PRAMOD KULKARNI, EDITOR

|

| From left: Transocean’s drillship Discoverer Seven Seas is drilling for ONGC on India’s east coast. A Cairn Energy technician monitors production activity at the Mangala Processing Terminal in India’s Rajasthan state. Reliance Industries is getting technical assistance from its minority partner, BP, to reverse declining production from the KG-D6 field. |

|

After China, India is the leading country in the eastern hemisphere, with an enormous economic incentive to explore for oil and gas. Over the last five years, India’s import dependency for crude oil and petroleum products has increased from 71.9% to 76.5%. With a burgeoning middle class switching from firewood and charcoal stoves to cooking with gas, and from riding scooters to driving automobiles, the demand for oil has increased from 2.1 MMbopd in 2000 to 3.2 MMbopd in 2010. Natural gas consumption has increased from 750 Bcf in 2000 to 2.3 Tcf in 2010, Fig. 1. The country’s oil production was 750,000 bpd, and natural gas production was 1.8 Tcf in 2010.

|

| Fig. 1. Consumption of both oil and gas are rising with oil production relatively flat and gas production rising, but unable to keep pace with demand. |

|

The history of oil and gas exploration on the Indian subcontinent is one of tantalizing discoveries from one decade to the next, but without the momentum to propel the country into a major producer. In fact, the first oil discovery took place in Digboi, located in the northeastern state of Assam, in 1889 (see Oil India Ltd. sidebar on page 75). For a long time, international oil companies had dismissed India’s hydrocarbon potential. As a result, only 30% of India’s sedimentary basins have been explored. In 1974, India’s public sector Oil and Natural Gas Corporation (ONGC) discovered the Bombay High field on the west coast of India. Ignoring pessimism of experts, the government of India opened up the country for exploration by private and international companies during the late 1990s and made a flurry of discoveries at the beginning of the new century, particularly Reliance Industry’s KG-D6 discovery off the east coast in 2002, and Scottish minnow Cairn Energy’s discovery of the Mangala field in the desert state of Rajasthan in 2004.

While exploration activity has remained steady with 27 jackups and seven drillships drilling, the pace of major discoveries has slowed, with emphasis changing to reversing production declines by seeking technical assistance from international oil companies. In February 2012, the Indian government approved BP’s agreement with Reliance to pay $7.2 billion for a 30% stake in the company’s 23 oil and gas blocks, including the KG-D6 field. ONGC is reportedly at a “nascent” stage of discussions to tie up with ConocoPhillips for joint exploration in 19 deepwater oil and gas blocks, and also undertaking shale gas exploration in India and abroad. Cairn Energy has the technical expertise, but in 2011, the company divested 58.5% of its investment in India to London-based mining company Vedanta Resources, to shift its exploration focus to Greenland. Cairn India is also exploring offshore Sri Lanka.

LICENSING ACTIVITY

To spur exploration activity, India launched a New Exploration Licensing Policy (NELP) in 1998 and has conducted nine licensing rounds under the aegis of the Directorate General of Hydrocarbons (DGH). According to the DGH, a total of 291 exploration blocks have been awarded, of which 228 are in operation, Fig. 2. For the ninth round, the DGH has received 33 bids and expects to award the blocks by March 2012. Under NELP-IX, 34 blocks (8 deepwater, 7 shallow water and 19 onshore) were offered with a total area of 88,807 sq km. By 2015, the government is planning to release all of the prospective sedimentary basins for exploration. For the time being, the government has postponed plans to hold the country’s first licensing round for shale plays.

|

| Fig. 2. India is licensing prospective blocks through a series of licensing rounds scheduled to run until 2015. Shown here are areas currently under petroleum exploration license (PEL) or mining license (ML). Exploration has also been extended to the Andaman & Nicobar Islands (southeast corner of the map) that are under India’s jurisdiction. Source: DGH. |

|

ONGC

As seen in Fig. 2, India’s leading public sector oil company is competing effectively against private and international oil companies to win exploration blocks in both the onshore and offshore areas. ONGC is also participating as a partner in JVs with other operators, including Reliance and Cairn.

