Regional Report: East Africa

In recent years, East Africa has been recognized as an emerging center for energy investment. In addition to the region’s economic growth, it has the potential to become one of the world’s largest oil and gas producers and exporters. Case in point, Tullow Oil, Africa’s leading independent oil company, has found approximately 2.3 Bbbl of resources in East Africa, most recently with discoveries in Kenya and Uganda.

East African countries that have traditionally depended on biomass to meet their energy needs are now transitioning to modern energy sources, in an effort to meet the growing demands of an expanding population, as well as rising per capita income levels.

Despite the sizable potential of this region, investment from private sectors is critical, as the required funding needed for East African energy reserves to reach full potential cannot be met by government subsidy alone. Private sector participation, however, could be limited, due to the price collapse, political instability and/or security issues.

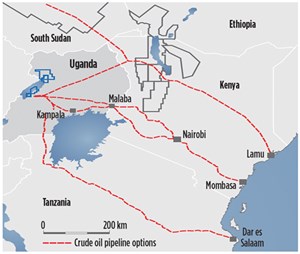

The biggest challenge faced by companies operating in this region, however, is the transport of proven resources. Discoveries in the South Lokichar basin, and throughout the land-locked Great Lakes region of Central and East Africa, are highly inaccessible. Transporting oil from these areas to the Indian Ocean—more than 850 km away—is difficult, while the East African pipeline route is still in progress.

The amount of recoverable oil reserves in this region could have an outstanding impact on the economic development of several East African countries, some of which are considered the poorest in the world. Nevertheless, additional infrastructure, including an export pipeline, is required to enable the commercialization of these reserves and to mobilize the recent boom in production.

KENYA

As the most economically advanced and industrially developed country in East and Central Africa, Kenya is considered East Africa’s top emerging oil province. The country’s production is estimated to reach approximately 85,000 bopd by 2027.

Since Tullow Oil entered Kenya in 2010, an estimated 600 MMbbl of oil have been discovered, predominantly in the rift basins, Fig. 1. The rift basins in Kenya share similar geological qualities with the Lake Albert rift basin in Uganda, where more than 1.7 Bbbl of recoverable resources already have been discovered. Tullow has been particularly successful in its exploration and appraisal drilling campaigns in Kenya’s South Lokichar basin. These drilling campaigns have even resulted in the opening of a second tertiary rift play.

Conversely, the North Lokichar basin has not been quite as successful, thus far. In November, prior to the spudding of the Etom-2 well, Tullow’s Emesek-1 wildcat reached a reported 3,000 m, TD, without uncovering any commercial hydrocarbons. The well was plugged and abandoned. It was the first well to be drilled in the North Lokichar basin. Despite the lack of commercial hydrocarbons, however, it did provide data for the assessment of the basin’s overall prospectivity.

Tullow, which has a 50% stake in the license block containing the Etom discovery, gained significantly after the Etom-2 well in Block 13T encountered 335 ft of net oil pay in two columns, in December. This could ostensibly further increase the potential of the discovery.

According to equal partner Africa Oil Corp., the objective of the well was to explore the north flank of the Etom structure in an untested fault block, which had been identified by 3D seismic. Additional prospects were identified in the Etom field area, as well as in the northern part of the basin. These prospects, including Erut and Elim, are now considered part of the company’s future exploration drilling program.

Maersk Oil is another company buying into prospective Kenya. In November, the company agreed to acquire half of Africa Oil Corp.’s shares in three onshore exploration licenses in Kenya, and another two in Ethiopia. The licenses cover an area of 100,000 km2, and include eight recent oil discoveries. The exploration areas cover the Turkana region of northern Kenya, where proven oil deposits already have been discovered.

SOUTH SUDAN

Like Uganda, the Republic of South Sudan is an entirely land-locked country of East Africa, making pipeline access a necessity. The country contains the third-largest oil reserves in Sub-Saharan Africa—after Nigeria and Angola—but continued fighting, trade disputes and low oil prices are taking a toll on the country’s industry.

Conflict between the army and rebel forces has caused ample disruption to the country’s energy operations. After the civil war erupted, Upper Nile was the only one of 10 South Sudan states still producing. Last year, workers at South Sudan’s largest oil hub, the Paloch fields in Melut County of Upper Nile state, were temporarily removed as a precautionary measure. They returned shortly thereafter, with the support of government troops.

