|

JIM REDDEN, Contributing Editor

|

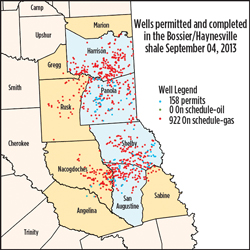

| One of the five rigs drilling in BHP Billiton Petroleum's core Haynesville shale acreage) photo courtesy of BHP-Billiton Petroleum). |

|

Ragan Dickens counsels those ready to wrap a “Rest in Peace” wreath around the once-venerable Haynesville-Bossier shale, to look well beyond its current ill health. “It’s not going to return tomorrow, but we have stability for the long term,” says Dickens, North Louisiana director of the Louisiana Oil and Gas Association (LOGA).

While a recovery of the Haynesville-Bossier to anywhere near its vigor of yesteryear is unforeseeable, signs of life are, nevertheless, starting to emerge in the predominately dry gas play that stretches some 9,000 sq mi across northern Louisiana and East Texas. This time last year, the technically daunting Haynesville was clinging to life with very feeble fingers. Formerly hyperactive players were either suspending drilling operations, or writing down assets that were seen as being on the downside of commercial attractiveness. Today, both new well, and rig, counts have increased, albeit modestly, and while no one is forecasting a return to the halcyon days of double-digit gas anytime soon, prices are inching upward. But, more importantly, prices have stabilized to a degree, spawning a manufacturing renaissance along the Gulf Coast, as companies seek to take advantage of the plentiful, and inexpensive, gas reserves in their backyard.

Meanwhile, barely a fraction of the more than 75 Tcf of technically recoverable gas reserves, that the U.S. Energy Information Agency (EIA) estimates resides in the Haynesville, have actually been put into the production stream. Consequently, operators with sufficient resources are taking Dickens’ advice to heart and using the play as an in-ground savings account, by bolstering reserve bases that can quickly be sent to the pipeline, once the price reaches an acceptable level.

“We look at the Haynesville as a swing field for us, in terms of our ability to go ahead and increase capital spending,” said Rod Skaufel, president of North American Shale for BHP Billiton Petroleum. “We like the Haynesville, but, with the current gas prices, we have no driver to maintain activity any higher than we are now. As long as we continue to hold good liquids-rich opportunities in our portfolio, when things [gas prices] switch, we want to be in a position to go full throttle. We probably have the best acreage position in the heart of the Haynesville, so we have good economic opportunities now. But, if there’s an increase in gas prices, we can go to the Haynesville and have really good economic opportunities.”

BHP Billiton is operating five rigs in its core Haynesville Louisiana acreage, up one from the average it was running last year. However, despite the few rigs, the operator plans to drill more Haynesville wells this fiscal year, which Skaufel attributes to the improved per-rig efficiencies achieved over the past year.

|

| Fig. 1. Encana has resumed activity in the Haynesville with a five-rig drilling program this year (photo courtesy of Encana Corp.) |

|

EnCana, which suspended drilling operations last year, likewise will run up five rigs this year, Fig. 1. “There was a time, they were so low it couldn’t be profitable,” a company spokesperson told LOGA. “But, gas has come up, and we are, and continue to be, a low-cost producer. We’ve become so good at what we do, we’ve been able to keep supply cost low, so that has really helped us.”

WELL, RIG COUNTS ON THE UP

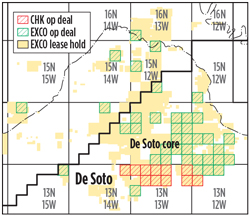

Baker Hughes’ latest well, and rig, counts show slight increases in both categories, with 112 new wells drilled in the Haynesville in the second quarter, compared to 109 in the same period last year. Meanwhile, as of Sept. 17, a total of 39 rigs were making hole in the Louisiana and Texas sectors, up one from the same period last year. Of those, 21 are drilling in the East Texas portion of the play, primarily comprising Harrison, Nacogdoches, Rusk, Panola, San Augustine and Shelby counties, where the Haynesville is part of some operators’ legacy fields that yield a quantity of liquids, as opposed to the gassy Louisiana sector, Fig. 2. The remaining 18 rigs are active in the Louisiana Haynesville fairway, an area that primarily encompasses Caddo, DeSoto, Red River and Sabine Parishes.

