Regional Report - North Sea: The near-term outlook is bright in Norway and Ireland, while a mixed bag remains for the UK, Denmark and The Netherlands

The near-term outlook is bright in Norway and Ireland, while a mixed bag remains for the UK, Denmark and The Netherlands

ANDRÉ SHARMA and ELIZABETH LLOYD, Deloitte Petroleum Services Group, London

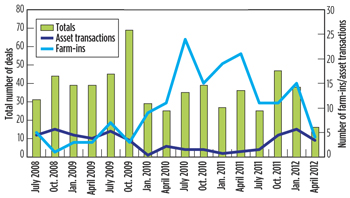

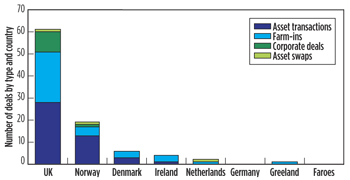

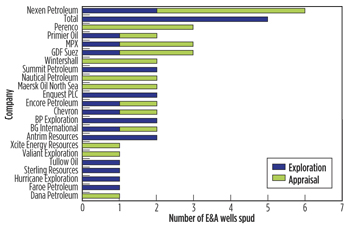

In the UK, the number of exploration and appraisal wells drilled between July 2011 and June 2012 decreased by 13%, compared to the same period the year before. The financial crisis and economic uncertainty, as well as the maturity of the North Sea, can be attributed to the downward trend that began in 2009. Norway has seen consistent levels of activity, with only a small decrease in the total number of wells drilled, three-quarters of which explored new prospects. A total of 126 deals has been recorded across North West Europe, 8% fewer than the previous year. The trend in favor of farm-in deals seen from 2010 until September 2011 has altered in the last year, as levels of asset transactions and farm-ins start to converge while investor confidence in the economy grows. Licensing activity remains relatively high, with awards made from the UK 26th Licensing Round and Awards in Predefined Areas (APA) 2011. Both Norway and the UK have announced the APA 2012 and 27th Licensing Round, respectively. The 27th Round has already proved popular, attracting a record number of applications. DEAL ACTIVITY Between July 2011 and June 2012, 126 deals were recorded across North West Europe. This is 8% less than compared to the previous year, during which 137 deals were announced. This year’s figure is also 13% less than the average deal activity recorded over the last four years, which has been 145 deals per year. The average quarterly figure for deal activity over the last four years has been 37. So far, in the second quarter of 2012, there have been 16 recorded deals, nine asset transactions, three asset swaps and four farm-ins. Deal activity in second-quarter 2012 has been lower, 58% less than the previous quarter. However, data for the quarter are not complete, and activity levels may still pick up. Levels of activity may also be low as the Eurozone crisis deepens, and markets react to this. When looking at levels of asset transactions and farm-ins across the region (Fig. 1), a clear trend in favor of farm-ins can be seen from early 2010 until September 2011. This trend was a consequence of the 2008 recession, as companies looked for partners to minimize their risk. However, in the last 12 months, levels of asset transactions and farm-ins are converging, as investor confidence in the economy has grown.

