KURT ABRAHAM, Executive Editor

|

| A Marcellus shale drilling site in Pennsylvania, operated by Statoil’s partner, Chesapeake Energy. Photo by Helge Hansen, courtesy of Statoil. |

|

Foggy mountain mornings are commonplace in the Appalachian Mountains of Pennsylvania, West Virginia, western New York and southeastern Ohio, home to the Marcellus shale. Early in the morning, at or before sunrise, visibility can be less than one-tenth of a mile.

The fog can make it tough for operator and service trucks to get to wellsites in a timely manner, causing even the most veteran driver to question whether he or she is on the right road, in the right direction. Yet, soon enough, the sun rises and begins to burn off the fog. By mid-morning, drilling sites that were once hidden emerge from the remnants of the fog, their rig masts soaring into the crisp blue sky. Another day is underway in the nation’s most productive shale gas play.

The above vignette serves as a metaphor for what has gone on in the Marcellus shale over the last two years. The fog represents a period of uncertainty, some indecision and reduced activity, all brought on by lower gas prices. The sun rising and burning off the fog represents the slow recovery that has pushed prices north of $3/Mcf, headed, at some point, back to $4/Mcf. The rig and its mast emerging represent both the drilling still taking place to retain acreage, as well as the promise of greater activity, once prices improve.

By comparison, the Utica shale of eastern Ohio and western Pennsylvania needs no literary assistance to tell its tale, producing its own dramatics. While still in the early stages of exploration, the Utica has come a long way in just two years, since the industry switched from drilling vertical exploratory wells to spudding horizontals. Already, two-thirds of Utica horizontals drilled have reported 24-hr initial production (IP) rates of 1,000 boed or more.

What follows are separate, in-depth examinations of both shale plays.

MARCELLUS SHALE

|

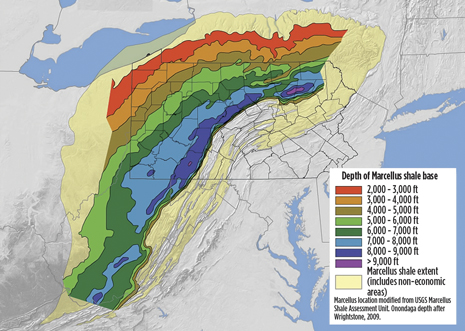

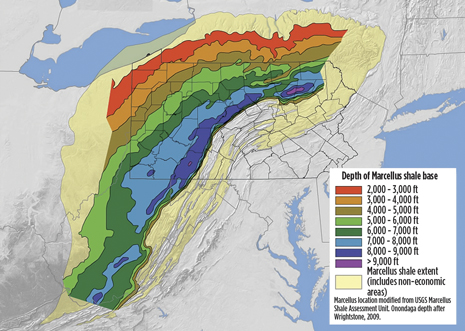

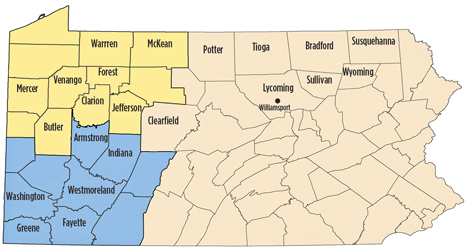

| Fig. 1. The Marcellus shale is now the most productive gas-producing play in the U.S. Map courtesy of Marcellus Center for Outreach and Research, Penn State University. |

|

The Marcellus shale (Fig. 1) has become the largest U.S. natural gas producing play, surpassing the Haynesville of Arkansas, Louisiana and East Texas. That amazing fact was revealed by IHS last month in a new report. Recent pipeline expansions have helped the Marcellus reach a production rate above 7 Bcfgd, exceeding the Haynesville. With this rise in production, noted IHS, the Marcellus’ growth has had a significant, positive impact on its early players, such as Range Resources, which drilled the first horizontal well in the play in 2006, and Cabot Oil & Gas. “The Marcellus has been a game-changer for early entrants Range and Cabot,” said Bryan McNamara, principal energy analyst at IHS.

With natural gas prices averaging $2.75/Mcf during 2012, the number of gas-directed rigs running in the Marcellus fell nearly one-third throughout the year to about 80, noted the report. This caused a considerable drop in the number of wells drilled to 1,365 during 2012, 30% fewer than the peak figure set during 2011. Interestingly, the number of Marcellus permits issued in 2012 fell only 5% from 2011 numbers. Despite decreased activity, returns in the play remain relatively strong, and the Marcellus still has more gas-directed rigs running than any other U.S. play.

Activity has remained strong in Pennsylvania’s top five Marcellus counties: Bradford, Lycoming, Susquehanna, Tioga and Washington. Except for Washington, the other four counties are in the dry gas window, in northeastern Pennsylvania. Drilling in Washington County has been dominated by Range Resources, as activity remains strong, due to the liquids-rich gas stream.