|

| Fig. 2. An overview of the Haynesville-Bossier shale. |

|

Unsurprisingly, despite the moderately higher well, and rig, counts, gas production continues to slide. As of July, the Louisiana Department of Natural Resources (DNR), the state’s oil and gas regulator, estimates that operators produced 166.88 Bcf from its Haynesville- dominant northern district, compared to the 221.57 Bcf produced by July 2012. Across the border, the latest data available from the Railroad Commission of Texas (RCC) show a similarly expected decline in gas production, which is offset by an increase in liquids output. Production figures from RCC District 6, which includes the core, six-county Haynesville sector, showed dry gas production of 597.09 Bcf between January and July, down year-on-year from the 681.85 Bcf produced in the same period last year. However, the most recent District 6 liquids production increased to just over 9.14 MMbbl of oil and condensate, compared to slightly more than 9.0 MMbbl for the first six months of last year.

|

| Fig. 3. Wells completed and permitted in the East Texas Haynesville shale, as of September (source: Railroad Commission of Texas). |

|

Going forward, new authorized drilling permits are down for both Texas and Louisiana. In the former, the RCC issued 318 new permits in the six-county Haynesville area between January and Sept. 18, compared to 428 issued over the same eight months last year, Fig. 3. While the DNR does not break out permits for the core Haynesville, the Louisiana regulator issued 904 onshore drilling permits in the state, as of July, down from 957 authorized in the same 2012 timeframe.

REDUCING COSTS, UNCERTAINTIES

The Upper Jurassic Haynesville shale directly overlies the Smackover limestones, and is unconformably overlain by the prospective, but lightly explored, Lower Bossier sandstones of the Cotton Valley group. Ranging in thickness from 150 to 300 ft, the Haynesville is unique to North American shales, in that access requires wells from 10,000 to 14,000 ft, TVD. At this depth, bottomhole temperatures can soar as high as 350°F, and pressure gradients of 0.85 to 0.93 psi/ft can send wellhead stimulating treatment pressures past 10,000 psi.

Although Haynesville wells have recorded some of the highest flowrates of all the unconventional plays, with enviable per-well, estimated ultimate recoveries (EUR), the downhole challenges also make them among the most expensive. Accordingly, when gas prices nose-dived, the economic margins in the Haynesville went with them. Little wonder then, that reducing well costs has been the top priority for operators with rigs in the Haynesville.

Prolific Haynesville player EXCO Resources touted its cost reduction program during its second-quarter earnings release. “Our cost reduction and efficiency program is delivering positive results. We continue to see improvements in drilling times, stimulation costs and overall capital efficiency. Our current DeSoto Parish well costs are averaging approximately $7.7 million per well,” the independent stated.

EnCana says that maximizing ultimate reservoir drainage, by increasing laterals from an average of 7,100 ft to 10,000 ft, has delivered noticeable improvements in ultimate economics, particularly in its wells in Red River and DeSoto parishes. “We’re just getting better. We continue to advance our completion optimization and our resource play up. We are able to capture more of the resource that we did before,” a spokesperson said.

Operators say one of the drawbacks to fully optimizing efficiencies, and in turn costs, in the Haynesville is the myriad geological unknowns that remain, despite the flurry of drilling activity in the play’s heyday, when gas prices were at some of their highest levels. Haynesville pioneer Chesapeake essentially kicked off the play in March 2008, which sparked a frenzy of drilling activity that led to the construction of more than 2,400 wells. However, LOGA’s Dickens and others say those wells represent only around 25% of the resources remaining, which bodes well for long-term supply, but also presents a host of geological uncertainties.

“With our acreage position, we can drill very economical wells there, even with today’s gas prices,” says BHP Billiton’s Skaufel. “But, we want to continue activity there in order to build up our technical understanding, namely how do you optimize your frac completions, what spacing do you drill the field on, and is there any Bossier potential above the Haynesville? There are a lot of unanswered questions in the Haynesville, and given our position, we want to continue to answer those questions. Then, as gas prices recover, and we decide to shift back to gas, we’ve worked through those questions and can really execute on the development of a field. Once we resolve these uncertainties, when we decide to go full force from a development point of view, we can really bang it out.”

