MIKE SLATON, Contributing Editor

RIG FLEET ADDITIONS–OFFSHORE NEWBUILDS

High tech sets sail for deep water

Big water and deep holes are the targets of much of the offshore newbuilds entering the market. Drillships dominate shipyard output, while semis and high-performance jackups fill in the spare slots. In bulk, these drilling rigs are highly automated, focused on safety and efficiency, and geared for exceptional water and hole depths in HPHT extremes.

Following are some of the advanced newbuilds that describe the leading edge of offshore rigs sailing into today’s marketplace.

Odfjell Drilling. Commissioning of the huge, multi-tasking Dalian Developer drillship was planned for second-half 2013, Fig. 1. Combining drilling and oil spill containment capabilities, it will be largest drillship afloat, at about 1,000 ft long and 150 ft wide.

|

| Fig. 1. When commissioned, the Dalian Developer will be the world’s largest drillship afloat. |

|

Odfjell will manage the rig. Vantage Drilling provided construction oversight at the shipyard in China, and Technip performed the conceptual design of the topside production system that acts as an oil capture system.

Vantage Drilling. The Vantage Tungsten Explorer ultra-deepwater drillship started work in September 2013. Vantage Drilling is employing it on a three-well contract in Southeast Asia. The 781-ft vessel is equipped for 10,000-ft water depths, able to drill to 40,000-ft well depths. Drilling equipment includes an AC 9,000-hp drawworks; four 2,200-hp, 7,500-psi mud pumps; and a 101,200-ft/lb top drive, all built by Aker Kvaerner Maritime Hydraulics.

Another Vantage ultra-deepwater drillship, Cobalt Explorer, is under construction. The company’s fleet consists of four Baker Marine Pacific Class 375 ultra-premium jackups and three ultra-deepwater drillships, the Platinum Explorer, Titanium Explorer and Tungsten Explorer.

Atwood Oceanics. Construction of the Atwood Archer was announced in June 2013. Due for delivery by December 2015, it will be the fourth ultra-deepwater drillship built by this contractor at the Daewoo yard in South Korea. The company also has a 2016 option for a fifth ultra-deepwater drillship.

The Archer will be Atwood’s 17th mobile offshore drilling unit. Its design is identical to the previously ordered Advantage, Achiever and Admiral. All four are dynamically positioned, dual-derrick, ultra-deepwater drillships, rated to 12,000-ft water depths and 40,000-ft drilling depths.

Noble Corp. Noble began operating two new ultra-deepwater drillships, the Noble Don Taylor and Noble Globetrotter II (Fig. 2), in third-quarter 2013, and took delivery in August of the company's first of six JU3000N high-specification jackups, the Noble Mick O'Brien. A third deepwater drillship, the Noble Bob Douglas, is planned for delivery this year, along with two more high-specification jackups, the Noble Regina Allen and Noble Houston Colbert.

|

| Fig. 2. The Globetrotter II drillship features the Husiman multi-purpose tower/derrick. |

|

The Don Taylor and upcoming Bob Douglas are Gusto P10000 designs, rated to 10,000-ft water depths and

40,000-ft drilling depths. Drilling equipment includes an AHD-1250, 9,000-hp main drawworks; NOV TDX-125 150,000-ft-lb top drive; four National 14-P, 2,200-hp mud pumps; and six Himsen 6H32/40-v engines with 8,000 kw, each.

The Globetrotter II drillship is a 10,000-ft water depth, 40,000-ft drilling depth unit that features the Husiman multi-purpose tower/derrick (see accompanying Rig Advances Section), as does the Globetrotter I. Other equipment includes an NOV TDS-1000 top drive and four NOV 14-P-220, 2,200-hp mud pumps, plus eight Caterpillar C-280 Tier II diesel engines with 4,790 kw, each.

Noble announced three-year drilling contracts for two of the ultra-deepwater drillships under construction at the Hyundai Heavy Industries shipyard in Ulsan, South Korea. The Noble Sam Croft and the Noble Tom Madden rigs will drill for Plains Exploration & Production. Noble has four ultra-deepwater drillships being constructed at the Hyundai yard. With the awards for these two units, all four ultra-deepwater drillships are under contract.

Delivery of the Noble Sam Croft is due in second-quarter 2014, followed by the Noble Tom Madden in second-half 2014. Both will work in the Gulf of Mexico. The two rigs will be fully equipped to operate in up to 10,000 ft of water while offering DP-3 station-keeping and two complete, six-ram BOP systems. Both rigs will be equipped with a 165 heave compensated construction crane, to facilitate deployment of subsea production equipment for greater efficiency during development programs.

Future construction includes an ultra-high-specification jackup for use in the UK North Sea. The jackup will be an enhanced version of Statoil’s “Cat J” specifications and will operate in water depths of up to 492 ft, in harsh-environment conditions, with a maximum total drilling depth capacity of approximately 33,000 ft.