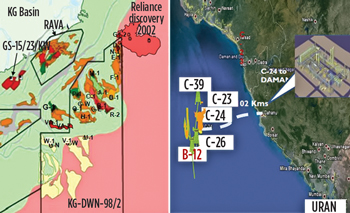

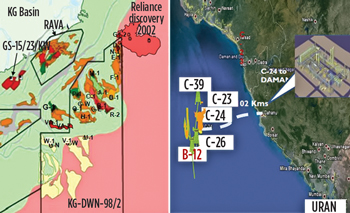

ONGC currently operates 30 seismic crews, 121 drilling rigs (87 onshore and 34 offshore) and 73 logging units, Table 1. Through these resources, ONGC made 24 discoveries in FY 2011 and achieved an ultimate reserve accretion of nearly 600 MMboe, the highest in the last two decades. ONGC’s reserve replacement ratio is 1.76. ONGC’s initiatives for 2012 and beyond include the monetization of its discoveries in the KG basin on the east coast and development of the Daman discovery on the west coast, Fig. 3. Production from the GS field has already begun, and the GI field is expected to start production in May 2012, with other fields to follow in 2012-13 and thereafter. These gas discoveries are to be developed based on a hub concept with facilities placed at shallower water depths in the GS-29 area. Off the west coast, ONGC plans to spend $4 billion in developing about 4 Tcf of gas reserves off the city of Daman. The Daman cluster constitutes the B-12 North, B-12 South, C-26 and SD fields. ONGC intends to build a terminal about 100 km north of Mumbai to receive and process the gas.

| TABLE 1. DRILLING ACTIVITY OFFSHORE INDIA AS OF MARCH, 2012. |

|

|

| Fig. 3. ONGC is in the process of monetizing its discoveries on the east coast that are adjacent to the Reliance discovery (left). Fields considered for development on the west coast are Daman (Main), Daman (North), C-24 and C-23. |

|

High on ONGC’s list of priorities are improved oil recovery (IOR) projects designed to reverse declining production from its Bombay High, Gujarat and Assam fields. The company completed 16 of 21 projects in 2011, to increase its recovery factor from 28% in 2000 to 33.5% in 2011. Last year, it achieved an incremental gain in production by 60.57 MMboe.

Meanwhile, ONGC is seeking a technology partner with deepwater and IOR expertise. This need has been heightened with the departure of BG, Statoil and Petrobras as its minority partners in the KG basin fields. According to Indian news media reports, ONGC is expected to tie up with ConocoPhillips for joint exploration. Under the proposed deal, ONGC has offered 19 of its deepwater oil and gas exploration blocks in the Krishna Godavari basin, along with other offshore basins, including Cauvery, Mahanadi and the Andaman and Nicobar basins.

ONGC is also seeking oil production with international ventures through its OVL subsidiary. OVL has a total of 3.1 Bboe of ultimate reserves in 12 assets in eight countries, including Russia, Kazakhstan, Venezuela and Sudan. OVL is producing from Odoptu field in Sakhalin since September 2010. The current production rate from the field is 54,000 bopd.

RELIANCE INDUSTRIES

An industrial conglomerate, which operates the world’s largest refinery complex in Jamnagar, Reliance Industries joined the ranks of the Indian oil and gas industry with its discovery of the KG-D6 field in 2002. Reliance is currently producing gas from the KG-D6 field at the rate of 45 MMscmd, and oil and condensates at the rate of 16,000 bpd. The company had expected to produce 60 MMscmd, but is encountering production declines. Reliance has blamed the production drop on reservoir complexities and a natural decline in reserves at the field. The company’s original field development plan called for a total of 31 development wells to be drilled by March 2012, but only 18 of the 22 development wells have been brought into operation, while five of the wells at D1 and D3 have stopped producing due to water and sand ingress. Without enhanced recovery efforts, gas production is expected to decline to an all-time low of about 22 MMcmd by 2013-14.

A technical team composed of Reliance and BP geoscientists and reservoir engineers is developing strategies to reverse the decline. BP’s entry into India came as a result of a farm-in agreement that was approved by the Indian government in February 2012 to allow the IOC to gain a 30% interest in 21 Reliance oil and gas blocks at a cost of $7.2 billion, Fig. 4. Recently, the Reliance-BP partnership gained approval from Indian authorities for a $1.53-billion plan to develop four satellite fields in the block: D-2, D-6, D-19 and D-22.

|

| Fig. 4. Reliance Industries Chairman Mukesh Ambani (left) and BP CEO Robert Dudley sign the farm-in agreement for joint project development in India and abroad. |

|

In anticipation of shale E&P activity in India, Reliance has acquired partnerships with three U.S. shale operators at a total cost of $1.6 billion—Pioneer Natural Resources in the Eagle Ford, and Chevron and Carrizo Oil & Gas in the Marcellus. While activity has slowed in the Marcellus due to low U.S. gas prices, production ramp-up is expected in the liquids-rich Eagle Ford play.

