Thriving in the Bakken during depressed markets: Lessons from the 2008 downturn

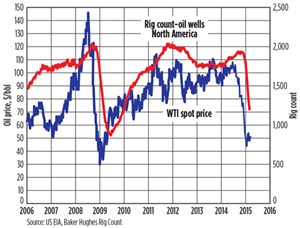

Crude oil spot prices plunged 60% in the closing half of 2014. From June 2014 highs near $110/bbl, to January 2015 lows near $45/bbl, the falling commodity prices have initiated a similar, albeit delayed, decline in drilling activity, Fig. 1. The U.S. rig count fell from a September 2014 high of 1,931 to an April 2015 low of 988, and accounted for 86% of the decline in the global rig count.

Despite this decline, U.S. crude oil inventories continue to build, exerting further downward pressure on the WTI price. Brent has fared slightly better, and has recovered relative to WTI in recent weeks, supported by economic activity in Europe, Japan and India. Nevertheless, “significant uncertainty remains … and price volatility is likely to persist.”1

Recovery from this downturn will take time; the rig count and crude prices took three years to climb from the 2008 slump, and, thus far, the road ahead looks similar. The U.S. Energy Information Administration (EIA) forecasts oil to remain below $60/bbl throughout 2015, and below $75 in 2016.2 Though crystal balls are rare, and forecasts are as fluid as Texas Tea, prudence suggests that we become comfortable in a depressed market.

The rising tide of the unconventional boom lifted many boats—it’s hard not to make money at $100 oil—but who will remain afloat at $60? At $40? This dip will have its victims. A review of 2015 capital programs shows that E&P companies are cutting spending, from 10% to 50% of 2014 levels, and a buzz of corporate consolidations is rampant during downturns. Yet we go on; the world needs oil. How can we thrive in this fallen market?

We can get back to work; we can dig in; we can solve new problems.

The work that is shared in this article began in the wake of the 2008 price collapse. Though the roots of the 2008 collapse (WTI fell from $145/bbl to $30/bbl in under six months) and the present one are different, the success that we wrought while recovering from 2008 can inspire, and guide, our actions in recovering from this one.

A METHODOLOGY, NOT A PRESCRIPTION

In the thick of the 2008 downturn, Helis Oil and Gas Co., LLC, commissioned a study on its assets in South Antelope Field, McKenzie County, N.D. This study, and the following three years of implementation of its recommendations, resulted in a four-fold increase in well productivity. The average well’s estimated ultimate recovery (EUR) quadrupled, from 300,000 boe to 1.219 MMboe. This success was not the result of one breakthrough, but rather the result of a comprehensive geological analysis, and systematic application, of engineering principles.

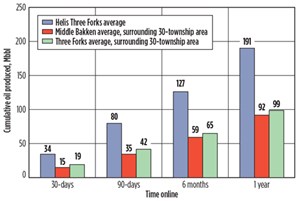

The study that Helis commissioned reviewed the entire process of oil extraction, from target selection to drilling, from completion to production. In effect, the study combined geologic analysis with—at that time—cutting edge technology and engineering principles, to drive the state of the art, and create an asset with wells that, on average, yielded double the production over contemporary wells within a 30-township area surrounding South Antelope field, Fig. 2.

The prescriptions developed through this study were unique for that time and place—the states of technology, and geologic understanding, are forever advancing—and will not necessarily apply directly to other areas of the Bakken, let alone a formation in a different basin. However, this study’s philosophy is applicable everywhere: understand the rock, understand how to break it and understand how to produce it; then execute, observe, learn and refine. This philosophy, applied in assessing South Antelope, yielded a 10-element production optimization program.

TEN STEPS TO A BETTER BAKKEN

The 10 elements of this program, enumerated below, span from better understanding and utilization of geology and technology (1–5), to improved execution (6–7), and elements that combine both (8–10).

The first five elements resulted from investigation into the geologic drivers of production, and assessment of past well performance, and the engineering solutions that accounted for these findings:

- 1. Select the most-attractive target

- 2. Increase wellbore lateral length

- 3. Increase density of stimulation injection points

- 4. Maximize fracture conductivity, limit complexity

- 5. Select suitable treatment fluids and proppants.

One-year cumulative production for early Helis wells (2007–2008) averaged 33,000 bbl of oil for wells drilled in the middle Bakken, and 45,000 bbl for wells drilled in the Three Forks formation that underlies the Bakken. Though the data set was limited (nine wells), based on one-year cumulative production, the Three Forks was selected as the target for primary completion, with the middle Bakken serving as a secondary target able to be drilled, and completed, at a later date, if so desired.