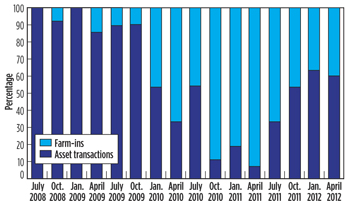

EXPLORATION/APPRAISAL DRILLING Exploration and appraisal drilling activity during the period of July 2011 to June 2012 is concentrated in the UK and Norwegian sectors. The UK has seen a declining trend in the number of exploration and appraisal wells drilled between July 2011 and June 2012, compared to previous years. Norway has seen consistent levels of exploration and appraisal drilling, similar to the previous 12 months. In Norway, exploration wells dominate, as companies look to find new discoveries, the Johan Sverdrup field being a prime example. Elsewhere, in Greenland, Cairn Energy’s first-phase drilling program provided no success in 2011, and Greenland’s frontier region is becoming ever increasingly uncertain. UNITED KINGDOM In fourth-quarter 2011, the Department of Energy and Climate Change (DECC) announced a second round of awards as part of the 26th Licensing Round, whereby 46 more licenses have been awarded, covering 110 blocks. These licenses were previously held back, pending the need for further assessment on Special Areas of Conservation (SACs) and Special Protection Areas (SPAs). These awards are in addition to the 144 licenses awarded in October 2010. In February 2012, DECC opened the 27th Licensing Round, inviting applications for licenses, for a total of 2,800 blocks. The deadline for applications was May 1, 2012, and the announcement of offers to be made is expected later in the year. DECC announced that the 27th Licensing Round has broken all previous records for the number of applications received. A total of 224 applications has been submitted, covering 418 blocks on the UK Continental Shelf (UKCS). This is 37 more applications than the previous high record, which was seen in the 26th Round. The 27th Round has seen seven frontier license applications, compared to three in the previous round, showing a potential increase in frontier areas, such as the West of Shetland. The increase in the numbers of applications may be a result of more favorable tax and field allowances announced in the 2012 budget. Compared to the number of applications made last year, there has been a reduction in the number of Promote licenses in favor of Traditional license applications. Promote licenses allow small and start-up companies to enter into production licenses and attract the necessary operating and financial capacity later. The decrease in applications of this type shows that large players are still investing in the North Sea. Deal activity. Overall, UK deal activity has remained relatively constant over the last four years. The average number of deals has been 61 per year, with this number of deals being made in the last 12 months. There has been a sharp rise in the number of deals made in the first quarter of 2012, compared to quarters three and four of 2011. In first-quarter 2012, there were 23 deals made, compared to 14 in the previous two quarters. Asset transactions have almost doubled compared to the previous quarter. Farm-ins have maintained levels similar to mid-2011. The number of farm-ins during the year has dropped 49%, compared to the previous year, when 45 farm-ins were carried out. This suggests that companies are starting to gain confidence in the market and are keen to acquire development and producing assets outright, making the maximum return from the sustained high oil price. Antrim Energy, Fairfield and Premier Oil have been most active farming out opportunities, while EnQuest and TAQA have farmed-in to the most opportunities this period, with two and three farm-ins, respectively. Asset transactions have increased, when comparing to last year. During the period July 2011 to June 2012, 28 asset transactions were carried out, compared to 18 in the previous year. In general, the trend seen in asset transactions is that larger companies are selling to smaller ones. Premier Oil, Centrica and Nexen have all been involved in two asset divestitures in the last 12 months. Bridge Energy, Iona, Ithaca and Parkmead have all been involved in asset acquisitions. In the last 12 months, there have been nine corporate acquisitions. These include the purchase of Agora Oil and Gas by Cairn Energy, which was confirmed in May 2012, and the purchase of Antrim Energy by Valiant Petroleum. This is significantly more than the four corporate deals made last year. There has been a reversal in farm-in activity versus asset transactions over the last five years (Fig. 3). During 2008 and 2009, deal activity in the UK was dominated by asset transactions. Following the financial credit crisis, deal activity was dominated by farm-in transactions. However, more recently, the numbers of asset transactions and farm-ins are starting to converge.

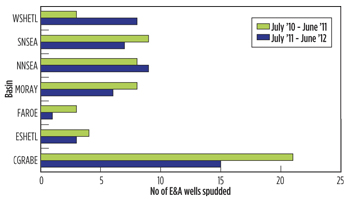

Exploration and appraisal drilling. In the UK, between July 2011 and June 2012, exploration and appraisal (E&A) drilling showed a declining trend when compared to the same period a year earlier. During this period, 49 wells were spudded on the UK Continental Shelf (UKCS), compared to 56 wells during the previous 12 months. Fifty-one percent of all E&A wells were drilled to explore new prospects, while the remaining 49% were drilled to appraise existing discoveries. During the last six months of 2011, 30 E&A wells were drilled, representing a 20% decrease compared to the same period in 2010. The first six months of 2012 show the same trend, where 19 E&A wells have been drilled so far, a 5% decrease when compared to the same period in 2011. Seven out of 49 E&A wells spudded on the UKCS are in the Southern North Sea, 15 in the Central North Sea, six in the Moray Firth basin, nine in the Northern North Sea, eight West of Shetland, three East of Shetland and one in the Faroe-Shetland Escarpment, Fig. 4. The Central North Sea is the dominant area for E&A drilling, with the majority of the drilling being conducted by medium-sized operators, who are focusing on mature and conventional plays. West of Shetland is seeing ever-increasing numbers of exploration and appraisal drilling, with majors such as BP and Total exploring this deepwater frontier area.

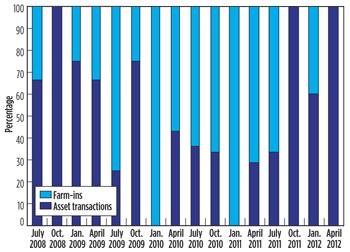

Figure 5 shows the number of exploration and appraisal wells spudded, by company, between July 2011 and June 2012. Nexen and Total have been most active in the UK, with six and five exploration and appraisal wells spudded, respectively.

