PRAMOD KULKARNI, Editor

|

| Environmental activists climb the derrick ladder of the Cuadrilla Resources rig in northwest England, bringing a temporary halt to the shale fracing operations. Photo credit: Associated Press. |

|

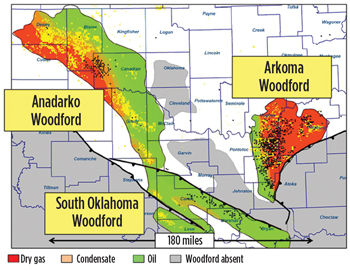

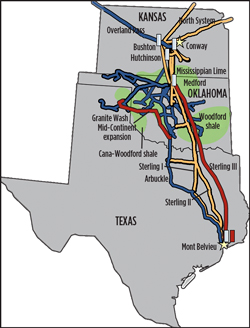

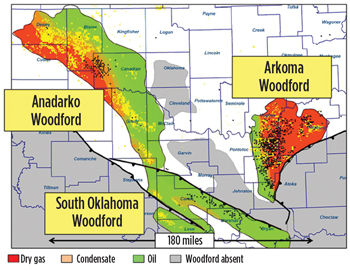

For North American shale operators, the latest cash crops are oil, natural gas liquids (NGL) and condensates, due to the high price disparity between dry natural gas and liquids. This trend is particularly apparent in Oklahoma’s Woodford shale play. Operators, such as Devon Energy, have shifted their leasing and drilling activity from the gas-prone Arkoma Woodford in southeastern Oklahoma to the to the liquids-rich Anadarko Woodford in the west and South Oklahoma Woodford in the southern region of the state, Fig. 1. As most of the Anadarko play is in Canadian County, the play is also referred to as the Cana Woodford. Prior to the current unconventional activity, the Woodford has been the source of conventional oil since the first commercial well was drilled in 1939 with total oil production from the region exceeding 4 million bbl.

|

| Fig. 1. Woodford shale play is divided into the gas-rich Arkoma Woodford in southeast Oklahoma and the liquids-rich Anadarko and South Oklahoma Woodford. Courtesy of Continental Resources. |

|

GEOLOGICAL SETTING

In 2010, the US Geological Survey (USGS) assessed undiscovered oil and gas resources for the Devonian Woodford shale to be about 16 Tcf of gas and 192 MMbbl of NGLs. Source rock hydrocarbon potential for the Woodford and Chattanooga shale units (5+) is highest in the region, Fig. 2. The major challenge, however, is that the pay zones in the formation are 11,000 to 15,000 ft deep. As a result, a typical Woodford well costs in the range of $7 million to 10 million.

|

| Fig. 2. The Devonian Woodford and Chattanooga shale lithostratigraphic units have the highest hydrocarbon source rock potential of 5+, at a depth of 11,000 to 15,000 ft. |

|

MULTI-UNIT DRILLING

In April 2011, Oklahoma passed HB 1909, which permits multi-unit drilling to facilitate horizontal drilling. Previously, laterals were restricted within the 640-acre units. Continental Resources has been the first operator to take advantage of this reform by drilling across two units. During the first quarter of 2012, Continental will complete Tom’s 1-21XH well in Blaine County. The horizontal section of the Tom’s well is expected to be twice the length of previous wells in the play. According to Continental, the technique is expected to turn two marginally economic projects into an economic one by exposing more of the formation and reducing the environmental footprint by drilling off just one pad. If the first well is successful, Continental plans to drill as many as nine such wells in 2012. The rules change should lead to increased fracturing activity in the region, Fig. 3.

|

|

| Fig. 3. The passing of HB 1909 to allow multi-unit drilling will increase fracturing activity for service companies. Photo courtesy of Weatherford. |

|

OPERATOR ACTIVITY

Devon Energy. The first company to drill in the Woodford shale play in 2005, Devon now has accumulated 243,000 net acres at low leasing costs in the liquids-rich Anadarko Woodford region and 43,000 net acres in the gassy Arkoma Woodford. Most of the acreage is held by production.