The geologic drivers of production (e.g., porosity, permeability, fracture density, brittleness and formation thickness) informed selection of stimulation fluids and proppants. The study determined that the relatively high formation deliverability required highly conductive fractures. The stimulation design was based on a borate/cross-linked, 25-lbm/Mgal guar-gel system that would limit induced fracture complexity, and allow placement of high-concentration proppant. Previous cross-linked gel treatments in the field were based on a 40-lbm/Mgal guar system. The reduction to 25-lbm/Mgal reduced formation damage, yet it maintained sufficient thermal stability, and viscosity, to place the desired conductive fracs.

Notably, this design was counter to the complexity-maximizing slickwater systems of nearby operators. Finally, to maximize conductivity and ensure long-term durability of the proppant pack, the assessment recommended 30/50- and 20/40-mesh ceramic proppants (the size for the absolute conductivity, and the material for the crush resistance, as necessitated by the formation closure stress). Note: slickwater and smaller-mesh proppants have their application, and operators in some areas of the Bakken are realizing great success with that strategy. Such strategies have been employed in the area of South Antelope field, but they did not create the success shown by the conductivity-maximizing treatments.

With the target selected, and the treatment formulated, the last piece of design was to connect the treatment to the target. The Helis wells of 2007–2008 were completed with an assortment of dual laterals (two wells, four laterals) and single laterals (seven wells), pre-perforated liners (three wells), and ported subs (six wells), with lateral lengths for these early wells averaging 4,000 ft.

Lateral lengths for the 2009–2012 Helis wells increased to an average of 8,700 ft, thanks to advances in directional drilling. Advances in completion technologies in extended-reach laterals enabled dramatic increases in stage density (stage count for 2007–2008 wells ranged from one to six stages, whereas 2009–2012 wells ranged from 24 to 31 stages). To achieve 30-stage completions, we selected plug-and-perf over ball-actuated sliding sleeves. Plug-and-perf enabled multiple injection clusters per stage (we used three pseudo-point source limited-entry clusters), whereas a sliding sleeve would have limited the injection to one point per stage. Rounding out the completion design, the production string was uncemented, and stages were isolated by swell packers, leaving the rock fabric unharmed by cement, open for stimulation, and potentially contributive to production.

Plug-and-perf completions averaged two weeks in duration, double that of ball-actuated sliding sleeve completions, but the high reliability and consistency of plug-and-perf ensured no lateral sections were left unstimulated. Premature sleeve shifts, failed sleeve shifts, and other mechanical failures plagued neighboring operators employing sleeves. This resulted in lost reserves and, in two notable cases, entire laterals left unstimulated and wells abandoned after costly attempts at remediation. We wanted to avoid this. (Again, these technologies were the best available at the time; had we access to today’s technologies, which enable upwards of 100 stages in a lateral, our story might be different.)

The next two elements focused on in-field execution, and were implemented to ensure integrity of the proppant pack detailed above:

- 6. Re-design the flush procedure

- 7. Use leading-edge and reliable completion technologies

Conventional fracture theory posits oil and multiphase flow regimes necessitate high-conductivity fractures. These high-conductivity fractures are best-supported with a highly conductive near-wellbore region connecting the fracture to the wellbore. The subsurface reality may not play out exactly to theory, particularly when based on trends that I have observed in unconventional completion strategies over the past two years. Nevertheless, the reservoir understanding of the Helis study warranted a high-conductivity, near-wellbore proppant pack.

Element 6 implemented two procedures to achieve the desired proppant pack in the near-wellbore region. First, in the final sand stage of each fracture treatment, for the last 3,000–5,000 lbm of proppant (one full “hopper”), proppant concentration was increased, from 6 lbm added per gallon of fluid (ppa), to between 10 ppa and 17 ppa. The second procedure focused on ensuring a rapid decrease, from the 10–17 ppa spike, to a proppant-free fluid, for flushing the frac stage.

The rapid and complete decrease from a proppant-laden fluid to a proppant-free fluid was achieved through coordination with the frac service provider’s blender equipment operator. The blender is the equipment that—true to its name—blends the gel system with chemicals and proppant in a large, continuously mixing tub. To achieve the spike and rapid transition to proppant-free fluid, as the ending grains of proppant blend into the frac gel, the blender operator switches the flow routing to bypass the mixing tub. Though this switch may leave a small amount of proppant in the blender tub (which can be cleaned up during preparations for the next frac stage), the abrupt transition prevents a low-level trickle of proppant tailing into the frac fluid and wellbore. A proppant-free wellbore is necessary to minimize issues from wireline plug-and-perf operations.

Element 7 evaluated completion technologies that would facilitate preservation of the near-wellbore proppant pack, and focused on the use of caged-ball frac plugs. Wireline flow-through plugs can be sealed with a ball released at surface and pumped down the wellbore to seat into the plug, or, as the study recommended, with a ball contained within a cage on the plug. Caged-ball plugs reduce the volume (150–300 bbl, reduced to near zero with a caged-ball system), needed to seat the ball and isolate the previously stimulated zone. However, a caged-ball plug, once set, prevents a second wireline run if a failure with the perforating guns occurs.