UK E&A activity still remains low, and current economic and market factors, rig and crew availability, as well as geological maturity of the UKCS continue to contribute to the low levels. However, drilling levels during the first quarter of each year tend to be low, driven by adverse weather conditions affecting operations during the winter months. Additionally, between July 2011 and June 2012, low rig and crew availability has been an issue, especially the heavy-duty rigs and drillships that are required for extreme water conditions, including deepwater drilling in the West of Shetlands and the North Atlantic. In first-quarter 2012, a number of rigs were unable to move off locations following the completion of drilling, due to bad weather conditions. Furthermore, the Elgin platform gas leak may have further health and safety implications for drilling in the North Sea, as it highlights technical and safety issues across the region. The number of commitment wells from the 25th and 26th Licensing Rounds is generally low. However, activity may continue to be spurred by new exploration and appraisal wells. The UK sector is seen to be geologically more mature than the Norwegian sector, and this may, in part, account for the lower levels of E&A drilling in the UK. Lower drilling activity may also still be a result of the 2008 financial recession, while the ongoing Eurozone debt crisis continues to affect equity markets, despite the fiscal compact agreed by European leaders on Dec. 9, 2011, to move toward closer integration. The lack of a long-term solution affects investor appetite for exposure to European risk. However recent positive announcements with regard to the decommissioning tax relief may result in an increase of drilling activity, looking ahead into 2012. With the new scheme, companies should be able to recover cash flow, which is tied up in financial guarantees related to decommissioning that may result in more expendable cash for exploration and appraisal. Discoveries. Between July 2011 and June 2012, five discoveries were announced on the UKCS. These include the 22/15-4, BG-operated well that targeted the Palaeocene Forties sandstone member Esperanza prospect. The 22/15-4 well encountered 52 ft of net oil pay over a gross section of 73 ft. The discovery, which contains light oil, is at the northwest end of an 11-km turbidite channel. Prior to drilling, it was stated that the accumulation exhibits a strong far-offset AVO anomaly. The Faroe Petroleum-operated 206/5a-3 exploration well tested the hydrocarbon prospectivity of the Devonian Clair sands at a depth of approximately 6,900 ft. The well encountered a 133-ft oil column in the targeted reservoirs with 45 ft of net pay. Average porosity was measured at 23%, and oil samples were successfully recovered. Antrim drilled exploration well 21/29d-11 on the Erne prospect in the Greater Fyne Area. Following an agreement signed by Antrim and Premier Oil in July 2011, Premier obtained a 50% share in the license, in return for paying a promoted share of the well costs. Preliminary estimates indicate the well penetrated a thick gross hydrocarbon column in excess of 50 ft in the Eocene Upper Tay Sandstone, including 20 ft of net oil pay and a separate 10 ft of net gas pay. Average porosity was measured at over 30%, and average hydrocarbon saturation was measured at over 80%. No flow tests were performed, but the well was sidetracked to further delineate the reservoir. Enquest Heather spudded exploration well 21/13a-5 to target the Crathes and Moon prospects in the central North Sea. Crathes is a Palaeocene structure, and Moon is a Jurassic structure. The 21/13a-5 well encountered a 52-ft light oil column in excellent quality reservoir sands at Crathes, and was then deepened to target Moon. Crathes, together with the Scolty and Torphins discoveries 12 km to the north, may be developed collectively. NORWAY In Norway over the last 12 months, 17 deals were made. This is 11 deals fewer than those made in the previous year, a decrease of 39%. This is the lowest level of deal activity seen in Norway in the last four years, during which 26 deals have been the average. Farm-in activity over the last year has been generally low, with only four farm-ins announced. This is 79% fewer then the number of farm-ins in the previous year, when 19 were announced. Det Norske and RWE were the most active companies involved in farm-ins over the last year, with both companies being involved equally in farm-ins and farm-outs. The level of asset transactions appears to be on the rise in Norway. Following two years of relatively low deal activity, with seven transactions in total, this year, alone, 13 asset transactions were recorded. Although this shows increased activity levels, this is still 62% lower than levels seen during the period of July 2008 to June 2009. Of the 10 asset transactions that occurred in Norway over the last 12 months, NORECO acted as seller in four of the deals. Centrica and Lundin were the most active buyers, involved in two asset acquisitions, each. Similar to the UK, from August 2010 to August 2011, deals in Norway were dominated by farm-ins and levels of asset acquisition were much lower. Recently, this trend has been reversed with dominance toward asset transactions, Fig. 6.