CAIRN ENERGY

The Scottish independent first entered South Asia through a 1993 joint venture in Bangladesh and discovered the Sangu gas field in 1996 in the Bay of Bengal. Cairn’s fortunes improved in 1997 when it made a deal with Shell to relinquish its interests in Bangladesh for the Rajasthan block (see Cairn Energy sidebar on page 76). After a string of 15 dry holes since 2000, Cairn achieved a major oil discovery in 2004 at Mangala. Later, Cairn also made significant discoveries at Bhagyam and Aishwariya fields. Cairn holds 70% ownership of the Rajasthan block with ONGC owning the remaining 30%. Oil production from Mangala field commenced in 2009. In 2010, Cairn sold 58.5% interest in Cairn India to London-based mining company Vedanta Resources, while continuing to hold about 22%.

The Mangala crude, currently produced at a rate of 125,000 bpd, is transported via pipeline to the Gujarat coast and then shipped to coastal refineries in south India. As the Mangala crude has high paraffin content, Cairn is building the world’s longest (590 km) insulated and heated pipeline. Bhagyam field commenced production in January 2012, proceeding to a plateau rate of 40,000 bopd. Development of Aishwariya field is underway and expected to commence production in second-half of 2012. The company envisages an eventual, total production rate of 240,000 bopd from its Rajasthan fields.

“Our successive discoveries in Sri Lanka have established a working hydrocarbon system in the frontier Mannar basin,” Cairn MD Rahul Dhir said. “This success demonstrates Cairn India’s strong skill set, which we will continue to leverage for future opportunities. With the new board now in place, Cairn India remains well poised for the next phase of growth.”

OTHER SOUTH ASIAN COUNTRIES

Pakistan. The latest oil production statistics for Pakistan date back to 2009, when the country produced crude oil at the rate of 55,000 bopd, but had to import 338,000 bopd to satisfy local consumption. Pakistan does have natural gas reserves of 30 Tcf, but it faces a shortfall of 2.2 Bcfd. The country is hoping to satisfy its growing gas needs by building a pipeline from Iran by 2014, notwithstanding objections from the U.S. and European countries which are in process of imposing an oil and gas embargo against Iran. Oil and Gas Development Company Ltd. (OGDCL) is the state oil and gas company, and the international firms active in Pakistan include BP, UK-based Tullow and Hungary’s MOL.

Bangladesh. In 2009, Bangladesh produced 5,000 bopd, but needed to import 90,000 bopd to support local consumption. The country is more endowed with natural gas, producing 2.04 Bcfd against a demand of 2.52 Bcfd in 2011. The country’s largest onshore gas field is Bibiyana, operated by Chevron at the rate of 750 MMcfd. State operator Petrobangla is seeking Russia’s Gazprom’s help to increase production from its Titas gas field. In a major blow to the country’s offshore sector, Australian operator Santos drilled two dry wells in the Sangu field in late 2011. Despite the failures, Santos is continuing its drilling activity. Meanwhile, Petrobangla approved a PSC with ConocoPhillips in June 2011 to begin deepwater exploration, with a 2D seismic survey over the prospective area. There are, however, maritime disputes with both India and Myanmar. The two neighboring countries have staked claims in two-thirds of Bangladesh’s 28 deepwater blocks.

|

| Fig. 5. Cairn Lanka has drilled two gas discoveries and one dry hole in the first phase of its exploration program in Sri Lanka’s Mannar basin. |

|

Sri Lanka. An island nation, Sri Lanka has no oil and gas production. In 1971, Gazprom carried out the first drilling in the region without success. Sri Lanka’s first licensing round in 2007 for Mannar basin resulted in the awarding of one block to Cairn India, Fig. 5. Cairn’s SL 2007-01-001 block is offshore north west Sri Lanka and covers approx. 3,400 sq km in water depths of 200 to 1,800 m. Cairn’s drilling program commenced in August 2011 with a three-well exploration phase. The first two wells discovered gas and condensates, but the third well was plugged and abandoned as a dry hole. Cairn is planning to enter a second phase of exploration in 2012.

|

OIL INDIA LIMITED: A PROUD HERITAGE

RAJ KANWAR, Contributing Editor, South Asia

Oil India Limited (OIL) owes its genesis to human courage and ingenuity—dating back to the 19th century—that led to the commercial discovery of oil in Digboi in the dense forests, swamps and river beds in the extreme northeastern parts of Assam. Digboi still retains the distinction of being the world’s oldest continuously producing oil field.

