Drilling interaction with social responsibility improves water access, resource utilization

BY N. WAGNER, and L. BRANTLEY, C. GROSVENOR, F. FLORENCE AND J. OGG, National Oilwell VarcoIn this second and final installment, authors explore water use and reuse in Australia, South Africa and China, in addition to more ways operators can be socially conscious. AUSTRALIA In Australia, unconventional coal seam methane gas (CSMG) is also being produced in high quantities, in addition to conventional oil and gas drilling. Currently, 90% of Australia’s onshore proven and probable petroleum reserves are in the form of CSMG, with most of that being in the Surat basin (61%) and Bowen basin (27%). Coal seam gas in Australia is wet (when compared to coal seam gas in Canada), which requires separating water from the gas. According to the Australian National Water Commission, “The beneficial use of co-produced water represents an opportunity for petroleum producers to maximize the resource by providing (including trading) water to other parties for use.”1 While water from CSMG wells tends to be fresher in quality than water produced from conventional formations, the water is generally of poor quality, characterized by high salinity, high sodium adsorption rations (SAR), and the presence of contaminants. Water quality and volume often determine whether, and how, produced water is used, how it is treated, and where it can be discharged.2

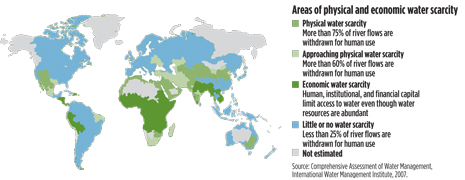

The review of Figures 2 and 3 shows that of the areas surveyed for water scarcity, Australia appears to experience little to no water scarcity, except in one area that approaches physical water scarcity. The driest areas of Australia would be inland, and water use there is limited. Australia has taken the approach of determining possible, potential, beneficial uses for produced water, before the development of unconventional resources has fully matured. This approach is slightly different from all other areas, and it could be a significant advantage in the long term. Possible beneficial uses for produced water, as can be seen in Table 1, include irrigation, livestock watering, industrial use, impoundments, water supply, aquifer storage and recovery, and aquifer recharge. Disposal options include deep injection into non-potable water reservoirs, the direct discharge to land surface or direct surface water discharge, and impoundments (not all currently used). Reinjection is used in the Cooper and Otway basins to maintain reservoir pressure (after pretreating water to a “suitable standard”).1

Produced water has a range of beneficial uses, as demonstrated in the Powder River basin. In addition to the aforementioned options for beneficial water use, it may be possible to use fit-for-purpose CSMG water to manage short-term transitions in water management and the acute ecosystem effects of drought. This pertains to dry areas like the Eagle Ford and Australia, where water resources are often limited, due to drought. Table 2 shows various uses and basins for reference.2

