WILLIAM J. PIKE, Contributing Editor

|

| The Shenzi facility, 120 mi off the Louisiana coastline in 4,300 ft of water, is the second-deepest TLP in the world. The field is producing near its nameplate capacity of 100,000 bopd almost four years after first oil. Photo courtesy of Shenzi operator, BHP Petroleum. |

|

The global oil and gas industry remains bullish on deepwater and ultra-deepwater development as a result of sustained, high oil prices. Activity levels remain high in the traditional development areas of West Africa, Gulf of Mexico, Australia and Brazil. Increasingly, however, operators are moving exploration and development into new areas, such as the eastern Mediterranean and East Africa.

The deepwater stakes are high, but so are the potential rewards, as BP illustrated recently, when it revealed plans to grow by focusing on deepwater oil and gas exploration, where it expects to increase its rig fleet by 40% by 2014. BP’s dedication to deepwater development is replicated across the industry and the globe. For example, BP’s deepwater competitor, Chevron, is operating six drillships at its deepwater prospects in the Gulf of Mexico. Presented below is a review of current activity in each of the major deepwater sectors.

GULF OF MEXICO

While deepwater drilling and production have expanded steadily since the end of the Gulf spill moratorium in 2011, the major discovery in 2012 belonged to Cobalt Energy. The independent operator’s discovery well, at its North Platte prospect on Garden Banks Block 959, encountered several hundred feet of net oil pay in the Inboard Lower Tertiary trend. Further appraisal will be needed to confirm its size and commerciality. North Platte is in a 4,400-ft water depth, and the well was drilled to a TD of 34,500 ft. Total holds a 40% interest in the North Platte discovery.

Another exploration success was announced by Mexican President Felipe Calderón—first discovery of crude oil in the deep waters of the Mexican sector of the Gulf of Mexico, confirming light crude oil deposits in the Perdido Fold Belt province. Pemex’s Trion 1 well is 24 mi south of the border with the U.S. and was drilled to 14,763 ft in 8,200 ft of water, 110 mi off the coast of Tamaulipas. Reserve estimates are approximately 350 MMboe. The discovery has buoyed Mexican hopes of finding and producing as much as 10 Bboe, from the Perdido area.

In Mississippi Canyon Block 698, Noble Energy has discovered oil at the Big Bend prospect at a 7,200-ft water depth. The discovery was drilled to a TD of 15,989 ft and encountered 150 ft of net oil pay in two high-quality Miocene reservoirs.

Several deepwater Gulf of Mexico projects are in the development phase. Chevron’s projects include Jack/St. Malo, Big Foot and Tubular Bells. According to Chevron, the Jack/St. Malo and Big Foot projects are approximately 55% and 65% complete, respectively, and are on budget. First production for all three of these projects is expected in 2014. Anadarko Petroleum’s Lucius development is 230 mi offshore in the Keathley Canyon in 7,200 ft of water. The project is being developed using a truss spar floating production facility that is under construction, Fig. 1. The spar is being built with the capacity to produce more than 80,000 bopd and 450 MMcfd from six subsea wells. Anadarko has also awarded Technip the contract to build and deliver a 23,000-ton truss spar hull for its Heidelberg field development. The spar, to be installed in 3,310 ft of water, will have a capacity of 80,000 bopd and 81 MMcfd.

|

| Fig. 1. The truss spar for Anadarko’s Lucius project in the Gulf of Mexico is under construction at Technip’s Pori, Finland shipyard. Photo courtesy of Technip. |

|

BHP Billiton has approved $708 million in pre-commitment funding for the BP-operated Mad Dog Phase 2 project. The proposed project includes the development of a second spar facility with all subsea production and injection wells. The new facility is estimated to have a design capacity of approximately 130,000 bopd that will be exported via the Mardi Gras pipelines. A final investment decision is anticipated in calendar year 2013, with first production scheduled for 2018.

LLOG Exploration has contracted Hyundai Heavy Industries to build a semisubmersible production hull for its Delta House project. The OPTI hull design by EXMAR is the second commissioned by LLOG. The first is producing from the Who Dat field. A location for the new floater has not been released, but there is a good chance it will go to the company’s Marmalard prospect in Mississippi Canyon 431.