The rig will be able to deploy either a surface or subsea BOP. It will be based on the Gusto MSC CJ-70-150 design. The rig was designed for operations over a very large platform or in a subsea configuration. Noble says that it will be one of the most versatile jackup rigs in the industry.

Ensco. Continuing its newbuild program, Ensco in 2013 has added three rigs, the ENSCO DS-7 drillship and two premium jackups, ENSCO 120 and 121. The ENSCO DS-7 was contracted to Total in Angola for three years. It is a 750-ft vessel, able to work in 12,000 ft of water. Rig equipment includes an NOV TDS-1250 main drawworks; a TDX-1250 top drive; four N14-P-220 mud pumps; and six MAN-STX 16V32/40 8,000-kW diesel main engines and generators. The ENSCO 121 jackup was contracted to Wintershall in the North Sea for two years.

Last year, the company delivered two semisubmersibles, ENSCO 8505 and ENSCO 8506, the final two rigs in its proprietary 8500 series. Also delivered was the ENSCO DS-6, the company’s fourth Samsung DP-3 ultra-deepwater drillship. Two drillships and one jackup are planned for 2014, with a jackup and drillship on the 2015 horizon.

Transocean. The company announced in mid-October that it would build a new ultra-deepwater drillship for a five-year contract with Chevron. Construction, geared to second-quarter 2016 delivery, is taking place at Daewoo’s Okpo South Korea shipyard, where Transocean is building six other drillships.

The new, 12,000-ft/40,000-ft vessel will support parallel drilling operations. It includes two 15,000-psi BOPs to reduce NPT between wells; a 2.5-million-pound hook load capacity; and a variable deck load capability of 23,000 mt.

Pacific Drilling. The company took delivery of its newest drillship in early 2013. The Pacific Khamsin drillship will work in Nigeria on a two-year contract, Fig. 3. It is a Samsung 12000 double-hull design. Focused entirely on deepwater markets, Pacific has added four drillships since 2011, for a fleet of eight. The company plans to have a 12-rig fleet operating by 2019.

|

| Fig. 3. The Pacific Khamsin double-hull drillship is working offshore West Africa. |

|

The 12,000-ft water depth, 40,000-ft drilling depth Khamsin drillship features dual-load path capability and dual-drilling fluid systems. It has an NOV RST 755, 75.5-in main rotary, and an NOV RST 605, 60.5-in auxiliary rotary, plus two NOV active heave drawworks and TDX-1250 top drives. The rig has four NOV 14-P-220 7,500-psi mud pumps, and a dual-gradient-capable mud system.

Diamond Offshore. The first of three deepwater semisubmersibles ordered by Diamond Offshore in the last several years, the Ocean Onyx, was expected in fourth-quarter 2014. The unit will work for Apache Corp. in the U.S. GOM early in 2014.

The next semi in line is the Ocean Apex, slated for delivery in fourth-quarter 2014. Earlier this year, Diamond ordered a third deepwater semi, the Ocean GreatWhite, for delivery in mid-2016.

The Ocean Onyx (built at AmFELS in Brownsville, Texas) and Ocean Apex (built at Jurong in Singapore) are each 6,000-ft water depth, 30,000-ft drilling depth vessels with 15k five-ram preventers. The Ocean Onyx has a 750 maximum hookload, while the Ocean Apex can handle 1,000.

In addition to semisubmersibles, Diamond Offshore ordered four deepwater drillships in 2011 and 2012. Built by Hyundai Heavy Industries, the four identical drillships are a dual-activity design, and are 12,000-ft water depth; 40,000-ft drilling depth vessels with a 1,250 maximum hookload and two seven-ram BOPs. The Ocean BlackHawk and Ocean BlackHornet are due in fourth-quarter 2013, and will work for Anadarko in the U.S. GOM. The company's remaining drillships, Ocean BlackRhino and Ocean BlackLion, will be finished in 2014 and 2015, respectively.

RIG FLEET ADDITIONS–ONSHORE NEWBUILDS

Innovation is diverse in a dynamic marketplace

In terms of market drivers, land and offshore newbuilds share much in common, including environmental, safety, efficiency and operational imperatives. But the diversity of the results in the land rig market is remarkable. Focused on unconventional resources, newbuild land rigs cover a spectrum, reaching from small, powerful and exceptional mobile rigs, to deep-drilling behemoths that walk between wells.

Here are some of the new land rigs rolling, and walking, onto well sites.

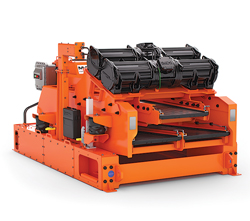

Nabors Drilling. Nabors continues to refine and reinvent its Pace rig design, with the introduction this year of the Pace-X walking rig, engineered specifically for multi-well pad, shale drilling applications, Fig. 4.

|

| Fig. 4. As the latest iteration of a rig series, the Pace-X walking rig is engineered specifically for use in multi-well pad, shale drilling applications. |

|

It is the latest iteration of a rig series introduced nearly a decade ago. The first model was aimed at shortening the drilling cycle. It was a powerful, compact design, with variable-frequency AC drives and programmable logic controller (PLC) technology for driller control of the main rig components. The company has 25 skid rigs and 61 walking rigs, each about one-third of the respective industry fleet. Newbuilds and upgrades in 2013 will bring the walking rig total to 114.