Skaufel said well spacing remains one of the primary uncertainties in the Haynesville, noting that the majority of sections presently hold only one, or two, wells, each. According to Skaufel, BHP’s base development plan calls for six wells per section which, given the natural fracturing in the Haynesville, may or may not be appropriate. “There hasn’t been enough work from an empirical standpoint,” he said. “We need to drill a lot of wells with different spacing to determine the level of interference, as well as the interaction between spacing and frac design.”

|

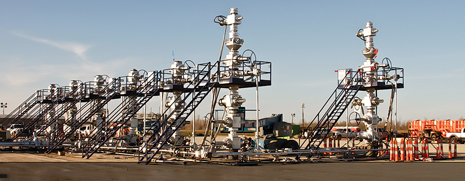

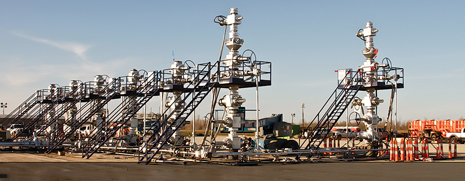

| Fig. 4. As symbolized by this image, the question of how best to optimize frac design is a vital issue. The image shows a 7-well pad, using Valveworks USA’s API 6A frac valves, in the Haynesville (photo courtesy of Valveworks USA). |

|

“The frac design is probably where the biggest opportunity exists in all the shale plays, in terms of maximizing the stimulated rock volume,” he added. “Again, for us, how to optimize the frac design (Fig. 4) is a question that is unanswered at this point, and one of the reasons we’re maintaining activity there.”

While some consider the Haynesville, and the overlying Bossier, one and the same, they are two distinct formations. While the Bossier, which can range in thickness up to 1,000 ft, has been evaluated to a degree, Skaufel said too few wells have been drilled to get a reasonable fix on its potential. “A great deal of trial and error, and empirical results, goes into the shale plays, and with so few wells having been drilled in the Bossier, there is very little control. So, when you look at well results, you simply don’t know if you’ve had any frac optimization. Our activity is focused on the Haynesville, but the Bossier is on our minds.”

In the meantime, Skaufel said present-day well efficiency and economics have been enhanced considerably with a changeover to the new-generation H&P Flex Rigs. “We’re learning how to really use the efficiency of these rigs to drive our costs down. Early results show that we’re drilling wells significantly faster with these flex rigs,” he said. “Overall, we just want to maintain an activity level that, first, allows us to learn in terms of how to drill these wells at less cost, but secondly, on the completion side, how can we get more gas per dollar invested.”

KEY OPERATORS STILL DRILLING

The slightly improving fortunes of the Haynesville play are reflected in the activity levels planned by some of the core players and major asset swaps.

BHP Billiton Petroleum holds 239,000 net acres in the core of the Haynesville, all of which is held by production (HBP). The operator plans to drill 35 gross-operated wells in FY 2014 with five rigs, compared to the 24 wells it drilled in FY13 with an eight-rig program.

|

| Fig. 5. An Encana location, prior to suspension of Haynesville 2012 drilling activity (photo courtesy of Encana Corp.) |

|

EnCana resumed drilling operations this year, with seven wells completed in the first half of the year on the 218,000 net acres that it holds in northern Louisiana and East Texas, Fig. 5. So far this year, the Canadian operator has drilled 14 wells, with an additional 11 planned. “We have been successful over time at creating greater efficiencies that allow us to profitably drill in the Haynesville, even in a low-price environment,” a company spokesman said.

Second-quarter gas production dropped to 375 MMcfd, compared to the 418 MMcfd recorded in the same period last year.

|

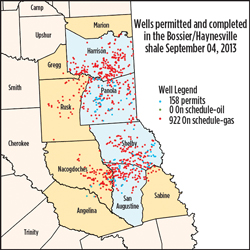

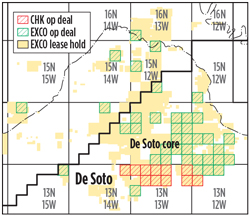

| Fig. 6. Overview of the 9,600 Haynesville acres that EXCO Resources acquired from Chesapeake this summer (map courtesy of EXCO Resources Inc.) |

|

EXCO Resources closed on the acquisition of approximately 9,600 net acres, in DeSoto and Caddo parishes, formerly held by Chesapeake in July, Fig. 6. Upon finalization of the sale, EXCO CEO Doug Miller said, “We are executing our strategy of acquiring assets in both our existing core areas and strategic new plays. Our recently announced acquisition in the Haynesville shale fortifies our leading position in that area.”