On Sept. 6, Petrobras began production from ultra-deepwater Chinook oil field from the FPSO BW Pioneer, moored 135 mi off the coast of Louisiana in 8,200 ft of water. It is the first FPSO to produce oil and gas in the Gulf (from Cascade field), with processing capacity of 80,000 bopd and 17.6 MMcfd, and storage facilities for 500,000 bbl of oil. Production in Cascade field began in February 2012, and the concession is owned 100% by Petrobras.

BRAZIL

Petrobras is making steady progress in its pre-salt fields, transitioning from extended well tests to full production. By 2020, the NOC expects to build 24 pre-salt production systems. In September, Petrobras started pre-salt oil production from Baleia Azul, Jubarte and Pirambu fields in the Campos basin through the FPSO Cidade de Anchieta. While the initial production rate is 20,000 bopd, peak production is expected to reach 100,000 bopd when work is completed on nine additional wells (six producers and three injection) by February 2013. In 2013, Petrobras is expected to start pilot production from Sapinhoá field with FPSO Cidade São Paulo, and Lula NE field with FPSO Cidade Paraty. For start of production in 2016, Petrobras has signed a letter of intent for the charter of an unnamed FPSO for Iraceme Norte field. Eight production and eight injection wells will run to the FPSO, positioned 186 mi off Brazil’s coast, at a 7,327-ft water depth. The platform will have a processing capacity of 150,000 bopd and 285 MMcfd.

In 2012, Petrobras announced a total of 15 discoveries, of which four were in pre-salt fields, including a light hydrocarbon discovery in the ultra-deepwater Sergipe-Alagoas basin. The discovery well reached 17,538 ft at an 8,472-ft water depth off Aracaju, Sergipe. A second discovery nearby in the basin, known as Farfan, encountered hydrocarbons at 18,314 ft in water that is 8,924 ft deep.

WEST AFRICA

West Africa, by far, is the world’s most active deepwater sector. Angola and Nigeria remain foremost among the region’s countries for E&P, but there have also been recent developments worthy of note in other countries, Fig. 2.

|

| Fig. 2. The sixth-generation semisubmersible Deepsea Stavanger is operating in deepwater Angola for BP. |

|

Nigeria. Total began production from Usan field in February 2012. The project has capacity to produce up to 180,000 bopd. Discovered in 2002, the field is at a 2,400-ft water depth, 62 mi from the coast. Production is taking place via an FPSO and what will ultimately be 42 subsea wells.

Angola. Sonangol has awarded ConocoPhillips operatorship and 30% ownership of two deepwater blocks (36 and 37). The PSCs became effective in January 2012. Each block is approximately 1.2 million acres, in water depths ranging from 5,600 ft to 8,200 ft. Seismic acquisition began in 2012, with first drilling planned for 2013/2014. On the production side, Angola is expected to start regular exports of LNG in first-quarter 2013, for deliveries to Europe and Asia. The 5.2-MMtpy LNG project is operated by Chevron.

Ghana. Eni made the first oil discovery in the Offshore Cape Three Points (OCTP) Block in the Tano basin about 30 mi off the coast in September 2012. The discovery was made through the Sankofa East-1X well, which reached a TD of 11,975 ft, in 2,700 ft of water, and encountered 249 ft of gross oil pay and 90 ft of gas and condensate pay in Cretaceous sandstones. During the production test, the well produced about 5,000 bopd. Eni has been active in Ghana since 2009 and operates two exploration offshore blocks, OCTP and Keta.

UK independent Tullow Oil’s Enyenra-4A appraisal well, in the deepwater Tano Block, encountered approximately 105 ft of net oil pay in high-quality sandstone reservoirs, expanding the areal extent of the TEN (Tweneboa, Enyenra and Ntomme) complex. The well was drilled to a depth of 13,694 ft in a 6,158-ft water depth. Earlier, Tullow’s Wawa-1 exploration well, also in the Tano Block, discovered 43 net ft of oil pay and 65 net ft of gas-condensate pay in Turonian-aged reservoirs in July 2012. Samples from the well are between 38° and 44° API, and pressure data indicate that the Wawa discovery is a separate, distinct accumulation from the adjacent TEN complex. The well is in 1,926 ft of water and was drilled to a TD of 10,899 ft.