Industry self-regulation. In May 2012, the Appalachian Shale Recommended Practices Group (ASRPG), a consortium of 11 of the region’s largest producers, announced creation of the Recommended Standards and Practices for Exploration and Production of Natural Gas and Oil from Appalachian Shales. The ASRPG’s Recommended Standards and Practices were developed to promote effective safety, environmental and health practices, consistent with key recommendations of both the U.S. Secretary of Energy Advisory Board’s (SEAB) final report (issued in November 2011), and the National Petroleum Council’s (NPC) Prudent Development report (issued in September 2011). Both reports acknowledge regional differences in geology, land use, water resources and regulation.

Consistent with these findings, the Recommended Standards and Practices reflect existing primacy of state regulation in the areas addressed, which encompass each phase of a well’s life cycle. The ASRPG has submitted the recommended standards and practices document to state regulators and legislators in the Appalachian area, as well as industry-related groups and associations.

|

| Fig. 2. Built in West Chester, Pa., the new T500XD Telemast drilling rig is designed for the Marcellus and Utica shales. |

|

New rig technology. Last month, West Chester, Pa.-based, Marcellus Shale Coalition (MSC) member Schramm, Inc., formally unveiled its new, cutting-edge T500XD Telemast drilling rig, Fig. 2. This made-in-Pennsylvania “walking, talking,” easily-movable rig is specially designed the Marcellus and Utica shales. The rig has a 500,000-lb. hookload and breaks down into a compact, eight-truckload package. It features full 360o “walking” portability for fast moves from hole to hole, without the traditional limits of two-axis pad-mounted designs.

The T500XD also “talks” by offering full communication interface connectivity to third-party data acquisition providers that utilize the Internet or dedicated satellite communications systems to remote operational centers in multiple locations. Specifically designed for horizontal and directional drilling to a TD of 15,000 ft or more, the T500XD can precisely control weight on bit without relying on drill collars and gross string weight, alone. Schramm has been in business for over 100 years and four generations.

Pennsylvania’s perspective. No one is happier about the progress that the Marcellus continues to make than the man who is charged with overseeing its regulation, Pennsylvania Secretary of Environmental Protection Mike Krancer (Editor’s note: As this issue went to press, Secretary Krancer was preparing to step down from his position in mid-April, to take an opportunity in the private sector). “Thanks to the Marcellus, we have seen about 240,000 jobs created statewide,” said Krancer. About 29,000 to 30,000 are directly involved in oil and gas extraction, a 244% increase, just since 2007. Another 200,000 jobs were created indirectly from the increased upstream activity. And of the 240,000 total, about 150,000 were new hires. The average salary in core E&P jobs is $83,000/year, while the average ancillary salary is $65,000/year. So, it’s been a major economic gain for Pennsylvania.”

|

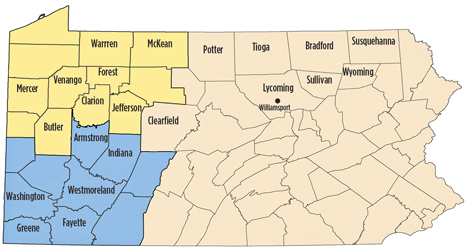

| Fig. 3. The Marcellus is revitalizing the economies of many Pennsylvania towns that had fallen on hard times, such as Williamsport, in Lycoming County, in the northeastern part of the state. Map courtesy of Pennsylvania Department of Environmental Protection. |

|

Krancer noted that the Marcellus is revitalizing the economies of many Pennsylvania towns that had fallen on hard times. “In Williamsport, in Lycoming County, in northeastern Pennsylvania (Fig. 3), they have GDP growth of 7.8%,” said Krancer. “That is the seventh highest GDP growth in the country. Contrast this with average GDP growth in the U.S. of just 2.5%. Of course, unemployment is much lower in Williamsport and in all Marcellus areas, so we have a double effect of not only lowering unemployment but also having people jump into the area, because they have the hope of finding a job. Thus, more people are coming out of the ‘give up’ category of unemployment.” What this has meant, in terms of tax revenues, is that all those new producing areas are paying state income tax. As Krancer noted, the industry, itself, has paid $1.6 billion in taxes since 2006.

Krancer continues to be impressed with individual well productivity and the state’s ever-growing gas production. “I think that if you talk to geologists, they’ll tell you that the wells are off the charts,” offered Krancer. “Take this trend in Pennsylvania’s gas production—1.2 Bcfgd in 2010, followed by 3.6 Bcfgd in 2011, 6.0 Bcfgd in 2012 and 8.0 Bcfgd today. That last number is a 69% increase from 2011. In 2009, that number was under 1.0 Bcfgd. Electricity and natural gas prices in Pennsylvania are down 40% and 50% respectively, since 2008, saving consumers nearly $1,000 a year.”

Krancer continued, “What you find is that the number of wells drilled may have leveled off or dipped, yet production has skyrocketed. From my perspective, the rig count is important, but the critical factor is the production of gas and liquids. Fracturing is not a new technology in our area of the country, but the consistent use of horizontal drilling is something new here. I can’t understate the potential for oil production in Pennsylvania.”