To address this, the study recommended addressable-charge perforating guns over the more commonly used select-fire guns. With select-fire guns, a failure in one gun renders all following guns inoperable, and would require coiled tubing, or wireline-tractor operations, to perforate the stage. With addressable-charge guns, however, a gun can be fired, even if the previous gun failed. Of the 31 wells drilled, from 2009 to 2012, and completed using the caged-ball, addressable-charge system, not one of the over 900 stages required coiled tubing, or a tractor, to perforate an interval. The system worked.

The final three elements drew on the improved understanding of the reservoir geology to guide in-field operations:

- 8. Implement in-field assessment of fracture mechanics

- 9. Oversee stimulation operations with adaptive engineering

- 10. Control flowback

The best plan, if poorly executed, is still a failure. In hydraulic fracturing, rock 2 mi below the Earth’s surface is breaking. There is no camera to see what is happening, though there are tools (microseismic, proppant tracer, fiber optics), that provide methods for characterizing the fracture behavior (and indeed these are fantastic tools; microseismic provided key insight into target selection in this project).

The data connected directly to the fracture treatment—injection rate, injection pressure, and proppant concentration—are ignored by some who seek to treat each well with a cookie-cutter uniformity that a computer spreadsheet design may suggest. A shale, contrary to earlier beliefs, is not “just a shale.” Early in the shale revolution, success in the Barnett shale drove completion designs across the country; the thought was that the key to the Barnett was the key to “shales.”

This is not the case. The Helis study understood the geologic heterogeneities of unconventional plays. The South Antelope program was designed with that understanding: elements 1-5 were designed for the geology, and elements 8 and 9 created the ability to assess, and adapt to, stage-level variability in the formation’s response to the stimulation.

Element 8 employed diagnostic fracture injection tests, and step-down rate tests, to assess near-wellbore properties like fracture closure pressure, fluid leak-off rates, near-wellbore complexity/tortuosity, and perforation quality. With these properties assessed, engineering staff tailored each frac stage to best stimulate the stage’s rock. The primary treatment parameters adjusted were proppant slugs, fluid rheology, and injection rate.

Element 9 made further use of the understanding gained with the diagnostic tools, with engineers monitoring, and scrutinizing, the pressure response that the formation had to the stimulation. Trends and small changes in pressure tell much about the formation’s receptiveness to the treatment, and careful adjustment to the signals seen in pressure are often the difference between a successful stimulation, and a failed stimulation. This element, along with design elements from above, reduced the percentage of screenouts, commonly viewed as a failure in completions, from 30% in 2007–2008 wells, to under 2% in 2009–2012 wells.

Following a successful stimulation, element 10 sought to maximize long-term reservoir productivity. A key driving factor of unconventional production is the natural fracture network of the rock fabric, a network ideally augmented by hydraulic fracture stimulation. To maintain contribution from this network, the 2009–2012 Helis wells were produced on a program that maintained a high flowing pressure. This high flowing pressure, well above the reservoir’s bubble point, prevented early gas breakout, limited the effects of multiphase flow, maintained reservoir energy, and minimized and delayed closure of the microfracture network. Though this high flowing pressure also depressed early oil recovery, from what an unrestricted, low-flowing pressure flowback program would have yielded, the end effect is that within three to six months, the restricted flowback program yielded greater cumulative volumes.

Put together, program elements 1 through 7 built a stimulation from the best geologic understanding and most appropriate technology available in the 2008–2009 period; elements 8 and 9 executed this stimulation with the plan of adapting in real-time; and element 10 brought the oil to the surface. The effect of this comprehensive program was a near-tripling of the productivity of each foot of reservoir (average production per lateral foot increased from 8 bbl/ft in 2007–2008 wells to 21 bbl/ft in 2009–2012 wells), and a quadrupling in EUR (300,000 bbl to 1.219 MMboe).

Some program elements were slower, and not as in vogue (plug-and-perf was seen as old hat next to the rapid-completions of ball-actuated sleeves), but the success of this program was built on the basis of sound assessment and understanding, a focus on reliability, the patience to do it right the first time, and the skill to adapt swiftly and adroitly.

This program was built for South Antelope field in the wake of the 2008 price collapse, and it culminated with the 2012 sale of the 27,000-acre South Antelope field for $1.3 billion. There is incredible opportunity in this downturn. Get to work. ![]()

ACKNOWLEDGMENTS

This article was adapted from SPE paper 1913075, presented at the Unconventional Resources Technology Conference, Denver, Colo., Aug. 25–27, 2014; and SPE paper 167168-MS, presented at the SPE Unconventional Resources Conference-Canada, held in Calgary, Alta., Canada, Nov. 5–7, 2013.

REFERENCES

- U.S. Energy Information Administration, Market Prices and Uncertainty Report, March 2015.

- U.S. Energy Information Administration, Short-Term Energy Outlook, March 2015.