PRAMOD KULKARNI, Editor

Oil and gas operators throughout the world are exploring for shale plays with the same fervor by which astronomers are scanning the universe for signs of life. If there’s life on Earth, shouldn’t there be life on some of the billions of planets out there? Applying the same logic, where are the Bakkens and Eagle Fords in the rest of the world?

There is sustained shale activity in Australia and Argentina, and early assessments in China and India. While France stubbornly clings to its ban on fracing, England seems to be gaining momentum to take a serious look at its shale resources. Yet none of the international operators have yet “cracked the code,” as did Mitchell Energy in the Barnett, and Range Resources in the Marcellus. Here’s a status report on current activity in some of the leading shale plays in the international arena.

GLOBAL OVERVIEW

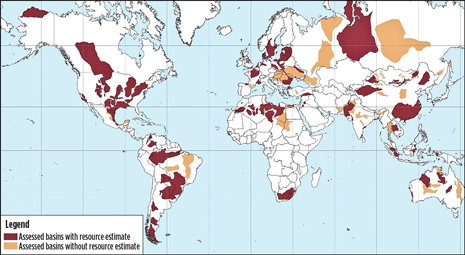

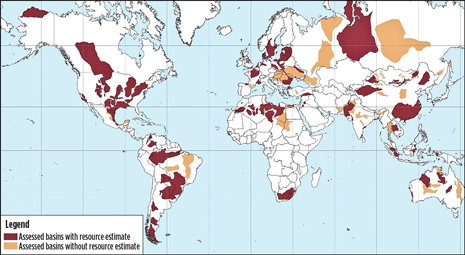

In June 2013, the U.S. Energy Information Administration (EIA) issued an update of its initial assessment of international shale oil and gas that was issued in April 2011. The report assesses 137 shale formations in 41 countries outside the U.S., expanding on the 69 shale formations within 32 countries considered in the 2011 report. The assessment of technically recoverable resources takes advantage of additional geological analysis and drilling data. While the 2011 report focused on natural gas, the 2013 assessment includes evaluation of oil, condensates and natural gas, resulting in a 10% increase in resources to 345 Bbbl and 372 Tcf. Tables 1 and 2 identify the countries and corresponding volumes of top 10 resource holders, and Fig. 1 describes the worldwide distribution of these resources. According to the EIA, Russia and China are the top countries with shale oil and gas resources.

|

| Fig. 1. EIA assessment of international shale and oil and gas resources, May 2013. |

|

| Table 1. Top 10 countries with shale oil resources |

|

|

| Table 2. Top 10 countries with shale gas resources |

|

|

WESTERN EUROPE

Geological assessments are underway in the Carboniferous, Permian, and Jurassic and Ordovician shales in France, Germany, the Netherlands, Sweden, Denmark and Austria. Estimated technically recoverable gas reserves in these countries stand at 372 Tcf, with France leading the pack. The largest shale gas resource in the area is the Alum shale, in Scandinavia.

France. The Paris basin contains two organically rich shale formations, the Toarcin “Schistes Carton” formation and the Permian-Carboniferous shale formations. The “Schistes Carton” is immature and, therefore, a target for oil development but not for gas. The Permian-Carboniferous is deeper and more mature, with estimated technically recoverable reserves of 76 Tcf. While firms have acquired acreage totaling about 4,000 sq mi in the eastern part of the basin, where the Permian-Carboniferous formation is thickest, development activity is at a standstill, due to the French ban on hydraulic fracturing in the basin following public demonstrations in July 2011. In June 2013, French Ecology Minister Delphine Batho reiterated that the French government will not reconsider the ban on shale gas. Earlier, U.S.-based Schuepbach, which holds two exploration licenses, had initiated a constitutional question regarding the legitimacy of the fracing ban.

North Sea-German basin. The North Sea-German basin has been defined as a large, 78,000-sq-mi area of Paleozoic through Tertiary fill, extending from Belgium to Germany’s eastern border. Thus far, 12 shale licenses have been issued, with Exxon Mobil being the leading leaseholder in the area. Despite the fact that fracing has been applied in Germany since the 1960s, with at least 275 frac operations linked to conventional gas and oil wells in Lower Saxony, Germany has not approved fracing for shale gas. The German government is drawing up a legal framework that would strictly regulate fracing. Among the provisions under consideration are mandatory environmental impact studies and a ban on exploration in water-protection zones. The latest anti-fracing news concerns the German Brewers Association, which has written to governmental ministers, warning about the risk of contaminated water being used for brewing.

