|

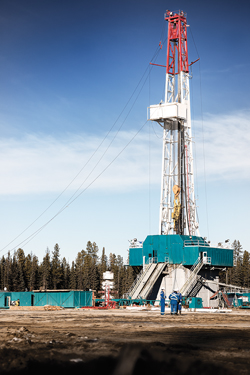

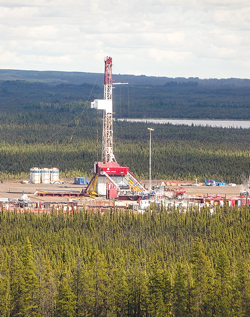

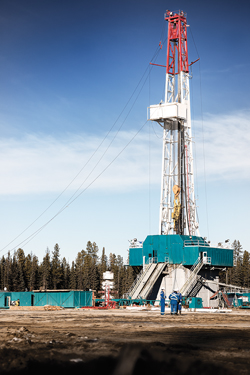

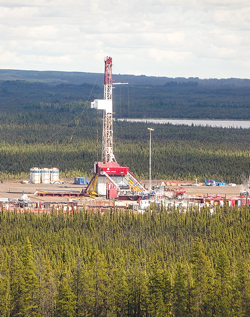

| Nexen’s two shale gas rigs in the Horn River basin in northeastern British Columbia at Dilly Creek. Courtesy of Nexen. |

|

Check out the trendline of the largely emerging Canadian shale plays, and what you find is a near photocopy of their more developed U.S. counterparts. Specifically, like their southern brethren, Canadian operators, having produced themselves into a shale gas glut, are now going full bore to exploit highly prospective liquids-rich assets—chiefly those underlying the 540,543-sq-mi Western Canadian Sedimentary basin.

Today, Canada is second only to the U.S. in terms of both shale gas and tight oil production, with the nation’s already prodigious reserve estimates continuing to climb with additional delineation. While the Canadian Society for Unconventional Resources (CSUR) has identified no less than 18 shale prospects nationwide, in varying stages of development and delineation, nearly all contemporary unconventional oil and gas production flows out of the Montney, Horn River, Duvernay and Cardium shales, and the northern extension of the Bakken shale, Fig. 1. Primarily traversing British Columbia, Alberta, Saskatchewan and Manitoba, that quintet represents a mixed bag of gas and liquids production, both of which are expected to increase this year, albeit modestly, along with drilling activity. Elsewhere, much like a significant portion of the northeastern U.S., a growing anti-fracing backlash has kept once-promising prospects in the east, including the Canadian slice of the Utica shale, either off-limits or severely restricted.

|

| Fig. 1. Aereal extent of predominate shale plays in Western Canada. Courtesy of National Energy Board. |

|

On the bright side, provincial prospects rose appreciably in November, with the release of an updated Canadian National Energy Board (NEB) reserve assessment for the thick and well-defined Montney, with a delineated aerial reach that extends some 50,193 sq mi beneath British Columbia and into Alberta. While a dominant gas play, the Montney’s liquids content tends to increase as it moves eastward into Alberta. The 23-page report, orchestrated by Canada’s chief regulator, estimates marketable Montney unconventional reserves at 449 Tcf of gas, 14.521 billion bbl of NGLs and 1.125 billion bbl of oil, Fig. 2. As for their share, British Columbia officials said the upraised gas assessment was nearly double earlier estimates for the province.

|

| Fig. 2. An Encana Montney multi-well production pad in the Dawson Creek area. Courtesy of Encana. |

|

“And that doesn’t include some of the areas where we have other drilling going on, like in the Liard basin area,” Rich Coleman, British Columbia’s Minister of Energy, Mines and Natural Gas, told the Vancouver Sun on March 28. “We have some deep wells being drilled out there, and I’m told the outcomes are pretty darn good.”

The regional appraisal comes on the heels of an updated U.S. Energy Information Administration (EIA) resource evaluation in 2013 that estimated Canada holds risked shale gas-in-place of 2,413 Tcf, of which 573 Tcf were determined technically recoverable. In addition, the EIA assessment credited Canada’s western provinces with unconventional reserves of nearly 9 billion bbl of technically recoverable shale oil, out of an estimated shale oil-in-place of 162 billion bbl.

RIGS, PRODUCTION TO RISE

Meanwhile, in a deviation from U.S. trends, the Canadian Association of Oilwell Drilling Contractors (CAODC) is documenting more rigs making hole in Western Canada, but, surprisingly, forecasts a slight decline in new wells this year. At the end of March, the CAODC reported 438 active rigs, scattered throughout the four provinces, compared to 421 drilling at the same time last year. The CAODC forecasts an average of 342 active rigs for 2014, up three from last year’s average rig count.

