|

JIM REDDEN, Contributing Editor

Drilling 101 holds that the primary objective of any wellbore construction exercise is to make a well, rather than simply drill a hole. Hyperbole aside, this most elemental of aspirations could have been intended expressly for drilling unconventional shale wells, where the delivery of a useable, low-tortuosity wellbore is an especially imperative prerequisite for the multi-stage frac stimulations often required for optimum reservoir drainage.

For these wells, handing over a quality wellbore, and one that is landed precisely for maximum reservoir exposure, requires operators to prudently balance distinctive technical challenges, with notoriously constricted economic margins. For one thing, to accurately target shale “sweet spots” in the tight well and fracture spacing intrinsic to now-routine multi-well drilling pads, it is essential that the drillstring be steered clear of any inter-reservoir communication. At the same time, with laterals showing no signs of shortening anytime soon, high hook load and torque control requirements have helped raise the stakes appreciably for contractors and service companies, alike.

Moreover, all of this must be executed within an ever-tightening economic framework, heavily dependent upon the commodity prices of the day, as clearly illustrated by the prompt rig withdrawals in the Haynesville and other predominately dry gas shale plays. At the same time, the comparatively rapid decline in per-well production rates obliges operators to drill hundreds of wells within their holdings to optimize asset value, putting additional pressure on manufacturers and service providers to continually advance technologies that can deliver premium results, doing so at the lowest possible cost.

While some operators weigh the costs and rewards of employing the more advanced and pricy drilling tools, what is not under debate is that the near-meteoric intensification of unconventional drilling activity, in the face of vexing technical and economic issues, is directly responsible for what some describe as an unprecedented surge of enabling technology development. Refinements in rotary steerable drilling, driven by new generation gamma ray, resistivity and acoustic geosteering sensors, for instance, continue to push the envelope in well placement within tight horizons. And, as angles and lateral lengths grow higher and longer, myriad technologies and methodologies—both mechanical and chemical—are being introduced to manage ubiquitous torque. Developments include a novel automated surface rotation control system, new PDC bit technologies, advanced double-shoulder drillstring connections to handle higher torsional stresses, and lubricants for more cost-effective, less environmentally-restrictive, water-based drilling fluids.

For drilling contractors, the mercurial increase in horizontal shale drilling has germinated a cottage industry, of sorts, with the design of new fit-for-purpose AC rigs, with increased hookloads, more power, and the mobility to “walk” easily between different well locations on the same pad. Together, advanced geosteering and batch drilling have helped foster a “factory-style” approach to well construction, and, in turn, opened the door for more automation and remote monitoring capabilities.

However, geophysicists caution that all of the new-age geosteering technologies must be accompanied with a thorough understanding of reservoir characteristics, lest operators find themselves steering into, and fracing, zones with little or no productive potential.

LANDING THE WELL

Apart from hydraulic fracing, augmenting meticulous geophysical homework with the capacity to reference geological markers, in real time, to keep a well on track, is undoubtedly one of the principal technical contributors to the phenomenon that is unconventional shale drilling. Today, it is generally accepted that the horizontal shale picture would look remarkably duller, had it not been for continual progression in the development and application of geosteering, where the only restrictions on lateral lengths can possibly be boiled down to site limitations and equipment load capacities.

A sampling of the technology portfolios of pertinent service companies clearly reflects the steady advancements in geosteering sensing, in tandem with rotary steerable systems, which have removed much of the geological uncertainties. They have, according to Halliburton, cleared the way for tightly spaced wells to be landed squarely in predetermined stratigraphy.

Halliburton Sperry Drilling services says LWD and real-time cuttings analysis provide the most the cost-effective answers for the placement and evaluation of horizontal wells, to ensure that they are landed in the “sweet spots.” Advances in LWD resistivity measurements, it says, have improved the real-time geosteering process significantly, and helped operators in major shale basins achieve precise horizontal wellbore placement and gather additional reservoir insights that can be used to refine stimulation designs.