Something that Krancer emphasizes is the environmental end of industry regulation, and the importance that he and Governor Tom Corbett put on responsible energy development in Pennsylvania. “That’s job number one,” said Krancer. “We’ve been visited by people all over the world, who are taking lessons from us on how to do this. We have the best regulatory program in the country, when it comes to unconventional energy—downhole, surface, environmental, etc. By the same token, the Safe Drinking Water Act was never designed to affect regulation of hydraulic fracturing. No Congress or President had ever mentioned doing this until the current administration. Traditionally, the regulation of safe energy development had been left to the states as the primary regulators.”

West Virginia’s outlook. In a state where coal has been king for so many years, oil and gas were an afterthought. With the Marcellus’ success, much has changed, including the role of the West Virginia Oil & Natural Gas Association, said Executive Director, Corky Demarco. “Some years back, we had just 39 members,” said Demarco. “But with all the activity in the Marcellus, we’re now up to 225 members. It’s a busier place here.”

West Virginia’s economy has benefitted from the Marcellus, added Demarco. “We’re one of the few states operating in the black. The Marcellus is making up for some of the shortfall coming from companies not being able to mine some of the coal, due to federal regulations. In some of these areas, we’ve seen a big pick-up in support businesses, like motels, restaurants, dry cleaners, etc. These things are really helping the smaller towns. The overall state economy may be showing just a small increase, due to coal being down, but the pickup from oil and gas is huge. People are starting to realize, that we can be all that we thought we could be, thanks to all this energy development.”

Demarco is optimistic about the Marcellus’ future in his state. “The West Virginia rig count is between 24 and 28, and has been in that range over the last three years,” he said. “Permits are steady or slowly increasing. In fact, there were 615 Marcellus permits last year, and we’ve already had 139 filed during the first three months of 2013. The wet zone is in the western part of the state. We’ve got a fair amount of stranded gas while the mid-stream infrastructure is being constructed. There’s a lot of pipe being put into the ground and a lot of fractionation and liquids extraction facilities being built.”

The number of operators remains steady, said Demarco, with EQT, Antero, Noble, Chesapeake, XTO and CONSOL as the main operators. “Those are the companies with leases in the wet zone,” he explained. “I think we will continue to drill. As prices increase, we hopefully will see more rigs running. The gas will flow, as the facilities are completed. I wouldn’t suspect any activity cutback at all this year. If anything, we’ll see an increase. As prices get back around $4/Mcf, we’ll even see an increase in dry gas activity.”

New York state. Shale activity remains frozen by the state’s inability to resolve the fracing issue. The industry has waited five years for officials to reach some decision, yet the administration of Gov. Andrew Cuomo has missed several deadlines to either formally permit or deny fracing.

Meanwhile, three more Marcellus shale drilling applications from ExxonMobil subsidiary, XTO Energy, were quietly entered into New York state’s electronic records during February 2013, without any mainstream news reporting and with zero fanfare, said the blogspot, nyshalegasnow.com. Adding these three to two previous XTO filings in October 2012, the company now has five well projects sitting in New York’s stalled shale gas queue. According to the blogspot, these filings are XTO’s first applications statewide in New York. They’re also the first horizontal shale gas requests from a large operator, since New York started informally refusing such applications during the early months of a now five-year-old bureaucratic blockade against shale drilling. A number of pre- and early-moratorium applications still technically sit idle within the state’s records. Yet, many underlying leases have lapsed in the meantime, or fallen under the legal confusion of the state’s use of force majeure, and will have to be completely re-filed.

XTO’s filings are in Broome County’s easternmost Sanford Township or the adjoining Township of Deposit in Delaware County. While the Deposit filing appears to sit entirely within the Delaware River drainage, Sanford straddles the watershed divide between the incapacitated Delaware basin, and the more active Susquehanna River drainage area, bureaucratically speaking. Nonetheless, the surface pads for these XTO wells are proposed for tracts that ultimately drain to the Delaware. This means that XTO has inexplicably gotten into an area that’s been long blocked by moratoria.

The first moratorium goes back to Feb. 15, 2008, when New York officials first stalled any shale gas application statewide. Then, since July 23, 2008, the date that the still-unresolved SGEIS (Supplemental Generic Environmental Impact Statement) process began, state officials have engaged in studious delay.

For the second moratorium, as the blog site notes, the federal-state compact Delaware River Basin Commission (DRBC) has been unable to reach a consensus, or even take a vote, on its own version of overlapping regulations governing shale activity, forcing officials to delay shale drilling applications.

Operator activity–Range Resources. The company has 1.0 million net acres in the Pennsylvanian Marcellus, including 145,000 net acres in the northeast, 540,000 in the southwest and 315,000 in the northwest. During fourth-quarter 2012, Range exceeded its production goal of 600 MMcfed, finishing the year with an average Marcellus output of 622.4 MMcfed, a figure 80% greater than the 2011 average. Approximately 88%, or 5.746 Tcfe, of Range’s reserves are in the Marcellus.

The firm had 689 proven drilling locations, as of Dec. 31, 2012. During 2012, Range drilled 132.8 net development wells and 51.4 net exploratory wells in the Marcellus, all successful. During last year, the company ran 11 drilling rigs in the field. In 2013, Range will direct over 75% of its capital budget toward development drilling in the region, including 123.5 net wells and an average seven rigs.

