KURT ABRAHAM, Executive Editor

Concerned about lagging crude oil production, Mexico is increasing its capital expenditures over the next several years to stabilize output and then grow it. Last year, Pemex spent $19.1 billion on capital projects, of which more than 80% was spent on upstream work. This year, the firm will raise capital spending 21.5% to $23.2 billion, of which 85%, or $19.7 billion, will be dedicated to E&P projects.

Exploration. Last year, Pemex spent $2.2 billion on exploration. This year, the company will boost that amount 9%, to $2.4 billion, or slightly more than 10% of total capex. The state firm has made great progress in improving its proved oil reserves replacement rate. Back in 2005, Pemex was replacing just 22.7% of proved reserves but managed to more than double that rate by 2008, at 50.3%. Last year, the replacement rate improved to 85.8%. In 2012, Pemex has finally hit the 100% replacement rate, and the company expects to finish the year by replacing 101.1% of oil reserves.

In the Gulf of Mexico, Pemex has spent $3.68 billion in the 2002-2011 period for deepwater exploration. The firm has acquired 107,762 sq km of seismic in that period and drilled 19 wells, of which nine are producers. Pemex has discovered proved, probable and possible reserves of 736 MMboe, and identified heavy and extra-heavy oil reservoirs in the southern portion of the Salina del Istmo area of the Gulf. The company has established several collaboration agreements with Shell, BP, Petrobras, Intec, Heerema and Pegasus. At present, Pemex is operating three deepwater rigs in the Gulf, including Centenario, Bicentenario and West Pegasus.

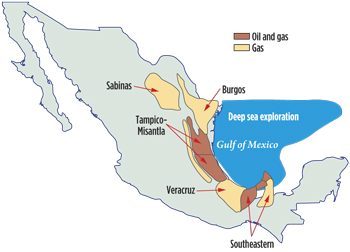

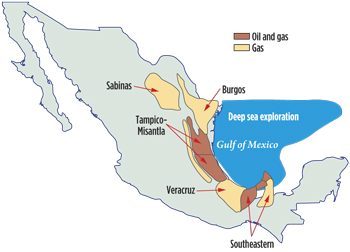

Onshore, Pemex has identified five geological provinces that have shale gas potential. The firm estimates that prospective shale gas resources range from 150 to 459 Tcf. This represents 2.5 to 7 times the conventional 3P gas reserves of Mexico. Pemex is evaluating Mexico’s shale gas potential—in 2011, the Emergente-1 well was drilled, but no details were released. The company is finishing the drilling of three additional wells.

Drilling/development. During 2011, Pemex drilled 1,046 wells, of which 45 were offshore. Active rigs drilling totaled 72 onshore and 22 offshore. This year, the forecast calls for 1,031 wells onshore and 51 offshore, for a total of 1,082. According to national hydrocarbons regulator CNH, Mexican state oil company Pemex drilled 500 new wells during the first five months of 2012. That represents a 29% increase over the 387 wells drilled during the same period in 2011. In May 2012, Pemex drilled 105 new wells, up from 103 in April 2012 and 81 in May 2011.

Pemex has now conducted two rounds of awards of integrated production services contracts. Last year, three contracts were awarded, one to Schlumberger ($9.40/boe to redevelop Carrizo field in the south) and two to Petrofac ($5.01/boe, each, to redevelop Magallanes and Santuario fields in central Mexico). Schlumberger has since begun work at Carrizo in mid-2012, while Petrofac began operations at its two fields in the first quarter of this year.

In the second round of awards, made in June 2012, Schlumberger and Petrofac jointly won a contract to redevelop four fields in the Panuco area of Pemex’s North region at $7.00/boe. Work should begin by early 2013. Two additional contracts were awarded to Mexican firm Monclova Pirineos Gas to redevelop Tierra Blanca and San Andres fields in northern Mexico at $4.12/boe and $3.49/boe, respectively. A fourth contract was awarded to Cheiron Holdings Ltd. to redevelop Altamira field in the North region for $5.01/boe.

Pemex hopes that the contracts awarded in the first round will result in new, incremental production of 55,000 bopd. Similarly, the firm expects the second round contracts to generate an additional 70,000 bopd. This is just part of an overall strategy, whereby Pemex wants to increase oil output between 125,000 and 160,000 bpd by 2014.

|

| To complement the concentration of oil production in the lower Gulf of Mexico, Pemex is increasing capital expenditures to develop resources in several onshore basins, as well as the deepwater Gulf. |

|

Production. Mexican oil output averaged 2.55 million bopd in 2011, up 2.0% from the 2010 figure. This year, crude production in the first 24 days of June remained relatively flat from the level of May 2012 and June 2011, averaging 2.53 million bpd, according to CNH figures. Crude output this year peaked in March at 2.55 million bpd and fell to 2.54 million bpd by May. Production has been falling since reaching a peak of 3.3 million bopd in 2004.

Pemex is working to stabilize output and now estimates that this year’s average should be about 2.56 million bopd. The firm’s giant Cantarell field offshore is no longer the largest producer in the country. Cantarell produced 63.2% of Mexican oil in 2004, but its share fell to 19.6% in 2011. Meanwhile, the Ku, Maloob and Zaap (KMZ) field complex offshore became Mexico’s leading production area in 2009. The KMZ complex contributed 33.0% of Mexican production in 2001.

Natural gas production totaled 1.95 Tcf last year, up 13.4% from 1.72 Tcf produced during 2010. Natural gas output remains concentrated in the Burgos basin, in northeastern Mexico, and offshore in the Gulf of Mexico.

CUBA

The country continues to experience economic problems with limited options to fix them, so any increase in oil and gas activity, along with greater production, would be welcome.

There were 24 wells drilled last year for 103,456 ft of hole. The total included 20 oil wells and four dry holes. This year, activity is forecast to remain steady at 24 wells, including 20 onshore and four offshore. Earlier this year, Spanish firm Repsol drilled its first deepwater offshore well in Cuban waters of the Gulf of Mexico from the Scarabeo 9 semisubmersible rig. Unfortunately, Repsol announced on May 18 that the much-ballyhooed well had come up dry.

The rig has since been used by Malaysia’s Petronas to explore an area in the Florida Straits known as the Northbelt Thrust, about 110 mi southwest of Repsol's drill site. Results were expected to be announced at the end of July, as this issue went to press. Repsol is under contract to drill a second deepwater well, but the firm has been evaluating whether to fulfill that commitment or pay a penalty and withdraw from the project. There is a feeling among industry analysts that if none of the four deepwater wells scheduled by operators finds hydrocarbons, that it could be another five to 10 years before more offshore drilling occurs.

Onshore, the largest foreign operator in Cuba continues to be Canada’s Sherritt International. The company operates three commercial oil fields—Puerto Escondido, Yumuri and Varadero West—in two separate blocks of the heavy oil region stretching roughly between Mantanzas and Cardenas. During 2011, Sherritt Oil produced 20,888 gross working-interest bopd, representing approximately 43% of Cuba’s oil production. About 94% of Sherritt’s total oil and gas production originates in Cuba. Last year, the firm concentrated its drilling within Cuba. Eight development wells were initiated and seven were completed. Of the seven development wells completed in 2011, four were put into production. In 2012, Sherritt will likely drill a similar number of wells and continue to develop existing fields, utilizing advanced technology, where applicable, to improve production. Applications have been made for additional exploration blocks.

Crude oil production averaged 55,203 bpd during 2011. The Ministry of Basic Industry said that 234 oil wells were active, including 36 flowing and 198 on artificial lift. Natural gas output was 101.4 MMcfd.

|