The new Pace-X design features a “side-saddle” substructure, with a 16-ft-wide-by-26-ft-high clearance that allows the rig to walk over existing wellheads. It has one-fifth the permit load of a traditional unit, so rig moves can be at night, and on weekends and holidays. A closed-loop mud system provides for cuttings disposal in environmentally sensitive areas. The unit’s bootstrap mast rigs up vertically, with a hookload of 600, 800 or 1,000 kips, and a 500 AC top drive that provides 42,1000 ft-lb of continuous torque. Two 1,150-hp motors drive the rig’s AC drawworks.

Three Derrick Hyperpool shakers ride on the substructure, when moving, to cut the time and risk of flowline handling. The mud system has two 1,600-hp mud pumps, with the option for a 7,500-psi system and up to three 2,200-hp mud pumps.

The rig’s driller’s cabin and console feature advanced monitoring and control, including Canrig’s RigWatch instrumentation system, which also provides access to a variety of software, such as applications for directional steering control and stick-slip mitigation.

Helmerich & Payne. As of October, six of H&P’s AC-drive FlexRigs remained to be delivered, Fig. 5. Roughly 24 rigs were planned in 2013, based on an expected build rate of about two rigs per month.

|

| Fig. 5. Two newbuild FlexRigs work on-site for owner Helmerich & Payne. |

|

During 2012, H&P dominated industry AC-rig construction, with delivery of 48 new FlexRigs. Last year, and into 2013, the newbuilds are mostly FlexRig3 (67%) and FlexRig5 (28%) designs, with a handful of FlexRig4 units. The latter rigs target a shallower depth market. H&P figures that almost 40% of the 650 estimated, active AC-drive rigs in the U.S. land market are FlexRigs.

The FlexRig3 is a 22,000-ft, 1,500-hhp unit. In 2006, the 18,000-ft, 1,500-hhp FlexRig4 model introduced multi-well pad drilling capabilities to the company’s line. That pad drilling capability is continued in the latest model, FlexRig5, which extends bi-directional multi-well pad drilling capabilities to deeper-drilling units, with the same 22,000-ft reach of the FlexRig3.

Precision Drilling. Precision built eight of its Super Series (Fig. 6) rigs between December 2012 and August 2013, and planned to deliver three more U.S. rigs and two international units by the end of 2013. The 13 newbuilds and upgrades boost Precision’s Super Series fleet from 188 units to 201, out of a total fleet of 331. Since 2009, the company has added approximately 90 newbuild and upgraded Super Series rigs, with approximately half going to the U.S. market.

|

| Fig. 6. Precision Drilling is boosting its Super Series rig fleet from 188 to 201 units. |

|

Precision’s Super series consists of three basic models—the 1500 and 1200 triples, and a single design. Built for high-performance horizontal drilling, the rig features include walking/skidding systems (Fig. 7), a small footprint and automated pipe handling.

|

| Fig. 7. Walking system on a Precision Drilling Super Series rig. |

|

Patterson UTI. Six of Patterson’s APEX rigs were delivered during first-half 2013, and the contractor planned to add six APEX XK 1500 rigs (Fig. 8) to its fleet during the last half, for an APEX total of 126 rigs. All APEX rigs delivered in 2013 have walking systems for pad drilling.

|

| Fig. 8. The APEX-XK 1500 rig is Patterson’s newest design. |

|

The APEX-XK 1500 rig is the company’s newest design (there is also an APEX-XK 1000 Model). The latest newbuilds will bring the 1500 series total to 19 rigs by year-end. The XK model features a ground level around the sub-structure that allows for greater movement and clearance over wellheads and other pad structures. The rig is capable of multi-directional walking, with drill pipe and collars racked in the derrick. Walking times average 45 min. for 10-to-15-ft well spacing.

The rig was designed to improve move times between locations, hence there is a modular design, dedicated shipping skid for the mast, and unified skids for the solids control equipment. The company reports that rig moves are routinely done in less than three days. The AC-rig operating and control system allows strict drilling parameters to be set, to enhance drilling rates, and it offers a platform for drilling process automation. The rig comes standard with the latest in rig floor handling systems.

DrillMec. The firm will build six rigs for SnamProgetti Arabia Saudita and for Iraq Drilling Company (IDC). Three 2,000-hp, 21,000-ft conventional rigs built for SnamProgetti will go to work in Saudi Arabia’s Dammam region. The contract includes rig-up services, maintenance and dedicated technical support. For IDC, three customized conventional rigs outfitted for 11,000-ft to 21,000-ft drilling will join operations initiated by Iraq in 2008, to increase the county’s production.