Rig utilization in the first quarter of this year averaged just over 64%, according to CAODC data, up from the 60% utilization seen in the first three months of last year. In Canada, drilling activity, typically, picks up later in the year and well after the so-called “Spring break-up,” when melting snow restricts the movement of rigs and equipment.

Despite the higher rig count, the contractor trade group expects 10,604 new wells to be completed in Western Canada this year, representing a 45-well drop from 2013. The CAODC attributes the stronger rig activity, but lower well count, to more complex wells and resulting increases in drilling time. A case-in-point is Alberta’s still emerging and costly Duvernay oil and condensate play, where operators are still finding their way through this geological puzzle. “We’re seeing a shift in Duvernay exploration now, as operators figure out the best methodology to exploit those reserves,” said Ahmed Youssif Mousbah, Baker Hughes North America marketing and business development director.

Its uncertainties notwithstanding, the Duvernay, which is likened to the giant Eagle Ford of South Texas, is one of the primary contributors to the expected increase in tight oil production this year. The EIA said Canada’s tight oil production averaged 340,000 bpd last year, accounting for nearly 10% of 2013 oil production that totaled slightly more than 3.4 MMbpd, including the oil sands. Natural Resources Canada still maintains that Albertan shales are poised to add upwards of 170,000 bopd this year, Fig. 3.

|

| Fig. 3. As seen through a wheat field, a lone pumpjack delivers crude from the Alberta prairie. Courtesy of Alberta Energy Regulator. |

|

As in the U.S., gas had been relegated to the back burner, with more operators unloading “non-core assets,” which, in shale-speak, is any holding not sufficiently wet. Last year, CAPP data had Canada’s total gas production at around 12.0 Bcfd, but, with prices inching up slightly since winter, production is expected to begin a modest rebound this year. In fact, CAPP expected gas wells to comprise 16% of the total wells to be constructed, up from roughly 13% last year.

The lion’s share of any new gas production is expected to come from the thick siltstones of the Montney, which the NEB describes as “one of the largest gas plays in the world.” According to the NEB, Montney thickness ranges from 328 ft to a high of roughly 984 ft, on its most westerly portion, before it begins outcropping in the Rocky Mountains. NEB Chairman and CEO Gaétan Caron told the CERI Natural Gas Conference, in March, that the sprawling play will provide nearly 8 Bcfd of future gas production, Fig. 4.

|

| Fig. 4. Apache’s Ricinus gas plant in its West 5 operating area in Alberta, which extends north from Sundre through James River, Stauffer and Willesden Green to Buck Lake. Courtesy of Apache. |

|

“The rapid growth in the Montney is largely due to its low production costs, which make the basin economic, even at the relatively low prices. In addition, the Montney benefits from relatively high natural gas liquids content, which fetches a higher price than dry natural gas. There is also a relatively large amount of pipeline infrastructure already in place in the area, which allows Montney gas to easily reach markets,” he said.

U-TURN ON ASSET SALE

The improving fortunes projected for Canada’s gas producers are perhaps best illustrated by the atypical about-face of Calgary’s Canadian Natural Resources Ltd. (CNRL) earlier this year. After advertising its planned liquidation of more than 1 million Montney dry gas acres in British Columbia, CNRL pulled the acreage, holding an estimated 6.7 Tcf of reserves, off the table in January, saying, in a statement, that none of the offers were acceptable.

A month later, CNRL paid $2.85 billion for Devon Energy’s 2.2-million-acre, largely gas acreage in Western Canada. The acquisition did not include Devon’s heavy-oil operations in Alberta or its natural gas-rich assets in the Horn River, of northeastern British Columbia. In explaining the decision reversal, CNRL CEO Steve Laut told the Wall Street Journal on Feb. 19 that “2014 and potentially into 2015 looks like pretty strong gas pricing, and that helps the metrics of this deal.”

The acquired assets produce roughly 383 MMcfgd, 12,000 bpd of NGLs and 10,800 bpd of light oil, said CNRL, which said the deal will increase its total production 11%, to around 780,330 boed.

However, other planned sales of gas-dominant properties remain on track. Apache, which drilled 115 net wells in Canada last year, was expected to close April 30 on its sale of 622,600 gross acres of primarily dry gas-producing properties in the Ojay, Noel and Wapiti areas of the Western Alberta and British Columbia Deep basin. In 2013, the properties averaged 101 MMcfgd and 1,500 bpd of liquids.

