Making informed human resources decisions based on workforce outlook

Younger and locally based workforces in developing nations will likely take on larger roles in the oil and gas industry. Companies will need knowledge transfer, training initiatives and mentorship programs to help smooth this transition.

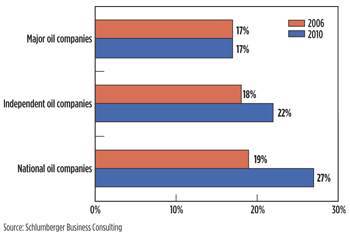

RECRUITMENT & RETENTIONMaking informed human resources decisions based on workforce outlookYounger and locally based workforces in developing nations will likely take on larger roles in the oil and gas industry. Companies will need knowledge transfer, training initiatives and mentorship programs to help smooth this transition.JILL TENNANT, Gulf Research All industries struggle to balance and optimize their workforce needs, and the oil and gas industry is by no means an exception. Economic conditions, aging populations, availability of potential workers, and competition for skilled labor affect the dynamics of the constantly changing oil and gas workforce. Recruiting and retaining productive, loyal workers affects both the company’s financial bottom line, as well as its perceived image. Understanding both the current and forecasted states of the oil and gas workforce, in addition to recognizing the unique factors that drive individual workers’ attitudes and choices, helps companies make better employment decisions and plans. CURRENT WORKFORCE The oil and gas industry employs millions of workers—men and women, imported and local labor, direct hires and contractors, and millennials through baby boomers. Although the industry continues to remain male-dominated, trends are changing. For instance, Fig. 1 shows that the percentage of women geoscientists employed at various surveyed national, major and independent oil companies, which together accounted for 30% of the world’s oil production, increased from 2006 to 2010, most notably at national oil companies. Interestingly, Schlumberger Business Consulting’s 2010 Oil and Gas HR Benchmark Survey noted that while North American schools awarded only 20% of their geoscience and petroleum engineering degrees to women, the percentage is double for Asian schools.

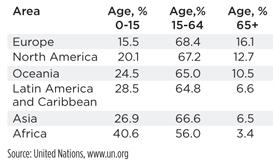

Despite some progress, including a recent uptick in U.S. engineering degrees awarded to women, challenges remain. A June 2011 Bloomberg Rankings report indicated that the Standard & Poor’s 500 list included 29 companies that had no women in decision-making roles, defined as being the top five highest-paid officers and the board of directors. Thirty-one percent of these companies (nine of the total 29 companies) were in the oil and gas industry. The researchers found that the oil and gas industry had the lowest percentage of women directors, as compared to all other industries (only 9.6%). Another issue that global oil and gas companies face is the mandate of host nations and national oil companies regarding local content programs, to hire and develop local workers. Despite the efforts to employ local labor, the use of imported (expatriate) labor remains common. The Oil & Gas Global Salary Guide 2011, a collaborative effort between Hays Oil & Gas and Oil and Gas Job Search, found that about 41.9% of its survey respondents reported working in a country not of their origin. The survey of 10,800 oil and gas workers in over 50 countries indicated that 90% of the respondents working in Middle Eastern countries were not native to those countries, the largest percentage of any region surveyed. Contract labor is another way that companies obtain necessary skills and allow for greater staffing flexibility. Insurance issues, contractor labor rates, location, type of work performed, and the desire for a stable workforce in a competitive environment all affect a company’s balance of permanent vs. contract labor. The percentage of local vs. imported contract labor varies by company and region. For instance, according to national oil company Saudi Aramco’s 2010 Corporate Citizenship Report, 87% of its direct employees, compared to only 25% of its contractor labor are Saudi Arabians. Companies must also address the varying needs and career drivers of their multi-generational workforce. The U.S. Department of Labor estimates that the average age of the American oil and gas worker at about 50 years old. Oceania and Western European countries also have older populations as compared to other areas, Table 1. This makes the hiring of younger personnel, the importing of workers, and the transferring of knowledge from retirement-approaching baby boomers to less experienced workers increasingly urgent.