In the Arkoma Woodford, Devon operates 400 producing wells with 2011 third-quarter net production of 13 Mboed, with reserves of 48 MMboe (19% liquids) at the end of 2010. In 2010, the company drilled and completed 61 horizontal wells, including the longest lateral in the area at 6,700 ft. In 2011, however, Devon severely cut back its drilling activities with only one non-operated horizontal well, and reduced costs by improving the efficiency of its gathering systems.

In the Anadarko Woodford, Devon more than doubled its acreage in the play, where it expects to yield upwards of 100 barrels of NGLs per 1 MMcfd of natural gas produced. In 2011, Devon doubled its Anadarko production to 250 MMcfd by year-end, including 14,000 bpd of NGLs and condensate from 180 producing wells. With 5,000 risked locations remaining, Devon expects to implement strong drilling programs in upcoming years to increase production and achieve reserves growth. In 2010, Devon built a gas plant capable of processing 250 MMcfd. The plant’s capacity can be increased to 750 MMcfd to support future production growth.

Continental Resources. The Oklahoma independent has 330,540 net acres leased in the entire Woodford play, including 275,605 net acres in the Anadarko Woodford. Continental produced 157 MMboed of liquids during third-quarter 2011, a 78% increase over the second quarter. Already, the company has excellent rates of return, even at a $3/Mcf Henry Hub price, Fig. 4. During 2012, Continental has allocated capital expenditures of $355 million for Anadarko Woodford and only $2 million for Arkoma Woodford.

|

|

| Fig. 4. Daily production rate and cumulative production for a typical Cimarex well. |

|

Marathon. Active in Oklahoma for more than 70 years, Marathon increased its holdings in the Anadarko Woodford during 2011 to 160,000 net acres, most of which are held by production. The P50 resource potential for the acreage is 300 MMboe. The independent also ramped up its drilling activity from three to seven wells and plans to drill 45 to 55 net wells per year up to 2013. The production rate is expected to be 30,000 boed by 2015.

Newfield Exploration. Based in The Woodlands, Texas, Newfield holds 172,000 acres in the Woodford play. The company had drilled a total of 375 wells till 2011, but has shifted its focus to the more lucrative Eagle Ford shale and Uinta basin. Nevertheless, the company planned to drill 12 to 18 wells in 2011. Newfield’s peak IP for five wells in the area was greater than 1,400 boepd, consisting of 35% oil of 41°API gravity.

ExxonMobil. Through its XTO unit. ExxonMobil has acquired more than 150,000 net acres in the play. The firm’s activity in the Woodford Ardmore play has ramped up significantly during 2011, with the operated rig count increasing from three to seven rigs, and gross operated production more than tripling since year-end 2010.

Cimarex Energy. The Denver-based independent holds 120,000 net acres in the Anadarko Woodford, including 64,000 net acres in the core Anadarkodian County. Cimarex’s resource potential in the area is 4-5 Tcfe, with 500 Bcfe of booked reserves at the end of 2010. During third-quarter 2011, Cimarex produced 139 MMcfed (65% gas and 35% liquids), a 66% increase over the same quarter in 2010. In 2011, Cimarex expected to drill 50 net wells using 9-12 rigs. At 80-acre spacing, Cimarex has 730 net well locations in the core area. The company expects its wells in the Anadarko Woodford play to have first month’s production rate of 6,200 Mcfed and an estimated ultimate recovery (EUR) of about 9.2 Bcfe over a 10-year span, Fig. 6.

|

|

| Fig. 5. Continental Resources’ rates of return for several wells based on Henry Hub prices. |

|

|

|

| Fig. 6. Devon has built saltwater disposal wells and central water impoundment ponds as part of its water management program in the Anadarko Woodford. |

|

BP. As part of its transition from gas to liquids plays, Chesapeake sold 88,000 acres with 2-Tcf potential to BP in 2008 at a price of $1.75 billion. The IOC is drilling test wells to research optimum drilling and completion parameters, such as well spacing, proppant size, drainage patterns, etc. The company has yet to announce major drilling and production projects.

