RECRUITMENT & RETENTION

Expectations are high for upstream hiring and pay rates

Air Energi and OilCareers.com

The oil and gas industry has pretty much fully recovered from the 2009 recession. Everyone learned a great deal from their mistakes, and companies are now ready for the next surge in the industry. However, we find ourselves on the brink of yet another labor crunch.

The global flow of labor is a highly complex equation that has historically been answered through just-in-time solutions, dictated largely by the price of oil. While nobody can afford to ignore commodity prices altogether, savvy operators are choosing not to let the tail wag the dog, taking a global approach to their hiring practices. Where possible, they are proactively recruiting or reassigning talent as it becomes available.

There is also an imperative need to protect and enhance the young stream of professionals entering the industry. This has taken a much higher priority, including providing young graduates with the internships and other opportunities they seek to transition into their professional oil and gas careers. Field experience, and a succession of short-term global assignments, have also been successful methods that our clients have observed. In other words, fast-tracking may help, but there are no shortcuts to hands-on experience.

Fortunately, with the sheer volume, diversity, and technical challenges and innovations posed by today’s oil and gas developments, there should be ample opportunity for eager young graduates to get out into the field.

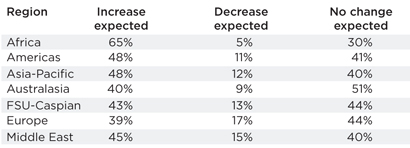

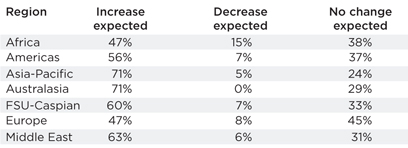

This report covers the global trends, broken down by region, of expectations for hiring and pay rates (Tables 1 and 2), based on the responses of 10,500-plus direct recruiters or senior decision-makers, in over 50 countries, and seven oil and gas producing regions.

| Table 1. Hiring rates |

|

| Table 2. Contract and Pay Salary Rates |

|

AFRICA

Offshore activity is in huge growth offshore West Africa. This is creating significant demand for subsea specialist engineers, who already are in short supply worldwide, an issue compounded here by the expatriation of foreign workers required by local content regulations. These positions are being backfilled by local personnel with on-the-job training as they become available, and many foreign personnel are being redeployed to similar projects in the Asia Pacific (APAC) region, where possible. Despite the many challenges of working in Africa, such as personal safety and high cost-of-living, the average rates in Africa have somewhat decreased, largely owing to the steady increase in local content within the industry.

AMERICAS

Following months of uncertainty surrounding the U.S. economy and offshore regulatory reforms, massive investment in the upstream sector is underway across North America, driven in particular by unconventional gas activity in the United States. Offshore work is also making a significant rebound post-Macondo. Skills shortages are still palpable in North America, although felt less acutely here than elsewhere, in large part because Houston has long been the epicenter of talent for the oil and gas industry. Rates remain competitive in North America, helping draw in available talent looking for attractive assignments in the region. There are still technical and political barriers to development in South America. However, local content regulations and the need for foreign operators to work through local business channels can slow progress, as compared to other parts of the world.

ASIA-PACIFIC

World-leading record investments are still being made in the offshore segment throughout APAC, some 40% higher here than in the North Sea. The demand for engineering and technical expertise is ongoing, not only for E&P work within the immediate region but in support of the seemingly unending string of major plays coming out of Australia. Refinery, chemical and power processing is also growing at unprecedented rates. APAC experienced the biggest jump in salaries during 2011, supported by strong regional commitment to boost production. Across the entire region, the following disciplines are in increasing demand: Naval Architects, Subsea Engineers, Construction Advisors, Project Control specialists, QA/QC, Safety Engineers and Process Engineers. In terms of the global talent crunch, APAC may be well-poised for the future through the comparatively large numbers of new engineering graduates entering the workforce here, particularly in Vietnam.

AUSTRALASIA

Early in 2012, Ichthys joined Gorgon, Prelude, Gladstone and Wheatstone as one more in a string of multi-billion dollar megaprojects. It is anticipated that an additional six world-scale projects will be commissioned in the coming months. The region is already experiencing significant labor shortages and resultant cost overruns, so just how will Australia continue to feed its voracious appetite for investment and personnel? Fortunately for Australia, it has the reputation of being among the most sought-after destinations for expats seeking a term abroad, both in terms of lifestyle and technically challenging (resume-boosting) experience.

FSU-CASPIAN

As offshore activity picks up worldwide, so do the issues of sovereignty and development rights among countries who share oceanic geography. As in Asia Pacific, contested claims for the reserves in Caspian waters may take years to resolve. The Caspian region may be the next big pre-salt contender alongside West Africa and Brazil. What remains is to determine what portion belongs to each of the five countries in dispute: Russia, Iran, Azerbaijan, Turkmenistan and Kazakhstan. As with other developing nations, whose future security and well-being hinges on the development of its energy resources, the stakes are equally high here.

EUROPE

Europe may not be figuring as prominently in the international E&P stage as other regions, yet its North Sea basins are still highly active. Any labor shortfall here is doubly complicated, due to the age of several projects. While much of the world’s offshore activities are in start-up phases, they are mature in the North Sea and/or in need of decommissioning. This places a premium on project managers, structural and process engineers, planning and other site personnel. But thanks to new discoveries here, several projects are also entering FEED and related stages, particularly based out of Norway.

MIDDLE EAST

The Middle East is home to nearly half of the world’s total gas reserves and almost a third of global oil production. As with other regions, there are the haves and the have-nots. Those besieged by civil war or other economic repression first need to play catch-up, in terms of infrastructure and education of their local workforce, before becoming a larger presence on the global energy scene. Iraq and Saudi Arabia are driving forces in this region, as regards total investment and spending, particularly in drilling activities. The region boasts some of the lowest start-up and operational costs, and the large numbers of expats on contract here typically enjoy solid remuneration, longer contracts and pleasant quality of life.

OILCAREERS.COM is an international job board for the oil and gas industry. This global oil and gas workforce report focuses on employment and salary trends in the energy sector throughout 2012 and addresses the issues affecting the oil and gas industry and what they mean for the second half of 2012. The report, which covers global employers' perceptions of the energy industry, found operators and contractors have a largely positive outlook about the numerous, major projects underway or planned worldwide. |