Scandinavia. The region’s shale gas resource exists, primarily, in the Cambrian-Ordovician Alum shale, with prospective areas occurring in western Norway, eastern Sweden and northern Denmark. Shell Oil drilled three wells on an acreage position in 2010, but the company relinquished its licenses in 2011, stating that gas could not be produced from the Alum shale. Interestingly, Australia-based Aura Energy is drilling for uranium in the Alum shales.

United Kingdom. The news across the English Channel is much more optimistic for shale development. A survey released in June 2013 by the British Geological Survey estimated that about 1,300 Tcf of shale gas are held in the Bowland basin, which covers 11 counties in the north of England. The government also plans to authorize an assessment of shale resources in southeastern England. In the budget announced during March 2013, the British government announced incentives for shale gas explorers, combined with handouts to the local communities. Shale operators will receive a tax allowance for developing gas fields and offset their exploration spending against tax for a decade. But these companies will have to hand over £100,000 per well site, and 1% of their revenues from production to the local communities. These handouts are similar to the compensation payments imposed on onshore wind developers.

These incentives provided the backdrop for Centrica’s purchase in June 2013 of a 25% interest in the Bowland exploration license in Lancashire from Cuadrilla Resources for £40 million in cash. Centrica will also pay exploration and appraisal costs of up to £60 million. Thus far, Cuadrilla has drilled three shale wells and established the presence of gas and the shale thickness. While initial assessment suggests 20 Tcf of gas in place in the Bowland basin, Centrica has suggested further drilling to confirm that the discovery is commercial. In mid-June 2013, Cuadrilla applied for a permit to use its Balcombe exploration site as a mining waste facility, as a precursor to exploratory drilling at Lower Stumble, Fig. 2.

|

| Fig. 2. Bowland basin operator Cuadrilla Resources received a boost with new government incentives and the purchase of an exploration license interest by Centrica. Source: U.S. EIA and Advanced Resources International. |

|

Several majors, including Total, Exxon Mobil, Shell and Statoil, have expressed interest in exploring for shale in the UK. A Total spokesman said that the company would await participation until a new bidding round is announced.

EASTERN EUROPE

Poland. While the EIA increased its global estimate of shale resources by 10%, the agency reduced its estimate of Poland’s resources from 187 Tcf to 148 Tcf, as a result of removing from analysis formations whose total organic content (TOC) is less than 2%. Three large operators—Exxon Mobil, Marathon and Talisman—have exited Poland after failing to turn up commercial quantities of gas. Chevron is drilling a fourth well and plans two more this year.

To help prevent further departures, the Polish government is working on new regulations to ease shale investment. The new regulations are designed to allow operators rights to produce and market the gas. Furthermore, tax collection on shale gas production will be delayed until 2020. Thirty-nine wells were planned for 2013, but only two had been drilled by May 2013.

Meanwhile, Ireland-based San Leon Energy is plodding along on it exploration licenses, Fig. 3. In mid-June, San Leon obtained government approval to frac its Lewino-1G2 well in the Gdansk W concession in the Baltic basin. Following the fracture operations, the well will have production tubing installed and be flowed for up to 30 days. San Leon believes the well to be in the Baltic basin sweet spot. The company is also drilling and completing the Czaslaw-1 well in the Nowa Sol concession in the Southern Permian basin and the Siciny-2 well in the SW Carboniferous basin. In the Czaslaw-1 well, San Leon is trying an acidizing/fracturing stimulation. In the Siciny 2 well, San Leon is conducting diagnostic fracture injection tests to identify a suitable formation for fracing.

|

| Fig. 3. San Leon Energy is drilling three wells in hopes of finding the shale sweet spot in Poland. |

|

Rest of Eastern Europe. The Ukraine, Lithuania, Hungary, Romania and Bulgaria boast promising shale gas resources. For the three basins for which sufficient information exists—Baltic (Lithuania), Dnieper-Donets (Ukraine) and Lublin (Ukraine)—technically recoverable reserves are estimated to be 65 Tcf. The EIA estimates Ukrainian shale gas reserves at 42 Tcf. Ukraine is hoping Chevron will invest $25 billion to develop the potentially large Olesska shale gas deposit in its west. The Olesska shale formation stretches across Lvov and Ivano-Frankovsk regions, and could produce up to 10 Bcm of gas annually. Chevron was selected after a tender offering in May 2012.

RUSSIA

The EIA has estimated Russia’s shale oil reserves at 75 Bbbl, which places the country on top of the global standings, followed by the U.S. and China. Because of Russia’s lucrative conventional oil and gas production, there is not an immediate incentive to divert resources for shale gas exploration. Nevertheless, Rosneft has entered into an agreement with Exxon Mobil that refers to the transfer of shale gas-related technological know-how and experience. Rosneft may also depend on BP for its expertise in shale development.

