norwegian shelf totaled NOK 135 billion in 2016, which represents a NOK 50-billion decline from the levels seen in 2013 and 2014. Despite the drop in investment, explorers reported 18 discoveries in 2016. While just 36 exploration wells were spudded last year, 20 fewer than the year prior, recent licensing rounds reflect continued interest in the Norwegian shelf. Fifty-six production licenses were awarded in APA 2016, while 10 were awarded in the 23rd licensing round, all in the Barents Sea. Norwegian drilling will be down 4%, to 208 wells.

United Kingdom. In October, the UK’s Oil and Gas Authority (OGA) reported that 29 applications, covering 113 blocks, had been submitted as part of the 29th Frontier Licensing Round. OGA said the bids are being evaluated, with award announcements to be made as soon as possible in 2017. In December, the regulator announced that companies could apply for 14 new blocks in the Offshore 2016 Supplementary Round. Locations vary across the UKCS, from the southern North Sea to East of Shetland. Meanwhile, that regulator said the nation’s remaining offshore potential is more than 3 Bboe in approximately 350 unsanctioned discoveries across the UKCS. The majority of these discoveries are small pools, containing less than 50 MMboe of technically recoverable reserves. In September, Maersk Oil began drilling the first production well on the HPHT Culzean field, the largest discovery in the UK North Sea for over a decade. First gas is expected in 2019. British drilling should improve 8.9%, to 110 wells.

Denmark. Maersk Oil plans to halt production from Denmark’s largest gas field, Tyra, during fourth-quarter 2018. According to the company, an economically viable solution for full recovery of the field’s remaining resources has not been identified. Production is consequently expected to cease on Oct. 1, 2018. Danish wells should be up slightly, to 14.

EASTERN EUROPE/FSU

Due to the fact that Russian operators (particularly Rosneft again boosted their drilling, regional wells drilled were up 11.4%, at 9.448 wells. This year, operators will begin to backl off their frenzied pace, but there will still be a 3.3% increase to 9,758 wells. With Russian producers pushing the limits of their capacities, oil production across the area rose another 2.5%, to 14.02 MMbpd.

Russia. In a move that confounded skeptics, Russia pledged to cut production in a pact between both OPEC and non-OPEC nations at the end of last year. As part of the agreement, Russia agreed to curb its production by 300,000 bpd. As of Jan. 22, the world’s largest producer was reported to have pared production by an average of 100,000 bopd, a level it wasn’t expected to reach until February. Meanwhile, Russian drilling surged last year, and it is expected to gain another 3% this year, to 8,838 wells this year. In September, Russia’s northernmost active oil field was commissioned. The Vostochno-Messoyakhskoye field, developed by a Gazprom Neft/Rosneft JV, lies in the Gydan Peninsula, about 211 mi north of Novy Urengoy. Recoverable oil and condensate reserves are more than 340 million tonnes.

Azerbaijan. In December, SOCAR and AIOC (the Azerbaijan International Operating Company) signed a Letter of Intent for the future, additional development of Azeri-Chirag-Gunashli (ACG) field. Investment in the field stood at more than $32 billion by the end of first-half 2016, with present production at about 620,000 boed.

Kazakhstan. The much-delayed Kashagan field resumed production last year. Meanwhile, in July, Chevron announced that its 50% owned affiliate, Tengizchevroil (TCO), would proceed with the development of its Future Growth and Wellhead Pressure Management Project (FGP-WPMP), which will increase output at Tengiz oil field by about 260,000 bopd.

AFRICA

As drilling fell to a six-year low in 2016, E&P activity declined dramatically throughout Africa. Wells drilled totaled just 772, down a whopping 35% from 1,182 in 2015. This year, activity will hold nearly steady at 767 wells. Not surprisingly, production declined 3.2%, to 7.62 MMbopd.