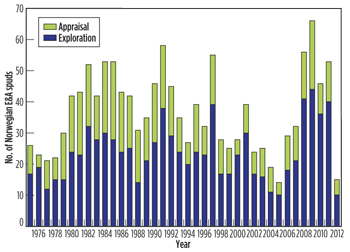

Licensing activity. The deadline for nominating blocks for the 22nd Licensing Round was Jan. 11, 2012. The Ministry of Petroleum and Energy received nominations from 37 companies for blocks over large parts of the Barents Sea and the Norwegian Sea. The firms nominated 228 blocks or partial blocks, 107 of which were nominated by two or more companies. The Barents Sea has attracted record number of nominations with 181 blocks. The 22 Licensing Round is scheduled to be announced during summer 2012, with the awards scheduled for the spring of 2013. In first-quarter 2012, the Norwegian Petroleum Directorate (NPD) announced the offers made in the Awards in Predefined Areas (APA) 2011. Offers have been sent to 42 companies for 60 new production licenses on the Norwegian Continental Shelf (NCS). The offers were submitted after authorities had evaluated applications from 43 companies. Of the 60 production licenses awarded, 34 are in the North Sea, 22 in the Norwegian Sea and four in the Barents Sea. Fifteen of the production licenses are additional acreage for existing production licenses. Of the companies that applied, 42 will be offered interests in at least one production license. Twenty-seven companies will be offered operatorships. One of these, Valiant Petroleum, has not been an operator previously on the NCS. The offers are subject to obligations stipulated by the authorities. There is a requirement for acquisition of new seismic data in 11 areas, and seven fixed wells are to be drilled: five in the North Sea (by GDF SUEZ, Lundin, Statoil and Total); one in the Norwegian Sea (by Faroe Petroleum); and one in the Barents Sea (by Det Norske). For the other production licenses, there are “drill or drop” conditions, in which licensees have from one to three years in which to make a decision to drill a well. In fourth-quarter 2011, the Ministry of Petroleum and Energy announced the commencement of a formal 18-month process to open the central Barents Sea for oil and gas exploration. This announcement comes in the wake of this year’s treaty with Russia to divide the sea into two economic zones. The area covers approximately 44,000 sq km to the south of 74° 30’ N and west of the demarcation line with Russia, covering the areas not currently available to the petroleum industry. Parliament has decided to initiate an impact assessment for the area under the Petroleum Act. Following the results of the assessment, the government will submit a report recommending the opening, or otherwise, of the area for petroleum activity. Hydrocarbons have been proved east and west of the formerly disputed area, which gives hope that there may be hydrocarbons in the portion that lies west of the demarcation line. In the summer of 2011, NPD conducted 2D seismic acquisition over the area. Seismic surveys continue during the summer of 2012. In March 2012, the Ministry of Petroleum and Energy announced the APA 2012. The blocks available for application are in the North Sea, Norwegian Sea and Barents Sea. The deadline for companies wishing to submit applications is Sept. 6, 2012. The awards are to be announced during first-quarter 2013. When compared with the APA 2011, the pre-defined areas have been extended by 48 blocks or parts of blocks—two in the North Sea, 13 in the Norwegian Sea and 33 in the Barents Sea. The expansion of the APA 2012 has been made, to follow criteria set out in The Petroleum White Paper, a Norwegian document that sets goals to further petroleum activities in mature areas. The document states that APA areas must be inclusive of areas near both existing and planned infrastructure, areas which have exploration history and areas which border existing pre-defined areas, but which have not been applied for in numbered rounds. Exploration and appraisal drilling. Norway has had 42 E&A wells spudded on the Norwegian Continental Shelf (NCS) between July 2011 and June 2012. This figure is comparable to the 43 E&A wells that were drilled in the same period between 2010 and 2011, representing only a 2% decrease. In 2009, there was a record number of 66 E&A wells drilled compared to the last decade, but since then activity has been in decline. In 2010, there were 46 E&A wells drilled, and 2011 saw a small increase to 52 wells. Of the 42 wells drilled in Norway during the period of July 2011 to June 2012, 32 were exploration wells (76%) and the remaining 10 were appraisal wells (24%) (Figure 7). The Northern North Sea contained 26 of the 42 wells drilled, while 11 were drilled in the Norwegian Sea and five in the Barents Sea.