Unit Drilling. Unit planned to deliver the first of its new BOSS rigs during fourth-quarter 2013, along with three to five more units in 2014. The BOSS (box-on-box, self-stacking) rig is a proprietary-design, 1,500-hp AC electric drilling rig, built for multi-well pad drilling.

Features include a multi-directional walking system, a compact location footprint, and a quick assembly substructure that moves in 32 truckloads. The unit has two 2,200-hp mud pumps and dual-fuel-capable engines.

RIG EQUIPMENT ADVANCES

Latest innovations meet new challenges with high-tech and engineering insight

The span of rig technology innovation runs the gamut, from automation and intelligent systems, to catching a wrench dropped in the hole. No option remains untouched or unconsidered, as software and hardware are driven toward increasing safety, efficiency and capability.

Here are just a few of the latest advances in rig design, and the impressive components used to build today’s new rigs.

ADVANCES IN RIG DESIGNS

Deepwater planning aims for 20,000 psi and 350°F

The next generation of deepwater drilling technology is in the works with Maersk Drilling and BP collaborating on conceptual designs. Their focus is on rig technologies that can operate in HPHT environments, up to 20,000 psi and 350°F.

The collaboration is part of BP’s Project 20K, a multi-year initiative to develop next-generation deepwater systems and tools for wells conditions in excess of current 15,000-psi, 250°F limits. BP estimates that the technology across its own portfolio, alone, could access an additional 10-20 Bbbl of oil.

A jointly staffed team in Houston will perform engineering studies to design the rigs, risers and BOP equipment. Areas of interest include operating systems that aid the situational awareness of the rig crew and inform decision-making; real-time BOP monitoring to continuously verify its functionality; and significantly enhanced mechanical capabilities for the BOP, rig structures and piping systems.

Tower design adds new drillship advances

The latest advances in Huisman’s dual multipurpose tower (MPT) are featured aboard the Noble Globetrotter II drillship that was delivered this year. The novel technology was first introduced as a single MPT in 2001, aboard a Helix vessel. In 2010 and 2011, the Noble Bully I and II featured the first dual-MPT, followed in 2012 by the Noble Globetrotter I.

The MPT technology’s open character sets up a new way of organizing drilling systems that enables smaller vessels, offline capabilities, and other safety and efficiency gains. Locating the dual MPT box-type structure between the drill floor and the auxiliary floor creates two physically separated work areas, allowing different processes to be conducted discretely and simultaneously. One side supports offline activities, such as stand building, and riser and tree running, while the other supports drilling, landing the BOP, and completion operations.

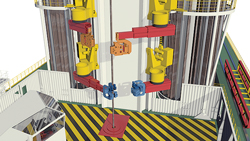

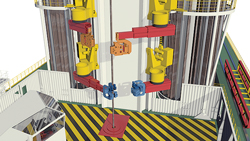

Advances include multi-functional pipe manipulators, a “skiddable” rotary table, and a drill floor that is flush with the vessel’s main deck. Designed for fully automated control, the new manipulators can be fitted with various tool heads, such as drill pipe, casing and tubing grippers, Fig. 9.

|

| Fig. 9. Automatically controlled Huisman pipe grippers can be fitted with a variety of tools. |

|

The innovative rotary table uses a set of U-shaped clamps, one for drilling and one for casing, to reduce handling of power slips and bushings. The drillstring clamp can handle 27/8-in. through 10-in. pipe without changing inserts. The clamps can also be skidded out of the well center to provide a 90-in. opening.

Changes in the rig/vessel layout have allowed the drill floor to be lowered, so that it is flush with the vessel’s deck. Onboard material handling is more efficient, as goods do not need to be hoisted to different elevations. A removable section of the floor facilitates the handling of large objects.

Lowering the floor lowers the vessel’s center of gravity (CoG), to increase its stability, so that a larger payload can be stored on the smaller vessel. For example, on the HuisDrill 12000 design, lowering the floor to the work deck level allows for a vessel that can carry a 30,000-mt VDL, with a displacement of only 67,000 mt versus a traditional VDL of 20,000 mt, with a displacement of approximately 100,000 mt.

Semi design will quell heave and vortex motion

A low-motion HVS semisubmersible concept from Technip optimizes the hull form to improve heave and vortex-induced motion (VIM) performance, which translates to increased riser fatigue life.

The heave- and VIM-suppressed (HVS) semisubmersible design uses a caisson ballast system to eliminate the need for pump rooms and sea chests inside the lower hull. Higher pontoon blisters are attached to the base of the columns, and the pontoons are narrower and taller than a conventional semi. The higher blister stops vortex shedding oscillations along the column length and improves stability at quayside. The narrowed pontoon helps reduce heave load, and the higher pontoon provides more VIM dampening and vertical bending stiffness.

Such designs come about through considerable simulation power. Technip conducts simulations before and after rig modeling, to optimize the design process. The simulations also reduce the number of physical models and shorten design time.

After model testing, computational fluid dynamics simulation (CFD) can be used to create design variations that shorten the overall process. In addition, simulation provides more information on the physics than can be acquired in model tests.