Tullow announced in early December that the first Jubilee Phase 1A production well has been brought onstream and is now producing in excess of 16,500 bopd, resulting in field production of over 90,000 bopd. The rig on site has been carrying out acid stimulation work on two Jubilee Phase 1 wells, to further increase production before completing the second Phase 1A well by the end of the year.

Sierra Leone. Chevron has been awarded operator participation in two deepwater blocks in water depths ranging from 4,900 to 9,800 ft. The two blocks, SL-08A and SL-08B, have been combined into one concession covering 2,100 sq mi, about 75-110 mi southwest of Freetown. Anadarko’s Jupiter-1 exploration well in Block SL-07B-11 offshore Sierra Leone and Cote d’Ivoire, 12 mi west of the Mercury-1 well (which discovered oil in the block) intersected 98 ft of hydrocarbon pay in the primary Upper Cretaceous objective in February 2012. Jupiter-1 was drilled by the Transocean Discoverer Spirit drillship to 21,210 ft in a water depth of 7,214 ft. Subsequently, Anadarko’s Mercury-2 appraisal, about 1,300 ft down dip of the Mercury-1 discovery well, intersected more than 885 ft of reservoir-quality sandstones in the targeted Cretaceous interval that were water-bearing. The partnership plans to integrate the data from Mercury-2 into its model as it evaluates both the Mercury discovery and future drilling opportunities. Mercury-2 was drilled to 16,870 ft in 5,950 ft of water.

Cote ‘d Ivoire. Tullow Oil made a light oil discovery at the Paon-1X exploration well offshore Cote d’Ivoire. The Paon-1X discovery well, in the CI-103 Block, encountered more than 100 net ft of oil pay (41° API) in a Turonian-aged reservoir. “The Paon well marks the first deepwater discovery in the CI-103 Block offshore Cote d’Ivoire and opens up an entirely new play for the country and our partnership,” said partner (40%) Anadarko’s senior vice president, Worldwide Exploration, Bob Daniels. “This discovery confirms that the Upper Cretaceous fan system, present in Ghana, extends westward into Cote d’Ivoire and provides significant running room within the CI-103 Block.” The well was drilled to a TD of 16,700 ft, at a 7,195-ft water depth.

Total signed production sharing agreements with local NOC Petroci for three new ultra-deep offshore licenses. The company will operate the CI-514 license with a 54% interest, in partnership with Canadian Natural Ressources International (36%) and Petroci (10%). Total will also hold a 45% interest in the CI-515 and CI-516 licenses, alongside Anadarko (45%) and Petroci (10%). For each block, Total will become the operator upon the first commercial discovery. The licenses cover an area of 1,235 sq mi, with water depths ranging from 6,500 ft to 9,800 ft. Total is already present in exploration activities in Côte d’Ivoire as operator of the CI-100 deep offshore license. This license covers a surface area of 772 sq mi, in water depths from 5,000 to 10,000 ft. A complementary seismic campaign of 386 sq mi was launched in 2011 to finalize the 3D studies of the whole permit. First exploration drilling was planned for the end of 2012.

Gabon. Marathon has entered into a farm-out agreement with Total for a 21.25% working interest in the Diaba License G4-223 and its related permit in Gabon with an effective date of June 15, 2012. With an area of approximately 3,500 sq mi, the Diaba license is off the southern coast in water depths between 300 ft and 11,500 ft. A 2,316-sq-mi 3D seismic survey of the permit was conducted in 2010, following 2D seismic work in 2008 and 2009. Processing of the Diaba seismic data was completed in late 2011. Data interpretation continues in preparation for the planned start of exploration drilling in the first quarter of 2013.

