|

U.S. crude oil producers should be able to cruise through 2012, if oil prices continue to hover in the $100/bbl price range. Natural gas prices in North America are at a 10-year low and threatening to reach $2/MMbtu, due to an oversupply caused by a combination of an unusually warm winter and surge in shale gas production. Thus, U.S. natural gas operators, who have yet to transition from dry gas to liquids, are in for a rough ride.

Chesapeake, a leading shale gas operator, has already announced plans to reduce its dry gas drilling activity by 50% to approximately 24 rigs by the second quarter of 2012. All operators and service companies will have to maneuver through regional turbulence in the form of regulatory uncertainty over shale fracturing and any recessionary slowdown in the national economy. As we enter 2012 with relatively high oil prices balanced by slumping natural gas prices, World Oil’s forecast indicates:

-

U.S. drilling activity will grow an additional 6.7% to 47,918 wells

-

U.S. rig count will average 2,019 rigs, up 7.6% from 2011.

U.S. prices. The U.S. Energy Information Administration (EIA) has predicted that as global economic activity rebounds, world oil consumption will outstrip supply, causing oil prices to hit the $120 mark in four years. Near-$100/bbl oil will support increased shale oil and liquids exploration in U.S. shale plays, as well as encourage large deepwater projects in the Gulf of Mexico and EOR activity in mature areas, such as the Permian basin in West Texas and the Anadarko basin in Oklahoma.

In 2011, the Brent-WTI spread went through an unprecedented swing of as much as $27, due to increasing imports from Canada and a surplus in Cushing, Oklahoma. This spread is likely to narrow in 2012, due to the renegotiation of supply contracts and the expected reversal of the Seaway pipeline between Cushing and the Gulf Coast refineries.

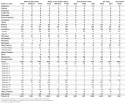

| Forecast of 2012 U.S. wells and footage to be drilled |

|

Just a few years ago, NYMEX futures prices for natural gas were over $10/MMbtu, and experts were predicting the U.S. would have to become a major LNG importer. The shale gas production and a warm winter have combined to increase working gas in storage to 3.3 Tcf, as of Friday, Jan. 13, 2012, according to the EIA. This volume is 539 Bcf higher than last year at this time and 566 Bcf above the five-year average of 2.7 Tcf. The oversupply is encouraging development of LNG liquefaction facilities in North America to take advantage of higher prices in Europe and Asia. Cheniere Energy, which has signed LNG export agreements with European and Asia gas companies for its liquefaction terminal in Sabine Pass, Texas, is now considering an additional terminal near Corpus Christi to export production from the Eagle Ford. Similar LNG facilities are under consideration to capture shale gas production from the Marcellus play in Pennsylvania.

U.S. rig count. The Baker Hughes U.S. rotary drilling rig count stood at 2,008 on Jan. 20, up 295 rigs from the same week in 2011. In Dec. 2011, the international rig count was 1,180, up 65 from December 2010. About 61% of the U.S. rigs were drilling for oil, a ratio that is likely to increase during 2012. Another dominant trend is that 59% of the rigs were drilling horizontal wells.

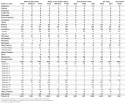

| What 80 U.S. independents1 plan for 2012 |

|

U.S. operators’ survey. World Oil’s survey of 11 U.S. major drillers (integrated companies and independents with large drilling programs) and 80 independents reports a total of 7,321 wells drilled last year, accounting for 16% of our total 2011 estimate of wells drilled. Majors reported 6,371 wells drilled in 2011, a number that is 1,137 less than last year’s respondents had originally forecast. (Independents drilled some 950 wells, far below the 2011 forecast of 2,572 wells, but since respondents vary considerably from year to year, such comparisons are not particularly meaningful.)

For 2012, major drillers expect their programs to increase by a substantial 19% to 7,604 wells, of which 9% will be wildcats. This reflects an increasing exploratory forecast for the majors, and is broadly distributed. The largest number of wildcats—211—is slated for Oklahoma.

Somewhat unexpectedly, the independents are not as optimistic as the majors, but they still predicted a 9% increase in wells drilled, for a total of 1,034. Independents are more aggressive explorers than the majors, with 21% of their 2012 wells planned as wildcats. Combined, our major and independent respondents plan to drill 8,638 wells in 2012, accounting for 18% of World Oil’s U.S. drilling forecast.

| What 11 U.S. major drillers1 plan for 2012 |

|

Drilling details. A drilling boom is underway in the liquids-rich Bakken shale play in North Dakota and Montana and the Eagle Ford in South Texas, matched by a steady exodus away from the relatively dry Barnett play in North Texas and the Haynesville in Arkansas and East Texas, despite record gas production in both areas in recent months. The Marcellus is also likely to experience a slowdown in the dry gas areas.

Excitement is building up in the oily Utica play in Ohio and the Niobrara play in Colorado, where exploratory drilling is underway. In November, Anadarko announced a potential resource of 500 million to 1.5 billion BOE in the Niobrara and Codell plays as a result of its drilling activity in the Wattenberg field.

Attempts by the EPA to issue directives to regulate fracturing activity or require the disclosure of proprietary frac fluid additives is likely to have a dampening effect on shale drilling activity.

Activity in the Gulf of Mexico has increased considerably since this time last year, when the deepwater drilling moratorium was in full swing in the aftermath of the Macondo well blowout. The operators have adapted to the stricter SEMS and spill containment requirements and are receiving permits at a steady pace. The number of rigs drilling in these waters has more than doubled, with all of the increase in activity coming from the oil-rich, deepwater segment.

About these statistics. World Oil’s tables are produced with the aid of data from a variety of sources, including the American Petroleum Institute, IHS Energy, the Texas Railroad Commission, other state and federal regulatory agencies, as well as international energy agencies. Most importantly, operating companies with drilling programs responded to this year’s survey. Please note credits and explanations in the table footnotes. We thank all contributors for their time and effort in providing data and analysis.

World Oil editors try to be as objective as possible in the estimating process to present what they believe is the most current data available. Sound forecasting can only be as reliable as the base data. In this respect, it should be noted that well counting is a dynamic process and most historical data will be continually updated over a period of several years before “the books are closed” on any given year.

|