Within its Wapiti holdings, Apache said it will keep its 100% working interest in horizons below the Cretaceous, thereby retaining rights to the liquids-rich Montney and other deeper targets. Apache still controls some 3.2 million net acres, most of which are in the liquids-rich fairways of the Duvernay and Montney shales, where it plans to drill eight and two wells, respectively, this year. Apache also holds a considerable lease block in British Columbia as part of the upstream component of the Kitimat LNG project.

Last November, homegrown Talisman Energy unloaded 127,000 acres of Montney gas prospects in British Columbia, to Calgary-based Progress Energy Canada Ltd., for $1.4 billion.

In the sale, Progress Energy, a wholly-owned subsidiary of Malaysia’s Petronas, will assume the previously signed JV agreements with Sasol Ltd. that cover much of the acquired leaseholding.

Progressive Energy has justified the acquisition by pointing to advancing plans to export LNG to Asia that, hopefully, will take significant chunks out of the saturated market. Progressive’s parent, Petronas, is a 50-50 partner in one of several LNG export facilities eyed for British Columbia.

DUVERNAY STILL ON TOP

Even with the heightened appraisal for the Montney, Alberta’s rapidly emerging, liquids-rich Duvernay shale, which extends beneath the Peach River Arch and Calgary, remains the unconventional play of the moment. Located within the rich-gas fairway, in and around the Kaybob area, the Duvernay is described as a conglomeration of interbedded bituminous shales, calcareous shales and dense argillaceous limestones, with formation depths ranging from, roughly, 8,200 ft to 13,126 ft, and thickness varying from just under 33 ft to approximately 230 ft. The rock characteristics of Duvernay, including critical total organic carbon, are said to be closely comparable to Texas’ Eagle Ford. “The Duvernay is about as interesting and exciting a play as I’ve ever seen,” Talisman CEO Hal Kvisle told Canada’s Financial Post.

In an early resource estimate, the Alberta Geological Survey (AGS) pegged the formation as holding at least 443 Tcf of gas, 11.3 billion bbl of NGLs and 61.7 billion bbl of oil. In November 2012, the then-embryonic Duvernay was one of the centerpieces of a joint Alberta Energy Resources Conservation Board (AERCB) and AGS updated reserve assessment, which had Alberta holding probable in-place shale reserves of 423.6 billion bbl of oil, 3,324 Tcf of gas and 58.6 billion bbl of liquids. On March 31, the regulatory functions of AERCB were formally transferred to the newly designated Alberta Energy Regulator (AER).

However, owing to the depth and geological uncertainties of the Duvernay, accessing those impressive reserves requires the deepest of pockets, with well costs currently running up to $20 million. Consequently, unlike typical shale plays, where independents are the predominant first-movers, most Duvernay acreage is held by major players, such as Chevron, Exxon Mobil, Encana and Talisman, among others.

With its acquisition of 67,900 net acres from Alta Energy Luxembourg S.à.r.l. in August, Chevron now holds a commanding 325,000 net acres in the Duvernay. At the end of 2013, Chevron had completed its initial 12-well exploration phase, with five wells completed and tied into production. Chevron reported liquids yield for the completed wells that ranged from 30% to 70%, with initial production (IP) rates up to 7.5 MMcfgd and 1,300 bcpd.

“Early results of our Duvernay exploration program are encouraging,” Chevron Vice Chairman George Kirkland, said in a statement. “This discovery creates a foundation for future growth in Canada.” Chevron plans to continue appraisal drilling this year, but has not said how many wells it intends to drill.

However, Encana said it expects to drill between 15 and 20 net wells this year on its 253,000-net-acre Duvernay leasehold, Fig. 5. The Calgary operator said it “moved into full resource play hub mode” earlier this year on its northern Duvernay property, in the Kaybob area, and plans to continue appraisal drilling in the southern sector.

|

| Fig. 5. An Encana-operated rig making hole in the company’s Duvernay holdings. Courtesy of Encana. |

|

“By February, we had our first multi-well pad underway, with two of the eight planned wells on production. Drilling of the remaining six wells was initiated in March after completion of pad construction. We currently have five rigs running in the Duvernay, and we are continuing to work towards commerciality in the Willesden Green area in the southern part of the play,” said Encana spokesman Doug McIntyre.