EAST AFRICA

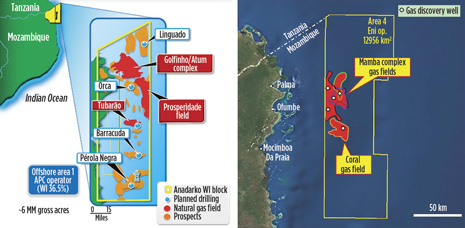

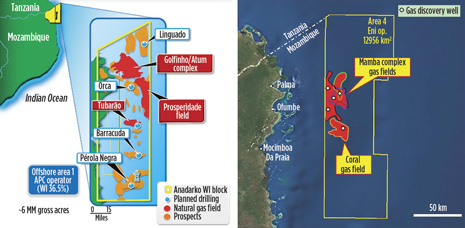

Mozambique is the center of activity in East Africa, with early exploration activity extending to Kenya, Fig. 3. Anadarko has made several significant natural gas discoveries in Area 1. Eni, operator in Area 4, which is further east, has also made major gas discoveries. As there is not a significant domestic market, there is the likely prospect of LNG exports to South Africa, Europe and Asia. Anadarko is conducting preliminary studies on an onshore gas processing center with two LNG trains.

|

| Fig. 3. Anadarko has made several gas discoveries in deepwater Mozambique (left) and has numerous prospects for wildcat drilling in Area 1. Total has made two discoveries in Area 4—Mamba and Coral. |

|

Mozambique. In June 2012, Anadarko’s Atum exploration well discovered significant natural gas accumulation within Offshore Area 1 of the Rovuma basin. The well encountered more than 300 net ft of natural gas pay in two high-quality Oligocene fan systems. Preliminary data indicates that this latest discovery is connected to the partnership’s recent Golfinho discovery, approximately 10 mi to the northwest. The Atum exploration well was drilled to a TD of 12,665 ft, in water depths of 3,285 ft. “With this latest discovery at Atum and a successful upcoming appraisal program, we believe the total estimated recoverable natural gas resource in Mozambique’s Offshore Area 1 is between 30 and 60 Tcf, and the current upside for total gas in place for the discovered reservoirs on the block is approaching 100 Tcf. “We still have additional exploration opportunities that could expand the resource potential further,” said Anadarko President and CEO Al Walker.

Anadarko has also announced that, with the success of its Barquentine-4 appraisal well in April, 2012, the partnership has completed the drilling portion of its planned appraisal program. The Barquentine-4 well, also in Offshore Area 1, encountered approximately 525 net ft of natural gas pay, and became the Anadarko partnership’s ninth successful well in the Prosperidade complex. Prosperidade includes the Windjammer, Barquentine, Lagosta and Camarao discoveries, as well as five subsequent appraisal wells in the block. Prosperidade is estimated to hold recoverable natural gas resources of 17 to 30-plus Tcf.

Meanwhile, Eni has new natural gas discoveries within the Mamba Complex, in Area 4, at the Mamba South 2 and Coral 2 delineation wells, which are, respectively the sixth and seventh wells drilled back-to-back in Area 4. The new discoveries add 6 Tcf of gas-in-place to Area 4. The resources located exclusively in Area 4, are now estimated at about 23 Tcf, and the full potential of Mamba Complex is 75 Tcf of gas-in-place.

Mamba South 2, in 6,290 ft of water, and reached TD of 14,100 ft. The well encountered 197 ft of gas pay in high-quality Oligocene reservoirs. The discovery proved the existence of hydraulic communication with the same reservoir in Mamba South 1. Coral 2 , in 6,400 ft of water, reached a TD of 15,498 ft, encountering 460 ft of gas pay in good-quality Eocene reservoirs. The discovery proved the existence of hydraulic communication with the same reservoir in Coral 1. Eni is the operator of Area 4 with a 70% participating interest.

Kenya. Total signed a production sharing contract with the Kenyan government in June 2012 for Block L22, which it will operate with a 100% interest. Covering an area of more than 3,800 sq mi, the exploration license is offshore the Lamu Archipelago in water depths between 6,500 ft and 11,500 ft. The first phase of the exploration program consists of a 3D seismic survey.

AUSTRALASIA

Australia. During 2012, Chevron announced its 15th drilling success in Australia since mid-2009. In the Greater Gorgon area in the Carnarvon basin, the Satyr-2 discovery well confirmed approximately 128 ft of net gas pay. The well is in the WA-374-P permit area approximately 75 mi northwest of Barrow Island off the western Australian coast. The well was drilled in 3,570 ft of water to a TD of 12,454 ft. The company’s subsequent Satyr-4 exploration discovery well confirmed approximately 220 ft of net gas pay. The well was drilled to a TD of 15,023 ft.