Mobile land rig is a 100-t, high-tech package

Atlas Copco has developed a 100-t pullback (hook load) top-drive mobile rig called the Predator. The automated hydraulic system is a self-contained, single-load drilling package, made up of three key components: the rig, substructure and pipe skate, Fig. 10. The company had three of the compact rigs in the field in fourth-quarter 2013, and three more were expected by year’s end.

|

| Fig. 10. Predator is a mobile, three-component drilling package from Atlas Copco. |

|

One key market for the versatile system is drilling pre-sets using the mixed-fleet approach, says Atlas Copco. The rig’s depth, plus its capacity and ability to move and rig up quickly, makes the Predator well-suited for drilling and casing surface and intermediate hole in advance of a larger rig.

The drilling unit is powered by a 950-hp, high-efficiency hydraulic system. Environmental features include leak and spill protection, a substructure with distributed weight for less land disturbance, and rig enclosures for less noise.

Crew size and manual labor are reduced, thanks to hands-free pipe and casing handling, and an on-demand control system. The advanced control system also monitors operating efficiency, and includes diagnostic and safety programs. An innovative, API 4F telescopic mast handles range 2 and 3 drill pipe and casing, and a powerful, two-speed top drive provides performance rated to 30,000 lb-ft of torque and 180 rpm.

Compact hydraulic rig designed for shale plays

Schramm has introduced a compact hydraulic rig designed for shale plays. The T500XD Telemast rig has made its debut in the Marcellus and Utica shales, Fig. 11. It is a 500,000-lb hook load unit that moves in an eight-truckload package. It has full, 360° walking portability, for fast moves from hole to hole, and is self-erecting.

|

| Fig. 11. The T500XD Telemast unit from Schramm is a 15,000-ft walking rig. |

|

Designed specifically for horizontal and directional drilling to well depths of approximately 15,000 ft, the rig can precisely control weight-on-bit and does not rely solely on drill collars and gross string weight. It offers 35,000 ft-lb of top head torque, third-party directional steering interface, and 80,000 lb of hydraulic pull-down capacity.

Pipe handling is automated (Fig. 12), with an integral system that can handle 24-in. diameter, range III tubulars weighing up to 10,000 lb. Drill pipe is racked in the horizontal position for easier and safer loading and offloading. The rig has full communication connectivity to third-party data acquisition providers, who use Internet or dedicated satellite communications to reach remote operational centers.

|

| Fig. 12. Automated pipe handling on Schramm’s new T500XD Telemast rig can handle 24-in. diameter, range III tubulars. |

|

ADVANCES IN OPTIMIZATION AND AUTOMATION

Intelligent condition monitoring optimizes equipment

If equipment optimization had a face, it would look a lot like that old guy down the hall, who can sniff the breeze, lay his hands on the railing, and reliably predict that the mud pump will need work next week. Monitoring the condition of rig equipment, using intelligent data acquisition and analysis, is starting to provide that level of expert performance. The magic is in assimilating a broad range of data, comparing it to past experience, tossing out the irrelevant items, making a decision, and learning from it.

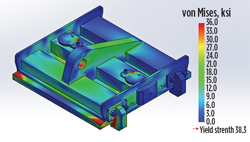

That’s the task faced by new hires and grizzled veterans alike, and it’s the solution that National OiIwell Varco (NOV) is working toward. The company’s eHawk condition monitoring service is based on intelligent data acquisition and analysis that looks for patterns in operational parameters, compares it to past failures, and predicts outcomes, Fig. 13.

|

| Fig. 13. Condition monitoring provides advance notice of equipment failure, such as a mud pump drive fault, that reduces parts and repair time. |

|

The data include equipment usage and performance, as well as estimates of remaining equipment life and component durability, based on such parameters as running hours, cycle counts, pressure, load and stress.

In this data mix, the intelligent system must account for changes in operating conditions (including tripping, circulating, and making connections) as well as random events, such as jarring. This information is integrated with historical data, and the equipment’s normal and abnormal operating states, to dynamically create an operating profile, listen for abnormal signatures, and produce high-quality predictions that avoid false alarms.

In addition to the intelligent platform, the eHawk system includes online monitoring and support, vibration and debris monitoring, and can be extended with real-time BOP monitoring services.

Software brings subject matter experts into the loop

Here’s another look at optimization from NOV—this one aimed at drilling. In this case, software advances improve the pace and flexibility of drilling optimization by automating the process of information analysis and action. A plug-in software framework developed by NOV, and incorporated in its DrillShark automated drilling service, makes it faster and easier for subject matter experts to prototype and develop various drilling optimization algorithms.

Early drilling optimization efforts used general algorithms that were independent of drilling-specific knowledge. Later systems sought to improve performance by focusing on information analysis and the development of algorithms to apply driller-specific knowledge. The plug-in architecture extends this evolution by allowing analytical and control techniques to be developed and implemented in the field. Drilling specialists with low-level computer programming skills can apply drilling-specific knowledge and techniques without a team of software engineers and software release cycles.

