|

RUSSELL WRIGHT, Contributing Editor

|

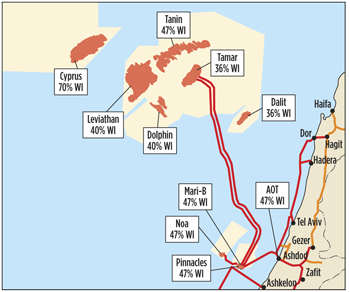

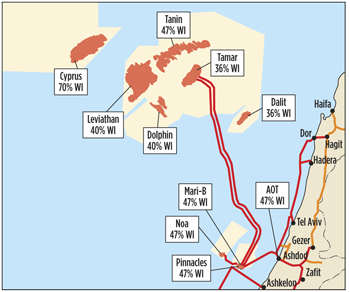

| Noble Energy used the Sedco Express (left) to drill wells to delineate Tamar field offshore Israel. The map shows the Noble Energy fields offshore Israel and the lease blocks offshore Cyprus (center). The Homer Ferrington rig (right) drilled both the Leviathan 1 discovery offshore Israel and the Cypress A (Aphrodite I) well offshore Cyprus in Block 12. |

|

Shell, Statoil and ExxonMobil forgot to tell Noble Energy that the Arctic was to be the next hydrocarbon frontier. In an exceptional effort with several minority partners, the U.S. independent has upended plans of the Arctic-focused IOCs by making significant natural gas discoveries in the eastern Mediterranean’s Levant basin: Tamar (9.7 Tcf), Leviathan (17 Tcf) and Cypress A (5-8 Tcf). These discoveries will fulfill the domestic needs of Israel and Cyprus, and leave plenty of gas for LNG exports to adjacent markets in the European Union, which would be pleased to diversify its supplies away from pipelined gas from Russia and LNG imports from Qatar. Noble Energy is investigating development options that include a floating LNG (FLNG) facility with Woodside as its LNG partner, or a pipeline to Cyprus, where an LNG liquefaction plant would be built. Meanwhile, Eni has been awarded blocks offshore Cyprus in January 2013, in the hopes of extending Noble’s discoveries in adjacent blocks.

LEVANTINE BASIN

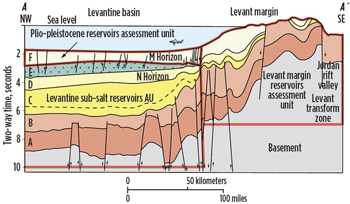

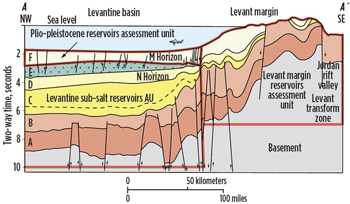

The eastern Mediterranean’s Levantine marine basin encompasses 83,000 sq km at water depths ranging from 1,500 to 2,000 m. The basin is flanked on the east by the Levant margin, Fig. 1. In 2010, the U.S. Geological Survey (USGS) conducted an assessment of the basin based on geological studies to date at 1.7 Bbbl of oil and 122 Tcf of natural gas. The exploration targets in the basin are subsalt reservoir sands within the Miocene strata.

|

| Fig. 1. Levantine basin geologic cross section. Source: USGS |

|

PGS has conducted several seismic surveys in the region, including 3D surveys in 2006-2007, covering approximately 1,550 sq km (Phase 1 to the south) and 1,350 sq km (Phase 2 to the north). Phase 1 covered the central part of the Levantine basin and Phase 2 covered the northern part of the basin, the Latakia Ridge, and several other large Syrian and Cyprus-Arc deformation folds. Interpretation of the surveys allowed analogs to be drawn from the proven hydrocarbon producing provinces of the Nile Delta, North Sinai, Gaza and Israel. A dual-sensor 2D survey was also conducted over a broader region. In 2011, PGS created a merged dataset to obtain a smooth interpretation for seismic data of different vintages.

Noble’s Tamar discovery occurred at the Oligo-Miocene clastics at about 13,000 ft , where it encountered 600 ft of net pay in the form of pure methane in three reservoirs. For the Leviathan discovery well, the net pay was 220 ft at 17,000 ft, but the well was drilled to 23,000 ft to provide well data for more detailed formation evaluation.

ISRAEL

With recent large discoveries as the prime mover, Israel now sees natural gas becoming the primary fuel for electricity generation and industrial consumption. In 2010, Israel consumed 187 Bcf of natural gas, with 40% of the electricity generated from natural gas. By 2015, the rate of natural gas consumption is expected to rise to 50%. At the same time, natural gas production from new reserves will be increased, and the transmission and distribution systems will be upgraded.

