|

| A rig and wellhead (left) co-exist in a Surgutneftegas mature field in Western Siberia. Custom-built for the purpose, the Mikhail Ulyanov tanker (center) arrives at Gazprom Neft’s Prirazlomnoye field, to load the first 500,000 bbl of Arctic oil production. In the northern portion of Western Siberia, Surgutneftegas has had to build a number of artificial islands, to enable drilling in the swampy area. |

|

This is a period of contrasting achievements and challenges for Russia’s oil and gas industry. During 2013, Russia relinquished its position as the world’s No.1 producer of oil and gas, combined, to the U.S., which ended the year with the world’s top output.

Yet, for all of 2013, Russia still produced more crude and condensate than any nation in the world—10.523 MMbpd, or 12.2% of the global total of crude, condensate and NGLs, combined. Nonetheless, in November 2013, total U.S. field output of petroleum liquids averaged 10.63 MMbpd, which made the country the world’s leading oil producer for that month. The U.S. already has gained the position of top dry gas producer.

FINANCIAL ACTIVITY

Last Sept. 30, a new fiscal regime for the Russian hydrocarbon sector, the 55-61 system (in place of the previous 60-66 structure), was introduced by federal law No. 263-FZ. It changed the rates of export duty and established the future base rates of the mineral extraction tax (MET) on crude oil. As of Jan. 1, 2014, the MET rate per ton of oil produced was raised from RUB470 ($13.49) to RUB493 ($14.13). It will go higher, to RUB530 ($15.19), on Jan. 1, 2015, and to RUB559 ($16.02) on Jan. 1, 2016.

Simultaneously, the maximum export duty rate on crude oil, established by governmental decree on a monthly basis, is being lowered (by reducing the coefficient in the formula) from the previous 60% to 59% in 2014, 57% in 2015 and 55% in 2016.

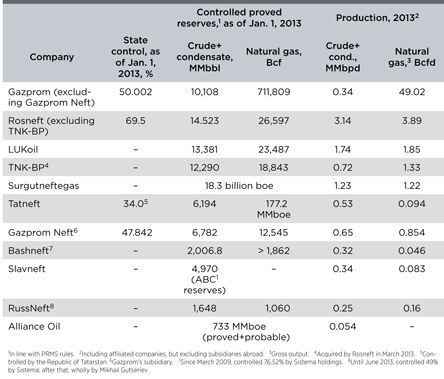

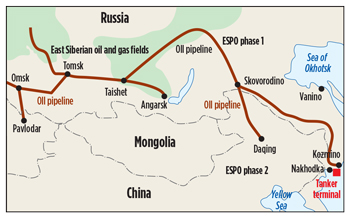

Only several firms in Russia (like Rosneft, LUKoil, and Surgutneftegas) fall into the category of major, integrated petroleum companies, Table 1. At the end of March 2013, Rosneft’s acquisition of TNK-BP from BP was completed. BP received $17.1 billion in cash and 12.84% of Rosneft’s assets. This history-making deal is estimated at $55 billion. Meanwhile, in May 2013, Rosneft said that it would pay $3 billion in cash for the remaining 49% of shares in Russia’s major gas trader, Itera Oil & Gas.

| Table 1. Leading Russian producers |

|

|

On Dec. 23, 2013, Germany’s BASF and Gazprom swapped assets of equivalent value. BASF subsidiary Wintershall will further expand its oil and gas production, and exit gas trading and storage. The transaction should complete in mid-2014.

World Oil’s Contributing Editor for South Asia, Raj Kanwar, reports that strange as it may seem, the ongoing, overtly confrontational posturing by Russian President Vladimir Putin in Crimea and eastern Ukraine has produced some unexpected side-effects. Concerned about sanctions imposed by the U.S. and the European Union, Rosneft has now approached both India’s flagship explorer, ONGC, and private conglomerate Reliance Industries for possible joint ventures.

RESERVES

Oil and gas reserves first became classified under the Soviet regime in 1949. For many years, the Soviet Union was not a member of any international supervisory organization. On July 5, 2013, Russian Prime Minister Dmitry Medvedev signed a decree lifting the secrecy that surrounded the country’s reserves data, and now, finally, the numbers have been published officially. According to Natural Resources Minister Sergey Donskoy, Russia’s oil reserves stood, as of Jan. 1, 2012, at 17.8 billion tonnes (Bt) under the explored (AB) and estimated (С1) categories of the Russian ABC1 classification system, equal to 128.7 Bbbl. In addition, total ABC1 natural gas reserves were 1,817 Tcf, noticeably more than the 1,310-Tcf figure under the U.S. system (a Russian/FSU standard cubic meter corresponds to around 37.24 U.S. ft3, and not to around 35.3147 ft3, as is true in other parts of the world).