In northeastern Pennsylvania, Range is running one to two rigs to hold acreage. In addition to Lycoming County, wells have been tested in Clinton and Centre Counties. About 69% of this acreage is held by production (HBP). Estimated ultimate recovery (EUR) is 8.5 Bcf/well. Drilling and completion costs per well are $5.0 million.

In southwestern Pennsylvania, 51% of acreage is HBP. It is this area in which Range tested the Marcellus discovery well in 2004, and first production began in 2005. Range divides the 540,000 acres further into three categories—Wet Gas (220,000 acres), Super-Rich (110,000 acres) and Dry Gas (210,000 acres).

In the Wet Gas area, more than 200 wells have gone onstream over the last four years. In one 62-well group, average lateral length was 3,200 ft, and the frac stage average was 13. Average per-well EUR is 8.7 Bcfe. For 2013, Range will drill 3,200-ft laterals with 13 frac stages as its “typical” wells. Average cost per well is $4.9 million.

In the Super-Rich Marcellus of southwestern Pennsylvania, the company placed 51 Super-Rich wells onstream, with average laterals of 3,895 ft and 15 frac stages. During 2012, average per-well EUR in the Super-Rich area was 1.32 MMboe. If wells drilled in 2013 have 18 stages, as planned, then per-well EUR will rise to 1.44 MMboe. Average cost per well is $5.1 million.

In the Dry Gas portion of southwestern Pennsylvania, 53% of horizontal wells drilled have projected recoveries of 5 to 20 Bcf of gas. The company’s dry gas acreage is predominantly HBP. Average well cost is $5.0 million.

Chesapeake Energy. Chesapeake holds 1.8 million net acres in the Marcellus, including 1.5 million in the northern dry gas portion, and 285,000 in the southern wet gas section. Its fourth-quarter 2012 daily net production in the northern portion was 645 MMcfed (1.485 Bcfed, gross operated), up 135% year-on-year, and 19% sequentially. In the southern, wet Marcellus, net output was 155 MMcfed (260 MMcfed, gross operated). Production will remain flat until the ATEX pipeline comes online later this year.

|

| Fig. 4. Chesapeake has reduced its rig count to five in the northern Marcellus and three in the south. Photo courtesy of Pennsylvania Department of Environmental Protection. |

|

To reduce capex, the operated rig count has been reduced to five in the northern Marcellus and three in the south Fig. 4. Three wells completed in the north during fourth-quarter 2012 achieved peak output between 10.5 MMcfgd and 12.6 MMcfgd. In the south, Chesapeake completed three wells that initially tested between 955 and 1,195 boed. About 6% of capex for 2013 will go to activity in the north, while another 8% will be directed toward the south.

Anadarko Petroleum. This operator holds more than 260,000 net acres in Bradford, Centre, Clinton, Lycoming, Potter, Sullivan and Tioga counties of Pennsylvania. Since 2006, Anadarko has produced about 350 Bcfg and invested approximately $5 billion in Pennsylvania and Marcellus activities.

Last year, Anadarko spudded 78 operated horizontal wells, and 77 were brought online, utilizing an average five rigs. Anadarko produces more than 1.0 Bcfgd, gross.

EQT. The firm holds 530,000 acres in the Marcellus. In 2012, EQT began drilling 127 gross horizontal wells, with an aggregate of about 700,000 ft of pay. Average well cost was $7.3 million, with a per-well EUR of 8.8 Bcfe. Total proved reserves increased 25% last year, to 4.3 Tcfe, primarily as a result of drilling.

Natural gas production in 2012 from the Marcellus was 150.5 Bcfe. As of Dec. 31, EQT’s proved undeveloped reserves totaled 3.2 Tcfe. Of 153 wells planned for 2013, 134 will utilize reduced cluster spacing. Average lateral length will be 4,500 ft.

CONSOL Energy. The company holds 361,000 net Marcellus acres in Pennsylvania, West Virginia and New York. In September 2011, CONSOL Energy entered into a 50-50 JV with Noble Energy regarding its Marcellus assets and properties in West Virginia and Pennsylvania. The JV holds 628,000 net Marcellus acres in those states, as well as the producing wells that CONSOL had owned.

The company has proved, developed reserves of 1.805 Tcfge, up 105% from 2011’s level. CONSOL more than doubled its Marcellus production last year, to about 135 MMcfed. There were 64 Marcellus wells drilled, with 51 completed. This compares to 78 wells drilled in 2011, with 57 completed. Average lateral length increased 43% to 5,514 ft. Average TMD increased 12%, to 13,280 ft.

CONSOL’s well and project costs, overall, are decreasing, with a few exceptions. Average lateral cost decreased 4.2%, to $529/ft. On the other hand, average drilling cost, overall, rose 22.2%, to $220/ft. The average number of frac stages increased 50%, to 18/well. Average cost per stage declined 10.2% to $184,000.