Additionally, Rosneft has signed an agreement with Statoil to explore for shale oil in the Samara region, in the southeastern part of European Russia. The partners will explore for shale oil in 12 license blocks in the Domanik shale geological formation, with Rosneft holding a 51% stake in the project, while the Norwegian firm would hold 49% and provide $60 million to finance the initiative. Six exploration wells will be drilled between 2016 to 2021, with Statoil carrying the expenses of exploration activities, while Rosneft would reimburse its share of exploration costs from production of commercial discoveries.

CENTRAL NORTH AFRICA

The EIA has estimated Algerian reserves to be around 231 Tcf. The Algerian government has introduced attractive terms to entice the interest of major operators in shale development. Majors who have held talks with the government include Shell, Exxon Mobil and Eni. Shell drilled its first shale gas well in Algeria’s Ahnet basin. In Tunisia, Shell is still awaiting approval for an exploration permit. Despite recent political turmoil, Libya is looking to study its own shale gas reserves. While the war-torn country works to increase its output, which was suspended last year, IOCs such as Shell, Exxon Mobil and Total, are reportedly in talks with governmental officials and conducting initial formation studies. The EIA has estimated Libya’s shale resources at 26 Bbbl.

CHINA

China’s 12th Five-Year Plan called for natural gas production to expand from a baseline of 4% to 8% of the mix in 2015 and 10% in 2020. The country conducted its first shale licensing round in 2011 to award blocks to Sinopec and Henan Coal Seam Gas Development Co. The second round in June 2013 went to 13 Chinese companies, who do not have the expertise for shale development. In March 2013, the government approved a PSC between CNPC and Shell. In March 2013, the Chinese government approved a production-sharing contract for Royal Dutch Shell PLC and China National Petroleum Corp. (CNPC) to produce shale gas from Fushun-Yongchuan Block in the Sichuan basin, covering 3,500 sq km. Shell plans to conduct a drilling season during 2013-2014, at a potential cost of $1 billion. Earlier in December 2012, Sinopec signed a similar PSC with ConocoPhillips to produce shale gas from the Qijiang Block in the southwestern Sichuan basin.

SOUTH ASIA

India and Pakistan contain a number of shale-rich basins. Those in India include Cambay, Krishna Godavari Cauvery and the Damodar Valley sub-basins, such as Raniganj, Jharia and Bokaro. In Pakistan, shale potential exists in the Southern Indus and Baluchistan basins. India has estimated technically recoverable gas reserves of 63 Tcf, compared to Pakistan’s 51 Tcf. Additionally, the EIA estimates Pakistan to hold 9 Bbbl of potential shale oil resources.

After two months of delays, India is expected to release a national shale gas policy in early July 2013. According to the EIA, it may be hard for India to exploit its shale oil and gas resources, as many of the shale basins are extensively faulted. Furthermore, the basins are located in remote areas, far away from the existing pipeline structure.

Reliance Industries, India’s leading private oil and gas operator, has invested $5.7 billion in both the Marcellus and Eagle Ford shale plays, but is reluctant to begin shale exploration in India, due to the legal framework associated with E&P activity. Reliance Chairman Mukesh Ambani has revealed that the company’s U.S. shale gas business has contributed one-third of the aggregate production. Meanwhile, the Asian Development Bank is urging Pakistan to exploit its shale oil and gas resources.

AUSTRALIA

The Cooper basin, Australia’s main onshore gas producer, is in an early state of shale gas production. Estimated, risked recoverable reserves in the basin total 85 Tcf. Shale exploration is also taking place in other prospective shale basins in Australia, including the Georgina, Galilee, Bowen, Sydney, Canning, onshore Perth, Beetaloo and McArthur basins. These basins hold an estimated 396 Tcf of technically recoverable reserves. The latest trend has been the entry of major oil companies to support the independents, who are burdened by technical challenges, and rising drilling and completion costs.

Santos is active in the Cooper basin, with drilling and production underway in both shale and tight gas formations. Its Moomba 191 well is producing at the rate of 2 MMscfd and tied to the gas gathering infrastructure, Fig. 4. The Australian independent’s 2013-14 program includes four additional wells with multi-stage fracturing. The company plans to perform microseismic frac monitoring to improve well production.

|

| Fig. 4. Gas production from the Santos-operated Moomba-191 shale well has been connected to the Moomba gathering infrastructure. |

|

Chevron is in the process of farming into Beach Petroleum’s PEL 218 and ATP 855 unconventional acreage in the Cooper basin. The IOC is expected to invest about $349 million over a multi-year program and eventually become the operator. At the PEL 218 license, Beach has an eight-well drilling program, including one horizontal well. Gas flow from the first three wells is in excess of 2 MMscfd per well. At ATP 855, Beach has drilled one well with a constrained flowrate of 2.2 MMscfd.

