A new technology reduces formation water

Produced water, or formation water, is water from underground formations that is brought to the surface during oil and gas production. By volume, it is the largest by-product of oil and gas production, with some sources estimating that 3 bbl of water are produced for every barrel of oil.1 The water that is produced may contain organic chemicals, salts, bacteria and naturally occurring radioactive materials (NORM).2

Water enters the production stream in several ways. An improper cement job can leave channels behind the casing that connect a brine water zone to a pay zone, or the casing, itself, could be leaking. In the reservoir, water can occur naturally in the oil-producing zone, or layers of high-permeability rock can convey water to the wellbore. Fractures, existing naturally or from well stimulation, also can connect water zones to oil zones. Water layers below the wellbore can reach the perforations, due to the high-pressure drawdown near the well, in a phenomenon known as coning. Water drive, natural or occurring due to enhanced oil recovery (EOR) techniques, can be a source of water production, as well.2

Costs associated with handling the produced water can include water treatment, storage, transportation and disposal. Estimates on the cost to handle a barrel of water vary greatly, depending on the region where the work is being performed. These costs can range from $0.25–$8.00/bbl.3 The higher costs often occur in areas where there is a restriction on disposal wells leading to higher transportation expenditures. States, such as Kansas and Oklahoma, are placing restrictions on the rates at which water can be re-injected into disposal wells. An estimated $40 billion or more is spent annually on managing global water production.1 In addition to these costs, produced water can lead to corrosion of downhole and surface equipment, which also can reduce a well’s profitability.

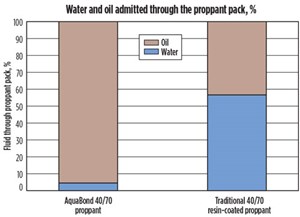

Another way of looking at costs is considering the effective oil price. When considering an individual well, a true price per barrel of oil can be determined after taking into account the water cut or percentage of water, compared to oil. The chart shown in Fig. 1, from chapter three of the Mature Oil and Gas Wells Downhole Remediation Handbook, demonstrates how the effective oil price works. The effective price per barrel of oil decreases as the water cut increases. Some wells in North America can have water cuts of 90% or more.

Treating the produced water issue downhole can be more expensive than handling the produced water on the surface. Remedial water control techniques are typically only undertaken when they can be done inexpensively, and when there is no negative effect on hydrocarbon production. The problem is that water control strategies practiced today do affect hydrocarbon production. The use of hard-set resins and cement squeeze jobs may shut down high water producing zones, but then all fluid is blocked, including oil and gas. Gel treatments and swelling chemicals used in the fracture may suffer from the same shortcomings. Once the pathway for water to reach the wellbore is blocked, the pathway for hydrocarbons is also lost. Other options, such as downhole oil/water separators (DOWS) which separate the oil and water downhole and re-inject the water into a completely different zone, are very costly.2

A new approach to reducing water production is needed. Produced water must be decreased; hydrocarbon output must not be affected negatively; and the solution needs to be inexpensive. By improving the chemistry of a product that is already used in well stimulation, these requirements can be met.

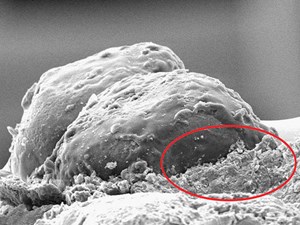

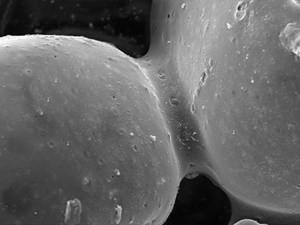

Hexion’s AquaBond proppant, Fig. 2, is a new technology that has been developed to reduce the production of formation water, while maintaining oil and gas output. The unique resin chemistry of this water-reducing proppant (WRP) alters the relative permeability of the proppant pack for preferential flow of hydrocarbons over water. Since the water-reducing properties are part of the chemistry of the resin-coated proppant, water reduction characteristics may be seen for the life of the well.

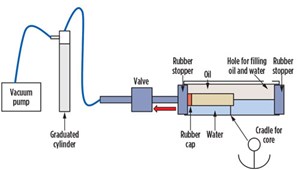

A new laboratory test method was developed to evaluate WRP, Fig. 3. A consolidated proppant core was placed in a clear cell filled with oil and water. The core was connected to a tightly sealed rubber cap that attached to a hose, and extended out from the test cell to a graduated cylinder that collected the fluid that flowed through the proppant pack. The drive mechanism for this test apparatus was a vacuum pump that pulled the fluid from the test cell, through the proppant pack and into the collection cylinder. The fluid that the proppant pack prefers to admit is determined by measuring the oil-to-water ratio in the graduated cylinder.