Russia’s subsoil agency, Rosnedra, said that during 2013, 30 fields were discovered in Russia—27 oil fields, two oil/gas fields and one gas/oil field. The ABC1 reserves of the finds totaled roughly 4.4 billion bbl, of crude oil; 37.24 Tcf of gas; and about 300 MMbbl of condensate. At the start of 2014, there were 2,508 fields officially recognized in Russia, including 1,710 oil, 238 gas, 217 gas/oil, 208 oil/condensate and 135 gas/condensate fields. In terms of size, 28% were small- and medium-sized fields (with reserves up to 200 MMboe); 41% were major ones (200 MMboe to 2.2 Bboe) and 31% were giants (over 2.2 Bboe).

Other oil reserve estimates. Published data on Russia’s oil reserves vary considerably, mainly because, for many years, they were a state secret. Russian proved oil reserves tended to be (and still are) substantially downgraded (to 45 Bbbl to 85 Bbbl) by almost all Western experts. This is despite the fact that the proved oil reserves of just the five largest Russian oil and gas companies (Lukoil, Yukos, SNG, TNK and Sibneft), alone, when audited in 1999-2000 by Miller & Lents and De Golyer & MacNaughton, amounted to 46.3 Bbbl.

If one takes the 110-Bbbl estimate of proved oil reserves from Moscow-based Center for Petroleum Business Studies at MGIMO University, and the average R/P ratio typical of Canada, whose industry resembles Russia’s in terms of 20 years, then Russia could produce about 50% more oil (or around 15 MMbpd, at 110 Bbbl÷20 years÷365 days), compared to what it actually produces now, provided that it had sufficient oil markets.

Natural gas reserves. According to BP, Russia holds nearly one-fifth of the world’s proved reserves of natural gas, equal to 1,162.5 Tcf, as of the end of 2012. This is close to the U.S. estimate of 1,310 Tcf and noticeably lower than the official, 2012 Russian figure of 1,817 Tcf.

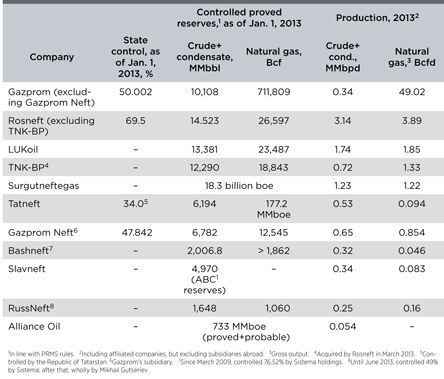

PRODUCTION

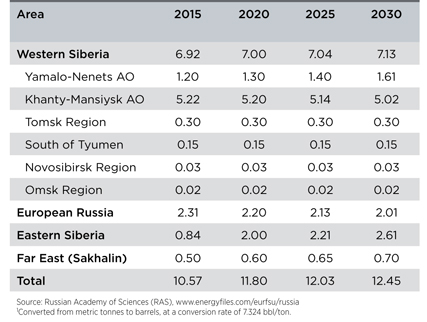

The aforementioned projection of higher national oil output is indirectly backed by a long-term forecast by the Russian Academy of Sciences (RAS), Table 2. In the same vein, the leading expert at Russian Union of Oil and Gas Industrialists, Rustam Tankayev, estimates Russia’s oil production potential at about 14 MMbpd. In November 2013, the Russian government slightly increased its long-term forecast of production in 2030 from 10.36 MMbpd to 10.46 MMbpd. Still, a majority of Western experts predicts a foreseeable decline in Russia’s oil output.

| Table 2. Ras forecast—Russian oil (crude & condensate) production, 2015-2030, mmbpd1 |

|

|

According to Russia’s Energy Ministry and Roskomstat, oil production grew 0.9% during 2013, to reach a record 10.523 MMbpd, with 73% produced by six companies. The bulk of Russian crude was produced, as usual, in Western Siberia (about 70%), as well as in Volga-Urals, Eastern Siberia, on and around Sakhalin Island, and in Timan-Pechora, Fig. 1. During the 2013-2018 period, some $220 billion will be invested in Russian oil production, plus $65 billion for gas production.

