|

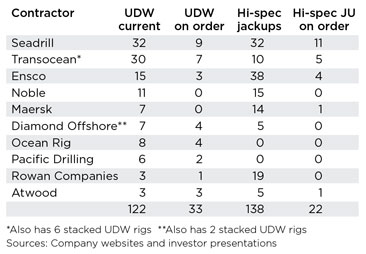

Given the cyclical nature of the offshore industry, drilling contractors have shown exceptional skill in managing their companies through numerous calamities. Students of industry strategy can’t help watching how contractors respond to falling oil prices, just as a new generation of deepwater rigs comes out of shipyards. According to Wood Mackenzie, more than 80% of new offshore reserves have been discovered in deep and ultra-deep waters. This potential led to a wave of orders for floating rigs that could operate in 7,500-ft or deeper waters—so-called ultra-deepwater (UDW) rigs. In 2013, 18 UDW rigs were delivered, and more than 20 entered the market in 2014, for a combined 40% increase in UDW capacity. At least another 33 UDW rigs are under construction. With the year-end drop in oil prices and the arrival of so many new UDW rigs, day rates have dropped from an average above $525,000 to the lowest levels for newbuilds since 2006. In November, Diamond Offshore signed contracts for two new UDW rigs at $400,000 per day. Fleet bifurcation. Before oil prices started to fall, contractors began a process known as “fleet bifurcation,” based on the belief that operators prefer UDW rigs—even for drilling in waters shallower than 7,500 ft—and that high-specification jackups would command higher day rates and achieve superior utilization than standard-capacity jackups. November 2014 data from IHS and Petrodata support this conclusion, Table 1.

Transocean first accelerated the fleet bifurcation trend in 2012, when it spun off 38 older, standard-specification jackups to a new Dubai-based company, Shelf Drilling, Inc. Transocean’s objective was to reinforce its position as a high specification deepwater (and ultra-deepwater) driller, and to prepare the way for 12 newly-built rigs scheduled for delivery through the rest of the decade. Shelf Drilling, with older units and a lower cost structure, could compete for work in shallower water, in fields previously served by Transocean. In 2014, Noble made a similar move by spinning off 42 standard-capability rigs to newly-formed Paragon Offshore. To complete its transition to a “premium asset base,” while reducing the age of its fleet, Noble has taken delivery of 11 new rigs since early 2013, and has two jackups under construction. Paragon’s strategy is based on the premise that not all operators will require the most advanced rig technology. Efforts to high-grade. Other major contractors also have embraced bifurcation by high-grading their fleets, Table 2. From 2000 to 2010, Diamond Offshore built five UDW rigs from existing mid-water hulls, and acquired two newbuild UDW semis. In the next three years, the company ordered four UDW drillships and three UDW semis.

Seadrill’s strategy has been to target the high-end segment with newer-generation rigs. Seadrill has 32 sixth-generation UDW units, 29 high-specification jackups, two mid-water, harsh-environment semisubmersibles and three harsh-environment jackups, with 11 floating rigs on order. Ensco has 15 relatively new UDW rigs and three more on order, as well as a fleet of 42 premium jackups. Since 2010, as part of continuous fleet high-grading, Ensco has sold 18 rigs. Five more rigs are up for sale. Traditionally a jackup supplier, Rowan Companies entered the floater market, when the first of four newbuild UDW drillships began service offshore West Africa in April 2014. Two more UDW drillships are scheduled for delivery in 2014, with the fourth coming in March 2015. Pacific Drilling, which was formed to provide only UDW services, has a fleet of six newbuild UDW drillships, with two more to be delivered in first-quarter 2015. Similarly, Ocean Rig focuses exclusively on the UDW sector, with seven rigs in operation and four on order. Maersk Drilling also has set its sights on becoming a significant UDW contractor, with seven UDW rigs in operation at the end of 2014. Belt-tightening. With the rapid drop in oil prices and the apparent oversupply of UDW rigs, deepwater drilling contractors have felt pressure to do more than just position themselves as high-end suppliers. Transocean idled six rigs and wrote down the value of its assets by $2.8 billion. On Nov. 26, Seadrill announced that it would stop paying its dividend to conserve cash for operations and investment. Other contractors were expected to follow suit. Investor presentations by the major contractors argue that all the newbuild rigs will find work, as up to 120 obsolete floaters and 240 outdated jackups are retired. According to Wood Mackenzie, ultra-deepwater and deepwater developments will be break-even at an average oil price of $70/bbl. If commodity prices don’t stay low for too long, the outlook for contract drillers may be less problematic by 2016. Stay tuned. |

- Coiled tubing drilling’s role in the energy transition (March 2024)

- Advancing offshore decarbonization through electrification of FPSOs (March 2024)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- U.S. operators reduce activity as crude prices plunge (February 2024)