Range Resources. A major player in the Marcellus, Range Resources has only 42,000 acres in the Anadarko Woodford. The resource potential in these lease areas is 1.1 to 1.7 Tcfe, net. The company has thus far identified 700 prospective drilling sites.

GATHERING SYSTEMS

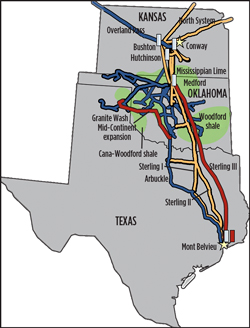

Delivering liquids to market is an important requirement for the Anadarko Woodford producing wells. Oneok Partners has announced a plan to invest up to $240 million for NGL projects in the Anadarko Woodford and Granite Wash plays. The company plans to construct over 230 mi of pipelines specifically for NGLs, and pumping stations to build capacity to 240,000 bpd, Fig. 7.

|

|

| Fig. 7. Oneok Partners is planning to expand its midcontinent pipelines in the Woodford and Granite Wash plays to process additional liquids at its processing plants in Medford, Oklahoma, and Mont Belvieu, Texas. |

|

In a related development, Atlas Pipeline Partners has signed a long-term deal with ExxonMobil’s XTO unit to provide natural gas gathering and processing services in the Woodford shale. These services will provide incremental output of up to 60 MMcfd from the Woodford shale region to the Velma processing facility in Oklahoma. The deal will bring the Velma facility’s processing capacity to 160 MMcfd after the expansion is completed. The project is expected to be complete in the middle of next year. Additionally, Energy Transfer Partners (ETP) will build a $360 million pipeline and processing plant to handle natural gas produced by ExxonMobil in North Texas and Oklahoma. ETP will build a 117-mi gathering line from Woodford shale to ETP’s gathering and processing infrastructure in the North Texas Barnett shale. The pipeline will have a diameter of 24 in. to 30 in., and will initially be able to move 450 MMcfd. A planned expansion would boost capacity to 1 Bcfd. ETP will also build a new cryogenic processing plant at its facility in Godley, Texas. The pipeline is expected to be in service by fourth-quarter 2012. The new processing plant will begin operating in third- quarter 2013.

In December 2011, Newfield Energy renewed its contract for another two years to continue to provide recycling services in the Woodford Shale with Ecosphere, which employs its patented mobile Ozonix systems to treat flowback and produced water for bacteria and biofilms control, scale and corrosion inhibition oil and grease removal, iron precipitation, and total suspended solids removal. According to Ecosphere, its water treatment technologies are capable of reducing well completion costs by recycling 25,000 bbl of water per well, eliminating the cost of hauling produced and frac water in the Woodford shale at the rate of $3.71 per bbl.

WATER MANAGEMENT

A typical Woodford shale well requires approximately six million gallons of water. A majority of the supply comes from surface water such as rivers, lakes and streams, including the Canadian River. According to Devon, flowback and produced water in the Anadarko Woodford shale contains very low total dissolved solids (TDS). The flowback water has approximately 12,000 TDS, and produced water has about 20,000 TDS. The company is attempting to reduce freshwater requirements by reusing produced water at the rate of 8,000 bpd from 78 wells.

TECHNOLOGY APPLICATIONS

As one of the early shale plays with substantial, conventional oil and gas production, the Woodford shale has been a venue of technology applications, such as geosteering and simultaneous fracturing. Recent research and technology applications are summarized below.

Statistical analysis of the effects of mineralogy on rock mechanical properties of the Woodford shale. Researchers at the Colorado School of Mines and the University of Alberta used multivariate statistical analysis techniques, including factor, cluster and multivariate regression analysis, to relate 36 different components of a 260-ft core section from the Woodford shale, including total organic content (TOC), rock mechanical properties, and geochemical data. The statistical analysis shows that Poisson’s ratio is most strongly influenced by clay and quartz content, and, to a lesser extent, TOC. Similar results are seen for Young’s modulus measurements. The mechanical properties and mineralogy of the Upper Woodford zone suggest it is the most brittle interval and is most prone to hydraulic fracturing. Hydraulic fracture modeling results indicate that upward growth from the Upper Woodford interval can be expected, and that the Middle Woodford zone is less conducive to hydraulic fracturing.

