|

| Thousands of vertical wells have been drilled in the Mississippi Lime, since its discovery, but recent advances in pad and horizontal drilling have made the play’s resources more accessible (photo courtesy of Superior Oil and Gas Co.). |

|

All that glitters is surely not gold. Since the beginning of the so-called “shale revolution” a few years ago, operator interest in unconventional, onshore domestic plays has been on a steady rise, especially as well and service costs continue to skyrocket outside of the U.S., and offshore. Across the country, E&P companies have been keen, sometimes overly so, to align themselves with the next big basin, in hopes of replicating past successes in areas like the Bakken and Eagle Ford.

As oil prices stay close to the $100/bbl-mark, and with natural gas prices remaining healthy enough, there is money to be made in the effective development of U.S. shale resources. This balance between resource potential and resource retrieval is at the heart of success, and the failure to succeed, in the mid-continent’s Mississippi Lime play. Many have tried, but only a handful of firms seem to have worked out a repeatable, return-generating method for drawing out some of the formation’s liquid potential.

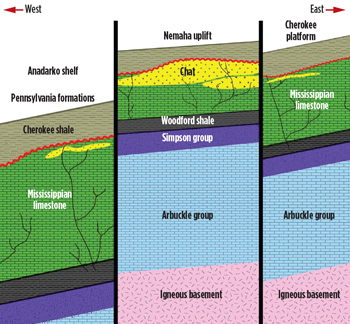

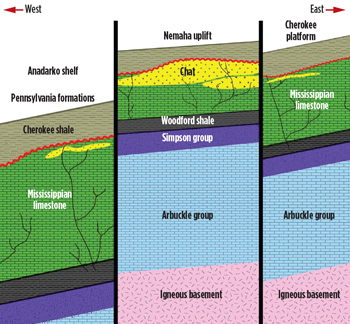

The largely oil-prone Mississippi Lime reservoir stretches from north-central Oklahoma into much of western Kansas. Sandwiched in age above the Devonian system, but below its fellow Carbonate system companion, the Pennsylvanian, the Mississippian’s limestone structure is the cause of much of its inherent fickleness, as it relates to drilling. Through weathering, digenesis and erosion over time (roughly 323 to 358 million years), the play exhibits varied properties, both horizontally and vertically; it is strongest through the Nemaha Ridge. Where time has been kind to the formation, it shows a 15%-to-20% porosity; weaker, lower-permeability sections, all within the same play, exhibit only 4%-to-6% porosity. Since the 1940s, thousands of vertical wells have been plunged into the Mississippi Lime, with production ongoing in the intervening decades.

However, as in other domestic plays, the advent of horizontal drilling has given operators a much-needed strategic boost, enabling them to hit more sweet spots, and fewer empty zones. With production possible at depths of 4,000 to 7,000 ft, the relatively shallow Mississippi Lime boasts similarly undersized average lateral lengths, in the range of 2,500 to 5,000 ft. Fewer fracturing stimulation stages are required to produce wells in the formation, with the job often done in less than 20 stages. The combination of shallow depth, short laterals and petite stimulation jobs is music to the ears of E&P bookkeepers, as well costs for the Mississippi Lime average $2.4 to $3.5 million, on the high end.

In a report last May from AAPG’s Explorer publication, Dan Boyd, a petroleum geologist and AAPG member (who worked previously with the Oklahoma Geological Survey), described the layer sitting atop the core of the Mississippi Lime formation, the Mississippi Chat, as “a thin, siliceous zone of variable reservoir quality that intermittently develops.” With stacking throughout the formation, and relatively high water content in some areas, well-informed stimulation design and increased understanding will likely be key in unlocking some of the reservoir’s more desirable resources.

To that end, among the handful of operators planning to remain active in the Mississippi Lime, several are opting to devote reasonable portions of their annual budgets to seismic and acreage, while maintaining strong drilling allowances. Midstates Petroleum bills itself as an E&P focused on applying “modern drilling and completion techniques to oil/liquids-prone resources in previously discovered, yet underdeveloped, hydrocarbon trends.” The firm estimates that 11% of its 2013 capital guidance was directed at land, seismic and other costs. In the same company report from December, Midstates also planned seismic coverage of the Mississippi Lime.

Elsewhere in the formation, Range Resources, an independent active in the southwestern U.S. and Appalachia, devotes attention to both the Mid-continent and Marcellus areas, and will direct 16% of its budget this year to seismic and acreage costs, according to a February company report. According to its website, Devon Energy, which operates throughout the middle-U.S. and Canada, will “continue integrating data from 3D seismic, production, logs and core samples” to increase well performance in both its Mississippi Lime and Woodford assets.