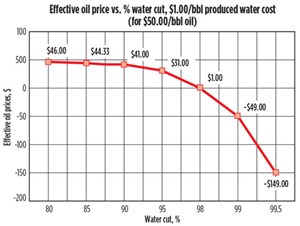

The test setup used two parts water and one part oil, with both fluids in contact with the proppant core. Initial test results of the WRP showed that 95% of the fluid that flowed through the proppant core was oil, and 5% was water. A traditional resin-coated proppant was used as the control. The traditional resin-coated proppant flowed 40% oil and 60% water, which is close to the starting oil/water ratio in the test cell, Fig. 4. Initial experiments were conducted with 40/70 mesh-size proppant for the WRP and the control. Additional tests using 30/50 and 20/40 mesh size proppant yielded similar results.

It is important to note that this test method cannot be used to test uncoated frac sand or ceramic proppant, since a consolidated proppant core is required. It is predicted that uncoated frac sand and ceramic proppant would allow more water to flow through the proppant pack than traditional resin-coated proppant, due to the hydrophilic nature of the sand and ceramic proppant.

Since the WRP pack, itself, is a porous medium, water is never blocked completely from flowing through the pack. Laboratory tests have shown that oil will dominate the flow through the consolidated WRP proppant pack, when both fluids are contacting the proppant pack. Water will flow through the proppant pack, when it is the only fluid in contact with the pack. This avoids any loss of production, due to the formation of a water block.

Another concern when developing WRP was if the proppant would properly wet in a frac blender tub and be transported via water-based fluid systems. The chemistry of the resin was designed to properly wet in a frac blender tub, avoid pump cavitation, and travel downhole just as any other resin-coated proppant. Once downhole, the frac water that transported the WRP should be returned to the surface, at the same recovery percentage as any traditional proppant.

Proppant costs are incurred as part of most hydraulic fracturing jobs, to ensure effective well stimulation. WRP serves two main purposes: propping fractures and reducing formation water. Adding the ability to reduce formation water adds value by eliminating the need to stop production and treat the problem after it has occurred. The additional up-front investment of purchasing WRP over a traditional proppant would be regained in a relatively short amount of time.

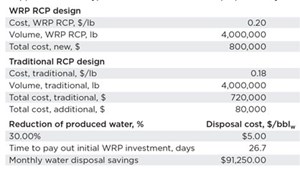

Consider a well producing 2,000 bwpd, with disposal costs of $5.00/bbl of water. Even if the WRP proppant is 10% more expensive than traditional resin-coated proppant, savings from reducing the water production would offset the initial investment in less than 30 days. This assumes that the WRP could reduce water production by 30%, with no negative effect on hydrocarbon production, Table 1. Additional savings would also come from avoiding downtime and chemical costs to treat the water issue.

WRP will deliver all of the traditional benefits of a curable resin-coated sand, including grain-to-grain bonding, Fig. 5. Proppant fines, due to crushing, are reduced by stress distribution throughout the bonded proppant pack and encapsulation of broken substrate within the resin. Reducing proppant fines leads to higher conductivity, which can be translated into higher production. Generation of only 5% fines can reduce conductivity in the proppant pack by 60%.3

Proppant embedment, which leads to reduced fracture width and formation fines due to spalling, Fig. 6, is also reduced by the use of resin coated proppants. By forming a consolidated proppant pack, stress is distributed throughout the entire bonded network, reducing the depth that the proppant pushes into the fracture face. Proppant flowback is also reduced by the use of curable resin-coated sands. By reducing proppant flowback, damage to surface equipment and electronic submersible pumps (ESPs) can be avoided, and production can be maintained, since the proppant remains in the fracture for the life of the well.4

Water-reducing proppant is an innovative solution to deal with unwanted produced water. By combining water-reducing properties with a proppant, formation water can be reduced, oil and gas output can be maintained, and costs can be lowered, compared to traditional water-reducing techniques. WRP incorporates all the benefits of curable resin-coated proppant, while reducing formation water for the life of the well. ![]()

REFERENCES

- Bailey, B., M. Crabtree, J. Tyrie, J. Elphick, F. Kuchuk, C. Romano and L. Roodhart, “Water control,” Oilfield Review, 12 (2000) 30–51.

- Graves, W. G., W. K. Ott and Joe D. Woods, Mature Oil & Gas Wells Downhole Remediation Handbook, Gulf Publishing Company, 53–130. Print, Houston, Texas, 2004.

- Coulter, G. R., and R. D. Wells, “The advantages of high proppant concentration in fracture stimulation,” SPE, doi: 10.2118/3298-PA, June 1, 1972.

- Terracina, J. M., J. M. Turner, D. H. Collins and S. Spillars, “Proppant selection and its effect on the results of fracturing treatments performed in shale formations,” SPE. doi: 10.2118/135502-MS, Jan. 1, 2010.

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)