Sliding oil price necessitates more cuts and pain

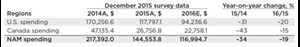

In our initial spending forecast for 2016, we, at Evercore, reported that upstream North American spending was poised to decline 19% in 2016, after falling 34% in 2015, Table 1. However, in January, less than a month after the publication of the original forecast, deteriorating market conditions necessitated a sharp downward revision. Given continued market weakness, Evercore now expects initial 2016 budget reductions for the region of as much as 40-50%.

Market conditions also necessitated a downward revision to the company’s International forecast. In December, Evercore reported a 15% fall in international upstream spending for 2015 and called for an 8% decline in 2016, Table 2. However, in January, the forecast was adjusted to reflect a more likely ~15% decline.

Assuming a 45% sequential North American spending decline, and a 15% international spending reduction, global upstream capex would post a 23% year-on-year contraction during 2016, compared to Evercore’s initial forecast of an 11% decline.

Such a decline would effectively remove an additional $65 billion of global upstream spending from this year’s market. If oil market fundamentals improve heading into the second half of 2016, we expect some upward revisions to budgets, particularly in North America where budgets are more flexible.

Budgetary decisions. In Evercore’s 2015 Mid-Year Spending Survey, nearly 60% of respondents were expecting 2016 capex to increase relative to 2015—an optimism countered by the continued downdraft in oil prices. According to Evercore’s survey results, a record 74% of respondents selected oil prices as the key determinant of 2016 budgets, followed by cash flow (59%) and natural gas prices (54%). Just 35% of participants selected capital availability. Also worth noting is that prospect availability and drilling success yielded all-time lows of 13%, apiece. While oil prices displaced cash flow as the leading determinant of budgeting decisions, cash flow remains a preeminent factor in total E&P spending.

MAJOR THEMES

Service pricing fell sharply, and swiftly, at the downturn’s onset and throughout most of 2015. Pricing cuts were indiscriminate; no service lines were spared. Evercore estimates that service pricing has fallen 20-50% from 2014 peak levels. With pricing for certain services below break-even levels, the majority (59%) of E&Ps are not factoring in further service price deflation in their 2016 budgets. However, 26% of E&P survey respondents are factoring in further pricing concessions of up to 15%, suggesting that this could further soften the blow of depressed commodity prices. Another 15% of E&P respondents are factoring in pricing concessions of more than 15%.

Exploration. Significant oilfield pricing concessions appear to have improved U.S. exploration economics the most, as 63% of respondents view this category as “excellent, good, or fair,” while only 38% view the U.S. as “poor.” This contrasts with the Canadian and international markets, where half of all respondents view the exploration economics as poor. The other half views them as good or fair.

Consolidation. Faced with a depleting reserve base, and with NOCs controlling the vast majority of known reserves, Supermajors will have to decide whether to replace reserves organically or pursue M&A. Evercore ISI Integrated Oil Analyst Doug Terreson sees elevated pressure on management teams, in the integrated oil and E&P space, to create value. With both integrated oils and E&Ps trading at decadal lows on valuation, the landscape is highly conducive to M&A. Consolidation could have a pronounced impact on non-OPEC supply and near-term upstream spending, alike.

Development cycle. Evercore believes that a new deepwater business model is required to drive secular growth back toward offshore. Timelines between discovery and development must compress, and project costs must come down. Lower costs and a shorter timeline would also open up, as opportunities, many of the ~400 deepwater discoveries that have yet to be developed. This could temper periods of oversupply, and benefit companies with enough scale and resources to maintain excess capacity, to rapidly respond to incremental opportunities. While the global oil break-even cost for deepwater and ultra-deepwater projects is not prohibitive, at ~$48–49/bbl (down from $53–57/bbl in mid-2014), the projects require upfront investment before generating returns with payback periods ~2–3x longer than North American shale.

Project costs. Rystad Energy estimates that average offshore greenfield project costs have fallen 10–30%, and as much as 50% over the past year. Some of the savings come from downsizing and re-engineering. Evercore sees standardization of field-tested equipment as a sustainable trend in the industry, and significant cost-savings would stimulate operators to FID additional offshore projects in 2016, and beyond.

Lower service pricing also has lowered overall project costs, with drilling rigs down ~50%, while oilfield service costs are down substantially less. The average break-even price for a “typical” offshore project is now closer to $55/bbl, down from $70/bbl in 2014. As a result, Rystad expects a large step-up in new greenfield projects for 2016 and 2017.

The firm forecasts offshore greenfield spending to trough at $75 billion this year, with the average break-even price of these projects at about $60. Spending should increase in 2016, with significant new project starts in Africa, and increasing spending in Asia, Australia and the Middle East. This more than offsets a spending slowdown in Russia, Europe and South America. Rystad forecasts offshore greenfield spending to double to $150 billion in 2017.