Overcoming fracturing challenges in Cana Woodford. Due to vertical depths ranging from 10,500 to 15,400 ft, and lateral lengths ranging from 2,500 to 5,200 ft, the Cana Woodford requires unique solutions with respect to the design and implementation of the hydraulic fracturing program. Early completion efforts were characterized by extreme difficulties in placing designed fracture treatments, and inconsistencies in both job implementation and well performance. Devon Energy and Halliburton authors have described a systematic approach to identifying these problems, which led to design changes to the Cana Woodford stimulation program. These wells typically have 5½-in. casing from surface to TD, and the lateral section is cemented. Well operators have drilled the laterals, such that transverse hydraulic fractures are expected. During the initial exploration phase and early part of field development, breakdown and fracture initiation were extremely difficult and inconsistent. Proppant placement for the first 28 wells completed ranged from 16% to 98% of designed volumes, and averaged 70%. Since the implementation of specific design changes, proppant placement in the last 81 wells has ranged from 68% to 105%, with an average placement of 90%. Additionally, the total proppant placed has increased from an average 150,000 lbm/stage to a more-than-300,000 lbm/stage. Initial results indicate that these improvements in placement and consistency have improved overall well performance.2

Dual-porosity model for history matching and forecasting shale gas reservoir production performance. Texas A&M researchers have developed a new method for history matching production of shale gas wells and future forecasting. The method is based on linear, dual-porosity analytical solutions, which include horizontal wells with multistage fractures. A linear dual-porosity model assumes hydraulic fractures as a secondary porosity system and conduit to flow. Homogeneous matrix blocks are sources of primary porosity that feed fluids to the hydraulic fractures. The authors conducted a systematic analysis to determine the main parameters affecting transient flow regimes. Since main flow regimes observed in the field are bi-linear and linear, more attention was given to those regimes to match with the field data. Analytical solutions are modified for gas properties and desorption of gas from matrix surface. The proposed method was applied to history match the production of shale gas wells from the Barnett, Woodford, and Fayetteville plays. The main parameters found from history matching are effective matrix and fracture permeabilities and fracture half-length. In wells with successful matches, future production can be forecast with some confidence.3

DRIVEN BY ECONOMICS

The Woodford shale play is a testament to the ability of the US independents to shift their activities in response to changing economic conditions. While natural gas was the primary incentive for the operators in 2005, the stagnation of gas prices and the rise in the prices of NGLs and crude oil has resulted in the slowdown in the gassy Arkoma Woodford and the concurrent rise in exploration and production from the Anadarko Woodford. If the economic incentives shift in future years, one can be sure of the nimble reaction of the Woodford shale operators.

LITERATURE CITED

1. K. Aoudia, J. L.Miskimins, C. A. Mnich, Colorado School of Mines and N. B.Harris, University of Alberta, “Statistical analysis of the effects of mineralogy on rock mechanical properties of the Woodford shale,” paper 10-303 presented at the 44th U.S. Rock Mechanics Symposium and 5th U.S.-Canada Rock Mechanics Symposium in Salt Lake City, Utah, 27-30 June, 2010.

2. D. Wood, B. Schmit and L. Riggins, Devon Energy; B. J. Johnson and Chris Talley, Halliburton, “Cana Woodford stimulation practices - A case history,” paper SPE 143960 presented at the North American Unconventional Gas Conference and Exhibition in Woodlands, Texas, 14-16 June 2011.

3. O. Samandarli, H. Al-Ahmadi and R. Wattenbarger, Texas A&M University, “A new method for history matching and forecasting shale gas reservoir production performance with a dual-porosity model,” paper SPE 14435 presented at the North American Unconventional Gas Conference and Exhibition in The Woodlands, Texas, 14-16 June 2011.

|