At an investor presentation in February, CONSOL said that it will drill 23 dry gas wells in southwestern Pennsylvania, versus 45 in 2012. Similarly, the firm will drill five dry gas wells in central Pennsylvania, versus 13 in 2012. However, in northern West Virginia, CONSOL will increase drilling 33%, to eight wells. By contrast, the company will more than triple its drilling of wet gas wells in West Virginia to 85 to 90, versus just 25 in 2012.

Antero Resources. Antero holds 305,000 net acres in northern West Virginia and southwestern Pennsylvania, all in the southwestern Marcellus. Net production is 389 MMcfed, which includes 2,600 bpd of NGLs and oil. Antero has drilled and completed 140 horizontal wells, of which 135 are online, and is in the process of drilling and completing 44 additional horizontals. Five recently completed wells in the rich gas area are shut-in, waiting on pipeline. The firm is operating 13 drilling rigs in West Virginia.

Ultra Petroleum. Roughly 260,000 net acres in the Pennsylvanian Marcellus are held by Ultra, including 170,000 in Potter and Tioga Counties. Seventy percent are HBP, represented by 202 horizontal producers. In Clinton and Lycoming Counties, 90,000 net acres, or 80%, are HBP, with 120 horizontal producers.

The company drilled 68 gross horizontal wells during all of 2012 and initiated production from 117 gross wells. Ultra’s production for 2012 grew 66%, year-over-year, from 43.3 Bcfe produced during 2011.

In a March 2013 investor presentation, Ultra Chairman, President & CEO Mike Watford said that average IP in the firm’s wells ranged from 5.0 MMcfgd to 7.7 MMcfed. Average well costs to completion have ranged from $6.2 million to $7.2 million. Compared to first-quarter 2012 figures, Ultra’s well costs in fourth-quarter 2012 were down 17% in Potter and Tioga Counties, and down 19% in Clinton and Lycoming Counties.

Watford said that strategically, Ultra is still in the early stages of its Marcellus development. At the end of 2012, the company had 322 producing wells, compared to 204 a year earlier. For 2013, the firm will drill 30 gross (15 net) wells and put 41 gross (20 net) wells online.

Talisman Energy. The firm holds 208,000 acres in the Pennsylvanian Marcellus. Gas production last year averaged 514 MMcfd. The 2P reserves are 2.4 Tcfe, and the company has about 1,600 remaining well locations, based on 80-acre spacing. Last year’s EUR per well was 5.8 Bcf Talisman expects its 2013 Marcellus capex to be about $150 million, while gas production will average 410 MMcfd to 420 MMcfd.

Cabot Oil & Gas. The operator holds 200,000 net acres, of which 43% are HBP. This compares to 29% HBP in 2011. For 2013, Cabot expects to achieve a 60% HBP factor. Last year, Cabot achieved record gross Marcellus production of 1.038 Bcfd. In addition, the firm, according to Pennsylvania state data, had 15 of the top 20 Marcellus horizontal wells during 2012, in terms of Bcf of cumulative production. “While we derive value from each of our plays, the Marcellus continues to be the primary contributor to our recent success,” said Chairman, President & CEO Dan Dinges in February 2013. Among other successes, Cabot had a 13-stage well with an IP of 28.5 MMcfgd and a 30-day average of 20.2 MMcfgd. There was also a four-well pad with a combined 24-hr peak of 92 MMcfgd. One 35-stage well had a 24-hr peak of 41.4 MMcfgd and a 30-day average of 35.9 MMcfgd.

|

| Fig. 5. Cabot Oil & Gas has increased its frac stages per well 13.5%, while reducing the cost per stage significantly. Photo courtesy of Pennsylvania Department of Environmental Protection. |

|

Drilling activity last year totaled 69.7 net wells, as the firm implemented 200-ft stage spacing. As of early 2013, the company had 236 wells producing, including 197 horizontals and 39 verticals. Average horizontal length increased 8%, to 4,100 ft. Average number of frac stages increased 13.5%, to 17.7, Fig. 5. Average EUR rose 7%, to 14.1 Bcf. The firm also reduced the average number of drilling days to TD to 16, with four wells being drilled to TD in a record 10 days. Completion cost per frac stage was also reduced to $105,000 in 2012, compared to $150,000 in 2011 and $165,000 in 2010.

This year, the firm will focus more on development, and conduct additional testing of the Upper Marcellus. The company also will operate five rigs and spud 85 wells. The 2013 program will average slightly longer laterals than in 2012. During this year, the program will utilize 200-ft frac stage spacing exclusively.

Southwestern Energy. At year-end 2012, the company held 176,298 Marcellus acres in northeastern Pennsylvania. Gross operated production was 300 MMcfgd from 71 horizontal wells, up from 133 MMcfgd at the beginning of 2012. Net production was 53.6 Bcf in 2012, up 130%. In 2012, Southwestern invested approximately $507 million in the Marcellus, including $400 million to spud 92 wells. Including midstream operations, the company expects to spend $800 million on the Marcellus this year, and drill 86 to 88 wells.