|

| Fig. 1. Russia’s main oil-producing areas. |

|

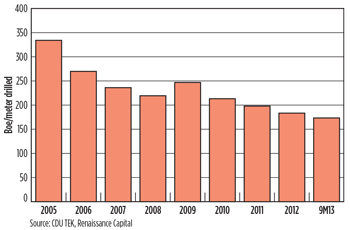

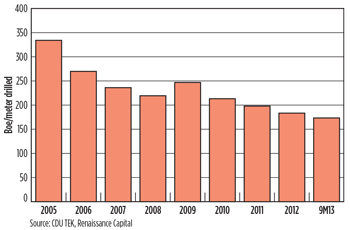

Contrary to conventional wisdom, Russian oil has never been cheap to produce, and the cost is increasing. Adding to the rise in production cost is the ever-growing water cut, standing now at an average 85.4% for Russian producing oil wells, and estimated to reach 89% by 2030. Another factor adding to the cost of Russian oil production is the decreasing reserve yield of exploratory drilling, Fig. 2.

|

| Fig. 2. Oil and gas reserve additions in Russia as a function of the volume (boe/meter) of exploratory drilling, 2005-2013. |

|

Natural gas. According to Russia’s Energy Ministry and Roscomstat, the country’s gross natural gas output rose 2.1% in 2013, to 68.16 Bcfd, including 61.27 Bcfd of free gas and 6.89 Bcfd of associated gas. Gazprom accounted for 71.9% of Russian gas output, although the firm’s production slipped 0.4%. In line with the latest forecast of the Russian Ministry of Economic Development (MER), natural gas output will amount to 68.77 Bcfd in 2014, 69.58 Bcfd in 2015, and 70.19 Bcfd in 2016.

Most Russian gas is produced in the Nadym–Pur-Taz (NPT) region of Western Siberia. However, the region’s share of Russian gas production is shrinking, due to its dwindling resources. Output is increasing in other areas, especially in Yamal.

Russian gas is usually associated with national monopoly Gazprom, but there are other gas companies in Russia, which are formally independent. Though Gazprom fiercely impedes their independent gas exports to outside the FSU, they do cooperate with the gas giant on sales to the former Soviet republics and production of indigenous gas within these republics.

Gazprom is especially active in European countries, for which it has been the main (and in some cases the only) supplier of gas for many decades. According to Eurostat, in 2012, Russia and Gazprom supplied nearly 32% of natural gas imports to the European Union (intra-EU gas trade excluded), while Norwegian gas accounted for 29%, and about 14% came from Algeria. Thanks to price cuts, cold weather and more production, Gazprom’s exports to Europe, including Turkey, rose 16% during 2013, to a record high 161.5 Bcm, up from 138 Bcm in 2012.

Rosneft is expanding its gas business. Its previously mentioned acquisition of Itera enables Rosneft to produce an additional 1.33 Bcfgd, or 2% of total Russian output and gain recoverable liquid and gas reserves of 440 MMbbl and 44.7 Tcf, respectively. Rosneft also has joined forces with gas independent Novatek, to lobby for the right to export LNG. Rosneft plans to increase its share of the Russian gas market from 9% now, to 19%-22% by 2020. Rosneft produced 1.67 Bcfgd in 2012 and 3.90 Bcfgd in 2013. The firm will produce more than 6.12 Bcfgd by 2016.

DRILLING

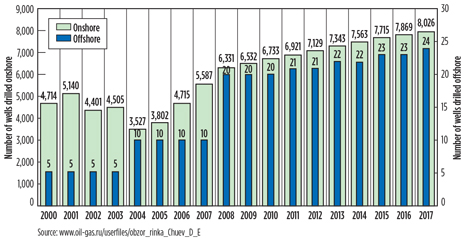

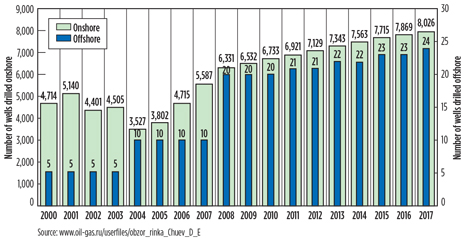

During 2013, nearly 7,370 exploration and development wells were completed in Russia, including 22 offshore. This compares to less than 3,540 wells in 2004 and 7,159 wells in 2012. By 2017, the number of wells drilled should increase to 8,050, Fig. 3.

|

| Fig. 3. Number of onshore and offshore wells drilled in Russia during 2000-2012, and forecast for 2013-2017. |

|

More than 12,020 new oil and gas wells were drilled in Russia during 2012-2013, including 5,890 in 2013. Of the 2013 total, almost 1,600 wells (over 27%) were completed by Rosneft. Nearly 1,480 (over 25%) were completed by Surgutneftegas, and more than 990 wells (16.8%) were drilled by LUKoil. The latter accounted for more than 37.7 MMft drilled in 2013.