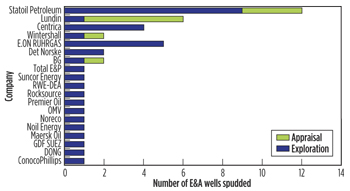

In the 2012 APA, there has been an expansion of the pre-defined area by a total of 48 blocks or parts of blocks, compared to the area in the 2011 APA. These are distributed with two blocks in the North Sea, 13 in the Norwegian Sea and 33 in the Barents Sea. As seen by the 2012 APA block distribution, companies are encouraged to start exploring in frontier areas, such as the Barents Sea. Figure 8 shows the number of exploration and appraisal wells spudded offshore Norway by company between July 2011 and June 2012. Statoil has been the most active of the companies in Norway, with 12 exploration and appraisal wells spudded. Lundin has also been active with six exploration and appraisal wells spudded, while the remaining companies only spudded one or two wells between July 2011 and June 2012.

A number of factors suggest that levels of E&A activity will remain high offshore Norway over the coming years. The Norwegian Government currently offers extremely favorable conditions for exploratory drilling. Companies are able to claim 78% of their exploration costs in a dry hole case, substantially reducing the risk associated with drilling wildcat wells. Such initiatives provide additional encouragement for exploration-focused companies considering where to invest. Additionally, unlike the UK, Norway is viewed as a fiscally stable regime; however companies are reluctant to invest in drilling opportunities due to the high tax burden in place by the government. Constraints on rig availability and, specifically, heavy duty rigs across the North West Europe region continues to be an issue. This may affect activity from the West of Shetland through to the Norwegian North Sea, where drillships and the latest generation semisubmersible rigs are required to deal with extreme metocean conditions. This issue has been further complicated by delays in the drilling of wells, due to operational and weather conditions over the last 12 months. In the first quarter of 2012, a number of rigs were unable to move off locations following the completion of drilling operations, due to bad weather conditions. Discoveries. Between the period of July 2011 and June 2012, a total of ten discoveries were announced on the NCS. Statoil drilled three discovery wells in this period; 16/7-10 was drilled 16 km northeast of Sleipner East, close to the border between production licenses PL072B and PL569, but within the latter. The targeted prospect was called Theta North-East. The well encountered a 377-ft reservoir interval in the Palaeocene Ty Formation, which had the expected reservoir quality and contained a thin gas/condensate column. The Skinfaks South discovery well 33/12-9 S encountered a 260-ft light oil column in good-quality reservoirs of the Middle Jurassic Brent Group. Preliminary analysis suggested that the discovery contained recoverable reserves of between 1.9 and 6.9 MMboe. It is anticipated that the Skinfaks discovery, as well as the others made in the area, will be tied back to existing infrastructure in the Gullfaks area as capacity becomes available. The 7220/7-1 exploration well was drilled to target the Havis prospect in production license PL532. The main targets were reservoirs of the Jurassic Stø and Nordmela formations, and the well proved a 157-ft gas column overlying a 420-ft oil column. Preliminary analysis suggested that Havis contains between 200 and 300 MMboe and, the combined reserve estimate for the Skrugard and Havis area is now between 400 and 600 MMboe. Noil Energy drilled exploration well 6508/01-02 and discovered Skaugumsasen field in production license PL482. The well proved a 75-ft oil column and a 50-ft gas column in the Lower Jurassic Tilje formation. ConocoPhillips’ 7/11-12 A exploration well discovered Peking Duck, a HP/HT discovery. This exploration sidetrack encountered a 112-ft gross gas column in the Upper Jurassic Ula formation. OMV’s 6407/5-2 S exploration well had a primary target, which was the Chamonix prospect, a large amplitude-supported stratigraphic trap within a Cretaceous sandstone reservoir. However, the targeted sands were poorly developed and water-bearing. The Jurassic Cortina prospect was identified as a secondary target, and a 130-ft gas column was encountered in sandstones of the Middle Jurassic Rogn and Garn formations. Maersk spudded the 6406/03-09 well to target the T-Rex and Bolan prospects, 6 km south of Smørbukk field, part of the Aasgard development, on the Halten Terrace in the Norwegian Sea. The well encountered sub-commercial volumes of oil in Lower Cretaceous reservoirs. Butch field was discovered by the Centrica-operated 8/10-4 S well and is situated in the Norwegian North Sea, 7 km from Ula field. The well targeted a stratigraphic pinch-out of the Upper Jurassic Ula formation against a salt diapir and encountered 160 ft of net oil pay. Preliminary results suggested that the well encountered light oil in good-quality reservoir sands with high net-to-gross ratios. The entire reservoir section was found to be oil-bearing, and an oil-water contact was not penetrated. Total’s 6607/12-02 