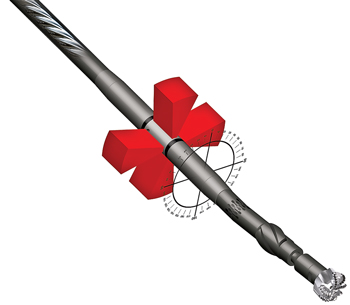

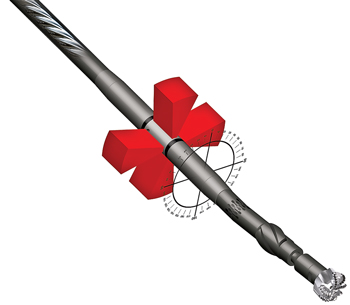

Accordingly, Halliburton offers a comprehensive portfolio of LWD technologies that are part of its “drill-to-frac” solution, which helps position the wellbore precisely in the spot most conducive to hydraulic fracturing. Halliburton Sperry Drilling says its most cost-effective shale drilling package comprises the newly-engineered GeoForce XL high-torque motors, Geo-Pilot Rotary Steerable Systems (RSS), ADR resistivity sensors, GABI motors (Fig. 1), new XBAT acoustic sensors, LaserStrat chemostratigraphy and the StrataSteer 3D geosteering service.

|

| Fig. 1. Halliburton says its GABI geosteering technology provides at-bit azimuthal gamma ray and inclination readings, both in the sliding and rotating modes. Courtesy of Halliburton Sperry Drilling. |

|

Halliburton says the bit-driver solution for a particular application is determined by the formation drillability and well profile requirements. The high-torque XL motor, or the Geo-Pilot Dirigo RSS, is used to provide the torque and directional control necessary to precisely place laterals.

As fracture identification is an important part of unconventional well placement, the company’s suite of imaging LWD tools, including the Azimuthal Formation Imager (AFR), the XBAT Acoustic Imager and the ADR resistivity sensor, are used to identify natural fracture swarms, where fracture stimulation may improve production, as well as orientation of drilling-induced fractures. The new-generation XBAT contains four discrete transmitters, each one capable of firing a positive or negative wave to create monopole, dipole, quadrupole, and crossed-dipole modes. Up to five different firing modes can be used in a single run. The source frequency and wavelet are programmable for a wide range of formation velocities. The tool has four azimuthally-spaced arrays of receivers, with six receivers in each array. Each receiver is sensitive across a broad range of frequencies, and is isolated from the collar in a manner that eliminates bit noise and mud circulation noise. Four ultrasonic calipers determine borehole size and shape, enabling higher accuracy of anisotropy calculation.

“Fast reaction to real-time measurements-while-drilling is key to making the economical viability of LWD a reality,” the company says. “Near-bit measurements, like the GABI provides, offer high-quality, at-bit, azimuthal gamma ray and inclination readings, both in sliding and rotating drilling modes. Asset teams are provided with immediate feedback on changes in gamma ray and inclination for shorter reaction time, smoother wellbore, precise well placement and increased drilling efficiency.”

As for MWD, Sperry Drilling’s electromagnetic telemetry is used extensively in the shale plays, to keep the drilling tool in the sweet spot by enabling constant communication with the bottomhole assembly. “The StrataSteer 3D geosteering software pulls it all together, and is used to visualize this real-time data, comparing geological models, which reduce uncertainties in the structure and formation properties. These measurements and real-time tools are used to identify the rock properties for optimum well placement and fracture stimulation design,” said Halliburton.

Meanwhile, Baker Hughes says its AutoTrak Curve RSS system allows operators to kick off deeper into the well, while typically drilling the vertical, curve and lateral sections in a single run, Fig. 2. The closed-loop rotary drilling technology incorporates near-bit azimuthal gamma ray sensing to deliver the real-time data critical for maintaining precise wellbore trajectory,” said Baker Hughes.

|

| Fig. 2. Baker Hughes said its AutoTrak Curve rotary steerable system has reduced drilling time in some shale plays up to four days, and saved operators up to 60% rig time per well. Courtesy of Baker Hughes. |

|

As of late last year, Baker Hughes said that the RSS had been used to drill more than 2 million ft in the unconventional shale plays. Recently, the AutoTrak RSS was combined with an application-specific PDC bit in the single-run drilling of high build-rate curves and laterals of geologically complex Pennsylvania Marcellus shale wells. The geological composition of many wells drilled, particularly in the Pennsylvania sector of the Marcellus, feature extremely large thrust faults, making landing of the laterals, and keeping them on line, particularly daunting. Emblematic of Marcellus wells are curve build-up rates (BUR) from 8° to 10°/100 ft where, according to Baker Hughes, conventional bent-angle mud motors and PDC bits are fraught with, among other limitations, inconsistent BUR, requiring increased bent-angle motor settings used to slow drillstring revolutions to avoid fatigue, which also reduces ROP.