WELLS PER RIG RISING

As of fourth-quarter 2013, there were 408 wells and 77 rigs in the Mississippi Lime, according to Baker Hughes, which refers to the area as the “Mississippian.” The healthy well count marks a 6% jump from the previous quarter, when 385 wells were recorded, and a 20% increase year-over-year, when 2012 saw 339 wells tallied. At 5.3 wells per rig, the play is more efficient than its immediate neighbors, Granite Wash (2.5 wells per rig) and Arkoma Woodford (5.0 wells per rig); its efficiency is only rivaled by activity in the Fayetteville, Barnett and Marcellus shales.

On a similarly positive note for the Mississippi Lime, its quarter-to-quarter well count gain is only topped by the highly-prospective Arkoma Woodford and Cana Woodford plays, and the perennial powerhouse that is the Eagle Ford. On a larger scale, well increases from 2012 to 2013 in the Mississippi Lime were outnumbered by the aforementioned areas, plus the Ardmore Woodford, Marcellus and Williston basins. The fact that the Mississippi Lime can throw its hat in with some of the nation’s top producing basins tells us that this play is not to be written off.

During 2013, there were 179 rotary rigs in operation in Oklahoma, which takes into account nearby formations other than the Mississippi Lime, but, nevertheless, accounts for a little more than 10% of the total U.S. activity, according to the U.S. Energy Information Administration. As of November 2013, the EIA reports that the state was producing 9,753 Mbbl of crude, for 4.2% of the U.S. total. In Kansas during 2013, the EIA reports that the state saw 27 rotary rigs in operation, for 1.5% of the U.S. total. In November 2013, the state recorded crude production of 3,728 Mbbl, for 1.6% of the U.S. output.

STATE-BY-STATE

Kansas, which owes most, if not all, of its hydrocarbon production to the Mississippi Lime area, has introduced pro-industry measures, to promote activity in the state’s basins. The Kansas Department of Commerce notes that potential benefits to the state could include billions of investment dollars, the creation of thousands of jobs, and sustained activity for the next several decades. In 2013, the commission issued a report that detailed the applicability of state and federal regulations, and industry-specific exemptions, related to transportation. While the factsheet only tackles the issue of transportation, as it would pertain to any oil and gas activity, it marks a distinctly positive attitude toward future development within the state’s borders.

In its latest update, from September-October 2013, the department recorded that, by the end of June, there were 247 active horizontal wells in Kansas, in addition to more than 64,000 vertical oil wells, and 24,000 vertical gas wells. The state’s horizontal wells were producing 260,000 bbl/month of oil, and 2 MMcfg, per month; statewide oil production came in at 3.8 million bbl/month, and 24 MMcfg per month. The department also reported that, in September, the Kansas Corporation Commission approved 575 intent-to-drill notices, including 23 for horizontal wells. For the same period in 2012, the commission approved 504 intent-to-drill notices, including 24 for horizontal wells. Looking at annual statistics from 2012, the commission approved 6,861 intent-to-drill notices, including 296 for horizontal wells, from Jan.1 to Dec. 31.

Oklahoma, with its bevy of Woodford formations and a sizeable chunk of the Granite Wash, may have bigger fish to fry, but, nonetheless has seen continued development dollars pour in from operators looking to tap the Mississippi Lime. According to the Oklahoma Corporation Commission, the state’s petroleum supply, as of the latest count in 2010, put crude oil proved reserves at 710 million bbl, for 3.1% of U.S. oil reserves, which falls in line relatively well with EIA data. The commission recorded 74,319 Mbbl of crude oil production in 2011, with an average 62 rigs in operation per month, and 115,000 total oil wells (drilled, but not plugged).