Egypt had commenced supplying natural gas to Israel in 2008, up to 247 Bcf per year over a 20-year period at lower-than-market prices. Gas was transported via subsea pipeline from El Arish to a receiving facility next to Ashkelon. As turmoil spread during the Arab spring, the pipeline was bombed repeatedly until Egypt’s state-owned gas company scrapped the deal in April 2012.

Noble’s association with the eastern Mediterranean began in 1998, when Noble’s predecessor, Samadan Oil, joined the Israeli Yam Tethis consortium. This group (Noble Energy, 47%; Delek Drilling, 25.5%; Avner Oil and Gas Exploration, 23%; and Delek Investments and Properties, 4.4%) discovered Noa field in June 1999—the first, large, natural gas reservoir in Israel—about 20 mi offshore from the coastal town of Ashkelon. In February 2000, an additional reservoir was found in Mari-B field, which at the time of discovery contained an estimated 1.6 Tcf of gas. The same partnership had also discovered 250–300 Bcf in March 2009, with the Dalit 1 drill site about 35 mi off the coast of Hadera.

Tamar and Mari-B. In January 2009, Noble drilled the Tamar 1 discovery about 55 mi off the coast of Haifa in 5,500 ft of water. Tamar field contains some 8.7 Tcf in three high-quality reservoirs, which is equivalent to 10 years of Israel’s total energy consumption. In December 2012, the Tamar production platform was inaugurated. The 34,000-ton, 950-ft-tall structure will be used to process natural gas, which will then be transported to the Mari-B platform via a 90-mi subsea tieback, the longest in the world. From Mari-B, the gas will flow to a receiving station in Ashdod via a 16-in. pipeline. These offshore gas fields were discovered in intermediate-to-deepwater depths—Mari-B at 820 ft, Tamar in 5,900 ft and Dalit in 4,920 ft.

Leviathan. In late December 2011, Noble Energy announced a significant natural gas discovery in the Leviathan offshore license area 80 mi off of Haifa. Noble’s well data confirmed initial reserve estimates for the field at 16 Tcf of gas, making it the world’s largest deepwater gas discovery in 10 years, and increasing Israel’s total natural gas reserves to as much as 26 Tcf. Noble’s flowback test confirmed a high-quality reservoir with a single well capable of 250 MMcfd, and a condensate yield of 1.8-2.0 bbl. Thus far, the operator has drilled three appraisal wells, and drilling of the fourth appraisal is underway. The second appraisal well had to be plugged.

Noble is studying multiple export options, including both LNG and pipeline scenarios. A successful appraisal well was drilled in 2011, and the initial discovery was being deepened to test for a deep oil prospect. Production could begin by 2016, depending upon success of appraisal drilling. For Phase 1, the production scenario at this time is to use an FPSO on-site and use an entry point in northern Israel to bring processed gas to shore for domestic consumption. For Phase 2, during a 2018–2020 timeframe, several options are under consideration, including onshore LNG facility, FLNG or pipeline export. Noble Energy has brought in Woodside as a partner by selling a 9.66% interest from all the partners for a total investment of $808 million. Noble will continue as the E&P operator with a 30% interest, and Woodside will take over in 2018 as the LNG operator.

For 2013, Noble has announced an E&P budget of $400 million for the Eastern Mediterranean, and this includes final commissioning at Tamar, a Mesozoic oil test, appraisal work and flow tests at Leviathan, and additional testing of natural gas prospects.

Aphrodite-2. In March 2013, Norway-based operator AGR reported that its Aphrodite-2 well discovered a 50-ft natural gas-bearing layer at a 13,000-ft depth in 5,600 ft of water. The Aphrodite-2 well is the first drilled within the Pelagic licenses and is located in the Ishai license, the tract closest to Cyprus. Prior to drilling, the Aphrodite prospect was estimated to have the potential for 3.7 Tcf of natural gas, based on a resources report compiled by petroleum consultant Ryder Scott in 2012, with a 76.7% probability of success. The Noble Homer Ferrington rig drilled the well, after completing wells on the Myra and Sarah licenses. The rig had also drilled the Leviathan 1 well. There are five deepwater Pelagic licenses covering 500,000 acres, 100 mi west of Haifa. The Pelagic fields are in the same area as Tamar and Leviathan.

LNG imports. In February 2011, Israel’s Minister of Energy and Water Resources announced a plan to build a buoy-based LNG receiving terminal off the Hadera coast. The buoy will be built by the government-owned Israel Natural Gas Lines Co. and was slated to be up and running by the end of 2012. The offshore buoy approach was selected, because it was found to be the only technology capable of quickly facilitating the supply of LNG to Israel.