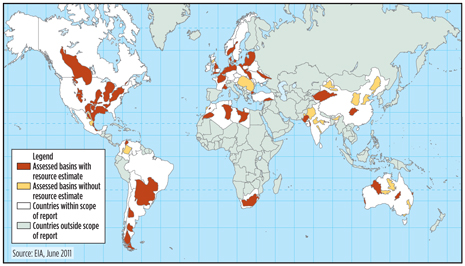

SOUTH AFRICA In South Africa, which has the world’s fifth-largest assessment (Fig. 3) of technically recoverable shale gas resources with 485 Tcf, development is on hold. In April 2011, the country’s cabinet ministers enacted a temporary moratorium on hydraulic fracturing in the Karoo region, pending assessment of an environmental impact report. While the ban has since been lifted, little development is taking place. The Karoo is a semi-arid region that covers two-thirds of South Africa. The Karoo basin is just as large and contains thick organic-rich shales, with the southern portion being the most favorable for shale gas development. However, like any international shale play, the resources are likely of varying quality and require significant de-risking. The presence of volcanic intrusions may impact the quality of the rock and inhibit the use of seismic imaging.3 At least one operator is interested in developing the area, and the firm is actively working to show its commitment to an environmentally responsible approach to shale development. In March 2012, the company released the Karoo Groundwater Atlas, an initial study of Karoo’s groundwater, and it plans to follow with a second phase, integrating more detail around their proposed areas of development.4 As can be seen in Fig. 1, most of Africa is experiencing either physical or economic water scarcity. According to the United Nations, the water scarcity is to the degree that globally, of the people without adequate access to water, 37% live in Sub-Saharan Africa. In addition, less than one in three people in Sub-Saharan Africa has access to a proper toilet.5 Water access is minimal, and generally water is brought to houses via a jerry can, with an estimated 40 billion hours per year (equal to one year’s worth of labor in France) spent on collecting water. While there is a hydraulic fracturing ban in place, there is also sufficient need to encourage the potential reuse of produced water for beneficial purposes, such as for sanitary sewers or agriculture. CHINA According to the Chinese National Energy Administration (NEA), China is intent on developing its unconventional resources with a similar execution pace as the U.S. Compared to the high production of U. S. shale gas basins, shale gas development is in its infancy in China, due to unique geological and topographical characteristics. Analysis of the sedimentary environment, shale types, and evolution history and characteristics, reveals geological peculiarities of marine and continental oil and gas shales in China. In its most recent “Five Year Plan,” the Chinese government expressed intentions to increase natural gas production more than two-and-a-half-fold, with natural gas production representing 10% of the country’s total energy mix by 2020.6 Benefitting China’s development plans is their governmental structure, as unconventional E&P will be less harnessed by restrictions related to surface disruption and environmental impact than other countries. Considering only 3.8% of Chinese natural gas is in the primary energy consumption structure, the Chinese government, in its latest five-year plan, expects to produce 6.5 Bcm per year of shale gas by the end of 2015. With the right technology, by 2020, China could be producing as much as 100 Bcm of shale gas. One operator is drilling numerous wells for tight gas and shale gas in China, and plans to spend US$1 billion a year over the next five years on shale gas in China, if its exploration work underway proves a success. China is drawing up a national shale gas development plan, aiming for commercial production as early as possible, as it gears up to boost cleaner energy consumption and reduce reliance on carbon-intensive coal. The NEA is drafting the plan, studying relevant policies and establishing a “pilot shale gas development” area, according to a report posted on the National Development and Reform Commission’s website. Although China is in the early stages of developing shale gas and does not have reliable reserve estimates, the government plans to release “concrete” fiscal and tax support policies to promote and encourage the development of a local shale gas industry.7 However, the report did not provide more details on the plan or when it may be finalized. In addition, the government has also set up a special research project for key shale gas exploration and development technologies. Surface conditions present a challenge for Chinese development, as rough terrain surrounding the basins restricts location access. Pad drilling and compact rigs with smaller load sizes and shipping dimensions could be key technologies, when China begins exploring more extensively. For now, China is in the initial exploration stages, pursuing JVs with leading U.S. independents and super-majors. It only recently introduced horizontal drilling and hydraulic fracturing within the past 18 months, but, over time, it could leapfrog into more advanced development technologies by combining its own financial resources, with the knowledge of active international operators, to pursue pad drilling and compact rig design. To accelerate shale gas exploration and production, the analysis of shale gas pooling mechanisms, geological conditions, and the distribution of favorable exploration target zones, based on the said peculiarities of shale gas in China, will be required. A comprehensive evaluation method, and a package of techniques, should be introduced for such peculiarities. Concerning the water resources requied by current shale development techniques, there are some limited water access areas that can lead to additional development challenges. As Figs. 2 and 3 show, most of the highlighted areas, where shale reserves have been documented, show water resource scarcity. Further, in a recent article in the China Oil and Gas Monitor, local media are highlighting the water scaricy and related development challenges. “The government-controlled China Daily in Beijing published an article raising questions about China’s technology shortcomings and the country’s acute shortage of water, an essential commodity for successful fracing.. One potential path forward involves international partnerships and active involvement of multiple companies (operators, contractors and government) to enable development of these resources. As a potential benefit, they also have the opportunity to look at beneficial reuse of the related water sources to support developed areas and local communities. INTERNATIONAL GUIDANCE ON SOCIAL DEVELOPMENT One item that can be generally agreed upon is that access to water is critical to the development of unconventionals, much in the same way that it is critical to human development. According to one operator, the potential socio-economic impacts from oil and gas companies can be significant. Oil and gas companies can extensively impact local communities. This can include positive impacts, with the industry bringing significant revenue to the national economy, sharing skills and expertise, and providing local employment. It also can include negative impacts, if risks are not mitigated. Table 3 provides examples of both the potential positive and negative impacts that companies can have on local communities.8

There are a number of available guides to improving social development, many of which also discuss the importance of social responsibility. The International Petroleum Industry Environmental Conservation Association (IPIECA), whose focus is “to develop and promote scientifically-sound, cost-effective, practical, socially and economically acceptable solutions to global environmental and social issues pertaining to the oil and gas industry,” publishes a fairly comprehensive guide. IPIECA has established a Social Responsibility Working Group that looks at issues of social responsibility, especially in the developing world. According to IPEICA, oil and gas companies working in emerging economies are sometimes the first international companies to do business with local governments and, therefore, need to take care to conform to local standards of behavior and cultures. When oil and gas operations displace local indigenous peoples (with or without their consent), IPIECA refers to this as “involuntary resettlement.” IPEICA suggests that this should be used only as a last resort. Overall, oil and gas companies that maintain open communication and interactions with the local community, governments, NGOs, and security forces, are more likely to be successful in the long run. A few key elements to incorporate are:

An increasing number of oil and gas companies are starting to realize that community relations are important to the success of their projects, and are including community discussion as part of their environmental impact assessments to gain community buy-in. “Many company managers feel that helping nearby communities is, as one of them put it, simply the right thing to do. ‘We need to develop good long-term relationships with our neighbors so that everybody can benefit.’” For example, a number of companies are allowing NGOs in Ecuador and Peru to monitor environmental performance and project development. Past projects have shown that both senior management commitment at large companies is crucial, and having full-time teams to work with community leaders is crucial.10 Water made it onto the list of “7 Critical Issues” at the United Nations Conference on Sustainable Development with the following description: Clean, accessible water for all is an essential part of the world we want to live in. There is sufficient fresh water on the planet to achieve this dream. But, due to bad economics or poor infrastructure, every year millions of people, most of them children, die from diseases associated with inadequate water supply, sanitation and hygiene. Water scarcity, poor water quality and inadequate sanitation negatively impact food security, livelihood choices and educational opportunities for poor families across the world. Drought afflicts some of the world’s poorest countries, worsening hunger and malnutrition.11 In terms of numbers, 1.7 billion people have gained access to safe drinking water since 1990; 884 million people still lack it. Nearly one out of every five deaths under the age of five years old worldwide is due to a water-related disease.12 In developing countries, 80% of illnesses are linked to poor water and sanitation conditions.13 According to the World Health Organization, for every $1 invested in water and sanitation, there is an economic return of between $3 and $4.15 Almost two-thirds, 64%, of households rely on women to get the family’s water when there is no water source in the home. In developing countries, girls under the age of 15 are twice as likely as boys their age to fetch water. Over half of the developing world’s primary schools are without sanitary facilities; girls tend to leave school before completing their primary education.6 By investing in clean water, alone, young children around the world can gain more than 413 million days of health.15 Research has shown that for every 10% increase in women’s literacy, a country’s whole economy can grow by up to 0.3%.16 NEXT STEPS As of 2011, sustainable water resource extraction limits have been exceeded in western Asia and northern Africa, whereas southern Asia and the Caucasus and central Asia are approaching water scarcity. According to the UN, “The world is likely to surpass the drinking water target, though more than one in ten people may still be without access in 2015.” At the current rate of progress, it will take 30 extra years (beyond 2015) to meet the sanitation target set forth in the Millennium Development Goals. Globally, rural populations are at the greatest disadvantage in terms of water access. However, in some urban areas—particularly in developing countries and/or countries in conflict—water access remains a challenge. “In urban areas, the poorest households are 12 times less likely than the richest households to enjoy the convenience and associated health benefits of having a piped drinking water supply on premises.”17 The Stockholm Statement, agreed upon during 2011’s Stockholm World Water Week, calls for effective water management to manage climate change and promote economic growth. “By 2050, at least one in four people are likely to live in a country affected by chronic or recurring shortages of fresh water.”18 Equipment manufacturers, drilling contractors and operators can combine the water needs for drilling and unconventional resource development with the water needs of local communities. For example, operations in regions of the world, where water access is a challenge, can contribute to the nearby community, as in the example provided in Guatemala. In areas where unconventional development provides additional, otherwise unattainable water sources (produced water), the disposal options can include treatment and beneficial reuse. Ultimately, the cooperation between the oil and gas industry, and national oil companies or communities, could lead to the inclusion of water packages with land rigs. These water packages might include small solar-powered pumps, requiring less infrastructure, and appropriate diameter tubing (fiberglass, recycled coiled tubing, or more common concrete water distribution pipes) to enable water distribution, as well as the development of oil and gas resources. A logical approach would be to connect systems and packages that comprise part of the initial water sourcing kit with input from the community on placement, water quality standards, and operational boundaries, including any related costs and transfer of ownership once development activities had concluded. SUMMARY Oil and gas producers can work together with communities to meet water needs for operations and local residents. The key is to consider perspectives of all industry players: operators, contractors, service and supply companies, and the local communities. In the examples reviewed, environmental responsibility and social development contrast with unconventional resource development and water management. Water is required for drilling, completion and production. The need for unconventional reservoirs—which represent a growing percentage of wells drilled—is even greater than conventional wells. While oil and gas drilling can be water-intensive, it can also produce a large amount of water, which could be used for beneficial purposes. There are many people in the world with limited access to water. Understanding their needs may be essential to enabling the development of oil and gas resources in the future. Successful production of unconventional resources requires large amounts of water, and as water becomes more valuable, the option for produced water reuse grows more reasonable. As can be seen in California with steamflooding and field irrigation, in Guatemala with peaceful villages and sustained oil and gas operations, and in Australia, with the beneficial re-use of produced water, there are successful projects connecting the oil and gas industry with community needs. In China, the challenges of water scarcity and energy demand can both be successfully approached with a comprehensive review and utilization of available technogies, along with cross-collaboration within, and among, the industry and governmental agencies. It is possible that produced water could be used to meet these operational requirements and community water needs with the use of treatment options and extended reuse solutions. The practice could lead to improved safety, public relations, and operations for the companies involved, as well as a related improvement in the quality of life and access to potable water for communities worldwide.

BIBLIOGRAPHY 1. RPS, A. E., “Onshore co-produced water: extent and management,” Australian Goverenment, National Water Commission, Waterlines, 2011. Retrieved June 2012, from http://www.nwc.gov.au/publications |

|||||||||||||||||||||||||||||||||||||||||||||||||