DrillShark service objectives include improving ROP and bit life, and reducing vibration by automatically adjusting drilling parameters. It consists of a remote monitoring team that configures and adapts drilling algorithms in conjunction with rig instrumentation; a multi-parameter auto driller for managing weight on bit; and a top drive control interface.

Pipe makeup moves offline and off the rig

One of the latest innovations in optimizing rig floor tubing running and handling moves a lot of it offline, and keeps it remote from the rig. Using an adaptation of its wellsite makeup and breakout technology, Weatherford is building ready-to-run pipe stands at onshore facilities and delivering them to the rig.

The ComCam offline bucking system (Fig. 14) is integral to a broader Weatherford initiative for tubular handling and running. While top drive systems, along with the ability to remotely control derrick and drill floor operations, can achieve remarkable improvements in safety and efficiency, the company believes that further gains are achievable by a more inclusive approach that integrates planning, pipe logistics, preparation, and make-up with traditional rig floor competencies.

|

| Fig. 14. Offline tubing running and handing is achieved with Weatherford’s ComCam bucking system. |

|

The ComCam bucking system makes up API and premium tubing, casing and drill pipe in double or triples, using the same basic technology found in rig operations. The high-speed system monitors torque curves and provides automated control of tightening that ensures precise makeup. Each stand is individually bar-coded and torque, length, drift, and tally data are recorded and integrated with wellsite makeup data. The modular bucking system can also be configured for specialized operations, such as the sub-assembly of downhole equipment.

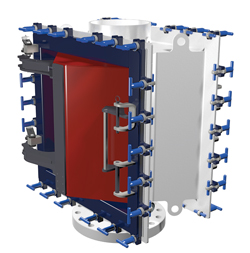

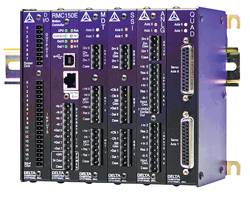

Controller gives grace and precision to heavy iron

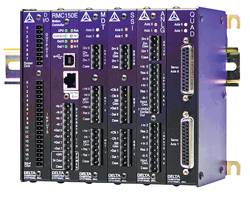

Precise, smooth control of rig floor pipe handing equipment is essential for successful automation. Delta Computer Systems makes the motion controller that choreographs this multi-ton ballet.

Its RMC 150 eight-axis electrohydraulic motion controller (Fig. 15) is used in Weatherford’s Iron Derrickman, where precise coordinates are required for each axis of motion (slew, extension, scoping up and down, and tilt. Given these coordinates, Delta’s controller changes the axes to move the pipe from one place to another.

|

| Fig. 15. At the heart of precise equipment motion is Delta Computer Systems’ RMC 150 controller. |

|

Feedback about movement comes from linear transducers mounted on the equipment’s hydraulic cylinders. The high-resolution transducers provide smooth motion using precise velocity measurements. Filtering large spikes in the command signal avoids vibration in the hydraulic system, which further ensures smooth motion.

Skidding system simplifies rig moves, reduces time

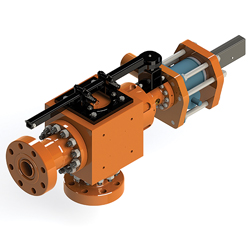

A new ratcheting, claw-type skidding system from AXON Energy Products is designed to enhance rig-up time and the removal process between each rig move by enhancing compatibility with AXON’s Mast Equipment Package.

The design is focused on accurate and controllable positioning; safety; skidding capacity; and ease of operation, installation, removal and maintenance. The patent-pending skidding system (Fig. 16) features a claw design that reduces the number of system components. The compact assembly has eight moving parts, with a total weight approximately 60% of existing systems. The design makes reversing the skidding direction a simple manual operation that does not require tools or rigging. Lightweight components that can be handled by one person, and a self-stowing feature, eliminate the need for removal between rig moves.

|

| Fig. 16. The patent-pending skidding system from AXON was designed in response to the needs of a mast equipment package project. |

|

Compact tools aimed at slant and single rigs

Tesco Corporation entered the small rig market with the introduction of the 150-ton HXI top drive (Fig. 17) and compact casing running tool, the HCCDS. Premiered to the industry earlier in the year, these tools have since penetrated the market. Both offerings stem from feedback received from customers to incorporate the firm’s equipment into a smaller compact package without sacrificing any performance. The 150 HXI is a scaled-down version of the globally known 250 HXI. Offering the same key features and benefits, the 150 HXI was designed to integrate into single rigs and slant rigs, for both newbuilds and retrofits. Recently, customers’ applications are looking at converting service rigs to drilling-capable rigs for specific operations. The HCCDS complements the 150 top drive in its compact, lightweight design. Taking the firm’s 500 Casing Drive System with a few design changes, the HCCDS’ overall length has been shortened, yet it still provides operational benefits.

|

| Fig. 17. Tesco’s 150 HXI top drive is designed for small rig, pad drilling of complex wells and horizontals. |

|

Both the HCCDS and 150 HXI went through a trial stage of significant field usage. Les Wilson Inc. was one such drilling contractor that first saw the 150 HXI turn to the right for a well in Indiana. Once this test was completed, Project Drilling pioneered the second trial, which extended the course of four wells and completed the field trial.

