|

| Depending on which association prediction is most accurate, Canadian drilling will total somewhere between 10,600 and 11,400 wells this year (photo courtesy of Nexen). |

|

Another year gone, and much seems the same for Canadian producers. High global oil prices are heavily discounted in Canada, due to transportation constraints. Natural gas prices, albeit slightly better, remain weak, and political uncertainty across Canada and the U.S. plagues development plans.

The recommended approval of the Enbridge Northern Gateway Project by a Joint Review Panel in early December has provided some hope that the oil supply glut in Western Canada could ease in the future, as has talk of constructing a trans-Canadian pipeline to ship oil to eastern Canadian refineries that are largely supplied by imported crude.

Also boosting optimism was the Canadian dollar’s free fall against its American counterpart, late in 2013. In early December, the two currencies were almost at par, but by late January, the Canadian dollar had dropped below the US90-cent mark. A low Canadian dollar is a boon to the export-driven oil and gas industry, including oil to the U.S. And after years of depressed pricing, natural gas prices have risen dramatically, as the unusually cold North American winter continues.

The positive developments seem to resonate with producers, as planned spending announcements will substantially exceed 2013 levels. Governments that depend on resource revenues are also reaping the benefits of higher pricing, particularly in Alberta and Saskatchewan, where oil production continues to surge. In fact, the so-called “bitumen bubble,” which saw Alberta benchmark heavy oil prices trading as much as $40/bbl less than West Texas Intermediate last year, has eased substantially this winter, attributed to frigid temperatures and increased shipments of crude oil by rail.

OIL TRANSPORTATION

But temperatures will rise, and there is a limit to the amount of crude that producers can ship by rail. As such, the Canadian industry continues to look south to the Obama administration, and its continued delays in issuing a decision on TransCanada Pipelines’ $5.3-billion, 700,000-bopd, Keystone XL pipeline.

However, an environmental impact statement issued by the U.S. State Department in late January supported what has been well known in Canada since the beginning—regardless of whether or not Keystone proceeds, oil sands extraction will continue, i.e. building the pipeline would not lead to increased greenhouse gas emissions. Given that Obama stated last summer that he would only approve the pipeline, if it would not “significantly exacerbate” the problem of carbon pollution, the report appears to eliminate any reason to potentially block approval.

Canada’s National Energy Board has recommended approval of Enbridge Inc.’s C$1.8-billion, 525,000-bopd Northern Gateway pipeline, following its receipt of the Joint Review Panel’s report in December. The approval comes with strings attached—the panel imposed some 200 conditions on the proposal, which would ship crude from Alberta’s Athabasca oil sands area, through British Columbia (B.C.), to the West Coast and on to waiting tankers, destined for Asian oil markets. The final decision on issuing an approval now rests with the federal cabinet.

Meanwhile, TransCanada intends to file an application for its Energy East pipeline project with federal regulators in first-half 2014. The proposed pipeline would ship oil from Western Canada to Saint John, New Brunswick. In addition, several rail disasters across North America, many of which involved crude transport, have reinforced the indisputable fact that pipelines are the safest, most cost-effective means of transporting oil. In response to these incidents, transportation safety board officials in Canada and the U.S. issued a joint warning, in late January, that communities across North America are potentially at risk, if recommendations for new rail safety measures are not followed.

In Canada, federal Transport Minister Lisa Raitt said that the agency recommendations will be reviewed with urgency, but it remains unclear when, and how, they will be implemented. The Canadian government also announced increases to absolute liability for companies operating offshore in Atlantic Canada, as well as in the Arctic. In both areas, the new level is $1 billion, up substantially from previous levels. Liability remains unlimited for any party found to be at fault or negligent for a spill.

Regardless of the outcome from any of the proposed pipelines, and despite the negative impact that pipeline constraints have on the profitability of oil sands projects, production continues to increase, particularly with in situ developments. A National Energy Board (NEB) report, released last November, suggests that crude oil production, driven by increased oil sands output, will increase some 75% by 2035. The NEB forecasts that oil sands production will top 5.0 MMbpd by that time.

The same NEB report identifies one of the key issues facing oil sands producers as production climbs: availability of diluent, which is blended with bitumen to make it flow more easily in pipelines. The NEB projects that diluent demand will grow almost 250% by 2035, and diluent imports will soar more than 600%.