Russian operators and drilling contractors now have about 1,835 operable drilling rigs available, with up to half of them in service. This compares to a little more than 340 units in 2000 and 760 rigs in 2009. However, more than 57% of the nation’s rig fleet is over 20 years old, according to VTB Capital Research. Summing up the situation, VTB Capital analyst Oga Danilenko said, “Russia’s rig fleet is too old, too light and it lacks agility.”

Because several large Russian operators have divested their in-house service arms, the leading drilling companies, like Eurasia Drilling (EDC), Siberian Service (SSC), Integra Drilling, Ru Energy and Burgaz, have organized a type of all-Russian cartel operating in the country. EDC is the largest of them, accounting for about 30% of footage drilled in Russia, including a record 20.54 MMft in 2013, up 3.5% from 2012’s level.

FIELD PROJECTS

In October 2013, Rosneft downgraded its production forecast for the Vankor group of oil and gas fields, its main oil asset, which produced 426,421 bopd during 2013, Fig. 4. Rosneft now believes these fields will only produce 458,110 bopd in 2016, at their production plateau. Rosneft previously had planned to produce 500,000 bopd from the Vankor fields by 2019.

|

| Fig. 4. At the Vankor field group in Eastern Siberia, Rosneft produced more than 425,000 bopd in 2013 and is headed toward a plateau of nearly 460,000 bopd in 2016 (photo courtesy of WEG S.A.). |

|

The Vankor fields are 81 mi west of Igarka in the Turukhansk District of Krasnoyarsk Territory in Eastern Siberia. The group includes Vankor, Suzun, Tagul and Lodochnoye fields. Vankor field has oil-in-place reserves totalling 3.8 Bbbl, of which 1.5 Bbbl are proved reserves, along with 3.54 Tcf of natural gas.

In February 2013, Alliance Oil completed infrastructure development and launched gas production of 26 MMcfd at Ust-Silginskiy field in the Tomsk region. The company began delivering gas via a 28-mi pipeline to the Gazprom trunk pipeline.

At the end of October, Novatek launched the Eastern dome of North-Urengoyskoye field, developed by the Nortgas JV. Eighteen production wells have been completed at the Eastern dome, which has a 223-Bcf/year gas treatment facility, gas gathering networks, and gas and condensate pipelines to the field’s Western dome. The Eastern dome allows the JV to achieve a peak production capacity of more than 1.0 Bcfgd and 3,835 bcpd during 2014.

North-Urengoyskoye field has proved reserves of 5.86 Tcf of natural gas and about 180 MMbbl of liquid hydrocarbons, as estimated under SEC methodology on Dec. 31, 2012. Commercial production at the Western dome began in 2001.

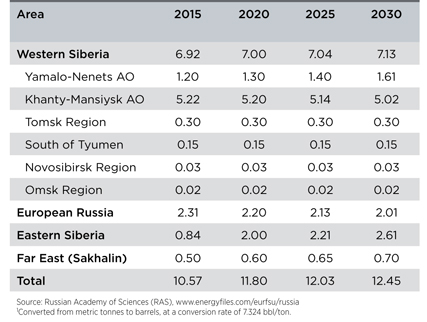

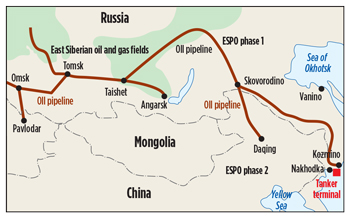

Last December, China National Petroleum Corporation (CNPC) and Rosneft agreed to jointly produce Eastern Siberia oil reserves. The companies will set up a JV (Rosneft 51%, CNPC 49%), to develop a number of fields, including Srednebotuobinsk. Oil produced in the future will be exported to China and other Asia-Pacific countries through the Eastern Siberia-Pacific Ocean Pipeline (ESPO) and a China-Russia oil pipeline stretching from Skovorodino, Russia, to Daqing City in Heilongjiang Province, China, Fig. 5.

|

| Fig. 5. Oil produced jointly by Rosneft and CNPC, and destined for China, will be transported via two pipeline segments, ESPO Phases 1 and 2. |

|

The Black Sea and Kara Sea JV operating companies, Tuapsemorneftegaz SARL and Karmorneftegaz SARL respectively, will begin projects as operators, pursuant to an agreement between Exxon Mobil (33.33%) and Rosneft (66.67), which is the license holder. Initial exploration cost in the two areas is estimated at more than $3.2 billion, most of which will be financed by Exxon Mobil. Drilling operations should begin during 2014.