With the growing trend to drill horizontals in a pad scenario, TESCO responded to customer demand to have a top drive ideal for drilling these complex wells. Capable of generating 24,000 ft-lb of drill torque, the 150 HXI can take the well from a vertical profile, all the way out to the end of the horizontal. Compact and lightweight, it makes mast transport, and mast raising and lowering, a safer operation that also allows the operator to move faster. Companies in Argentina are already seeing the benefits of using this top drive. After successful field trials in the U.S. with Les Wilson Inc. and Project Drilling, the 150 HXI is now being utilized in the South American market to tackle the region’s need for a compact, high-torque-output top drive. After completion of the recent well programs, the footage tally for the top drive model exceeds 70,000 ft to date.

ADVANCES IN MANAGED PRESSURE DRILLING

Choke and RCD advances contain, control pressure

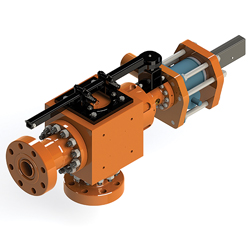

Applying managed pressure drilling (MPD) methods requires a basic set of rig equipment to establish a closed loop circulating system, and to monitor, analyze and control pressure. Key in this lineup is the rotating control device (RCD) that contains and diverts annular flow, and the MPD choke that manages and manipulates the flow.

To improve RCD operation, Halliburton’s Sperry Drilling group has fielded a compact RCD 1000 unit with a patented “no pre-load” design that houses all seals and bearings. The feature extends bearing life and allows easy replacement without tripping out of the hole. Its smaller size facilitates placement without making rig modifications.

Halliburton’s GeoBalance MPD service, which provides a suite of equipment, software, and engineering support for MPD operations, has designed a pump diverter to maintain pressure in the wellbore during trips and connections. Its RPD300 unit is a valve manifold with an onboard choke for diverting flow from rig pumps to provide a fluid supply and adequate flow to meet choke operational requirements. The technology replaces larger backpressure pumps that are typically employed to keep pressure applied to the wellbore, when the mud pumps are off.

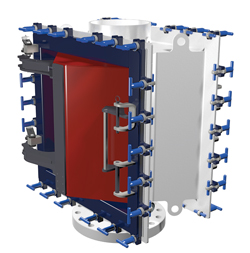

Large orifice, HPHT choke built for MPD extremes

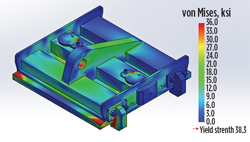

M-I SWACO/Schlumberger has introduced a high-pressure MPD choke to control and manipulate annular backpressure. Its Versa-Choke product (Fig. 18) features a large orifice and high pressure and temperature ratings in models rated for 5,000-, 10,000- and 15,000-psi service. In the higher-pressure models, the choke orifice is adjusted by a specially designed, hydraulically driven worm-gear actuator. The modular technology reduces maintenance time by enabling the actuator to be “hot-swapped” without any internal disassembly. Choke life is extended with reversible trim, and trim size can be varied with a change of internal components.

|

| Fig. 18. A large orifice and HPHT ratings are key MPD features of M-I SWACO’s Versa-Choke. |

|

Riser gas prevented with MPD deployment

Advances in deepwater MPD technology have provided an answer to the long-standing challenge of riser gas. Weatherford deployed the industry’s first riser-integrated RCD, the below-the-tension-ring Model 7875 BTR, aboard a drillship in 2010 to fully enable deepwater MPD, Fig. 19. Since then, experience has shown that automated MPD control of wellbore pressure prevents riser gas by eliminating the conditions that lead to its development in the first place.

|

| Fig. 19. Experience with Weatherford’s Model 7875 BTR shows prevention of development of riser gas. |

|

By detecting and stopping gas influxes at the onset, while they are very small, MPD minimizes and manages the entrainment of gas before it can break out of solution in the riser. Of the numerous deepwater MPD applications that it has conducted, Weatherford reports that no instances of riser gas were experienced. This capability removes a significant well control risk that is conventionally mitigated by venting gas in the riser to a high-rate mud-gas separator.

ADVANCES IN FLUID SYSTEMS

Shaker adjusts on the fly

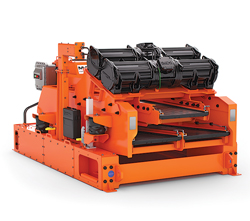

A new, four-panel shale shaker from Derrick Equipment Company allows the angle of the screen deck to be adjusted on the fly, to achieve the best performance without interrupting operations. The Hyperpool shaker can be configured as the primary shaker and mud cleaner, or as a secondary drier for drill cuttings. Its adjustable-while-drilling feature permits the screen deck angle to be lowered and raised within a range of +3° to +8°, respectively.