Meanwhile, a federal government study released in January found that although there are some differences between crude oil and diluted bitumen (or dilbit) when spilled in water, the two substances respond in a similar fashion: floating on salt water, and sinking when exposed to waves. Although the report concluded that more study was required to fully understand how dilbit responds to certain conditions and recovery methods, it further debunks the fear-mongering that certain environmentalists have engaged in, regarding dilbit transportation.

|

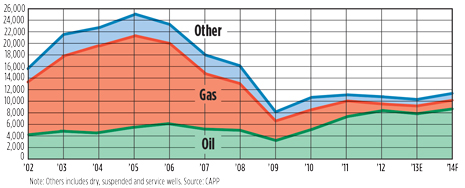

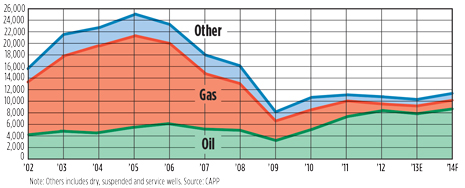

| Canadian wells drilled, 2002–2014 |

|

CAPITAL SPENDING

The clearest signal of industry optimism is in planned spending for 2014. Once again, the biggest spenders have ties to Alberta’s massive oil sands deposits. Suncor Energy leads the way, at C$7.8 billion, up 16.4% from 2013’s figure. Of that total, $1.9 billion is ticketed for oil sands developments (including $1.35 billion for the Fort Hills JV).

Canadian Natural Resources Limited will spend 10.8% more, at C$7.7 billion, including C$3.8 billion for oil sands development at the Horizon mine, as well as the Primrose and Kirby in situ oil sands projects. Husky Energy will lower 2014 capital spending 4%, to C$4.8 million. If the company can contract a deepwater rig for its offshore Newfoundland program, then spending will remain flat at $5 billion, including $400 million for the Sunrise SAGD project.

Cenovus Energy will spend more than 10% less, at $2.8–3.1 billion. About $1.4–1.6 billion of that is dedicated to its Foster Creek and Christina Lake oil sands projects. Spending at Pelican Lake will be cut by $250 million. EnCana, sister company to Cenovus, also has reduced spending, announcing a capital budget of C$2.4–2.5 billion in 2014, down 11.1% to 13.8%, compared to 2013. The company has shifted its focus to oil and liquids-rich plays, and expects that output to increase 30% in the year ahead.

Crescent Point Energy Corp. plans to spend $1.75 billion, compared to $1.7 billion in 2013. Of that, $1.42 billion will target drilling and completions, over half of which is allocated to plays in southeastern Saskatchewan.

M&A ACTIVITY

Following relatively slow merger and acquisition (M&A) activity in 2013, industry pundits predict an upturn this year. There was C$14 billion in value and 75 deals last year, compared to $55 billion and 94 deals in 2012. Reasons for the downturn include low Canadian oil prices, competition from U.S. oil properties, and the restrictions on foreign investment announced by Canadian Prime Minister Stephen Harper following the takeovers of Canadian firms by China’s CNOOC Ltd. (which acquired Nexen Inc.) and Malaysia’s Petronas (which bought Progress Energy Canada Ltd.) in 2012.

Notable deals in 2013 included Talisman Energy Inc.’s C$1.5-billion cash transaction, announced in November, to sell its portion of two Montney plays (Farrell Creek and Cypress) in northeastern B.C. to Petronas-owned Progress Energy. Talisman’s net production from the two properties is about 11,000 boed.

Suncor made a splash in September, selling the majority of its conventional natural gas business in Western Canada for $1 billion to CQ Energy Canada Partnership, a new venture between Centrica and Qatar Petroleum. The deal includes conventional properties throughout Alberta, northeastern B.C. and southern Saskatchewan, with production estimated at 42,000 boed.

In August, ConocoPhillips agreed to a C$720-million cash deal for 226,000 acres of undeveloped land in the Athabasca oil sands area, to Exxon Mobil’s Canadian unit and Imperial Oil Ltd., which is 70%-controlled by Exxon. The land is known as the Clyden oil sands leasehold.

The total in 2013 could have been much higher, if a rumoured C$17-billion takeover of Talisman Energy Inc. by France’s GDF Suez SA had not fallen through, late in the year.

DRILLING/PRODUCTION

Drilling projections remain mixed in 2014, although production is expected to increase, due primarily to increased output from oil sands projects, but also due to an increasing focus on tight oil. According to the Canadian Association of Petroleum Producers (CAPP), oil production, including oil sands output, jumped 9.6% higher, to 3.440 MMbpd. However, NEB says output grew 11.8%, to 3.507 MMbpd. The natural gas production estimate for 2013 from CAPP is 12.0 Bcfd.

Notwithstanding the recent uptick in natural gas pricing, 2013 was yet another year dominated by oil drilling, due primarily to low gas prices for much of the year. According to Daily Oil Bulletin records, 11,102 wells were drilled in Canada last year, of which 8,592 (77%) were oil producers. Overall, drilling increased slightly (about 1%) from 10,984 wells in 2012. Exploratory drilling continued to decrease, with just 1,068 wells drilled last year, down 14% from 1,247 in 2012.