Carrizo Oil & Gas. The company holds 80,500 net acres in the Marcellus, with 13 MMboe of proved reserves. During 2012, Carrizo used its Marcellus production growth to offset output losses sustained through the sale of its Barnett shale production in Texas. Production was 150,552 MMcfge last year, up 84.5% from 81,602 MMcfge in 2011.

Most Pennsylvania wells have depths ranging from 5,000 to 8,000 ft. West Virginia well depths range from 2,500 to 6,500 ft. The company drilled 38 wells last year, with 580 frac stages, or an average 15 stages per well. The wells are performing at, or above, expectations.

This year, activity will be dictated by requirements to hold leases. Carrizo’s capital program will be $70 million, down 11% from $79 million in 2012. The company will drill 33 gross (9.9 net) wells in the Pennsylvania portion and frac 42 gross (13.2 net) wells.

EOG Resources. This firm has gone sour on shale gas, in favor of crude oil, pun intended. In fact, in a March 2013 investor presentation, the company said that nationwide, it would have “negligible” North American dry gas investments.

EOG holds 170,000 net acres in the Pennsylvanian Marcellus. During first-half 2012, EOG continued developing its Marcellus asset, completing 19 wells. The company reduced its operations during second-half 2012, dropping from three drilling rigs to one, with activities focused on Bradford County. During 2012, net gas production averaged 43 MMcfd, a 24% increase over 2011’s level. During 2013, EOG will drill four net wells in Bradford County for acreage retention.

|

| Fig. 6. Having sold reserves and production in West Virginia, Virginia and Kentucky in July 2012 for $100 million, Penn Virginia’s Appalachian operations are now focused on exploring the Pennsylvanian Marcellus. Photo courtesy of Penn Virginia Corp. |

|

Penn Virginia. Following the sale of reserves and production in West Virginia, Virginia and Kentucky in July 2012 for $100 million, Penn Virginia’s Appalachian operations became focused on exploring the Pennsylvanian Marcellus, Fig. 6. The firm operates 150 horizontal drilling locations on about 35,000 net acres in Potter and Tioga Counties, and about 10,000 net acres in southwestern Pennsylvania. Penn Virginia plans to resume testing of its acreage in eastern Potter and western Tioga Counties in 2013 or 2014, subject to the price of gas. The company estimates, as of year-end 2012, that it has 522 MMboe of proved Marcellus reserves.

ExxonMobil. Through its XTO subsidiary, the firm holds about 625,000 net acres in the Marcellus. ExxonMobil made substantial acreage additions in some of its core shale gas plays shortly before natural gas prices declined deeply, into sub-economic territory. Like many of its competitors, the company now faces numerous lease expirations. With its dry gas drilling effort cut to the absolute minimum, ExxonMobil may not be able to hold, by production, all of the acreage it initially intended to keep.

Chevron. With the acquisition of Atlas Energy in 2011, Chevron became a U.S. shale gas producer. Chevron is, thus, one of the largest Pennsylvania Marcellus leaseholders, controlling roughly 714,000 acres. During 2012, 100 development wells were drilled, mostly funded by a 75% drilling carry. Chevron had 10 rigs in operation at year-end. In light of market conditions, development is proceeding at a measured pace.

Stone Energy. The firm owns 90,000 acres of Marcellus leasehold rights in West Virginia and Pennsylvania, and is actively looking to expand its operations. Stone’s Marcellus production last year was about 40 MMcfgd, and the firm expects that figure to grow nearly 50% this year, to about 60 MMcfgd. The company held about 300 Bcfe of gas and liquid reserves last year, and officials predict that this will grow to about 400 Bcfe by the end of 2013. Stone’s drilling costs continue to come down. In 2010, the per-well cost was about $6.75 million, decreasing to approximately $6.3 million in 2012. During 2013, the cost should approach just $6.0 million. The company in 2013 will stay focused on liquids-rich areas while maintaining a one-horizontal rig program that drills 25 to 30 wells.

Exco Resources. The company holds 128,000 net acres. Net production of 43 MMcfgd from Marcellus wells represents a 73% increase from year-end 2011. During 2012, 38 wells were put onstream. Exco said that recent results in northeastern and central Pennsylvania represent some of the firm’s best wells drilled to date, with IPs exceeding 7.0 MMcfgd. During 2012, drilling costs fell 46%, and completion costs declined 11%.

For 2013, the focus is on appraisals in northeastern and central Pennsylvania. Development drilling is on hold at current gas prices. Exco is running one operated rig during first-half 2013, focusing on delineation of select acreage blocks.

Noble Energy. The firm’s Marcellus presence began in 2011 by virtue of a JV agreement with CONSOL Energy. While CONSOL operates rigs in the dry gas portion, Noble will focus on the wet gas areas. Noble will and have the potential to reach net output of 600 MMcfed in 2015. Noble holds 314,000 net acres, with net resources increasing 41% to 10 Tcfe. About 87% of acreage is HBP. Marcellus production more than doubled in 2012, to 140 MMcfgd.

For 2013, Noble will increase its wet gas rig count from three to six and target 85 wells. The company will maintain two rigs in the dry gas area to drill 55 wells.