Nigeria. Ongoing conflict and corruption in Nigeria has resulted in acute underinvestment. Militants have begun targeting Nigeria’s infrastructure, causing production rates to plummet. Output fell to a 27-year low in 2016, from 2.2 MMbopd to about 1.4 MMbopd. By August, however, output had begun to rebound to approximately 2.1 MMbopd. Furthermore, Exxon Mobil reported a major discovery of between 500 MMbbl and 1 Bbbl of oil offshore Nigeria, in Owowo field in late September. Drilling in the country is expected to be up slightly at 50 wells. Production was off significantly last year, falling 6.5% for an average 2.004 MMbopd.

Angola. Eni’s West Hub Development Project began producing from its third field in January 2016. The project comprises five fields, which are connected to the N’Goma FPSO. Mpungi field brought the project’s total production rate to approximately 100,000 boed during first-quarter 2016. Despite a major slowdown in drilling, the country’s oil output remained almost level at 1.82 MMbpd. Wells drilled, however, tumbled 45%, to just 100. A further 8% reduction to 92 wells is predicted for 2017.

Others. Activity in Ghana, however, intensified slightly, as Tullow Oil achieved first oil from Tweneboa, Enyenra and Ntomme (TEN) fields in August. Despite a border dispute with Ivory Coast, Tullow’s TEN project began producing on schedule. The company estimated average output at about 23,000 bopd in 2016, but plans to reach full capacity at 80,000 bopd by year-end.

Estimates show that production in Kenya could reach approximately 85,000 bopd by 2027. In northern Kenya, Tullow Oil’s Cheptuket-1 well struck oil in Block 12A last March. It was the first well to test the Kerio Valley basin. Last month, the company reported another discovery in northern Kenya that encountered 82 ft of net oil pay at a depth of nearly 2,297 ft.

Tullow Oil has discovered more than 1.7 Bbbl of oil, to date, in Uganda. However, the country’s high tax burden on exploration companies has impeded its rate of development. Conversely, it was reported in August that Tullow Oil, Total and CNOOC were issued production licenses in the region, with plans to pump up to 230,000 bopd.

Mozambique struggled through a harrowing debt crisis in 2016. Nevertheless, E&P activity continued to move forward. Sasol commenced drilling its first of 13 wells in May. The campaign will see development of the Temane G8, Temane East, Inhassoro G6 and Inhassoro G10 reservoirs. The first plan of development in the Rovuma basin was approved last year. The Coral discovery, in Mozambique’s Area 4, will see the drilling and completion of six subsea wells, as well as the construction and installation of an FLNG facility.

MIDDLE EAST

The bright spot for upstream work has been in the Middle East. Yet, even here, activity appears to have peaked. Wells drilled were down 8%, at 3,096. An additional 3% decline is forecast for 2017, yielding a 3,002-well total. Oil production continued its impressive growth in the region, gaining 5.2%, to 27.036 MMbpd. That type of performance may not be repeated this year, given OPEC’s production quota agreement in December.

Saudi Arabia. Following OPEC’s agreement to cut output, Saudi Arabia went from a record production rate of approximately 10.67 MMbopd in July, to below 10 MMbopd last month. This represents the Kingdom’s lowest production rate in almost two years. Meanwhile the kingdom’s E&P operations have endured. In May, Saudi Aramco completed expansion of Shaybah oil field, increasing production capacity to 1 MMbopd. Saudi drilling will be down slightly from its peak level last year.

Iraq. According to Bloomberg, Iraq pumped 4.61 MMbopd in December 2016, but has since complied with the OPEC agreement to cut production. It had reportedly reduced production 210,000 bopd by the end of January 2017. This represents 4.5% of its total output.

Iran. The country had an eventful year in 2016, as international sanctions were lifted last January, spurring a push to regain market share. By April, Iranian production had reached 3.56 MMbopd—a 25% surge. By December, output had climbed to nearly 3.8 MMbopd, after OPEC allowed a 90,000-bopd boost in production amid other members’ reductions.

Eastern Mediterranean. As a major oil producer, Egypt has seen significant advancement in the development of its assets, particularly offshore. Since its discovery in August 2015, Eni’s super-giant, 30-Tcf Zohr field has entered the appraisal phase. In February 2016, Eni completed its first appraisal well, Zohr-2, which encountered 1,000 ft of net pay. In May, Eni, with BP, made another gas discovery in the Baltim South Development, also in the East Nile Delta, that encountered approximately 205 ft of net gas pay.