In addition to highly productive formations and a long history of oilfield development, Oklahoma makes a strong showing in the infrastructure arena. Range Resources pinpointed three important processing and pipeline facilities within the immediate vicinity of the Mississippi Lime’s headlining Nemaha Ridge portion; one plant is located within the ridge’s boundaries, while the other two are not far from it, Fig. 1. Superior Pipeline Company’s Bellmon Plant, with its 30-MMcfgd capacity (which could expand), is near a Southern Star residue pipeline, for easy transport of Mississippi Lime production. Nearby, Mustang Gas Products’ Rodman Plant can accommodate 70 MMcfgd, and up to 140 MMcfgd with offloads to the company’s other plants. Phillips 66 has its wholly-owned Ponca City Refinery to intake crude oil just east of the Nemaha Ridge, and it can handle 200,000 bopd.

|

| Fig. 1. Many operations in the Mississippi Lime are in close proximity to significant pipeline and plant infrastructure (photo courtesy of Range Resources Corporation). |

|

DRIVEN BY TECHNOLOGY

In December 2013, Petro River Oil, an independent with producing wells in the Kansas portion of the Mississippi Lime, announced that it had formed Petro Spring, a wholly-owned subsidiary created to “acquire and develop technologies, with a focus on enhanced oil recovery.” The announcement followed the private placement of common stock purchased by Petrol Lakes Holding Limited, which is described as a China-based investment group with ties to oil and gas. The group, with Petro River, was said to be working toward a potential JV, with a Chinese partner, regarding the company’s 85,000 net acres in the Kansas portion of the Mississippi Lime, according to information released late last year.

In a presentation released in mid-January, Petro Spring highlighted, in its technology development timeline, plans in the first half of the year to focus on multi-lateral, horizontal drilling technology for Mississippi Lime reservoirs. The company hopes to increases laterals, adding access to the reserve base and allowing for a larger drainage pattern, to increase recovery. Also outlined for the year’s first half were plans for plasma wave technology, to distribute pressure-in-oil movement operations. Petro Spring indicated that the concept, with vacuum, heat, drive and multi-lateral technologies, would be beta-tested in the Mississippi Lime.

Petro River, prior to forming Petro Spring, had gained experience funding operations in Kansas and Oklahoma, bringing hydraulic fracturing and enhanced stimulation to assets held by AusTex, described as an independent Mississippi Lime oil producer. That early R&D venture saw AusTex implement its current drilling plan in the formation by first-quarter 2012, recording quarterly production of 291 boed in September 2012, and 828 boed by September 2013.

Chesapeake Energy stepped into the produced water arena back in 2006, launching its reclamation and conservation effort, called Aqua Renew. The project resulted from the firm’s involvement with the Barnett Shale Water Conservation and Management Committee, and additional collaboration with the City of Fort Worth, Texas. While the company carried out initial produced water recycling at its Marcellus and Utica projects, the same system of filtration and re-use has expanded to wells in the Mississippi Lime. Chesapeake said that several of these Oklahoma wells were hydraulically fractured with 100% produced water. The company said it is “experimenting with newer additives and higher concentrations of salt in our base fluids,” to limit freshwater use as much as possible.

According to a presentation given at a conference in February, Chaparral Energy, a Mid-continent-focused E&P that emphasizes horizontal drilling and EOR technology for production, is the third most active CO₂ EOR player in the U.S., behind only Denbury and Oxy. The company has 50 units with 1P, 2P and 3P EOR reserves, and nine units with proved reserves, in its CO₂ project inventory. Chaparral maintains 473 miles of CO₂ infrastructure, with 85 MMcfgd of existing supply, and budgetary expectations of $162 million of capital going to these projects this year. However, the company has not yet deployed this technology on its Mississippi Lime assets.

CHANGING LANDSCAPE

Discovered, but underdeveloped, the Mississippi Lime has garnered attention from domestic majors, large independents and plenty of smaller players, with some interest coming out of China in recent years, as some operators have chosen to exit the formation and try their hands elsewhere. Technological ability and healthy capital backing, with a bit of patience, are necessary to hit worthwhile return rates, making the play an odd gamble, full of unknowns, for many firms.

Around this same time last year, Shell was heralded as the lone major to have ventured into Mississippi Lime operations. Alas, what a difference a year makes. According to a Natural Gas Intelligence (NGI) Shale Daily report from late September, the operator has “thrown in the towel” at its south-central Kansas section of the Mississippi Lime, selling 45 producing wells and roughly 600,000 net lease acres. The report went on to say that Shell had “ceased its exploratory drilling operations in June, and a review of the results has prompted the sell-off,” according to company management. With a strategic review of its North American portfolio, the operator “identified assets ‘that do not meet [its] targets, and the best value option for Shell is to divest.’” The assets were then appraised for sale, with no firm timetable given.