S well encountered oil pay at the Alve North prospect. Meanwhile, Wintershall’s 35/9-7 wildcat found, as expected, very good-quality Upper Jurassic reservoir sands containing light oil, with a considerable oil column. Preliminary resource estimates range between 60 and 160 MMbbl of recoverable oil. The commercial viability, as well as potential further upside, will be established through appraisal drilling. THE NETHERLANDS Licensing and deal activity has been low in The Netherlands, with only two deals announced this year. Over the last four years, the average number of deals made has been six. As with other countries in Europe, low activity could be a result of the current economic and financial uncertainty. Sterling Resources has been active in the country, signing a farm-out agreement with Petro Ventures in September 2011 and partaking in an asset swap with Enquest in May 2012. Both transactions involved equity in the F-quad and L-quad licenses. On approval of the transactions, Sterling will act as operator with 35% interest in the shallow geological horizons of Blocks F14, F16, F17a, F18 and L01b. Exploration and appraisal drilling. The Netherlands Continental Shelf has had only six E&A wells drilled between July 2011 and June 2012. This figure compares to 12 E&A wells spudded during the same period between 2010 and 2011. Fifty percent of the wells drilled were exploring new prospects, while the remaining 50% were appraising existing discoveries. Discoveries. Of the three exploration wells drilled between the period between July 2011 and June 2012, only one discovery has been announced in The Netherlands. Petro-Canada drilled the P/11-07 well to target a prospect to the north of the Van Ghent discovery, which is being developed as a tie-back to De Ruyter. The well targeted a small prospect at the Bunter Sandstone level. Drilling operations were completed in December 2011 without comment, but Fugro later announced the well encountered oil and gas. Logs indicated the reservoir was of similar quality to nearby fields and, therefore, a well test was not required. DENMARK In the last 12 months, deal activity has been relatively low in Denmark. However, this is not unusual for the country. There have been three asset transactions and three farm-ins reported. All three farm-ins have seen New World Oil and Gas enter licenses with Danica, and these are the company’s first assets in North West Europe. New World farmed-in to licenses 1/09 and 2/09 in October 2011, which are onshore in the Jutland area in southwestern Denmark. New World announced the completion of its farm-in to license in April 2012. This license is both onshore and offshore, on the northern flank of the South Permian basin in southern Denmark. Exploration and appraisal drilling. In the Danish North Sea, four exploration wells were drilled between the period of July 2011 and June 2012. Two wells discovered oil, one well discovered gas and condensate, and one well was found to be dry. Discoveries. PA Resources drilled all three of the successful wells during the period of July 2011 to June 2012. PA Resources’ sidetrack well 5504/20-5 was drilled to target the Middle Jurassic reservoir sandstone, approximately 2.2 km down-dip of well 5504/20-4. At this location, the reservoir was found to be gas-bearing but of slightly poorer reservoir quality. The results of 5504/20-5 have helped to confirm a gross hydrocarbon column of over 1,180 ft, from the crest of the structure to the location of the latest well. PA Resources then targeted the Lille John prospect, using exploration well 5504/20-Lille John-1. The well targeted three reservoir units in the Miocene, Cretaceous and Middle Jurassic, but the main target was the Cretaceous Chalk. The well encountered the targeted sandstone reservoir at a depth of approximately 2,950 ft subsea and penetrated 16 ft of net oil pay over a gross interval of 80 ft. The Miocene target was identified from a seismic amplitude anomaly, but, as the main target of well 5504/20-Lille John-1 was in the Cretaceous, the well was not optimally placed to test the Miocene target. The well encountered modest reservoir development, as expected, at this location. It has confirmed the anomaly to represent an oil-bearing interval, with an apparent column height in excess of 950 ft. Following the discovery of oil in the Miocene, the well was deepened to test the main Cretaceous target. However, due to an unexpected pore pressure regime and extensive fracturing at the chalk level, 5504/20-Lille John-1 was sidetracked, with the aim of testing the Cretaceous target from a revised location. PA Resources’ second well, 5504/20-Lille John-2, targeted the Cretaceous chalk reservoir. However, it was cemented and exhibited only weak hydrocarbon shows. The well penetrated a Miocene oil-bearing reservoir, discovered using the parent well 5504/20-Lille John-1, for the second time. Reservoir quality encountered in the Miocene using this well was higher than in the discovery well. IRELAND In October, the awards for the 2011 Atlantic Margin Licensing Round were announced. In total, 13 Licensing Options