Energy issues

I gave a talk the other day that detailed our technological accomplishments over the past 40-plus years. Those accomplishments are truly impressive. Snippets of the presentation are discussed below. You might find these a bit boring, for the technical revolutions of 20 years ago are ho-hum to most of us today. It’s what is around the corner that piques our interest. Therein lies the problem, for there might not be the major breakthroughs around the corner that we have become used to over the past few decades. And that results not so much from the lack of creativity, but from the lack of incentive, due to low oil prices and booming shale development. First, the good news.

The major upstream technology boom began after the Second World War, when economies, particularly in the U.S., which was spared destruction on its shores, began to convert the huge industrial machine built to win the war into engines for economic growth. Those engines drove an unprecedented demand for oil and gas which, in turn, led to an explosion in upstream technology, to meet the exploding demand. That explosion, with a few lapses, has continued—actually increased—as the decades have sped by.

In any discussion of upstream technology advances, my frame of reference begins in the mid-1960s. That decade represented both the maturation of post-war technologies grounded in the 1930s and 1940s, such as modern rotary drilling, elemental fracturing and artificial lift, and the introduction of basic computerization. Innocuous as those technologies might seem, it was the advent of computerization that turned on the lights in the technology labs. To be sure, the computerization was primitive, consisting mainly of equipment monitoring and the generation of warning signals to note equipment failures. But, it pointed to a future that few could envision at the start of the decade. And, what a future that was.

Beginning in the 1970s, computer-aided design produced significant innovations, including the spread of floating facilities offshore, especially semi-subs, greater well deviation and the first attempts at laterals. Computers, themselves, became available to the average engineer in the field, with the advent of TI and HP handheld devices that could run simple applications, such as fluid and kill programs. It looked like the world was ours, until the 1970s oil price crises severely restrained technical innovation. But we recovered.

By the mid-1980s, we were back on the road of technical innovation, moving over the next few years into deeper waters, developing and perfecting horizontal technology, toying with automation and actively investigating passive and micro-seismic. In the 1990s through the 2000s, we developed and refined 3D seismic and then moved to 4D; introduced smart fields and intelligent operations; refined complex fracturing technology; redefined enhanced oil and gas recovery; moved equipment to the seafloor; and began to work in immersive environments. We were to energy, what NASA was to flight.

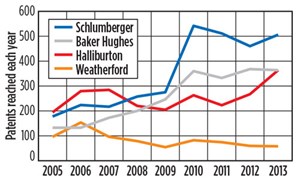

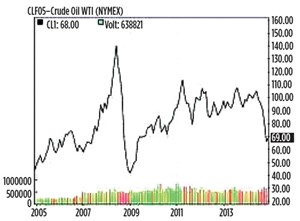

These thoughts were in the back of my mind, when I attended the annual World Oil Forecast Breakfast in late January. As the speakers presented graphs and tables detailing their forecast for the year, and talk turned to idle equipment, falling well counts and, by implication, layoffs, I began to wonder how much the low oil price could impact the development of technology. As might be expected, there is a very good correlation. Below are two graphs that illustrate the correlation. Comparing the number of patents granted (Fig. 1), and given time allowance for review and granting of those patents, you will note that upswings in price (Fig. 2), particularly in mid-2006, mid-2009 and mid-2012, resulted in an increase in patents granted to the four major service companies. Price declines, as in early 2007, resulted in a fall in patents.

Looking forward, we will see a year, or more, of languid new technology output based, primarily, on low oil and gas prices. That being said, early 2016 should kick off another uptick in prices. That’s the message that David Pursell of Tudor, Pickering, Holt & Co. (TPH) delivered at the breakfast. TPH research predicts an upturn in first-quarter 2016, with prices rising to the $85/bbl range. That should be good news for new technology.

But, I believe, there is another factor at work here—shale development. While there is still work to be done advancing shale technology, the sheer size of the resource, and its productivity, coupled with low oil prices, means that R&D in other oil and gas resource sectors could decline significantly. In fact, that appears to be happening in some R&D sectors. That could mean several years of curtailed R&D which, in turn, could hamper a post-shale world, whenever that may be. ![]()

- Coiled tubing drilling’s role in the energy transition (March 2024)

- What's new in production (February 2024)

- Using data to create new completion efficiencies (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)