Encana has said that it, and JV partner PetroChina, will spend between $500 million and $600 million this year to develop the Duvernay holdings.

Talisman, meanwhile, continues to delineate the high liquids portion of it 352,000-acre leasehold, which it estimates has a prospective resource of up to 1.4 billion boe. Talisman plans to operate one rig this year and drill up to six wells, including its first multi-well pad in the southern portion of its leasehold. The Canadian operator is actively seeking a strategic JV to help defray the high capital costs.

Calgary-based Athabasca Oil Corp, as one of the smaller players in the Duvernay, likewise, is seeking a partner to help foot the bill for developing its 200,000-acre leasehold. In the meantime, Athabasca said it drilled two wells in first-quarter 2014, and, by mid-year, it plans to have its initial four wells on production. Along with restarting its Duvernay drilling program in third-quarter 2013, the independent also drilled 20, and completed 22, horizontal Montney wells during the past year.

Another comparatively small player, Trilogy Energy Corp., participated in 13 gross Duvernay wells last year in the 125 net sections that it controls in the Kaybob area. Trilogy operates three of those wells, and this year it is earmarking roughly $150 million to drill and complete the tie-in of 9.3 net wells.

Elsewhere, Exxon Mobil, which acquired 104,000 net acres in the Duvernay, with its October 2012 acquisition of Celtic Exploration Ltd., has released no information on its drilling and development plans for the leasehold.

BC BANKING ON LNG

In gas-rich British Columbia, officials are keeping their fingers crossed that at least a few of the 10 LNG export projects currently planned for the West Coast reach fruition and cut into the supply glut. As part of its LNG strategy, the British Columbia Ministry of Energy and Mines said the province has set an objective to have no less than three facilities sending LNG to Asian markets by 2020. The NEB has granted exports for seven LNG projects in widely varying stages of development.

The Kitimat LNG project on Bish Cove, which has undergone a number of ownership changes since it was first announced, remains the furthest along in development, with its principals saying first shipments remain on track for 2018. Once both phases of the project are completed, Kitimat will have a designed export capacity of 10 MMtpa.

As of 2013, Kitimat is owned 50-50 by Chevron and Apache, with the former operating the facility, and the latter handling the upstream constituent. Apache Chairman and CEO Steve Farris suggested, in a fourth-quarter earnings call, that his firm would be open to a possible Chinese partner for its 50% stake. “We have got to rightsize the size of Kitimat in our portfolio, and that could come several different ways,” he said. “One is with a Sinopec buyer taking an interest across the board.”

Also on tap for first deliveries in 2018 is the Petronas and Japex Pacific Northwest LNG complex on Lelu Island in Port Edward. At its completion, the three-phase project would have a cumulative capacity of 18 MMtpa, requiring a feed rate of 2 Bcfgd.

Regardless of how many LNG facilities are actually constructed, more than ample feedstock will be available. The British Columbia energy ministry said the estimated 2,933 Tcf of gas-in-place in the provincial portion of the Montney, the Horn River, and the deeper and under-explored Liard basin to the far north, are sufficient to support development and LNG export operations for more than 150 years. It is estimated that some 21.6 Tcf of marketable gas remain to be discovered.

While providing no specifics, Rob Spitzer, executive V.P. of development for the Apache/Chevron Kitimat Upstream project, told the British Columbia Oil and Gas Report on Nov. 22 that “we’ll have to drill for tenure” in Horn River and the Liard basin this year.

At the time, he said, the upstream consortium would close 2013 with at least three, and as many as five, new wells in the Liard basin. Last year, Apache released results from one of its earlier Liard wells, which delivered an average 30-day initial production (IP) rate of 21.3 MMcfd, with EUR set at 18 Bcf.

With its sparse production infrastructure, many of the Northern Liard wells will be constructed with vertical boreholes, Spitzer said. “They’re basically vertical wells that are aimed at holding the land, but there will be 10 or possibly 11 horizontal wells over the next number of years. They will be horizontal wells, but they’re also drilled for tenure, primarily to learn more about drilling them and production. They’re fulfilling a number of different needs—tenure, technical information, production information, and so on,” he said.