According to Baker Hughes, the AutoTrak Curve system drilled 16 typically high-BUR Marcellus wells, reducing by nearly 52% the average drilling days per horizontal curve and lateral. The reduction in drilling days, Baker Hughes says, can be attributed largely to the near-bit position of the gamma formation evaluation sensor that, compared to traditional drilling assemblies, revealed data changes much earlier, thus making it easier to keep the wellbore within a 6-ft total target window in the average 8,000-ft laterals.

Elsewhere, Schlumberger counts its Pathfinder iPZIG at-bit inclination, natural gamma ray and imaging tool as one of the key modules in its wide-ranging shale imaging and drilling suite of technologies. Schlumberger claims that the iPZIG, which it describes as the industry’s first image, gamma and inclination tool positioned directly behind the bit, exploits early bed boundary detection to optimize well placements in target zones.

The iPZIG service provides at-bit macro gamma ray imaging, along with traditional, natural, gamma ray measurement; dynamic inclination; RPM; and temperature. The iPZIG system reduces the reaction time for making critical geosteering decisions and maintaining the wellbore in the targeted interval, the company said.

Weatherford, for another, says its MotarySteerable RSS offers a new wrinkle in directional drilling control in the form of targeted bit speed (TBS) technology. Described as a cost-effective alternative for controlling rotary well trajectory, the system provides full 3D directional control, while maintaining drillstring rotation to effectively reduce drilling time and mitigate the lost-in-hole (LIH) risk, says Weatherford. The MotarySteerable RSS combines a positive displacement mud motor (PDM) with a proprietary, synchronized motor, RPM controller and directional guidance system, said Weatherford. The use of modulated mud flow to control bit speed enables full directional control in deviations ranging from 0° to 3°/98 ft.

In April, Houston’s Scientific Drilling International (SDI) introduced its Sci-Steer geosteering technology, which the company said mitigates well placement risks by combining MWD and LWD data with interpreted seismic to provide a 3D geological perspective of the drilling corridor in real time. “This allows the user to visualize the sweet spot of the reservoir as drilling progresses,” said Carlos Manrique, SDI global product line manager.

TORQUE MANAGEMENT

Friction is an inescapable fact in any wellbore, but obviously the necessity to keep it under control and prevent the manifestation of excessive and destructive torque and drag is magnified considerably in high-angle directional wells. Reacting to torque spikes during drilling not only wastes rig time, but all-too-often increases wellbore tortuosity that compounds the inherent difficulties in running casing and tubing to bottom in directional wellbores.

“When you have an instantaneous spike in torque, all of a sudden you can be pointed completely in the wrong direction,” said Aron Deen, engineering project manager for PDC bit company Ulterra. “What you have to do, in that case, is pull off bottom, release all the built-up torque in your drillstring, go back to bottom, stack weight on your bit, and then slowly build the torque back up. You then have to wait for readings from your downhole tools, before you can get pointed back in the right direction and try to drill ahead. You could spend hours to get re-oriented in the right direction.”

“Every time you have some torque fluctuation, you have to go back and do it all again. Obviously, that affects your ROP and, over time, it also increases tortuosity and reduces well quality. You can end up with a tortuous, jagged curve that creates extremely high torque and drag forces along your entire drillstring.”

While an issue in any directional well, torque-related problems in many of the shale wells likewise have resulted in stick-slip problems, in which excessive friction at the rock face or on a BHA component literally causes the bit to cease rotating. A number of approaches have been taken to stabilize and reduce the ramifications of torque, including the addition of specially-designed rotary directional subs to the BHA, employing a bit-reamer tandem and engineering torque management into the bit design.