In early June 2013, PetroFrontier announced that Statoil has committed to spend the next $50 million throughout the remainder of 2013 and 2014, to fully fund up to a 385-km 2D seismic program, and the drilling and stimulation of four to six vertical test wells. Thus far in 2013, the two companies have spent $30 million on exploration in the Southern Georgina basin for D&E activity. Statoil is expected to become the operator in September 2013.

On its own, PetroFrontier has conducted a three-well horizontal drilling campaign in 2011-2013. Two wells were drilled into the Lower Arthur Creek formation, one horizontal well and a vertical well to test the Dulcie syncline. During the hydraulic stimulation program of the horizontal well, a shallow casing failure occurred. As a result, PetroFrontier was unable to complete the program. Drilling of the second horizontal well was completed in June 2012. A successful hydraulic stimulation was performed over nine open-hole stages. However, after recovering approximately one-third of the hydraulic stimulation fluid, traces of biogenic hydrogen sulfide gas were detected, and the well had to be suspended. The third horizontal location was completed in September 2012, testing the unconventional oil potential of the Toko Syncline, in both the Lower Arthur Creek and Upper Thorntonia formations.

LATIN AMERICA

Latin American countries endowed with shale resources include Argentina, Venezuela, Brazil and Mexico. Extensive shale activity is underway in Argentina’s Neuquén basin, and Brazil has included several basins with shale potential in its latest licensing round.

Argentina. Ranking fourth behind Russia, the U.S. and China, Argentina has technically recoverable shale oil reserves of 27 Bbbl, according to the EIA’s landmark shale report. These resources are primarily within the Neuquén basin and three other untested sedimentary basins. YPF is the national oil company, which seized the Argentine assets of Repsol and Petrobras, ostensibly for not doing enough to support the financially beleaguered country with new production. International operators active in the Neuquén basin include Apache, EOG, Exxon Mobil, Chevron and Total.

YPF has the rights to 3 million acres in the basin and is making efforts to bring in additional international operators to jointly develop shale resources. Chevron agreed in mid-May to expand its operations, with a proposed investment $1.5 billion. Earlier, YPF secured investment pledges from Bridas, an oil company owned by Argentine billionaires Carlos and Alejandro Bulgheroni, and China’s CNOOC.

Apache has 1.3 million net acres in the Neuquén basin, with an estimated net recoverable potential of 0.8 Bbbl. About 586,000 net acres are in the oil window of the play. The independent operator also has operations in the provinces of Rio Negro, Tierra del Fuego and Mendoza. In the Neuquén basin, two Apache wells reached total depth, and one was completed in first-quarter 2013. Additionally, Apache drilled two exploration wells and participated in two non-operated wells, targeting Vaca Muerta shale oil and wet gas trends. Apache’s average gas production during the quarter was 93 MMcfd.

Brazil. The greatest potential for shale gas deposits in Brazil is located in the Parecis basin in Mato Grosso state, the Parnaíba in Maranhão and Piauí states, the Recôncavo in Bahia state, Paraná in Paraná and Mato Grosso do Sul states, and the São Francisco basin in Minas Gerais and Bahia states. Basins with potential shale gas also exist in the Amazon and off the coast. With vital resources needed for pre-salt exploration and production, shale exploration will take a back seat in Brazil.

Mexico. The best shale opportunity for Mexico is the extension of the Eagle Ford in Texas to south of the border, into northern Mexico’s Burgos basin. The shale formation has an average thickness of 200 m, with TOC estimated to average 5%. EIA estimates technically recoverable hydrocarbons are at 343 Tcf of gas and 6.3 Bbbl of oil. State-owned Pemex started its exploration program in the region in 2011, and plans to conduct exploratory and appraisal drilling until 2015. In late June, Pemex announced a shale gas discovery in northeastern Mexico that runs through the northern states of Chihuahua, Coahuila, Nuevo Leon and Tamaulipas. Participation of international operators in Mexico will have to await legislative changes to allow foreign equity participation.

RESOURCES TO RESERVES

Much of this report deals with potential resources. The hard work of exploration and drilling is still pending, to convert the potential reserves in these international areas into probable reserves, and ultimately, oil and gas production. This progression will keep the oil and gas industry working to the end of the 21st century.

|