OIL was incorporated in February 1959 as a JV between the government of India and Burmah Oil Co., UK, to undertake the expansion of oil exploration that led to the discovery of Naharkatiya and Moran oilfields in Assam. In October 1981, the Indian government took over 50% equity of BOC and became OIL’s 100% owner. Today, OIL is a premier E&P national company, producing crude oil at the rate of 3.90 MTPA, which is creditable since most of its production is coming from aging northeast fields. There has, however, been a steady growth in oil production during the last three years due to induction of new technologies and accelerated exploration and drilling programs. The company also produces 8 MMscm of natural gas and 50,000 tonnes of LPG annually.

“OIL’s systematic and scientific approach to exploration had achieved an impressive success ratio of around 60% overall,” explained CMD N. M. Borah. “The company has the latest 2D and 3D seismic data acquisition, processing and interpretation resources. OIL has also gained considerable experience in aeromagnetic and geochemical surveys in offshore and onshore areas.”

Mr. Borah said OIL has formulated a Strategic & Corporate Plan, which will be a key instrument to meet the demands of the changing environment. “Thrust areas for the future are to sustain production from existing fields, explore in the northeastern frontier areas, acquire prospective exploration blocks and producing properties both in India and overseas, and selectively diversify across the hydrocarbon value chain.”

Under NELP, OIL has already acquired 30 blocks in the first eight rounds of bidding and has been provisionally awarded 10 blocks in NELP-IX round. “Our future strategy involves focusing on the acquisition of prospective exploration blocks as well as producing properties overseas either independently or with a joint venture partner,” Mr. Borah elaborated. “OIL already has presence in nine countries overseas, including Libya, Gabon, Nigeria, Sudan, Yemen, Timor Leste, Iran, Egypt and Venezuela.”

|

|

CAIRN ENERGY: REMARKABLE GROWTH IN THE BARREN DESERT

RAJ KANWAR, Contributing Editor, South Asia

|

| Cairn India MD Rahul Dhir |

|

Rahul Dhir joined Cairn India in May 2006. Within three months, he was promoted to managing director. After graduating from the Indian Institute of Technology (IIT) Delhi, Dhir completed his MS from the University of Texas in Austin and then earned an MBA from the University of Pennsylvania’s Wharton Business School.

The success story of Cairn India could rightly be attributed to the entrepreneurial skills of its founder, Sir Bill Gammell, the son of an investment banker and an international rugby player. In 1981, Gammell founded Cairn Energy in Edinburgh, Scotland. The company conducted E&P operations in the North Sea and acquired Conoco’s acreage to become the largest UK onshore oil producer.

Rajasthan turned out to be Cairn’s lucky mascot, drilling 15 dry wells in Mangala before it struck pay dirt in January 2004, and, in the process, made the largest onshore discovery in India in more than two decades. The journey from discovery to production was accomplished despite the harsh climate, sand dunes and limited infrastructure in the Rajasthan desert. Cairn India’s IPO in 2006 attracted $2 billion. Under Dhir’s stewardship, Cairn has grown in value to $13 billion. In August 2010, the company commenced production from Mangala field.

According to Dhir, one of the major reasons for Cairn’s success has been its business philosophy, with accommodation and adaptability as its twin fulcrum. “Right from the beginning, the company had to work with other operators in many parts of the world, both multinational and national, and thus acquired the ability to adapt to differing cultures and work ethics.” Cairn India has worked well with state governments, nongovernmental organizations and villagers in India and, in the process, won the Blue Dart Global award for the “Best Corporate Social Responsibility Practice”.

In December 2011, London-based mining company Vedanta Resources acquired a 58.5% stake in Cairn India at a cost of $8.67 billion. Vedanta’s Navin Agarwal is now the new Cairn India chairman while Rahul Dhir continues to be its CEO and managing director.

About Cairn India’s continuing operations, Dhir reports, “The commencement of production from the Bhagyam field is yet another significant milestone for the Cairn-ONGC joint venture in Rajasthan, and the JV is well placed to further develop the hydrocarbon-rich Barmer basin in Rajasthan, increase oil production and create value for the nation.”

|

|