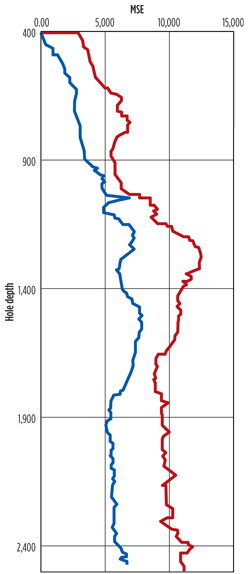

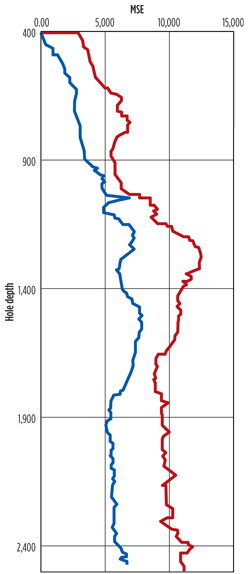

Ulterra says its recently introduced CounterForce PDC bit technology is designed specifically to reduce torque and maintain tool face control in the curve and laterals. According to the Fort Worth, Texas-based manufacturer, CounterForce PDC technology features a unique cutter orientation that re-directs lateral forces back into the formation, dramatically improving bit stability and reducing torque fluctuations. The energy that was once destructive and wasted is used by CounterForce bits to fail rock, which in turn extends bit life, and increases ROP and total footage drilled, Fig. 3.

|

| Fig. 3. Direct comparison of the mechanical specific energy (MSE) values of CounterForce (blue) and competitive PDC bits run on the same drilling pad in the Eagle Ford. A common measure of how efficiently energy, mainly torque, is used to drill a well, a lower MSE means less torque is required to achieve higher rates of penetration (ROP). Courtesy of Ulterra. |

|

The Ulterra CounterForce technology represents one of the latest PDC bit designs, introduced largely to address the intensified torque management and directional tool-face control requirements, resulting from the escalation in unconventional shale well construction. The newest PDC bit developments include the Baker Hughes Talon 3D, designed to improve both directional control and BUR aggressiveness; the Smith Spear matrix-body bit that its developer claims has set the benchmark for drilling the curve and lateral sections; and, among others, the Varel Voyager series that is said to deliver “smoother torque, advanced directional control and excellent wellbore quality.”

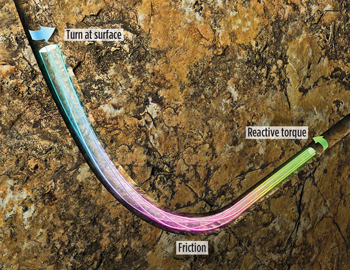

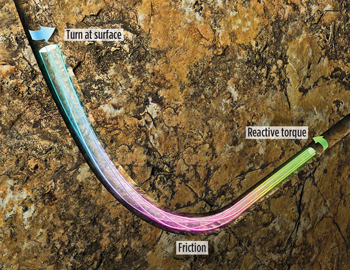

Meanwhile, friction-induced mechanical and operational problems are magnified considerably in the typically non-rotating sliding mode, necessary for making directional corrections and preparing to drill the curve. According to Schlumberger, the aptly-named Slider automated surface rotation control system reduces drag appreciably, and maintains constant tool face orientation without having to pull off bottom, Fig. 4. The system, Schlumberger says, eliminates motor stalling and otherwise improves dramatically the efficiency of steerable motors and MWD directional systems while sliding.

|

| Fig. 4. The Slider system applies appropriate torque at the surface to manage reactive torque and minimize friction zone. Courtesy of Schlumberger |

|

The technology works by commanding the top drive to impose rocking, or oscillatory, movements to the right and left, essentially managing drillstring friction during sliding mode. Torque readings, both at the surface and occasionally downhole, are fed into the computerized system that controls the rocking motion.

“The Slider system basically gives two commands to the top drive—speed and direction—while measuring torque,” said Eric Maidla, vice president of business development for Slider, Schlumberger. “When we get to the appropriate torque value, and the secret is how we determine the appropriate torque value, we tell the top drive to stop and turn the other way, left or right. When we see the torque value that we want to achieve, we give the command to stop and turn in the other direction.”

Compatible with any top drive capable of turning to the left, the Slider system, Maidla said, is the only technology capable of simultaneously controlling the hookload, the amount of torque being delivered to the wellbore and the tool face. “Most only oscillate pipe, but can’t control the tool face while drilling,” he said. “We can steer the tool face on bottom, much like you steer your car. During drilling, we can turn a few degrees to the left or to the right, depending on the amount of turn we want to make.”

Maidla said the capacity to oscillate the drill pipe at greater depths prevents motor stalling, which, aside from the obvious mechanical problems, can also ultimately wipe out the directional correction that is the primary justification for the sliding mode. “If you stall, you have to reduce the flowrate and come off bottom, and then you switch on the pumps and start the process again. By moving the pipe up and down to compensate for reactive torque with the bit turning, you shave off the correction you made in the first place.”