Two Derrick Super G vibratory motors apply more than 8-G acceleration to the screen frame. A greased-for-life, motor bearing system eliminates the need for lubrication, reducing maintenance and repair costs.

The shaker increases capacity over similar Derrick models, up to 35% in the same footprint. Fluid centering technology and a concave screen bed maximize fluid throughput. The larger, non-blanked API screen area significantly increases capacity over conventional shakers and, in some cases, may reduce the number of shakers required.

Shaker matches to the task by changing motion

A dual-deck shale shaker from M-I SWACO provides flexibility in responding to variations in drilling conditions and cuttings volume, Fig. 20. Equipped with DuraFlow composite screens, the MD-2 shaker can double the capacity of a standard single-deck stacker.

|

| Fig. 20. Dual decks and motion options provide performance with M-I Swaco’s MD-2 shaker. |

|

At the flip of a switch, the shaker changes between balanced and progressive elliptical motion. This option provides 7-G balanced motion for larger cuttings, and higher fluid capacity and conveyance rate. Progressive motion at 6.5-G acceleration produces a thin ellipse to remove solids, and a wide ellipse for drier cuttings.

The compact mid-range shaker features full primary and half-width scalping decks with adjustable angles to handle variations in drilling conditions, different fluid types, and solids. The scalping deck has a 4° adjustment range, and the primary deck can be adjusted between +3° to +7°.

The shaker accepts most gas detection devices and can be equipped with an optional fume extraction system for removing gas.

ADVANCES IN PROCESS ENHANCEMENTS

Magnet system prevents downhole litter

The recovery of objects dropped in the hole, and the capture of metal in the fluid system, is the objective of a novel magnetic device from 5D Oilfield Magnetics, Fig. 21. Placed above the BOP, its Open Hole Net (OHN) device catches metal objects dropped into wellbores, such as hand tools, nuts and bolts, and tong dies. Tests that dropped objects from a height of three feet in a water-filled wellbore—with pipe in the hole—have caught a 36-in., 18-lb pipe wrench.

|

| Fig. 21. 5D Oilfield Magnetics’ novel magnetic device, the Open Hole Net, keepsa wrench from becoming a bottomhole tool. |

|

The OHN also catches metal coming out of the wellbore, such as materials from pipe and casing wear, that can affect BOP and annular preventer cavities, and accelerate wear in LWD and MWD systems.

The device is an unpowered mechanical system of magnets in a set of doors that are opened selectively to remove the magnetic field, when running sensitive logging tools, or to retrieve captured metal and objects. Caught objects and materials are removed by draining fluid from the OHN and opening the doors, which is typically a one-man operation.

The OHN is designed for use on all rigs, from workover to marine riser systems. It is available in four sizes, with the unit for 133/8-in. bore BOP system service providing a 15-in. internal diameter.

Tagging pipe provides tracking and insights

The applications for radio frequency identification (RFID) technology continue to grow. Recent innovations have applied the technology to manipulating reamers and circulating subs. Now the move is to drill pipe.

Weatherford’s Smart Iron drill pipe RFID tagging technology (Fig. 22) promises a neat solution to keeping track of individual joints over the life of the pipe. RFID tagging is achieved with an insert that is embedded in the pipe collar, and read with a hand-held device or a reader at the rotary table.

|

| Fig. 22. RFID technology for drill pipe tagging is provided by Weatherford’s Smart Iron system. |

|

Tagging each individual joint sets up the ability to assign and collect various data associated with the pipe, which offers short- and long-term safety and efficiency benefits. Tracking history and usage provides hard-to-come-by data on fatigue, failures, and service interruptions for developing better technologies and practices.

The position of joints in the drill string, run history and downhole usage data, such as rotating hours, can be collected and accessed quickly. Pipe specifications and history, including inspections and maintenance, are immediately available on the rig, as well as remotely.

ADVANCES IN TRAINING

Rig training stresses communications, high-tech simulations

As new technology is fielded and competencies change, rig training remains an integral part of getting the job done. Yet, increasingly, even the training is taking on a decidedly techie feel. Its sophistication reflects the advanced technology and the risks at hand.

Maersk’s drilling rig simulator complex (Fig. 23) in Svendborg, Denmark, is on the leading edge of rig training capabilities and thinking. The facility is based on a team approach to well control training that emphasizes communication and situation handling in a near-real life environment. All the high-end rigs in the Maersk fleet can be recreated virtually in the simulator, including specific equipment and control systems.

|

| Fig. 23. Communication and situation handling in a near-real-life environment are at the heart of Maersk’s new drilling simulator. |

|

The 3D complex includes simulators for drilling, as well as the control room, engine room and crane, to enable integrated training for the full crew. The arrangement allows the entire crew to be trained, together, in communication and interaction, as well as technical skills. Simulations can be conducted for various well control scenarios, including historical industry events. A downhole visualization tool helps trainees better understand the drilling process.

|