UTICA SHALE

|

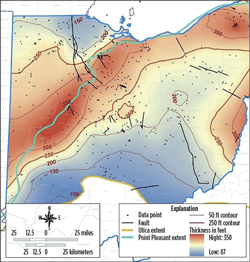

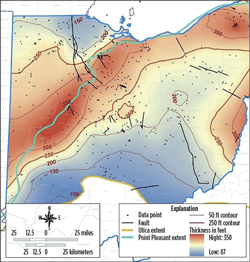

| Fig. 7. The Utica/Point Pleasant shale in Ohio and western Pennsylvania is somewhat analogous to the Eagle Ford shale of South Texas, featuring an extensive prospective area, vast resource potential, and three hydrocarbon-prone areas (oil, wet gas and dry gas). Map courtesy of Ohio Department of Natural Resources. |

|

According to a recent IHS report, it is still premature to conclude that the Utica/Point Pleasant shale in Ohio and western Pennsylvania will be as productive as the Eagle Ford shale in Texas, yet the Utica is, in many ways, analogous to the Eagle Ford, and early results are encouraging. Similarities include an extensive prospective area, vast resource potential, and three hydrocarbon-prone areas (oil, wet gas and dry gas), Fig. 7.

“To date, horizontal drilling results in the Utica have been very encouraging, with activity, so far, focused on targets within the wet gas window,” said Andrew Byrne, IHS director of energy equity research. “Approximately two-thirds of the horizontal wells drilled on the play have reported 24-hr IP rates of 1,000 boed or more, which supports our opinion that early results are encouraging. However, the Utica is still in the very early stages of exploration.” The most productive liquids-rich wells, so far, have been in Harrison and Carroll Counties in Ohio.

According to IHS figures, more than 135 drilling permits have been granted for Utica horizontal wells, but only 11 have been completed with IP test volumes. Utica drilling depths range from about 6,000 ft to approximately 9,000 ft, TVD, as compared to a typical Eagle Ford well with depths ranging from 9,500 feet, TVD, to 11,500 feet, TVD. Chesapeake’s Buell-8H (Utica) well in Harrison County, Ohio, has delivered the best production (1,350 boed) to date, and has an 8,564-ft TVD.

According to the IHS report, Ohio only reports production on an annual basis, so a true, peak, 30-day rate is not available. IHS derived “an inferred” 30-day peak rate by taking the actual 24-hr IP rate and reducing it 40%, which analysts determined was a reasonable number. The three best Utica wells have calculated output rates greater than 750 boed. However, all three are in the gas-prone window and are flowed 100% natural gas.

“Based on our early research, it appears the vast majority of the Utica liquids volumes are lower-value NGLs. Therefore, much of the economic outlook for the play relies upon not only gas prices, which remain low, but also prices for (NGLs), which have been highly volatile,” said Byrne. The initial horizontal drilling results in the oil-prone window are just becoming available, including recent results reported by Anadarko. The best oil-weighted well drilled to date is the Anadarko Brookfield well in Noble County during first-quarter 2012, which tested at a 24-hr IP of 731 boed (82% oil and condensate).

Ohio’s perspective. Someone who can appreciate what the Utica means to Ohio, and who has seen the best and worst times for the state’s industry, is Tom Stewart, executive vice president of the Ohio Oil & Gas Association (OOGA). “I’m encouraged by what I’ve seen so far,” said Stewart. “There have been some outstanding wells drilled, gas wells in particular, with high Btu gas, plus condensate that is being stripped out.”

Stewart said that regulators and companies believe that a sweet spot has been found in the Utica, within Ohio. “It appears that a sweet spot has developed in Carroll and Columbiana Counties, two to three townships wide, touching five counties, and tailing out in Noble County,” explained Stewart. “This is interesting, because Noble County is the site of the very first commercial well in Ohio in 1860. John D. Rockefeller’s children have come home; ExxonMobil is here.”

Stewart said that because Ohio only requires operators to provide production reports on individual wells once a year, it has been hard to gauge the productivity and reliability of Utica wells to date. In fact, the April 2012 production report from the DNR, covering 2011 data, included figures on only nine Utica wells, all operated by Chesapeake. That situation should change somewhat with the release of the April 2013 report, which was due out as this issue went to press.

The Utica, said Stewart, remains a somewhat temperamental play. “If you go east of the sweet spot, toward Pennsylvania, the gas becomes drier, so that puts a stress on the economics. If you move west of this fairway, you move into the ‘mythical’ oil window. The oil window has not worked out very well yet. However, I remain hopeful that this is a technical issue that eventually will work out. As you move west, you tend to move into traditional areas of oil production, where many of our members have been active, and I’d like to see them share in this bountiful shale. So, we hope that the western portion of the Utica begins to fulfill its potential.”

A primary problem, noted Stewart, is that most traditional Ohio producers, who are small-to-medium independents, have done very well over the years, but they still lack the capital and expertise to do sophisticated shale development. “Some have contributed their resources to JVs with bigger players,” explained Stewart. “So, we want that oil window to happen; we want our members to benefit from it. It’s hard for a traditional member to justify drilling a conventional well reservoir and even more so to reach the hurdle rate for a shale well.