Last Sept. 23, Phase 1 of the 1.94-Bcfd Kaliningradskoye UGS facility was commissioned. It has a maximum daily deliverability of 178.8 MMcfd (daily average gas consumption in the region is 219.7 MMcfd). This facility is a part of Gazprom’s plan to expand gas supplies to the Kaliningrad region.

Last October, Gazprom confirmed that production at Bovanenkovo field (Fig. 6) during 2013 would amount to 3.1 Bcfd, increasing to 4.1 Bcfd in 2014 and 4.3 Bcfd in 2015. This is less than half of the original plan to produce 9.2 Bcfd.

|

| Fig. 6. “Springtime in Bovanenkovo”: In April 2014, a Gazprom operator carries out a visual inspection of equipment at a gas well cluster in Bovanenkovo field, on the Yamal Peninsula (photo courtesy of Gazprom). |

|

The production cuts come as the company has experienced falling demand, due to declining sales in Europe. Bovanenkovo field was officially launched in October 2012. Totaling 182.5 Tcf of gas reserves, it is the Yamal Peninsula’s largest field.

Tight oil. Forty-five years after its discovery under the swamps of Western Siberia, efforts are underway to develop the world’s largest shale oil resources—the Bazhenov tight oil formation. In December 2012, Rosneft (51%) and Exxon Mobil (49%) signed documents establishing a pilot project JV for tight oil development in Western Siberia. The pilot program will assess and determine the technical possibility of developing the Achimov gas and Bazhenov oil formations in Western Siberia. Exploration work will be performed on 17 Achimov blocks and 20 Bazhenov blocks in a 2013-2015 timeframe, financed by Exxon Mobil.

In March 2013, Gazprom Neft completed its first experimental tight oil well in the Bazhenov-Abalak formation of the Pal’yanovsk zone of Krasnoleninskoye field in Western Siberia. Based on this successful well, development of the Pal’yanovsk zone is set to start during 2014.

Sergey Donskoy, the Russian Minister of Natural Resources and Ecology, gave more detailed information on the challenging Bazhenov reserves. He said, as of the beginning of 2012, Bazhenov reserves amount to 3.64 Bbbl (2.06 Bbbl of A, B and C1 categories and 1.58 Bbbl of C2 category). The majority of these reserves belongs to non-licensed prospects—2.675 Bbbl, while 967 MMbbl are already on the books of producing companies. These reserves are mainly in the Khanty-Mansi Autonomous Okrug (3.555 Bbbl).

During 2013, Surgutneftegaz (SNG) increased its Bazhenov shale oil production more than 60%, to 10,915 bpd. Over the past 30 years, SNG has drilled more than 600 wells into the Bazhenov, but about 37% have been dry, demonstrating the problems with understanding a reservoir that is not homogenous. However, the 63% of wells that succeeded have flowed as much as 2,200 bopd. To date, SNG has produced almost 9 MMbbl of Bazhenov oil. SNG produces oil at 10 Bazhenov deposits. By 2018, that number should rise to 13.

An optimistic, overall forecast from the Russian Ministry of Natural Resources suggests that total tight oil production might exceed 1 million bpd by 2025 and reach 1.7 million bpd by 2030. By contrast, the Energy Ministry’s forecast is much lower, at only 440,000 bopd by 2020, before declining to 400,000 bopd by 2025. To support these efforts, the Russian government, last August, introduced tight oil tax breaks.

As for the Achimov condensate-rich formation, drilling was begun in second-half 2013 by the Eriell/ Schlumberger/Artikgaz consortium at the Urengoyskoye gas/condensate field. By mid-November, the group had successfully completed a horizontal well in just 68 days, drilled to a depth of 17,060 ft. The 3,343-ft-long horizontal wellbore simultaneously exposed three pay zones.

Through the agreement between Gazprom and Wintershall mentioned earlier, Blocks IV and V in the Achimov formation’s Urengoi gas/condensate field of Western Siberia will be developed jointly. They have resources of 10.2 Tcf of gas and 635 MMbbl of condensate. An annual plateau of 815 MMcfgd is expected from the two blocks, once production starts up in 2016.