Elsewhere in British Columbia, both Encana and Nexen hold substantial acreage positions, Fig. 6. Encana, which holds 575,00 net acres in the proven Montney fairway with a potential of more than 2 Bcfd of gas and 50,000 bpd of liquids, says it is running nine rigs and has completed its fifth multi-well Montney pad in its liquids-rich Gordondale leasehold. The wells are expected to go into production in the second quarter. Encana also operates the Cutback Ridge Partnership, southwest of Dawson Creek in British Columbia, with 40% JV partner Mitsubishi, but no details of upcoming work have been made available.

|

| Fig. 6. Nexen’s is now operation an 18-well pad site in the Horn River basin of northeastern British Columbia; drilling began in July 2011. Courtesy of Nexen. |

|

Nexen, which China National Offshore Oil Corp. (CNOOC) acquired in February 2013, holds an aggregate 300,000 net acres in northeastern British Columbia, including 172,000 acres in its legacy Horn River properties and 128,000 acres in the Liard. Nexen operates an 18-well pad in the Horn River, but no additional information has been released on its near-term activities for either its Horn River or Liard basin assets.

CARDIUM, BAKKEN PATHS DIFFER

The Cardium shale/sandstone formation, which extends from Alberta into eastern British Columbia, may be one of the newest participants in the horizontal tight oil play, but it’s actually one of Canada’s oldest producing structures. Long a prolific conventional oil producer, operators only began targeting the low-permeability reservoirs horizontally early this decade.

Today, it has become a field lab of sorts, as operators embark on a wholesale field redevelopment campaign and, in the process, experiment with various fracing and completion designs, primarily in and around the mature Pembina field near Edmonton, Alberta.

ConocoPhillips is the largest leaseholder in the play, with a reported 2.4 million gross acres primarily targeting Cardium prospects in the Deep basin of northwestern Alberta and northeastern British Columbia. While no specifics were made available, ConocoPhillips was expected to ramp up activities in fourth-quarter 2013, in preparation for the winter drilling season with “continuing development drilling and unconventional exploration activity in Western Canada,” with a capital investment focusing on “high-return, liquids-rich opportunities.”

On the other end of the operator scale, Calgary-based Bonavista Energy Corp. drilled 27 Cardium wells last year in its Alberta acreage, including two in the fourth quarter. During 2014, Bonavista plans to drill 20 Cardium wells. “Despite this commitment to emerging areas in 2013, our continued focus on improving capital efficiencies has resulted in cost reductions on average of approximately $200,000 per well when compared to 2012,” the operator said in a statement.

Bonavista is not alone. Operators have steadily reduced completion costs, even as frac stages per well have increased appreciably, says Dan Allan, V.P. of CSUR, the unconventional resources society. Since 2010, he said data from more than 600 wells in the Pembina, Willesden Green, Garrington, Ferrier, Harmattan and Lochend areas revealed completion costs per stage dropping from more than $345,000 to $75,000.

“Arguably the single most significant driver in improving the economics of the Cardium has been the reduction in overall drilling and completion costs. The shift from higher-cost oil-based fracs to water-based fracs and hybrid fracs helped both reduce capital costs and improve productivity,” Allan said.

In a related development, in late March, NCS Energy Services said it successfully completed two horizontal Cardium wells, employing, for the first-time, a combination of high-rate slickwater and its Multistage Unlimited fracing system. The company says it placed more than 60 frac stages in one well, with aggressive spacing of individual fracture stages. NCS said that treating rates of 49 bbl/min enabled placement of 40 frac stages in a single 24-hr period, which, it claims, makes tightly spaced fractures a “viable and economical alternative to less precise and unpredictable stimulation methods.”

As for the Canadian Bakken of Saskatchewan and Manitoba, what a difference a border makes. Essentially the same rock formation as the Exshaw shale that runs throughout Alberta, the local Bakken is delivering only a percentage of the per-well production of its celebrated namesake down south. On the plus side, along with its well-defined sweet spot, the Canadian Bakken is shallower, less service-intensive and, consequently, appreciably less expensive than the North Dakota version.

Nearly all activity, to date, has targeted the Middle Bakken around the Viewfield area some 35 mi from the U.S. border. The newly renamed Lightstream Resources—formerly PetroBakken—is one of the primary players in the Canadian Bakken, holding more than 450 gross sections, where it continues to conduct a significant EOR campaign. Lightstream said its Bakken production averaged 17,095 boed last year, comprising 94% oil/liquids.

Lightstream says it can recover 15% of Bakken discovered-petroleum-initially-in-place (DPIIP) through primary recovery, but believes that with EOR, it can increase drainage to 25%. The independent plans to expand its Creelman Bakken EOR project this year, with the drilling of two additional gas injection wells affecting four sections of leasehold.

The operator also is evaluating EOR potential for its 270-net-section Cardium holding, which, in 2013, averaged 20,270 boed.

|