Three Cs for success in shale plays

The shale oil E&P sector is entering the second year of low crude oil prices. From a recent peak of $105.79/bbl in June 2014, WTI price slipped all the way down to $47.22/bbl in just six months. After a brief climb up to $59.82/bbl in June 2015, the price dropped again to $45.48/bbl by September 2015. After a winter spike to $6/Mcf in February 2014, natural gas prices at the Henry Hub have languished around $2.60/Mcf, trading as low as $1.90/Mcf in late October. In a keynote address at the Louisiana Gulf Coast Exposition (LAGCOE), Chesapeake Energy CEO Doug Lawler revealed that his company needs a break-even oil price of $50/bbl, and a natural gas break-even price of $2.50/Mcf. Under these dire circumstances, shale operators have to depend upon “three Cs” to remain viable: cost containment, G&G constraint and technology collaboration.

Cost reduction. Cost containment may already be reaching its limit. Operators have cut staff, to be sure, but they also have imposed other cost-cutting measures on those who’ve survived, such as business travel restrictions. Pressuring service companies to squeeze their rates also may have reached its limit. We’ve heard reports of a few of the service companies walking away from some jobs, if the job contract price was below their own break-even rate.

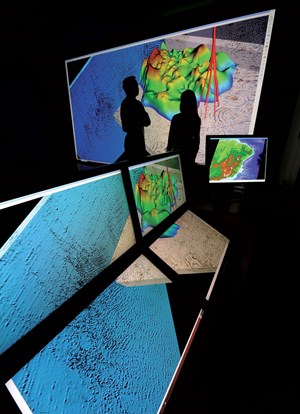

G&G constraint. Locating the best rocks is always the Holy Grail for operators. It is especially urgent at this time, because some operators have been able to focus their drilling and production activity in the sweet spots, so as to continue to achieve double-digit internal rates of return. This effort will continue to reap rewards.

Collaboration. We must enter a period of more intensive technology collaboration between operators, service companies and equipment manufacturers to achieve a step-change improvement in performance in all phases of the E&P cycle. Since the last industry contraction in the early 2000s, the operators have given up many of their R&D efforts to vendors.

A demonstration of the three Cs at work was revealed in a recent Bloomberg study. According to the news service’s researchers, the drilling cost per lateral in shale plays has dropped 71% since 2011. With results such as these, there is hope that the shale oil and gas industry will have a long-term future. ![]()