Indonesia. Total has signed two PSCs with Indonesia for the Telen and the Bengkulu I-Mentawai exploration blocks. The Bengkulu I-Mentawai exploration block is in the offshore Bengkulu basin in the province of Bengkulu, southwest of Sumatra, covering an area of 3,100 sq mi with a water depth ranging from 1,300 to 3,280 ft. The Telen exploration block is in the Kutei basin, in the province of East Kalimantan, covering 915 sq mi with water depths in the range of 1,300 to 3,280 ft. It is adjacent to the Mahakam Block operated by Total, the country’s most prolific offshore gas producing project. The company plans, over three years, to conduct a 3D-seismic study on the Bengkulu I - Mentawai Block and to drill an exploration well on the Telen Block.

Myanmar. Total has signed an agreement with PTTEP, Thailand’s NOC, to acquire a 40% interest in Block M-11 in Martaban basin. PTTEP will retain the operatorship. The block covers an area of 2,075 sq mi, with a water depth of 650 to 7,500 ft. The current exploration phase calls for a well to be drilled by third quarter 2013.

Phillipines Total has signed a farm-out agreement with Mitra Energy to acquire a 75% interest in offshore Block SC56, in the Sulu Sea. The block covers 1,660 sq mi in water depths ranging from 650 to 9,800 ft. Mitra will retain a 25% interest in SC56. Mitra will reprocess existing seismic data and acquire 193 sq mi of additional 3D data, after which the operatorship will be transferred to Total for the drilling operations.

|

| Fig. 4. Noble Energy has made six consecutive discoveries in the eastern Mediterranean, with over 35 Tcf of gross resources. |

|

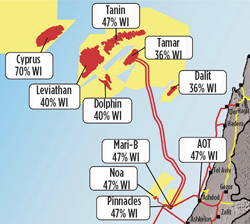

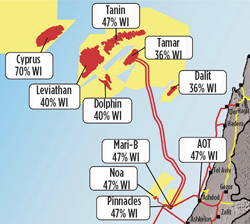

EASTERN MEDITERRANEAN

Noble Energy, with its local partners, Avner Oil and Delek Energy, has single-handedly opened up a new deepwater frontier in the eastern Mediterranean. Noble produces from Mari-B field, offshore Israel in an 896-ft water depth. A string of deepwater discoveries at Tamar, Dalit, Leviathan, Dolphin and Tanin has resulted in a significant resource base (35 Tcf of gross resources, 12 Tcf of net reserves and 2.2 Tcf of net booked reserves). In late 2011, Noble announced a 5-8 Tcf discovery offshore Cyprus. These discoveries have opened up the eastern Mediterranean as a new source for LNG exports destined for Europe or Asia.

Israel. In 2012, Noble Energy made its sixth gas discovery in the Levant basin at the Tanin prospect. The discovery well was drilled to a depth of 18,212 ft and encountered approximately 130 ft of gross pay in high-quality lower Miocene sands. Drilled in the Alon A license, the well is 13 mi northwest of Tamar field in 5,100 ft of water. Discovered gross resources are estimated to range between 0.9 and 1.4 Tcf. Including Tanin, total discovered gross mean resources in the Levant basin are now estimated to be approximately 35 Tcf. On the production side, Noble has installed a jacket in place for the Tamar production platform, and the topsides are being delivered from the shipyard.

Noble’s Leviathan prospect has an estimated 17 Tcf of discovered resources at a 5,550-ft water depth, and it is being appraised. To prepare for possible LNG exports, Noble and its partners have brought in Woodside Petroleum by giving up a 9.66% stake for $484 million. Noble will continue to serve as the E&P operator, and Woodside will take over as the LNG operator.

Cyprus. Noble Energy’s Cyprus A-1 discovery well encountered approximately 310 ft of net pay in multiple, high-quality Miocene sand intervals. The discovery well was drilled to a depth of 19,225 ft in 5,540 ft of water. Block 12 field covers 40 sq mi and will require additional appraisal drilling prior to development. Noble is considering an onshore LNG liquefaction terminal in Cyprus.

|