EXCO, which held 123,600 net acres in the Haynesville before the acquisition, reported its operated gross gas production reached 971 MMcfd in June, while non-operated production added 302 MMcfd. The Dallas-based independent operated three rigs in the second quarter and completed 15 gross wells. EXCO said it plans to continue running three rigs and drill 26 gross wells this year.

Chesapeake, which suspended drilling operations last year, has released no information on any activity planned on its remaining Haynesville acreage during 2013.

|

| Fig. 7. A pumping unit operating on Andarko’s East Texas holdings (photo courtesy of Anadarko Petroleum Corp.) |

|

Anadarko Petroleum Corp., which operates in the East Texas Haynesville sector, is running seven rigs, targeting prospective liquids in both the Haynesville and Cotton Valley formations. Anadarko’s East Texas net sales volume in the second quarter was nearly 56,000 boed, a 54% increase over second-quarter 2012, Fig. 7. Anadarko said its acreage holds more than 300 million BOE of net resources and 450 identified drilling locations.

Freeport-McMoRan Copper & Gold Inc. entered the Haynesville in late May with its acquisition of Plains Exploration and Production Co. which, at the time of the buyout, held 84,000 net acres. The acquired properties produced 134,200 Mcfed in the first quarter, with 11,000 identified drilling locations remaining.

The $16.3-billion transaction preceded Freeport-McMoRan Copper & Gold’s late June acquisition of McMoRan Exploration Co. No information has been made available on 2013 drilling plans for the newly acquired properties.

MARKET RELIEF IN OFFING

This time last year, much of the buzz centered on plans for three LNG export facilities in various stages of approval, and development, along the Louisiana coast. While some hoped the facilities would take a significant chunk out of the supply glut, the sanctioned export volumes will barely make a dent in overall production, and even then, LNG will not start flowing from the Gulf Coast until 2015, at the very earliest.

The real potential game-changer, most say, is the surge in new gas-driven manufacturing facilities in Louisiana that have been announced recently. Over the past year, more than $62.3 billion in capital investments has been released for new manufacturing facilities in Louisiana, which are planned to take advantage of the abundant, and inexpensive, gas supply, said David Dismukes, professor and associate executive director of the Louisiana State University (LSU) Center for Energy Studies. Dismukes was the author of the study “Unconventional Resources and Louisiana’s Manufacturing Development Renaissance,” which was released in January. It was co-sponsored by LOGA and American’s Natural Gas Alliance.

Along with the LNG facilities, Shell and Sasol have announced plans to build separate gas-to-liquids plants in Louisiana, while Sundrop Fuels is constructing a plant near Alexandria, to produce what it calls “green gasoline.”

In late September, Shell said it had selected a site in Ascension Parish for a proposed $12.5-billion gas-to-liquids (GTL) plant that would produce diesel, jet fuel and other liquids. As the project has not yet received final sanction, Shell has given no timeline on when it could be completed and in operation.

“Today’s announcement (Sept. 24) is a historic new opportunity for Shell to potentially expand its manufacturing operations onshore in a world-class, gas-to-liquids facility in Ascension Parish on the Mississippi River,” Louisiana Governor Bobby Jindal said in a statement. “Here in the heart of Louisiana’s world-scale petrochemical industries, the Gulf Coast GTL project would give thousands more of our people an opportunity for a rewarding career right here at home.”

In a press release announcing the proposal, Shell said that if the GTL plant receives final approval it would create at least 740 direct and 3,900 indirect jobs. Estimates from Louisiana State University have the project delivering an economic impact of $77.6 billion over the construction period and its first 15 years of operation.

Owing to the potential economic impact, Louisiana offered Shell an incentive of $112 million, according to a state news release. “The State of Louisiana offered Shell a competitive incentive package that would include a performance-based grant of $112 million to reimburse costs associated with necessary public road improvements, land acquisition and other infrastructure costs,” the state said.

Elsewhere, German steelmaker Benteler Steel/Tube broke ground, in September, on a $975-million, hot-rolling seamless-tube mill in Caddo Parish, its first in the U.S. The plant is expected to be completed by the end of the next year.

In November, steelmaker Nucor Corp. entered into a long-term agreement with Encana for an onshore U.S. gas drilling program. The agreement, which does not specifically target the Haynesville, calls for the manufacturer to pay a share of the drilling costs. Nucor said the agreement ensures “we will ensure a reliable, low cost supply of natural gas for our existing and expected future needs for more than 20 years.”

|