Because of this ongoing conflict within the country, South Sudan’s oil sector continues to suffer. Existing asset holders are reducing investments, and potential investors are deterred by the region’s instability. According to a report from GlobalData analysts, South Sudan was producing an estimated 240,000 bopd at the end of 2013, prior to the start of the armed conflict. Just one year after the fighting began, production had reportedly fallen to approximately 165,000 bopd.

Conditions are exacerbated by the country’s reliance on two Sudanese pipelines. The government is ostensibly exploring alternatives, including the possible construction of new pipelines through Uganda and Kenya.

UGANDA

Tullow Oil continues to be the most active operator in Uganda to date, with interests in four blocks and total acreage of 2,552 km2. It entered the country in 2004, following the acquisition of Energy Africa. Since purchasing its interests in 2006—after Heritage Oil & Gas’ initial discovery at Mputa-1—Tullow has drilled more than 80 wells throughout the country, and has discovered 1.7 Bbbl of oil, thus far.

Lake Albert, a rift basin situated on the border between Uganda and the Democratic Republic of the Congo, has been one of the most developed areas of the country. A government-approved development plan was set in motion in early 2014, which included development of the Hoima-Lokichar-Lamu export pipeline, Fig. 2. The rift basin, however, is an environmentally sensitive area that is home to a variety of threatened wildlife. Because it is such an important site for conservation and biodiversity, Tullow has begun conducting its own multi-year program to appropriately assess the impacts of its production activity there.

Uganda further advanced its efforts to improve economically last year, when the government abolished taxes on its emerging oil, gas and mining exploration industries. According to the Uganda Chamber of Mines and Petroleum, the tax burden on exploration companies can reach as high as 39%. The decision not to begin taxing until the start of production, is meant to encourage further growth in exploration throughout the country.

SOMALIA

The Federal Republic of Somalia is one of several African nations taking advantage of the downturn in drilling. With a rise in seismic surveys during the last year, an increase in future exploration activity is becoming more plausible.

Somalia continues its ongoing efforts to attract investors, with the hope of rebuilding its economy, after government forces regained control of its central and southern regions, which had been seized by al-Shabaab militants in an insurgency that began in 2006.

Puntland, in the northeastern region of Somalia, has managed to avoid much of the violence carried out by al-Shabaab. Although the UN had warned that oil exploration in Puntland and neighboring Somaliland could result in territorial disputes, the government awarded a contract to ION Geophysical Corp. in September for an offshore survey. According to ION, Puntland’s offshore territory has been delineated into 25 blocks, covering 180,000 km2. Seven of the blocks are in the Gulf of Aden, while the remaining 18 are in the Indian Ocean.

The border between Somaliland and Puntland is traversed by oil concessions that have been awarded to companies, including DNO International ASA and RAK Gas LLC. Last June, Africa Energy Corp. withdrew from Puntland, due to disagreements between Somalia and Puntland’s government regarding the legitimacy of Production Sharing Agreements, as well as potential territorial claims on the Nugaal Block, situated in Puntland’s Nugaal basin.

Early last year, Soma Oil & Gas Holdings Ltd. proposed a deal with the Somali government that would grant as much as 90% of the country’s prospective oil revenue to the company. The initial agreement set the state’s share of revenue on the first 25,000 bopd at 10%, if found at a depth greater than 1,000 m. Additionally, if output exceeded 150,000 bbl, Somalia’s share would rise to 30%.

Before signing the deal and launching production—which is reportedly scheduled to begin by 2020—the government must draft a Production Sharing Agreement. Soma already has spent a reported $40 million on seismic surveys of approximately 60,000 km2 off the Somali coastline, which stretches more than 3,000 km.

TANZANIA

The United Republic of Tanzania is home to the second-largest natural gas reserves in East Africa, after Mozambique. New discoveries are raising hope that it may soon become an exporter, with the building of a processing plant and pipeline. Several companies have been identified as participants in a plan to build an LNG plant for future exports.

The Tanzanian government has estimated total reserves at 55 Tcf. Of those, Statoil’s discoveries total 22 Tcf of in-place volumes, in partnership with Exxon Mobil Corp., Fig. 3. These companies are now beginning to focus on the transition from exploration, to the development phases of their discoveries.

Producers were forced to put their gas plans on hold last summer, as they were still awaiting the results of the general election. Additionally, Tanzania’s newest oil law decelerated the progress of development, as many companies sought clarification of the law’s impact on sharing agreements. Parliament passed the petroleum legislation in July, marshaling a recompense regime, in which energy companies pay 12.5% for onshore production, and 7.5% for offshore production. Under the new law, companies are to negotiate profit-sharing rates.

