Reversing declining production in ONGC’s Western Offshore fields

Declining production is a natural phenomenon in most mature oil and gas fields worldwide. It is a source of much concern to the producer, especially if the affected fields had once been prolific and contributed a large part of the country’s production. India’s most prolific field, Bombay High, now known as Mumbai High, had started production on May 21, 1976. Over the next 39 years, it had been ONGC’s milch cow. The production reached its peak in 1998, when the field produced 150 MMbbl, amounting to a majority of India’s total domestic crude oil output.

Mumbai High then entered a declining trajectory, owing largely to water-cut and GOR problems. This declining trend continued for several years, despite efforts to stop and reverse it. Through the infusion of technology, a major decline was arrested, but production continued to come down over the years. It then became imperative for ONGC to make every possible effort not only to stop the sliding offshore production, but also to devise innovative techniques and technology to enhance the output.

As a result of a sustained effort, ONGC’s offshore fields produced 121.5 MMbbl of crude oil in FY 2015, amounting to 43.2% of India’s total domestic production of 281MMbbl. The contribution to domestic production of natural gas was 17.272 Bcm (51.03%), as against India’s overall production of 33.656 Bcm. Likewise, in previous years, the contribution of ONGC’s offshore fields to the total oil and gas domestic volume had been substantial, more or less in a similar ratio.

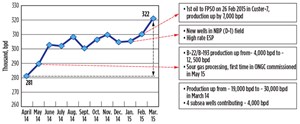

On March 12, 2015, production from ONGC’s Western Offshore fields exceeded 332,000 bopd, Fig. 1. Furthermore, these fields increased their production volume 14.6%, as compared to 2014. As such, ONGC achieved a marginal increase in production volume. Thus, ONGC defied the natural phenomenon of declining production from aging fields of 30-40 years’ vintage.

REVERSING THE DECLINE

Several factors have contributed to ONGC’s historic achievement. There were obvious factors, such as comprehensive planning, meticulous execution, better contracting, and conducive relationships with contractors and service providers. Intervention and advice from the decision-makers helped as well.

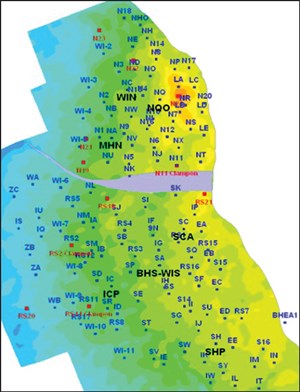

Exploiting the “cavern area.” Untapped oil in a basal clastic cavern area in western periphery, that divides Mumbai High North and Mumbai High South fields, was accessed through proppant hydro-fracturing (HF) of basal clastic and horizontal subsea completions in four wells, Fig. 2. This resulted in new production of about 4,000 bopd.

An earlier application of proppant HF of basal clastic in one of the low-producing wells in Mumbai High South field, in which production increased from 20 bopd to 1,885 bopd, acted as a trigger to repeat the exercise in three more wells. The entire HF job was conducted by ONGC engineers, providing them with the confidence to take up a long campaign in basal clastics.

New stimulation technique. Learning from experience, and capitalizing on years of knowledge, ONGC field engineers have devised a new stimulation technique and applied it in the NBP (D-1) field wells. Basically, the ESPs deployed in D-1 wells were performing sub-optimally (not providing high production volume) because of poor influx at the ESP suction. Acidization jobs undertaken in the wells to improve the influx were not delivering satisfactory results. As a result, the entire well completion chronology and sequence were re-visited.

Subsequently, the wells were stimulated (hydro-fractured, acidized), before lowering the ESPs to improve the influx. The result was quite encouraging, and it is expected to guide future well planning and ESP deployment. After application of this technology, the field experienced an increase in production from 16,000 bopd to 30,000 bopd.