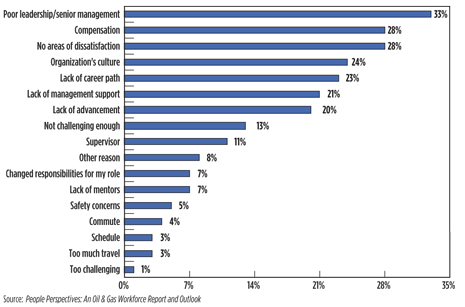

PricewaterhouseCoopers’ 2011 Global CEO Survey found that the recruitment and integration of younger workers was a key challenge for 55% of oil and gas companies, and that the retirement of older workers was a key challenge for 38% of them. In response, over 40% of these CEOs planned to provide different incentives to younger workers, as well as to attempt to recruit and retain their older personnel. WORKFORCE OUTLOOK Although individual companies will adjust the size of their workforces to meet specific business objectives, most industry surveys and analysts predict an overall increase in the size of the global oil and gas workforce. The International Energy Agency (IEA) predicts a growth in oil demand. Shale and oil sands developments, along with new oil field discoveries, will also contribute to the need for additional workers. However, political, regulatory and economic volatility could dampen these predictions. Approximately 76% of the upstream respondents in Gulf Research’s 2011 workforce survey anticipated an increased number of employees and 58% anticipated an increase in the number of contractors in their business group within the next one to two years. For years, industry analysts have used terms like “big crew change” and “talent drain” to describe the effect of the aging oil and gas workforce in many regions of the world. In 2011, the first baby boomers (those born between 1946 and 1964) reached age 65 and the U.S. Bureau of Labor Statistics expects the group of Americans aged 55 and older to increase from 18.1% of the total 2008 workforce to 23.9% of the total 2018 workforce. The median (middle-most) age of all employed Americans increased from 39.4 years in 2000 to 42.0 years in 2010. Additionally, the median age of workers in both the oil and gas extraction sector and the pipeline transportation sector is slightly over 43 years, several years older than the country’s overall working population. Therefore, it is not surprising that the U.S. Department of Labor predicts the retirement of up to 50% of the U.S. energy workforce within 5 to 10 years, given that the average retirement age within the entire energy sector is approximately 55 years. API estimates that one-fourth of U.S. engineers, geoscientists, skilled maintenance professionals, process and production operators, and health and safety professionals are currently eligible for retirement. Likewise, the Petroleum Human Resources Council of Canada predicts that over 30% of the Canadian petroleum industry’s core workforce will retire within the next decade, concurrent with decreases in traditional labor sources. The Council predicts that the exploration and production sector will experience one of the highest retirement rates in the industry, resulting in the loss of valuable knowledge and experience. The European Economic and Social Committee stated in July 2011 that raising statutory retirement age, alone, would not address issues related to an aging European population. The committee believes that the most effective action is to make full use of available employment potential, including young graduates, migrants, and underemployed or unemployed people. However, they acknowledge that there often exists a lack of appropriate or adequate skills among the job candidates. Regardless of the numbers, the face of the industry will most certainly change, as new hires supplement and/or replace aging workers, more women enter science and engineering fields, and people temporarily or permanently relocate in pursuit of better educational and employment opportunities around the world. Younger and locally based workforces in developing nations will likely take on larger roles in the oil and gas industry. Companies will need knowledge transfer, training initiatives, and mentorship programs to help smooth this transition. Yet, according to Gulf Research’s survey, only 33% of all upstream respondents (both technical and management) agreed or strongly agreed that their organizations had effective knowledge transfer programs in place to address the retirement of experienced workers. Likewise, only one-third of the upstream survey respondents reported having access to structured mentorship programs at their organizations. It appears that companies will have to either develop such programs or better communicate the existence of available programs to their personnel. WORKER ATTITUDES Employee turnover costs companies between 25% and 250% of the exiting worker’s salary when considering lost productivity, combined with exit, recruitment and on-boarding costs. Although compensation is an important part of workers’ employment decisions, other aspects also influence them. To provide an overall perspective of the oil and gas workforce, Gulf Research conducted a comprehensive global oil and gas workforce survey of nearly 900 oil and gas workers from around the world. The results are included in People Perspectives: An Oil & Gas Workforce Report and Outlook. Among the many questions posed, the survey asked workers to indicate areas of dissatisfaction with their previous employer, to help determine the reasons that they left the organization. If companies can address the major areas of employee dissatisfaction, they may have a better chance of retaining their workers. Although 28% of the upstream respondents reported no dissatisfaction with their previous organizations, many respondents indicated multiple areas of dissatisfaction, including poor leadership/senior management, compensation, an organization’s culture, lack of career path, and lack of management support, Fig. 2.