Accelerated growth in the use of natural gas in Israel is expected to continue, increasing from 184 Bcf in 2010 to 440 Bcf in 2020, and then to 635 Bcf by 2030, of which 85% will go to electricity generation and industry. Expectations are that the gas produced from the offshore Israel fields will be sufficient to meet domestic consumption and leave much more for LNG exports.

|

| Fig. 2. Noble Energy fields in eastern Mediterranean. |

|

CYPRUS

Exploration offshore the Republic of Cyprus is progressing at a steady pace. The large amount of geophysical data available, and attractive terms offered (zero taxation on revenues from offshore hydrocarbon exploitation), makes Cyprus very prospective. Cyprus has delineated 13 blocks in its offshore economic exclusive zone (EEZ), consisting of 51,000 sq km.

2D seismic data. According to PGS, which conducted four 2D seismic surveys over the EEZ during 2006–2008, the exploration blocks are approximately 4,000 sq km and span an area from the Herodotus basin in the west to the Levantine basin in the east. Block 1, and the northern parts of Blocks 2 and 3, are closest to the island and cover the Cyprus Arc and its deformation front. Blocks 4, 5, 6 and 10 are situated in the Herodotus basin. Blocks 7 and 8, and the western part of block 11, cover the Eratosthenes Continental Block and the west Eratosthenes basin. Finally, the southern parts of Blocks 2 and 3, together with Blocks 9, 12 and 13 cover the Levantine basin.

The first licensing round was held in February 2007, for the granting of 11 exploration blocks within the EEZ. Blocks 3 and 13 were excluded. About 35,000 line-km of 2D seismic data were purchased by the interested parties, and applications for three exploration blocks were submitted. After extensive negotiations, an exploration license was awarded in 2008 for Block 12 for an initial period of three years to the Noble Energy group.

Cypress-A discovery. In late December 2011, Noble announced a natural gas discovery at the Cyprus Block 12 prospect. The Cyprus A-1 well (also known as Aphrodite 1) encountered 310 ft of net natural gas pay in multiple, high-quality, Miocene sand intervals. The discovery well was drilled to a depth of 19,225 ft, in a water depth of about 5,540 ft. Since then, Noble has identified four appraisal well locations to delineate the reservoir. During 2013, Noble plans to conduct a drillstem test on the discovery well and drill the first appraisal.

Second licensing round. The Cyprus Ministry of Commerce, Industry and Tourism reported that 29 companies had made 15 bids for exploratory drilling, despite strong objections from Turkey. In January, Eni (operator with 80% interest) and South Korea’s Kogas (20%) signed PSCs with the ministry for Blocks 2, 3 and 9. Block 9 is adjacent to Noble’s Block 12, and Blocks 2 and 3 are to the northeast of Block 9. In late December, the ministry broke off talks with Total and its Russian partner, claiming that they were “unsatisfactory”.

| TABLE 1. MAJOR OFFSHORE ISRAEL FIELDS |

|

|

POLITICAL AND ECONOMIC ISSUES

In 2012, the presidents of Cyprus and Lebanon agreed to cooperate and look into ways to explore offshore in areas thought to have abundant natural gas deposits. But these energy fields lie in a politically tricky area, in the waters between Lebanon, Cyprus and Israel. The prospects lie in waters between the three countries and span the EEZs of each country. Lebanon and Israel have overlapping claims to an area that covers about 300 sq mi of sea. While all three countries could profit by finding reserves, maritime border disputes have prevented expedient exploration.

Perilous drilling. In September 2011, when Noble Energy began drilling off the coast of Cyprus, the Turkish government stated that it was considering deploying naval escort ships to protect exploration areas north of the country. Despite the threat, the Homer Ferrington rig continued to drill and made the Cypress A discovery.

While Turkish forces occupy the northern part of Cyprus, the Turkish Cypriot government is recognized as legitimate by only Turkey. From Turkey’s perspective, there is no such thing as drilling rights in northern Cyprus, contending that, for Cyprus, there is no north and south. The government of Cyprus sees it differently, considering the area as the northern side of Cyprus. But Turkey will likely try to make natural gas drilling and transportation rights in the region as difficult for Cyprus and Israel as possible. Cyprus is anxious to start earning oil and gas revenues, to relieve the exposure of its banks to the economic crisis in Greece.

Lebanon licensing round. In late 2012, Lebanon authorized its first offshore oil and natural gas licensing round, in an effort to catch up to its neighbors, Israel and Cyprus. The qualifying round is expected to start Feb. 1, and bids are to be accepted starting May 2. The Lebanese government hopes to use oil and gas revenues to reduce its debt burden, which is $56 billion, 135% of its economic output.

WHAT THE FUTURE HOLDS

If new discoveries continue to occur in the eastern Mediterranean, it could change the energy equation of Europe and the Middle East. Russia and Qatar will have to make adjustments, as a result of the entry of Israel, Cypress and, possibly, Lebanon, as LNG exporters. In a region that introduces new political and economic variables on a routine basis, the next decade should lead to a complex calculus between the embattled countries.

|