Once the original correction is wiped out, the directional driller can no longer measure and estimate the exact position of the bit relative to the MWD tool, which typically is located 40 to 60 ft behind the bit. “By not stalling, you keep your ability to project to the bit, which is a tremendous advantage, in that it allows you to get more effective slides, and helps to reduce your tortuosity and deliver a smoother wellbore. Basically, this gives you the highest-quality wellbore possible when using a steerable motor.”

Specifically, Maidla emphasized that, if conducted correctly, the pipe oscillation process enhances the overall efficiency of steerable motors considerably, Fig. 5. “On long laterals, even oscillating pipe has its limits. Slider extends those limits. We can routinely go over 10,000 ft,” he said, adding that the technology has been employed in all of the U.S. shale plays.

|

| Fig. 5. A full-scale model of the Slider technology is used for research, training and development. Courtesy of Schlumberger. |

|

Before its assimilation into the Schlumberger portfolio, development of the Slider technology was financed partially with the then-discretionary technology development funding program of the U.S. Department of Energy’s (DOE) National Energy Technology Laboratory (NETL).

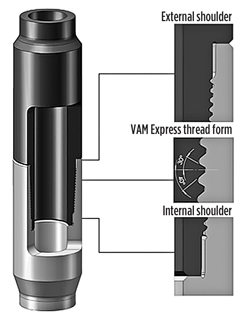

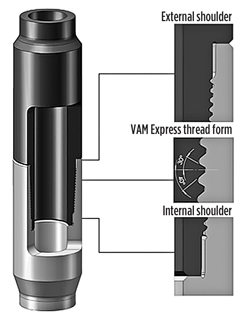

The increasing lateral distances that Maidla eluded to also multiply torsional drillstring stresses, which can accelerate thread connection failures. In response, the Vallourec Group and NOV Grant Prideco have led the manufacturing push to design advanced double-shoulder rotary connections capable of withstanding the higher torque values.

Vallourec says its VAM Express double-shoulder connection, which features a large, rounded stab crest and a laid-down stab flank for easy stabbing, has exhibited up to twice the average torque capacity of standard API connections, Fig. 6. NOV Grant Prideco, meanwhile, said its eXtreme Torque (XT) double-shouldered rotary connections provide more than 25% higher torsional capacity without increasing fatigue risks.

|

| Fig. 6. Schematic of the Vallourec VAM Express double-shoulder connection. Source: The Vallourec Group. |

|

However, not all the enabling developments have been mechanical in nature. Research continues within the drilling fluid community to formulate new-generation lubricants that will improve the directional performance of water-based muds to replace their non-aqueous counterparts in the shale plays. The application of conventional oil-based muds is either prohibited or heavily restricted in many of the shale plays and, where permitted, the disposal costs can be exorbitant, as licensed waste disposal sites are few and often far from the drilling location. Consequently, more shale operators are switching over to the use of the new-generation water-based muds, which are typically being run on closed-loop systems.

Obviously, much of the development work that led to this transition has focused, and continues to focus, on lubricating additives to reduce the coefficient of friction (CoF) values of the inherently less-lubricious water-based muds. Results illustrative of the development work on water-based mud lubricity were documented in a recent Newpark Drilling Fluid evaluation of a 50-well sampling from seven shale plays, including the Eagle Ford, Barnett, Haynesville and Bakken shales. Newpark said that the horizontal wells examined in the evaluation were drilled with its Evolution high-performance water-based mud, incorporating a proprietary lubricant. The study concluded that the performance of the Evolution mud system was “on par” with oil and other non-aqueous-based drilling fluids, “at considerable well cost savings.”

More recently, the new lubricant was mixed in a 9.9 lb/gal clear brine version of the Evolution mud system for the trouble-free drilling of a more-than-25,000-ft, MD, Middle Bakken well that included a 14,000-ft lateral. Michael Redburn, Newpark’s technology support specialist for the Rockies, said torque remained under 10,000 ft/lb, with a friction factor of 0.20 on the casing run, and a fluid lubricity coefficient of 0.04 to 0.06. “We had no problems, whatsoever, running casing to bottom. In fact, it was one of the cleaner casing runs we’ve had,” he said.