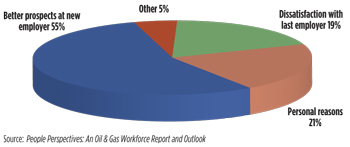

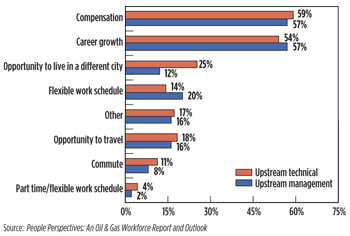

However, 55% of all upstream respondents indicated that the main reason they moved to their current employer was not in response to the above dissatisfactions, but rather in response to seemingly better prospects at a new organization, Fig. 3. Companies must be aware that competitors can lure away workers, even when the workers are seemingly satisfied with their current conditions. Yet only one-third of upstream workers agreed or strongly agreed that their organizations used programs or incentives to retain productive workers. Figure 4 shows that upstream respondents in both technical roles (geologists, engineers, geophysicists, etc.) and management roles (project managers, executive-level managers, etc.) cited similar reasons of attraction to their new employers, mainly compensation and career growth.

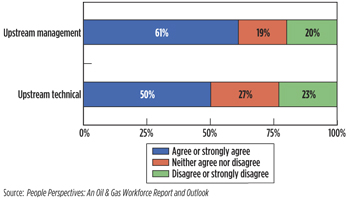

The survey explored both group and individual employment sentiments by asking questions regarding organizational morale and personal motivation. While 55% of all upstream workers reported high morale within their current organizations, those in management positions were more likely to express this sentiment (61%) than those in technical positions (50%), Fig. 5.

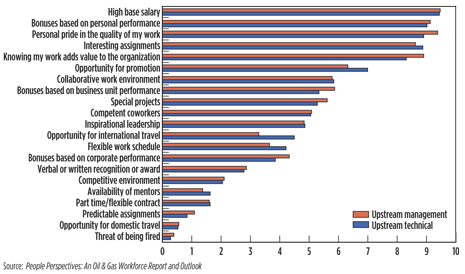

Gulf Research used maximum difference scaling (MaxDiff) to compare the factors that motivated individual workers. Respondents made choices to rank the relative importance of each factor in terms of motivation. The factors totaled a score of 100, and therefore, a factor that rated a score of 10 was twice as important as a factor that rated a five. Compensation was the number one factor that attracted survey respondents to their current organization, so it is not surprising that the MaxDiff results showed that compensation was, overall, the important motivating job factor. Figure 6 shows how upstream technical and management respondents ranked the importance of each factor in terms of motivation. For instance, the opportunities for promotion and international travel were more motivational for those in technical roles than for those in management.