As of September 2013, AusTex, which has offices in Australia and the U.S., held interests in 23,000 net acres, producing in both Kansas and Oklahoma, with average production of 828 boed, for the third quarter. This rate marks an increase from the 602-boed average recorded during the second quarter. The company says its primary focus is its 100%-owned, 5,500-acre Snake River Project, in the Kay County, Okla., section of the Mississippi Lime. By September, the company said, 20 wells at Snake River were in production, with six wells under completion or testing production, and one new saltwater disposal well and production hub commissioned and under testing. AusTex also planned to increase the development drilling rate during the fourth quarter, with up to eight wells scheduled to be drilled by Dec. 31. In the Kansas portion of its Mississippi Lime holdings, five wells were producing during the third quarter, at the company’s Cooper and Ellsworth Projects, which added 28 bopd, net, to AusTex.

Last June, Chesapeake Energy completed its Mississippi Lime JV with China’s Sinopec, but little has been mentioned of the agreement since that time. The operator sold a 50% undivided interest in approximately 850,000 acres in northern Oklahoma, for roughly $1.02 billion. First-quarter 2013 production of approximately 9,600 bpd of liquids and 54 MMcfgd went to Sinopec through the JV. Chesapeake still operates the assets exchanged, but the companies will split future exploration and development costs, with no drilling carries. Earlier this quarter, the company sold its 100% ownership interest in Mississippi Lime player, Chaparral Energy, for $215 million. In a release announcing the sale, Chesapeake CFO Domenic J. Dell’Osso, Jr., said that the sale “demonstrates the continued refinement and focus of our portfolio around core assets, and continues our strategy of reducing financial complexity.”

Because Chesapeake included its Mississippi Lime assets with a grouping called “Mid-continent,” comprising five total plays, the picture of production for the company’s activity in that formation, specifically, is a bit skewed. At any rate, production during fourth-quarter 2013 averaged 104,000 boed for the area, marking a flat year-over-year rate and a sequential decrease of 4%. Chesapeake operated, on average, 17 rigs and connected 70 gross wells to sales, versus the 22 average operated rigs and 89 gross wells during the previous quarter. Across the Mid-continent, the company had 32 wells awaiting pipeline connection, or in one or another stage of completion, as of Dec. 31. The company said in the release that it “anticipates that net production from the Mid-continent will decline during 2014, on a year-over-year basis,” due to reductions in drilling activity and asset sales.

Mentioned previously, Petro River received investment late last year from a Chinese firm, and is now moving steadily forward with drilling and development plans, buoyed largely by a commitment to technological advancement. By emphasizing R&D in its own assets, and others, the group could unlock some of the potential that so many others have not been able to target effectively.

According to company information released in February, Devon Energy’s Mississippian-Woodford Trend, described as an “emerging light-oil play,” averaged net production of 16,000 boed in December, representing a 47% increase over September. For the fourth quarter, the area averaged production at a rate of 14,100 boed, with 88 gross wells drilled and 15 rigs operated, as of Dec. 31. For the year, Devon’s mid-continental trend averaged 7,900 boed, with 232 gross wells drilled. The company holds 650,000 net acres in the area, with its 2012 JV with Sinopec comprising a subset of 200,000 of those acres. Interestingly, Devon, in January, brought on Thomas L. Mitchell as executive V.P. and CFO; Mitchell was previously V.P., CFO and a director of Midstates Petroleum, another regional independent that concentrates much of its activity on the Mississippi Lime.

REGIONAL MOVEMENT

In late-February, SandRidge Energy made big moves toward streamlining its focus on the roughly 1.9 million net acres that it holds in the Mississippi Lime, which it calls the Mississippian, by completing the sale of its Gulf of Mexico business for $750 million. When the company announced it would shed the assets earlier this year, President and CEO James Bennett said the company would be focusing further on the Mid-continent, as it has “established competitive advantages, including infrastructure networks, sub-surface knowledge and a best-in-class cost structure” for the area. SandRidge said it expects to have 29 rigs operating in the Mid-continent by the end of this year. Further enhancing its position in the Mississippi Lime, the company said, in February, that it would look to provide more details on plans for its recently-acquired 117,000 acres in Sumner County, Kan., as well as potential ideas to unlock the value of its water disposal business.

For 2013, SandRidge produced 33.8 MMboe, while spending $1.424 billion; the company came in at 1% more than its guidance for production, and spent 2% less than its guidance for the year. According to COO David Lawler, the company brought 80 horizontal wells online in the fourth quarter, for a record-low average cost of $2.9 million each. He said the “reduction in capital expenditures is linked primarily to redesigned wellsite facilities and synchronized pad drilling.” The company’s strengths in saltwater disposal and electrical infrastructure give it a competitive edge in an area, where others have struggled. SandRidge ended 2013 with an average Mid-continent well cost of $3.1 million, an 11% reduction.