PADS, NEW AC RIGS

Longer laterals and the multi-well drilling pads that have become fixtures in nearly every North American shale play are major contributors to the ongoing wholesale transformation of the onshore drilling rig market. Over the past few years, the distinctive demands of unconventional well construction have forced contractors to scrap the older mechanical and SCR-powered rigs in their fleets, in favor of new-generation, more powerful AC designs (Fig. 7), some with hookloads as high as 750,000 lb, and many equipped with hydraulic walking and skid packages to facilitate intra-pad mobilization. Some estimates have upwards of 40% of the cumulative North American fleet comprising older units that will find it tough to compete with the new-generation rigs on the block. Canada’s largest drilling contractor, Precision Drilling, for one, told Reuters in late December that it would decommission 52 of its older rigs, and absorb a related fourth-quarter charge of up to $203 million.

|

| Fig. 7. The state-of-the-art NOV Ideal Prime AC rig is engineered with an enhanced setback capacity of 575,000 lb, allowing it to rack more drill pipe for deeper wells and longer laterals. The walking system allows to it move with maximum setback, without rigging up or rigging down. Photo courtesy of National Oilwell Varco. |

|

Even with rig counts that have declined over the past couple of years, owing largely to depressed gas prices, overall economic uncertainties and the higher per-rig efficiency of pad batch drilling, manufacturers have been scurrying to keep up with newbuild orders. In today’s plays, it is a given that the competitive edge falls on fleets dominated by high-specification AC rigs that deliver faster top drive speed and higher torque capacity than their DC-driven ancestors.

Helmerick & Payne jumped on the conversion bandwagon earlier than most, and now 80% of its 298-rig onshore fleet is made up of AC FlexRigs. The Patterson-UTI Drilling fleet includes 113 high-specification, 1,000- and 1,500-hp, APEX rigs, all of which can be fitted with its proprietary multi-directional walking systems, capable of moving with the drill pipe and collars racked in the derrick. In a December presentation, the contractor said it would continue a “two-rig per month build program” to reach its goal of 126 APEX AC rigs by the middle of 2013.

Calgary’s Xtreme Drilling and Coil Services boasts one of the industry’s newest AC rig fleets, much of which is at work in the Bakken and Niobara shale plays. In its January 2013 corporate presentation, the drilling and coiled tubing contractor said that over the previous 18 months, it had commissioned 10 new XDR 500 drilling rigs, increasing its total fleet to 21 units. The XDR variable frequency AC rigs are designed with hookload capacities up to 500,000 lb, 1,500-hp drawworks, integrated top drives, automated pipe handling and well-to-well skidding systems.

One of the newest, and perhaps most novel, designs to hit the shale market is the T500XD Telemast rig that Pennsylvania contractor Schramm unveiled specifically for the Marcellus and Utica shales. The 500,000-lb hookload rig is unique, the developer says, in that it not only “walks” with full 360° portability, but also “talks” with full interface connectivity to remote operation centers in multiple locations, Fig. 8.

|

| Fig. 8. Schramm’s T500XD Telemast rig, with its unique “walk” and “talk” capabilities, was introduced to meet the specific needs of operators in the Marcellus and Utica shales. |

|

Meanwhile, the new rig walking systems are credited with playing leading roles in the spread of multi-well drilling pads that are now staples throughout the North American unconventional shales, particularly as operators move into the development phase, Fig. 9. Drilling multiple wells from a lone pad not only reduces the overall drilling costs, but, at the same time, shrinks the surface footprint, which is especially critical in more urban shale drilling environments like the Marcellus, Barnett and elsewhere. Devon Energy took multi-well pads to a new dimension in the Barnett by drilling of 36 wells on one pad and 21 on another. Major Bakken player Oasis Petroleum, for another, said 60% to 70% of its wells will be developed on pads this year. Oasis said the improved efficiencies from batch drilling on pads have reduced its costs up to 10%.

|

| Fig. 9. A post-drilling replica of the more than 40 so-called ECO pads that Continental Resources operates in the Bakken shale. Courtesy of Continental Resources. |

|

In a March Howard Weil presentation, Denver’s Forrest Oil said that the 2012 introduction of a rig-walking system in its net 86,000-acre Eagle Ford holdings has reduced completed well costs 8% to 15%. At the time of the presentation, Forrest said the drilling price tag on its then-most-recent Eagle Ford well was below $6 million. The independent said a four-well pad can be drilled out in 65 days, compared to 84 days, if the four wells were drilled singularly.