Offshore. Russia possesses the world’s largest continental shelf, which may contain more than 560 Bboe of resources. Yet, less than 300 wells have been drilled offshore. Last October, output was started from the country’s first subsea production system at Kirinskoye gas field. Operated by Gazprom, Kirinskoye is part of the Sakhalin III concession in the Sea of Okhotsk, 17.4 mi offshore eastern Russia. Its subsea facilities are in a 295-ft water depth. The produced gas is transported via a subsea pipeline to the onshore processing facility (OPF) in the Sakhalin region.

Gazprom’s new Polyarnaya Zvezda semisubmersible is drilling the Kirinskoye wells, Fig. 7. One production well is operable, and six more are to be drilled. At peak, the field will deliver over 560 MMcfgd. Eventually the Kirinskoye OPF will also receive gas from other Sakhalin III fields, which hold 41 Tcf of gas.

|

| Fig. 7. Gazprom’s new Polyarnaya Zvezda semisubmersible has been drilling Kirinskoye field wells offshore Sakhalin Island (photo courtesy of Gazprom). |

|

In yet another development related to the Russia-Ukraine situation, World Oil Contributing Editor Raj Kanwar reports that Rosneft has offered Indian firm ONGC’s international arm, OVL, a stake in 10 offshore blocks. Nine of these are in the Barents Sea, and one is in the Black Sea.

LNG. On Dec. 23, 2013, Gazprom and Shell agreed to move to project design stage for a third train at the LNG plant in Sakhalin. The firms addressed the prospects for the Sakhalin II project expansion and advised Sakhalin Energy to prepare FEED documents for construction of the third LNG process train in Prigorodnoye settlement, Sakhalin Island.

Also in place, is an agreement identifying further steps for the development of a 15-MMt/year LNG plant in the Russian Far East, near Vladivostok. Gazprom and the Japanese government have undertaken work to determine a plant site, gas liquefaction technologies and commercial structure for the Vladivostok project.

ARCTIC ACTIVITY

Last December, Gazprom began oil production at Prirazlomnoye field, Russia’s first Arctic offshore exploration project. The $4-billion Prirazlomnoye oil field lies 37 mi offshore in the Pechora Sea. Recoverable oil is estimated at about 530 million bbl. Production should be about 120,000 bopd after 2020. The first 500,000-bbl tanker was loaded with oil from Prirazlomnoye in April, and at least 2.2 MMbbl are expected to be in 2014.

Meanwhile, on June 11, 2013, Rosneft and Exxon Mobil signed agreements creating the Arctic Research Center and the joint use of technologies globally. Exxon Mobil will provide $200-million funding for the center’s initial research phase. Rosneft (66.67%) and Exxon Mobil (33.33%) will equally fund the next $250 million to continue this joint research.

In February, ExxonMobil and Rosneft increased their strategic cooperation by adding seven new blocks in the Russian Arctic, in the Chukchi, Laptev and Kara Seas, spanning 150 million acres. The companies have agreed to create JV entities in these areas. License obligations stipulate that 14 exploration and appraisal wells will be drilled, and a significant amount of 2D and 3D seismic will be gathered over the next 10 years.

Last November, Novatek and Gazprom Neft acquired Eni’s holding in a gas venture for $2.94 billion, increasing their control of one of the largest new energy projects. The Yamal Development venture will raise its total share in the SeverEnergia gas/condensate project to 80.4% from 51%. SeverEnergia has an estimated 9.8 Tcf of gas reserves and about 5 Bbbl of liquids. Last December, Total (20%) announced that it, along with Novatek (60%) and CNPC (20%) had reached a final investment decision to develop the onshore Yamal LNG project in Russia’s Arctic. It will develop reserves of more than 5 Bboe. It consists of an LNG plant with a capacity of 16.5 MMt/year and represents a $27-billion capital expenditure.

EXPORT PROJECTS

Last October, Russia concluded an $85-billion oil supply deal with China, whereby Rosneft will supply China’s Sinopec with about 730 MMbbl of crude oil over 10 years, starting from 2014. Last June, Rosneft signed a $270-billion deal with CNPC to supply 300,000 bopd to China over 25 years, starting in 2015.

At the end of 2013, Russia and Kazakhstan reached an agreement to cooperate on transportation of oil from Russia to China through Kazakhstan. Deliveries will be made on a swap scheme. Also in November, Gazprom and CNPC agreed on the basic terms of a deal to ship up to 2.5 Tcf of gas per year to China.

|