were awarded to 12 companies. Seven of the companies are new entrants to Ireland. The options are for a two-year period with modest work programs and have the option to be converted into 15-year Frontier Exploration Licenses, to undertake seismic and drilling operations. The awards follow the receipt of 15 applications, which was the largest number of applications received in any Irish round. This licensing round has attracted some smaller players to the Irish Atlantic Margin, such as Bluestack Energy and Two Seas Oil & Gas Limited. Ireland is showing signs of increasing interest for exploration. Deal activity over the last year in Ireland has been 50% lower than the previous year, with four deals being made in the last 12 months, three of which were farm-ins and the fourth an asset transaction. The average number of deals made each year in the last four years has been seven. Providence Resources has been active in the region. In October 2011, Providence and its partners, Lansdowne Oil and Gas, and San Leon Energy, were awarded Standard Exploration License (SEL) 1/11 over the Barryroe oil discovery. In December 2011, Providence was awarded SEL 2/11 in the Kish Bank basin, which contains the Dalkey Island exploration prospect. The partners have committed to drill at least one well during the first phase. In addition, Providence also agreed with San Leon Energy to acquire San Leon’s 30% working interest in SEL 1/11 for a net profit interest of 4.5% in the Barryroe field. Exploration and appraisal drilling. In the North Celtic Sea, Providence Resources spudded Barryroe appraisal well 48/24-10 in November 2011. On March 23, 2012, Providence revealed that results from final testing at Barryroe in the North Celtic Sea basin were better than expected. An additional 17 ft of net pay in the gas-bearing upper part of the basal Wealden sandstone were encountered. This followed the successful testing of the oil-bearing lower basal Wealden sandstone, which encountered 24 ft of net pay. Providence reported highly productive flowrates for the gas zone test, with results of 7 MMcfgd and 1,350 bopd through a restricted 36/64-in. choke, with a wellhead pressure of 1,700 psia. The productivity of the gas-bearing interval far exceeded expectations and thus controlled the ability to fully open the well to its maximum potential. GREENLAND Activity levels in Greenland remain relatively low. In December 2011, the government announced it will determine and announce the designation of the Pre-Round Area of 30,000 sq km and the 20,000 sq km of the ordinary licensing round in the Greenland Sea Licensing Rounds. Applications to the Pre-Round Area must include at least one of the Kanumas Group of companies (StatoilHydro, BP, ExxonMobil, Chevron, Shell, and Japan Oil, Gas and Metals National Corporation). The Pre-Round area contains 11 blocks and covers 29.9 sq km, and the ordinary round area contains eight blocks and covers 20 sq km. The application deadline for Pre-Round is Dec. 15, 2012, with an earlier deadline of March 2012 for those companies wishing to act as operator. The ordinary round will be open to all interested parties following the Pre-Round. In January 2012, Statoil announced that it has farmed into the Cairn Energy plc-operated Pitu license. Statoil has acquired a 30.625% working interest. The Pitu license was originally awarded to Cairn Energy during the first Baffin Bay licensing round in December 2010. The license is immediately adjacent to the two Shell-operated licenses, Anu and Napu, where Statoil has a working interest of 20.125% and 14.875%, respectively. The work program includes the interpretation of recently acquired seismic data. The first exploration period expires on Dec. 31, 2014, and all initial work commitments have been fulfilled. The partnership will evaluate the seismic data prior to making a decision on drilling an exploration well. Cairn will retain operatorship at this stage, while Statoil will operate any future development. Exploration and appraisal drilling. As in 2010, Cairn Energy, through its subsidiary, Capricorn Exploration, spudded three exploration wells in 2011, Fig. 9. Delta-1 was drilled to target Cretaceous reservoir units in a large structural closure below a Tertiary volcanic section. The well failed to reach its target, with no hydrocarbon shows encountered and was terminated in the Tertiary at a total depth of 9,766 ft. Gamma-1 targeted the Gamma prospect in the Eqqua Block. The Gamma prospect was a prognosed structural-stratigraphic trap in a Tertiary basin floor fan. Prior to drilling, it was estimated that the Gamma prospect held prospective resources of 1,840 MMbbl of oil or 7 Tcf of gas, and chance of success was estimated at around 10%. The prospect overlies a deeper Mesozoic prospect, but this was not targeted during the 2011 campaign. The Gamma-1 exploration well was plugged and abandoned after encountering the targeted fan with no hydrocarbon shows. The AT2-1 well was the fifth in Cairn’s 2011 Greenlandic exploration campaign. It encountered minor hydrocarbon shows in the Cretaceous, and was plugged and abandoned.