DRILLING FROM TOWN

Bolstered by the new AC-driven rigs working on multi-well pads, the “factory-like” drilling methodology has, in turn, fueled the transfer of remote monitoring systems to the onshore shale plays. Once reserved strictly for high-profile offshore wells, what is known colloquially as “drilling from town” has recently found applications for both drilling and stimulating onshore unconventional wells.

After what it termed a successful pilot project in the Haynesville shale, Shell Upstream Americas earlier this year said it eventually intends to conduct all of its onshore shale directional drilling, MWD/LWD and geosteering operations from remote drilling centers. Shell says remote geosteering from a centrally located facility “allows for efficient communication between geologists and interpreters, with a single geosteering expert and a single geologist being able to handle a large number of geosteering operations at the same time, while at the same time greatly improving the speed of decision-making.”

Furthermore, the operator said that evidence to date suggests that remote operations allow it to stay within the shale target zone and reduce the number of geosteering corrections and doglegs while landing the horizontal section, “resulting in noticeably improved wellbore quality, which yields immediate benefits in the ease of running production casing and will, ultimately, translate into higher hydrocarbon recovery.” Shell said the remote drilling process has since helped to deliver best-in-class directional wells in the Eagle Ford shale.

Earlier, Apache Canada established an offsite operations center to monitor stimulation activities in its Horn River basin shale lease holding in East British Columbia, Fig. 10. The operator said the facility was used in the real-time monitoring of fracing, water and sand supply, pressures and H2S sensor data from wellsites.

|

| Fig. 10. An Apache Canada location in its Horn River acreage. Courtesy of Apache Canada. |

|

Not surprisingly, both operators are among the leaders in automating key aspects of the unconventional drilling process. Shell is still developing its so-called well management system under a joint venture with China National Petroleum Corp. (CNPC). The system would employ a series of smaller rigs to handle each stage of the drilling process, with many functions fully automated.

According to Shell, an electronic information system will be connected to the rigs, where it would record details of well conditions and rig performance. The system will use this information to make automatic adjustments, for example, to the speed and direction of the drilling process. The JV partners also are automating other key aspects, such as moving drill pipe. The well manufacturing system is expected to make its debut later this year in Queensland, Australia, Shell said.

Apache, meanwhile, is looking at transferring off-the-shelf products and techniques used in the refining, chemical, auto manufacturing and other process industries, into the drilling of mass-quantity shale wells. While no specific projects have been announced, Jim Rogers, Apache automation advisor, said in December that “we’re all for setting up some pilot projects to prove to people that it’s viable, reasonable and should be done.”

REFERENCES

1. Cesar Gongora, Omar Awan, Jose Mota, Shell Upstream Americas, and Eric van Oort, University of Texas (formerly with Shell Upstream Americas), “Drilling Unconventional Shales Remotely,” presented at 2013 SPE/IADC Drilling Conference and Exhibition, Amsterdam, March 5-7.

2. Anthony Jones, Denise Livingston, Andrew Serdy, Sandeep Janwadkar, Baker Hughes Inc.; Toby Rice and Derek Rice, Rice Energy, “High-Build RSS Performance Delivers Improved Well Consistency in the Marcellus Shale,” presented at the 2013 AADE National Technical Conference and Exhibition, Oklahoma City, Okla., February 26-27

3. M. Redburn and H. Dearing, Newpark Drilling Fluids, and F. Growcock, Occidental Oil and Gas Corp., “Field Lubricity Measurements Correlate with Improved Performance of Novel Water-Based Drilling Fluid,” presented at the 2013 Offshore Mediterranean Conference and Exhibition, Ravenna, Italy, March 20-22

4. Jingmin Zhao, Linhu Ma and Guillaume Plessis, NOV Grant Prideco; Yongjin Zha, CNPC Drilling Research Institute; and Qiang Lu, Jianwen Su and Peng Liu, PetroChina Tarim Oilfield Company, “Double Shoulder Connection Technology Enables Exploration and Production of Ultra-deep Prospects – Case Histories and Lessons Learned in Xinjiang, China,” presented at the 2012 IADC/SPE ASIA Pacific Drilling Conference, Tianjun, China, July 9-11

5. Karl DeMong, Ron Hands and Brad Affleck, Apache Canada Ltd. “Advancements in Efficiency in Horn River Shale Stimulation,” presented at SPE Hydraulic Fracturing Technology Conference, The Woodlands, Texas, January 24-26, 2011

|