In August, Tanzania’s Mnazi Bay gas field opened its first two gas wells. The Maurel & Prom wells were purposed to deliver gas to the Madimba processing center, which is the entry point of the gas pipeline that links the city of Mtwara, in southeastern Tanzania, to Dar es Salaam, Tanzania’s main commercial port on the coast of the Indian Ocean. At the time, Maurel & Prom anticipated production capacity would reach 80 MMcfgd by year-end 2015.

The New Year brought a significant amount of progress to the industry in Tanzania, as a land acquisition for the site of the planned LNG plant was finalized. The LNG export terminal is being built by Shell, Statoil, Exxon Mobil and Ophir Energy, in partnership with state-run Tanzania Petroleum Development Corp. (TPDC).

With the confirmed acquisition, TPDC now owns 2,071.705 hectares of land that have been set aside for construction of the planned, two-train LNG terminal at Likong’o village in Lindi, situated in the southern part of Tanzania, and in close proximity to several major offshore gas discoveries.

The central bank reportedly believes that starting work on the multi-billion-dollar plant will draw in billions of dollars more in investment, and potentially add 2 percentage points to an annual economic growth of 7%. The project is expected to begin in the early 2020s.

MOZAMBIQUE

In the past year, Anadarko Petroleum Corp. has pursued major LNG projects in the Republic of Mozambique, despite the collapse in crude prices. Last summer, the company was still preparing to begin a $15-billion natural gas project, one that would allow shipments to be exported from the largest gas discovery in a decade. The initial discovery, which was made six years ago, is in the Rovuma basin off Mozambique’s northern coast.

Anadarko operates in Area 1 off Mozambique’s shores, with a 26.5% working interest. According to the company and its partners, Offshore Area 1 could contain as much as 75 Tcf of gas. That, according to the EIA, is enough to meet U.S. residential demand for up to 15 years.

In December, a 90% supply agreement was signed with Asian buyers, bringing the project another step closer to fruition. Anadarko has yet to make a final investment decision on the LNG project, but as increased competition from U.S. and Iranian supplies intensifies within the export market, partners are anticipating one in the coming year. According to the company’s manager in Mozambique, there are still legal issues and LNG offtake agreements to be finalized before that decision can be made.

Also in December, the operator signed a Unitization and Unit Operating Agreement (UUOA) with Eni East Africa (EEA), for development of the resources that straddle Area 1 and Offshore Area 4. Under the terms of the UUOA, the Prosperidade and Mamba natural gas reservoirs were to be recovered separately by the two operators, until 24 Tcf of reserves have been developed (12 Tcf from each area). All subsequent development of the Unit is to be pursued cooperatively through a JV.

Following the 5th Competitive Mozambique Bid Round, Eni (34% interest), together with Statoil, Sasol (25.5% each) and ENH (15%), was awarded the exploration and development rights for Block A5-A. The block covers a total area of 5,145 km2, and has a water depth between 200 m and 1,800 m. It is situated in an unexplored area of the Northern Zambesi basin, which is expected to hold a considerable amount of hydrocarbon resources.

Additionally, Sasol (70% interest), along with ENH (30%), was awarded Onshore Area PT5-C. The area is adjacent to Pande and Temane fields in Mozambique’s Inhambane region, and covers a total area of 3,012 km2. A consortium of Exxon Mobil, Rosneft and Mozambique Offshore won licenses for three additional blocks, as well.

Eni has been granted approval by Mozambique’s Council of Ministers, for the development plan of the Coral discovery in Area 4. The discovery is in more than 2,000 m of water, and is positioned approximately 80 km off of Palma Bay in the northern province of Cabo Delgado. The discovery was made in May 2012, and is estimated to contain 15 Tcf of gas in-place. The plan includes the drilling and completion of six subsea wells, as well as the construction and installation of a floating LNG facility, with a capacity around 3.4 Mtpa. The Plan of Development is the very first one in the Rovuma basin to receive approval.

Sasol also has made significant progress in Mozambique over the past year, as it obtained approval from the country’s Council of Ministers for its field development plan. The initial phase of the production sharing agreement proposes an integrated oil, LPG and gas project, which borders the company’s existing Petroleum Production Agreement (PPA) area. The PPA area produces and processes natural gas from Pande and Temane fields, before it is transported to gas markets in other parts of the country, as well as in South Africa.

David Constable, president and CEO of Sasol, said, “The Mozambican gas industry is playing an increasingly important role in the regional energy landscape, and this project represents a major milestone in further developing natural resources, which will significantly benefit Southern [and East] Africa.” ![]()

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)