In late-January, Midstates Petroleum said that, during fourth-quarter 2013, it had five rigs active in its Mississippi Lime horizontal drilling program; the company spudded 21 gross wells in the quarter, five of which were drilling at year-end. Its Mississippi Lime assets averaged about 17,500 boed for the fourth quarter. The company also reported that December’s harsh winter weather conditions in the Mid-continent reduced that quarter’s production by approximately 250 boed. Midstates’ capital guidance for 2013 dealt an estimated 60% of its weight to the play, with estimated capital expenditures of $330 million for the year, compared to $85 million for Anadarko, and $147 for the Gulf Coast.

In the same release from January, the company said it was considering strategic options to improve its financial flexibility and cushion its balance sheet; asset sales, possible JVs and farm-outs were mentioned, but discussions were still underway. As such, the company’s directors did not approve a 2014 budget. However, its preliminary 2014 capital budget is expected to be in the $500-million-to-$550-million range, with 80% to 85% going to drilling and completion activities. For this quarter, Midstates estimates that it will invest $125 million to $135 million, with five rigs running in the Mississippi Lime, spudding 20 to 25 wells. With this tentative capital budget in mind, the company said it expects its 2014 production to be in the 33,000-to-36,000-boed range (roughly 60% from the Mississippi Lime, and the remainder from the Anadarko basin and Gulf Coast assets).

As of late-February 2014, Range Resources Corporation counted its total Mid-continent resource potential at 7 to 10 Tcfe (an area which includes the Mississippi Lime, as well as the St. Louis, Cana Woodford and Granite Wash formations). The company expects to grow production this year, 20% to 25%. In 2014, Range expects to devote roughly 8% of its $1.5-billion budget to the region, including the Mississippi Lime, while 87% will go to its dominant Marcellus activity, and the remaining 5% or so going to Permian and Appalachia/Nora operations. The company will be heavy on drilling (78% of budget), with 16% going to acreage and seismic costs, and 6% assigned to “pipelines, facilities and other.”

In mid-December, Range announced that its net production has exceeded 1 Bcfed for the first time in the company’s history. The same informational release stated that “wells utilizing a larger frac design in the Mississippian Chat continue to show encouraging results.” In its 160,000 acres along the Nemaha Ridge, Range turned six wells, using the larger frac stimulation, to sales in 2013, with an average lateral length of 3,519 ft and 17 frac stages. According to the company document, in 2014, Range “expects to continue monitoring well performance on larger frac completions, while further delineating its 160,000-net-acre position by drilling 14 wells in the Mississippian Chat,” Fig. 2. This year, the company said it plans to send 22, of 163, net wells to sales in the Mid-continent; more than 4,500 Mississippian wells have defined the productive boundaries, Range reported. In all, the Mississippian could net nearly 1 billion boe for the independent.

|

| Fig. 2. Range Resources Corporation stated that it has seen encouraging results in Mississippi Chat wells utilizing a larger frac design. |

|

In February, the Mid-continent-focused independent, Chaparral Energy, announced that its anticipated 2013 production would be approximately 9.75 million boe, with total proved reserves of 158.5 million boe (as of Dec. 31). For this year, the company raised its production expectations to the range of 10.4 million to 10.8 million boe, spending $625 million to $650 million to hit those numbers. A presentation from a conference earlier this year showed that Chaparral holds 210,982 acres in what it calls the Northern Oklahoma Mississippi Play (NOMP). The reservoir holds more than 242 MMboe of potential recovery, with an estimated 3,034 un-risked drilling locations, on three to four wells per section spacing. This year, the company expects to run three to five rigs in the section, spending $116 million in capital on 35 to 45 wells. From second-quarter 2012 to fourth-quarter 2013, the company saw a 52% improvement in overall well performance in the NOMP, reducing both the number of days from spud to rig release, and from rig release to production.

Elsewhere in the Mississippi Lime, regional players are shifting gears in a variety of ways, with Superior Oil and Gas Co. undergoing a restructuring overhaul that began in 2011, according to company president Dan Lloyd, Jr. Lloyd commented that the Mississippi Lime is a good play for exploration, but not a great example of an easy in-and-out, sure-thing production opportunity. In a statement from Evolution Petroleum Corporation’s management, the company said that “based on our drilling to date, we have determined that the play is different than originally evaluated as to nature, risk and upside.” Consequently, the company is exploring alternatives for the asset.

|