Development of Israel’s largest reserve, Leviathan, which holds roughly 20 Tcf, was hindered by an Israeli High Court ruling that claimed a clause in the government’s regulation proposal would inhibit major regulatory changes for ten years. It was said in a statement, however, that Leviathan partners would work with the Israeli government to resolve the stability clause. Once resolved, development of Leviathan field can begin by the end of 2019. The field’s POD was approved in June 2016.

FAR EAST/SOUTH ASIA

China accounts for about 89% of all regional drilling, and last year was no exception. Overall, the region saw 17,817 wells drilled, down about 8.5% from 2015’s level. Precipitated mainly by a reduction in Chinese output, the area’s oil production declined 3.4%, to 6.75 MMbpd. Yet output was up in Brunei, Indonesia, Myanmar and Thailand.

China. Russia ousted Saudi Arabia as China’s top oil supplier last year. According to data from the General Administration of Customs, Russia boosted shipments 24% from 2015 to 1.05 MMbpd. Meanwhile, the kingdom shipped 1.02 MMbpd. Meanwhile, in July, BP signed a second PSC for shale gas exploration, development and production with China National Petroleum Corporation (CNPC). The PSC covers an area of approximately 1,000 km2 at Rong Chang Bei in the Sichuan basin.

Indonesia. After relinquishing its membership from OPEC in 2008, Indonesia returned to the fold. However, the nation requested its membership be temporarily suspended at the end of last year. Meanwhile, in July, BP announced that the FID had been approved for the Tangguh Expansion Project. It will add a third LNG process train and 3.8 mtpa of production capacity to the existing facility, bringing total plant capacity to 11.4 mtpa. The project also includes two offshore platforms, 13 new production wells, an expanded LNG loading facility and supporting infrastructure.

Malaysia. In December, Shell began production from the Malikai tension leg platform (TLP), about 62 mi off the Malaysian coast, Fig. 2. Malikai is Shell’s second deepwater project in Malaysia, following the successful start-up of the Gumusut-Kakap platform in 2014. Malikai is expected to have a peak production of 60,000 bopd. Meanwhile, Petronas’ first FLNG, PFLNG SATU, successfully produced its first drop of LNG from Kanowit gas field, offshore Sarawak.

SOUTH PACIFIC

This region has been particularly sensitive to oil prices, and thus activity has really taken it on the chin during the last two years. In fact, drilling has nearly dried up in New Zealand. Wells drilled across the region totaled just 83, down a mind-boggling 60%. This year, a strong, 32.5% recovery to 110 wells is seen, but that total will still only be about half of the 2015 figure. Meanwhile, oil production lost more ground, declining 3.1% to 459,500 bpd. Three of the four countries lost ground, although Papua New Guinea was a pleasant surprise, with a moderate, 7.5% gain.

Australia. Like many operators around the world, oil producers used 2016 to purge high-cost fields throughout Australia, selling old, depleted assets that once drew investors to the region. Exxon Mobil and BHP Billiton started the marketing process for about 13 fields, licenses and accompanying infrastructure held in the Gippsland basin JV in June. Assets include Kingfish field, Australia’s largest offshore oil field.

Complications and interruptions in production at existing fields took a toll, as well. In June, Chevron was forced to halt output at its $54-billion Gorgon LNG development, due to a leak. Conversely, Falcon Oil & Gas had considerable success last year, as it spudded its Beetaloo W-1 vertical well in July. The well is part of the company’s nine well drilling and evaluation program in the southern Beetaloo basin. Bengal Energy also made a discovery in Australia last year. In September, the company announced that the first four wells of its Cuisinier basin five-well drilling campaign had been classed as imminent producers in the Murta horizon. Australian drilling should improve 32% from an unusually low level in 2016. ![]()

- The last barrel (February 2024)

- Oil and gas in the Capitals (February 2024)

- What's new in production (February 2024)

- First oil (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)