|

Happy New Year to all of you, our faithful readers, and, while we’re at it, welcome to the new, “global oil price reality” for 2015. As most of you remember, during the back half of November, the WTI oil price was hovering in the mid-$70s/bbl. It then proceeded to take an average $20/bbl plunge during December, resulting in a level of just the mid-$50s/bbl by the end of the month.

During the last two weeks ending in very early January, we began to think that the WTI price had begun to stabilize in the mid-$50s/bbl. Unfortunately, during Jan. 5-7, the price took yet another fall, slipping below $50, and settling between $48 and $49 on the New York Mercantile Exchange. It was certainly possible that the price could slip further before hitting bottom.

Shades of 1986. Hence, we have the new oil price reality that this editor believes will be with us for some time to come—how long is hard to say, but certainly at least a year and probably longer, absent some significant, unexpected geopolitical event that changes the equation. And, despite substantial rhetoric from a plethora of overpaid analysts, this situation is not that complicated. It simply boils down to understanding one key component—Saudi Arabian governmental thinking, which, in this editor’s opinion, is extremely reminiscent of the Kingdom’s logic in 1986. That was the year, of course, when the Saudis were concerned about their shrinking market share and proceeded to flood the world with cheaply produced oil. In the process, with the encouragement of the Reagan administration in Washington, they destroyed the hard currency earnings of the then-Soviet Union (Russia) and nearly wrecked the U.S. E&P industry simultaneously.

Back to the present. The most visible, quoted source for current Saudi policy has been, of course, Minister of Petroleum & Mineral Resources Ali Ibrahim al-Naimi. His quotes in various media certainly have gyrated the global oil markets over the past two months. Perhaps the most extensive collection of remarks by Minister al-Naimi has come in an excellent interview conducted by the Middle East Economic Survey (MEES) on Dec. 21.

|

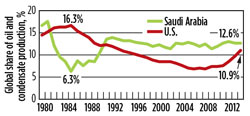

| Percent share of global oil/condensate production. |

|

In the MEES interview, the minister explained why Saudi has not cut production, to date: “First of all, why did we decide not to reduce production? I will tell you why. Is it reasonable for a highly efficient producer to reduce output, while the producer of poor efficiency continues to produce? ….If I reduce, what happens to my market share? The price will go up, and the Russians, the Brazilians and U.S. shale oil producers take my share.”

Al-Naimi adds that not cutting production “is also a defense of high-efficiency producing countries, not only of market share.” As to how long this price and market share war might go on, al-Naimi indicated to MEES that the Kingdom is prepared to go quite a long time without cutting production: “Whether it goes down to $20/bbl, $40/bbl, $50/bbl, $60/bbl, it is irrelevant.” Asked whether the “core of Middle East Gulf producers” can withstand two to three years of low oil prices, al-Naimi said, “Yes, I can assure you, they can withstand them.”

Data trends. To understand the Saudi mindset, one has to look at some key numbers, as shown by the two charts on this page. In the first chart, the percentage share of global oil and condensate production, the Saudis’ figure slipped from 17.5% in 1981 to just 6.3% in 1985. After flooding the market in 1986, the Kingdom’s share rose steadily, achieving 13.9% by 1992. From 1996, forward to today, that share has remained within a consistently narrow range between 12% and 13%.

|

| Saudi Arabia’s share of global oil, condensate and refined product exports. |

|

Meanwhile, U.S. output tumbled from a 16.6% share in 1985 to 12.3% in 1991, and eventually to a low of 6.8% in 2008. But since then, U.S. output has shown, as the chart indicates, a meteoric rise to 10.9% in 2014, with a higher level expected in 2015. This obviously is something that Saudi Arabia was not prepared to tolerate.

Furthermore, as the second chart indicates, Saudi’s share of the world market for total exports (oil, condensate and refined products) is at roughly the same level as in 1986—just over 12%. After flooding the market in 1986, Saudi saw its market share of global exports rise to 18.9% in 1991. This was followed by a period of stability during 1993-1996, when the Kingdom’s share ranged between 16% and 17%. Yet another stable period ensued from 1999 to 2008, when it fell within a range of about 13.5% to 14.5%. Then came the global recession of 2008, and the Kingdom’s share fell to just 11.2% in 2009. A mild recovery saw that figure rise back to 12.9% in 2012, but it has stalled out in the last two years, at an estimated 12.5%.

Simply put, Saudi Arabia appears to have decided that this level is unsatisfactory, and that it must be pushed back higher, to somewhere between 14% and 16%, judging by historical trends. These market share numbers, in a nutshell, may be the prime motivation for the current Saudi stance. Time will prove whether this is correct.

|