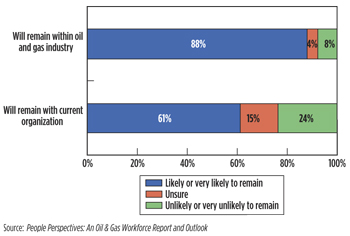

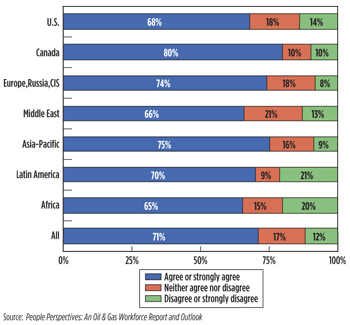

AVAILABILITY OF WORKERS The oil and gas industry obtains its workers from many sources, including science and engineering universities, technical and training programs, and other industries. According to the National Science Foundation, global educational institutions awarded over four million first university (bachelor’s) degrees in science and engineering (S&E) disciplines in the year 2006. Chinese schools awarded the largest percentage of all S&E degrees (21% of the worldwide total), with nearly 63% of those degrees being in engineering. Overall, U.S. schools awarded 78,347 engineering bachelor’s degrees (but less than 1% in petroleum engineering) in the 2009-10 academic year, according to the American Society for Engineering Education. This represented a 5.3% increase from the previous year. The American Geological Institute estimates the 2009–2010 U.S. undergraduate geoscience enrollment at 23,983 and graduate enrollment at 9,054. Although enrollments have increased recently, they have not returned to those levels seen in the early 1980s, when undergraduate enrollment was about 37,000 and graduate enrollment was about 12,000. Despite the increasing number of S&E graduates, Schlumberger Business Consulting’s 2010 Oil & Gas HR Benchmark report anticipated that the supply of geoscience and petroleum engineering graduates would remain tight. Additionally, their survey found that 72% of geoscience and 79% of petroleum engineering graduates come from Asia and Russia/Former Soviet Union, with more than 30% of them from China alone. Therefore, companies will need to change their college recruiting efforts to match the locations of this worldwide talent pool. Many countries accept foreign students to increase university revenues, and to attract highly skilled labor from other parts of the world. The U.S. is the most popular destination for foreign students, and witnessed a 30% increase in Chinese student enrollment and a 25% increase in Saudi Arabian student enrollment in the 2009-10 academic year. China, India and South Korea comprise nearly 44% of all of America’s international university students. The enrollment of Indian students seeking bachelor’s degrees in the U.S. actually decreased in 2009-10. Engineering is one of Indian students’ top three areas of study, and some analysts believe that a strong job market in India has encouraged students to accept well-paying engineering jobs in India, rather than attend graduate schools or study abroad. Likewise, the percentage of Chinese and Indian recipients of U.S. engineering doctoral degrees, who planned to remain in the U.S., has decreased. A decline in the supply of foreign-born engineering students could cause an additional strain on the United States’ oil and gas industry talent pool, given its aging population, but could bolster the workforces within the respective home countries. Besides four-year engineering programs, the oil and gas industry also recruits workers who have obtained specialized training, skills or education through other educational institutions or apprenticeship programs. Community colleges, trade organizations and national oil companies are all trying to address shortages of skilled laborers, especially considering the aging populations in many regions. Another option to help alleviate labor shortages is to seek job candidates from other industries. The Petroleum Human Resources Council of Canada has researched the possibility of transitioning integrated forestry, transportation manufacturing, or chemical manufacturing employees into the upstream petroleum industry. Similarly, the U.S. has successfully transitioned many former aerospace workers and recently returning military veterans into the oil and gas industry. However, many experts report that some areas, particularly offshore work, require previous oil and gas experience. Many companies have also expressed a desire for exploration and production job candidates to be “company” men or women that have industry experience with long-term potential. This can be a challenge for workers in other industries, who are attempting to change career paths. The Gulf Research survey found that most of its upstream respondents only had experience in the oil and gas industry (63% of those in technical roles and 49% in management). For those that had previously worked in other industries, among the most commonly reported categories were construction (11%) and technology (10%). COMPETITION FOR WORKERS Oil and gas companies compete among themselves, as well as among other industries, for the best talent. PricewaterhouseCoopers’ 2011 Global CEO Survey found that nearly 63% of oil and gas company CEOs reported that they were confronting a limited supply of skilled candidates to meet their workforce needs. Approximately 61% of the oil and gas company CEOs stated that competitor recruitment of their best people was a key talent challenge that they expected to face in the next three years. Gulf Research’s survey supports these concerns. Assuming it was their decision, 88% of surveyed upstream workers indicated they were likely or very likely to remain in the oil and gas industry, but just 61% were likely or very likely to remain at their current organizations for the next five years, indicating a willingness and/or desire to switch companies, Fig. 7. The survey also reflects industry concerns regarding skills shortages. Figure 8 indicates that, regardless of region, the majority of oil and gas workers perceive a lack of people within their organizations to fill specific roles. Canadian respondents perceived the greatest labor shortage (80%), as compared to the global average of 71%.

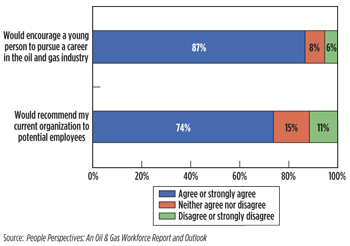

The oil and gas industry also competes with other industries for skilled labor. At the university level, many U.S. engineering students have competitive job opportunities in the computer, consulting, aerospace, or manufacturing industries. The Petroleum Human Resources Council of Canada suggests that to attract young people, the oil and gas industry should find ways to address its image, such as by highlighting environmental successes. It believes factors such as the oil and gas industry’s environmental image and the seasonality of its work influence its attractiveness. Gulf Research found that nearly 87% of upstream survey respondents indicated that they would encourage a young person to pursue a career in the oil and gas industry, Fig. 9. This is encouraging news because an industry’s current and former employees are its ambassadors. What workers communicate to their friends, neighbors, relatives and colleagues affects the perceptions of the industry. With people often choosing their career paths at young ages, the oil and gas industry needs to project a positive image to students, parents, teachers and guidance counselors. However, only 74% of upstream survey respondents would recommend their current organization to potential employees, indicating a higher satisfaction with their industry than with their particular employer.

Even as unemployment rates remain high in many areas, a mismatch of skills often produces hiring gaps. To increase efficiency and profitability, the oil and gas industry requires more technologically advanced workers. Collaboration among industry, government and educational institutions can help develop these workers’ skills. Upstream technician training schemes in the UK, apprenticeship incentive grants in Canada, multinational skill development programs in Iraq, and job training grants in the U.S., are all attempts to close the skills gap within the oil and gas industry.

|

|||||||||||||||||||||||||||||||||||||||||||||