Alberta’s well count fell yet again, to 6,598, albeit just by 1.5%, as compared to 6,701 wells drilled in 2012. Saskatchewan’s drilling increased some 7% to 3,375 wells versus 3,161. In B.C., 563 wells were drilled, up 18% from 477 recorded the year before. And Manitoba slumped to 535 wells drilled, down 13% from the record 615 wells drilled in 2012.

For 2014, the Canadian Association of Oilwell Drilling Contractors is calling for a slight decrease to 10,604 wells, with an average rig fleet utilization of 42%. Meanwhile, the Petroleum Services Association of Canada is once again more bullish, calling for 10,930 wells to

be drilled this year, which still represents a modest increase over 2013. CAPP is the most optimistic, calling for a 10.2% gain, to 11,392 wells, of which 22 will be offshore.

World Oil survey respondents plan to drill 5% less wells in 2014. It is expected that tight oil and liquids-rich gas plays, primarily Alberta’s Duvernay play and northeastern B.C.’s Montney shale, will draw the bulk of producers’ interest and drilling budgets.

|

| Canadian oil production was up between 10% and 12%, last year, to approximately 3.5 MMbpd (photo courtesy of Apache Corp.). |

|

OIL SANDS

The entities that oversee development of the oil sands—federal and provincial politicians and regulators—believe that these massive industrial operations have impacts, and therefore they must adhere to strict operational and environmental requirements. Regardless, a majority of Canadians support responsible oil sands development, as well as construction of pipelines to ship the product to markets.

The companies that operate in Alberta’s oil sands region also recognize the need to reduce their environmental footprint. For instance, Syncrude Canada Limited plans to construct a C$1.9-billion centrifuge plant at its Mildred Lake oil sands mine site. Once operational in 2015, the plant will utilize a series of centrifuges to process tailings, producing a clay-like material designed to meet requirements.

The rhetoric has not dissuaded investment in the oil sands, nor has it stopped companies from applying to develop more reserves. In December, Shell Canada Limited received approval from the federal cabinet for its proposed C$12-billion, 100,000-bopd expansion of the Jackpine mine, about 45 mi north of Fort McMurray, Alberta. The approval is controversial, as Federal Environment Minister Leona Aglukkaq has acknowledged that the project will cause significant adverse environmental effects. Should Shell and its partners, Marathon Oil and Chevron, proceed with the expansion, output will increase to 300,000 bopd.

In mid-December, Imperial Oil Resources Ventures Limited filed an application with regulators for its proposed C$7-billion Aspen in situ project, about 30 mi northeast of Fort McMurray, marking the company’s first commercial application of the SAGD technology that it patented decades ago. The project would be developed in three phases, with ultimate production ticketed at 162,000 bopd.

Meanwhile, Imperial’s C$10.9-billion, 100,000-bopd Kearl mine expansion is at 72% capacity, and is on track to see first oil in 2015. Canadian Natural expects total oil sands production from thermal in situ and Horizon to range from 227,000 to 250,000 bopd in 2014, as work continues on Phases 2 and 3 at the Horizon mine, and production ramps up at the Kirby South SAGD project.

In October, Suncor and its partners (Total E&P Canada and Teck Resources) announced that they will proceed with development of the $C13.5-billion, 180,000-bopd Fort Hills mine, about 55 mi north of Fort McMurray. The partners expect the project to be at 90% of capacity within a year.

The largest growth area in oil sands development continues to be on the in situ side. Its smaller footprint, reduced impacts, and lower capital costs have resulted in significant growth over the past several years. In fact, Alberta’s energy regulator projects that in situ production will surpass mining output by 2015.

LAND SALES

Land sales continued a downward trend in 2013, dropping below the billion-dollar threshold, to C$992 million, 28% lower than the $1.38 billion collected in 2012, and well below 2008’s $5-billion record. Once again, Alberta brought in the majority of the revenues, collecting $698 million, almost 38% lower than 2012 revenues of $1.12 billion.

Natural gas-rich B.C. finally reversed the trend of falling land sale income, bringing in $225 million, up 62% over 2012’s $139 million. The latter was the lowest total collected since 1998.

Land sale bonus bids fell once again in Saskatchewan, to $67 million, down 37% from $106 million in 2012. Land inventories are one of the most consistent indicators of future drilling activity; decreased land sale volumes indicate that although there are some positive signs in Canada, it is premature to suggest that any sort of boom is imminent.

|