REGIONAL ROUNDUP

Evercore surveyed about 300 oil and gas companies for its December report. A roundup of the regional highlights is below.

North America is in the midst of the most extreme global spending decline, and is poised to experience another sharp contraction this year. Evercore’s June survey results predicted a 34% yearly decline in 2015, and we warned of cuts as high as 40%, as companies revised their outlooks. As of January 2016, Evercore expects initial 2016 budget reductions in the region, as high as 40-50%. North American market costs are down ~20-50%, across the board, but we believe that this pricing will be less permanent than some perceive, as capacity will tighten due to attrition. An upcycle is likely to begin in second-half 2016, with rising crude oil prices.

U.S. onshore. In the U.S., we believe that a locational shift may be underway, as some producers may concentrate their efforts away from the Williston basin and more toward the Eagle Ford and Permian. For example, Continental Resources reduced its Bakken rig count to eight, from 13 at the beginning of second-quarter 2015. The company’s year-end inventory of drilled-but-uncompleted wells (DUCs) totals 160, up 60 from the company’s prior expectation for 100 such wells.

Near-term conditions in the Bakken may be exacerbated further by North Dakota’s approval of a plan to provide oil producers an extra year (for a total of two years) to bring new wells online. The state expects roughly half of its ~1,000 DUCs to be granted delays, which is likely to curtail 2016 statewide production by roughly 100,000-150,000 bopd.

Gulf of Mexico. In the Gulf, several positive developments have occurred. In July, Shell announced an affirmative FID for the Appomattox deepwater development, which should start production at the end of the decade. Meanwhile, in August, OneSubsea was awarded a contract for subsea processing systems for Shell’s Stones project—the system is slated to be ready for delivery in early 2018. Although BP pushed back the timeframe for sanctioning Mad Dog Phase 2 to early 2016 (from second-half 2015), Evercore expects an affirmative FID, as total project costs are now estimated to be below $10 billion versus as much as $22 billion previously.

Oil sands. Due to lower intermediate-term investment levels, and the slew of oil sands projects that have been delayed or postponed, several agencies revised down their prospects for Canada’s long-term growth. While Wood Mackenzie said it anticipates an upward trajectory in Western Canadian liquids production, beginning in 2016 and peaking in 2021, the Canadian Association of Petroleum Producers (CAPP) estimated that Canada will produce 5.3 MMbopd by 2030—down 1.1 MMbopd from its forecast last year.

IHS also expects Canadian oil sands growth to rise at a slower pace than previously anticipated, forecasting the region to account for an additional 800,000 bpd of new production by 2020. Canada produces about 4.4 MMbopd. Evercore counts at least 20 Canadian oil sands projects that have been shelved or postponed, comprising roughly 1.3 MMbpd or ~65% of capacity growth targeted for 2017-2018, due to lower oil prices.

Middle East. We expect Middle Eastern spending to have fallen just 1% in 2015. Looking to 2016, this region’s spending should decline ~3%, due to reductions from ADNOC and Qatar Petroleum. This will offset increased spending by Kuwait Oil Company, while Aramco likely maintains flat spending.

Latin America. Evercore had forecast a 14% decline in Latin American upstream investment during 2015. Yet, following additional budget cuts from Petrobras and little help from Pemex, the region’s E&P spending is now reported to have fallen 18%, marking 2015 as the first year that spending has contracted in the past decade. For 2016, spending is forecast to decline another 17%.

Russia/FSU. While Russian/FSU investment was forecast to decline 15% during 2015, the region has proven unexpectedly resilient, with spending down just 1% on the year. Overall, for Russia and the FSU, we forecast a 7% increase in 2016 spending.

Europe. Evercore’s expectation, that European spending would be down 12% in 2015, was fairly on par, as the decline appears set to approximate 14%. We now expect 2016 spending to drop another 7%, which may prove conservative.

Asia/Australia. We believe that upstream spending in Asia & Australia will fall another 11% in 2016, marking the region’s third consecutive decline. Our 2016 projection for the region calls for spending to be down about 35% from its 2013 peak.

Africa. The region held up relatively well in 2015, posting a modest 2% decline. The one bright spot appears to be onshore Algeria, where spending should ramp for natural-gas driven activity. However, this is not expected to offset additional declines by NNPC and Sonangol. ![]()

- The last barrel (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- U.S. producing gas wells increase despite low prices (February 2024)

- U.S. drilling: More of the same expected (February 2024)

- U.S. oil and natural gas production hits record highs (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)