Expedited FPSO procurement. Owing to the non-availability of an FPSO, production from Cluster-7 fields was transferred temporarily to the ICP platform for processing. However, this temporary arrangement proved to be an obstacle in achieving the field’s anticipated production potential, first on account of high back pressure, and secondly, owing to the sub-optimal performance of artificial lift. Taking cognizance of this significant deficiency, the Asset and Team management expedited the procurement of an FPSO vessel, Fig. 3.

With the commissioning of an FPSO in March 2015, the production from Cluster-7 fields was diverted to the new FPSO. This diversion helped greatly in reducing the back-pressure problem, and made available the gas line for artificial lift. As a result, field production increased from a sub-optimal level of 6,000 bopd to 17,000 bopd.

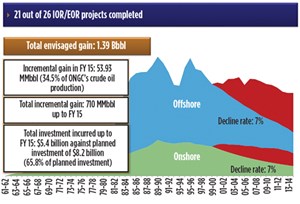

IOR/EOR. Fifteen major producing fields (both offshore and onshore) that contribute about 70% of ONGC’s production are of 30-to-55-year vintage. Worldwide, fields of such vintage show a natural decline of 6%–7% every year. However, ONGC has been able to stem the decline of its mature production to within a range of 2% to 3%.

These mature assets still have significant recoverable volume, with a recovery factor around 30%-35%. Fields of similar vintage, worldwide, have a recovery factor of 45%-plus. Some fields offshore Norway even have a recovery factor of 55%-plus. Hence, ONGC has been engaged during the past 15 years in enhancing production from these mature fields by placing big investments in redevelopment and rolling-redevelopments.

Close to 35% of India’s domestic crude production stems from ONGC’s efforts in technology-intensive IOR/EOR schemes. Incremental gain from these efforts during FY 2015 was 53.93 MMbbl, with the contribution from offshore fields being around 45 MMbbl. Of the envisaged total IOR/EOR gain of around 1.39 Bbbl, ONGC, thus far, has realized an incremental cumulative supply of around 710 MMbbl from these projects. The cumulative contribution of offshore fields is 520.5 MMbbl against the plan of 1.07 Bbbl expected from the lifecycle of these redevelopment projects.

BIG-TICKET IOR/EOR

ONGC has several additional big-ticket IOR/EOR projects underway. These include:

- Re-development of Heera and South Heera Phase-II fields

- Development of the C-26 cluster fields

- Development of the WO-16 cluster fields

- Integrated development of the B-127 cluster fields

- Development of western periphery of the MH South field

- IOR at B-173A field

- A development plan for lower pays in the NBP-14 Block of NBP field (D-1)

All of these projects are in advanced stage of execution, the completion of which is likely to add new production volumes in the near future.

Besides these big projects, the Western Offshore department is executing additional big-ticket items with an investment of over $4 billion. These include:

- Additional development of Vasai East field

- Redevelopment of Mumbai High North Phase-III field

- Redevelopment of Mumbai High South Phase-III field

- Development of Daman field

- Integrated development of the Mukta, Bassien and Panna formations in Bassien field

When completed during 2017–2019, these projects are expected to add significant oil and gas volumes, thereby offsetting the natural declines.

PARTICIPATIVE MANAGEMENT

Several factors have helped ONGC to achieve the given targets. A major factor was the offshore team’s efforts to minimize production losses, due to shutdowns by improving equipment availability and reducing the number of “sick wells” through timely interventions. ONGC could not have made production gains without synergy among the asset, services, institutes and contracting partners through the concept of participative management.

ONGC is optimistic about E&P activity on its Western Offshore front and a slow buildup of production credentials in the Eastern Offshore. With onshore fields mostly depleted, ONGC is looking to greater contributions from offshore fields, not only from its present area of operations, but also from huge potential reserves in deep and ultra-deepwater fields. ![]()

- Advancing offshore decarbonization through electrification of FPSOs (March 2024)

- What's new in production (February 2024)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- U.S. operators reduce activity as crude prices plunge (February 2024)

- U.S. producing gas wells increase despite low prices (February 2024)

- U.S. oil and natural gas production hits record highs (February 2024)