“Clearly, the Utica has great promise for the future, and we welcome the new, larger players that have come into Ohio to develop it,” added Stewart. “In fact, to my utter amazement, our membership has grown, thanks to the larger companies working the shales, and I’ve now got ExxonMobil and other companies like them as members. So, together, we have fought on regulatory and environmental issues as a united front, a united industry. We won’t allow people to screw up the Utica. This is the next wave of E&P, and you have no choice but to embrace it.”

Operator activity–CONSOL Energy.

The firm controls 114,000 net Utica acres in southeastern Ohio, southwestern Pennsylvania, and northern West Virginia. Additionally, CONSOL controls a large number of acres that contain Utica rights but are disclosed in other plays. Utica thickness in this area ranges from 200 to 450 ft. Further delineation of Ohio acreage was undertaken during 2012.

To facilitate the delineation, CONSOL entered into a 50-50 JV with Hess Ohio Developments, LLC (Hess) in fourth-quarter 2011. The Hess JV owns approximately 200,000 net acres of Utica rights in Ohio. In its JV with Hess, CONSOL holds 70,000 gross acres, with 35,000 net to the company. Core acreage is held across six Ohio counties, including Belmont, Carroll, Guernsey, Harrison, Jefferson and Noble.

Last year, the company drilled eight Utica wells and completed four. Frac stages varied from seven to 24. One well in particular, the NBL 16A in Noble County, Ohio, was completed with 16 stages. It tested 12.0 MMcfgd and 768 bcpd. CONSOL plans to drill 11 operated wells for 2013, all in Noble County, and participate in 16 additional wells.

Chesapeake Energy. The company is the largest Utica leaseholder, with 1.0 million net acres. In August 2012, the firm sold 72,000 net acres of non-core leaseholdings to affiliates of EnerVest, Ltd. for approximately $358 million in cash.

In just two years, since the play was discovered, Chesapeake has drilled 184 wells, including 45 producing wells, 47 wells drilled, but WOPL, and 92 wells in various stages of completion. The firm expects larger production growth in 2013, as midstream constraints are reduced, and two new third-party gas processing complexes become operational.

Chesapeake is operating 14 Utica rigs. Its remaining drilling carry from Total was about $1.15 billion at the end of 2012. Company officials anticipate using 100% of that carry by the end of 2014.

EQT. In southwestern Guernsey County, Ohio, the company holds 13,600 net acres in the Utica. Average well cost is $9.4 million. The firm will drill eight wells this year, with 6,000-ft average laterals.

Carrizo Oil & Gas. The company holds 28,000 acres in a JV with Avista Capital in the southern Utica of Ohio. Carrizo has exercised its option to raise ownership to 50% of the total acreage purchased, thus resulting in net ownership of 14,000 acres. The company also is buying additional acreage in the southern area as part of a second JV option.

Current acreage has the potential for 110 to 120 net wells. The firm will drill its initial Utica well during second-half 2013. Company officials anticipate development beginning in 2014.

Anadarko Petroleum. As reported by the Akron Beacon Journal in mid-March, the company has suspended plans to drill in the Utica beneath the Wilds animal preserve in Muskingum County, and quite possibly the rest of Ohio. Anadarko still owns the rights beneath the 9,000-acre Wilds preserve, which is home to giraffes, rhinos and zebras. It can drill an additional 141,000 acres across eastern Ohio under a lease it signed in 2011.

ExxonMobil. Through its XTO subsidiary, the firm holds 90,000 net acres in the Ohio Utica. The company drilled its first wells during 2012, with completions planned in early 2013.

Chevron. Thanks again to the acquisition of Atlas Energy, Chevron has about 491,000 Utica acres. Activity during 2012 included acquisition of regional seismic data in eastern Ohio to identify core areas. The company began drilling four exploratory wells during the year, with an eye toward development.

EnerVest Ltd. This company is Ohio’s largest operator, accounting for 25% of production. It also holds 800,000 acres in the Utica, along with its subsidiary, EV Energy Partners. However, EnerVest seems to be having second thoughts about that acreage and the liquids component.

Back in September 2012, EnerVest put 539,000 acres in the Utica up for sale, thinking that it would generate about $6 billion for the company. The firm had hoped to reach a deal by the end of 2012. As of mid-March 2013, no deal had materialized, and EnerVest reportedly had reduced the offering to 108,000 acres.

Range Resources. In northwestern Pennsylvania, Range drilled its first Utica well (50% WI). The well encountered 285 ft of pay at about 7,000 ft. The well confirmed that Range is in the wet gas window, and there is good pressure. Diagnostics indicate that the well was not effectively stimulated and, to date, has tested at just over 1.4 MMcfed. However, the firm is encouraged by the well data and will eventually drill another test.

Antero Resources. The firm has 88,000 net acres in eastern Ohio in the Utica’s rich gas/condensate window. Antero has drilled and completed three horizontal wells with encouraging results. One well is online, and two wells are shut-in, awaiting infrastructure. The firm is drilling and completing six additional horizontal wells.

|