FAROE ISLANDS No licensing or deal activity has been announced in the Faroe Islands in the last year. During the first quarter of 2011, ExxonMobil acquired 50% interest in licenses 009 and 011, and a 49% interest in license 006 from Statoil. The last major activity in the Faroe Islands was in the final quarter of 2008, when three licenses were awarded in the Third Faroese Licensing Round. TECHNICAL INNOVATION There have been some recent innovations made in North Sea operations. In particular, further progress has been made in drilling methods. MPD methods. In drilling a North Sea HTHP well in the Elgin/Franklin field area, MPD methods helped reach TD about 75 days ahead of plans, based on trouble with conventionally drilled offset wells. In the process, the MPD application successfully handled five separate influxes over nine days to facilitate a fast resumption of drilling. A liner section was also eliminated. A key aspect of the success was the ability to drill through abnormally pressured formation layers by manipulating backpressure to achieve dynamic mud weight management, rather than the time and cost of conventional mud weight changes. (Bouvet, et al.) Some offset wells had been abandoned or sidetracked. Others required contingency liners to reach TD. Challenges drilling these offsets included:

Safety and well control were enhanced, using the closed loop system to quickly identify when drilling moved into high-pressure, low-volume gas stringers. The system was then used to quickly and safely process the kick. Efficiency was increased by not having to go through a conventional open loop mitigation process of circulating the kick out of the wellbore. Early symptom detection of drilling problems. As described by authors from IRIS and Sekal, downhole conditions during drilling may deteriorate and lead to unexpected situations that can result in significant delays. In most cases, warning signs of the deterioration can be observed in advance, and by taking proactive actions, drillers can avoid serious incidents like pack-offs or stuck-pipes. A new analysis methodology, relying on an automatic real-time computer system, has been developed to detect those early indicator conditions. The methodology comprises constantly computing the various physical forces acting inside the well (mechanical, hydraulic and thermodynamic). These physical forces are coupled to an automatic model calibration, which then gives a reliable picture of expected well behavior. Through analysis of the deviations between modeled and measured values, an estimation of the current well state is derived in real time. Changes in the well condition are an early warning of deteriorating well conditions. The software has been used for monitoring 15 unique wells in five different North Sea fields. All major situations were warned in advance at different event time scales: rapidly changing downhole conditions (such as pulling a drillstring into a cuttings bed) were typically warned 30 minutes ahead of the actual event, medium duration deteriorations were detected up to 6 hours before the incident, and slow-changing downhole conditions were signaled up to one day in advance. The availability of good-quality, real-time data streams makes it possible to implement such analysis tools in an integrated operations setup. Early symptom detection can be used to make decisions in a timely fashion, based on quantitative performance indicators rather than subjective feelings and personal experience. Chalk reservoir management through rock physics diagnostics. As outlined by authors from Maersk Oil, there is value in an integrated approach to management of North Sea chalk reservoirs, utilizing 3D and 4D seismic. Quantitative geophysical analysis through integration with well-established reservoir engineering and geoscience processes has impacted reservoir management and field development significantly. The diagnostics have led to optimized drilling and near-field appraisal, maturation of wells, identification of remaining potential and insight to waterflooding dynamics. An integrated approach to field development and reservoir management includes quantitative geophysical interpretation. Rock physics is an excellent enabler for integration between geoscience and petroleum engineering. CONCLUSIONS With a record number of applications in the UK’s 27th Licensing Round, and an increase in the area on offer seen in the Norwegian APA 2012, licensing activity across the region is likely to remain high. Subsequent work commitments relating to the award of the 26th Licensing Round and the APA 2011 may also have a positive impact on drilling activity. Deal numbers are still relatively low. However, with an increasing number of asset transactions being made, the market may still show signs of improvement. Further increase in the number of deals being made as 2012 continues, and the effect of the 2012 Budget, is seen. North West Europe is very much dominated by drilling activity offshore the UK and Norway. However, the UK has witnessed a diminishing trend in the number of exploration and appraisal wells drilled between July 2011 and June 2012, compared to previous years. While the North Sea’s exploration plays are becoming ever more mature, companies are looking to frontier areas like the West of Shetland for technologically more-demanding prospects. Norway continues to demonstrate constant levels of activity, with companies exploring new discoveries in the hope of finding major fields like Johan Sverdrup.

|

|||||||||||||||||||||||||||||||||||

- Mixed outlook for activity on the UK Continental Shelf (December 2023)

- First Oil: Sorting through the muddled mess (November 2022)

- First Oil: Electricity problems reflect poor energy/resource policy (August 2022)

- First Oil: A tale of two “windfalls” (June 2022)

- The ESG perspective: A day without oil? (April 2022)

- Executive viewpoint: Texas oil and gas can save Europe—again (April 2022)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)