Regional Report - Offshore Africa: Following the discovery of Jubilee field, operators are chasing Upper Cretaceous, pre-salt and deep horizon opportunities in West Africa and significant gas accumulations offshore East Africa.

The vast African continent is considered to have some of the last remaining hydrocarbon frontiers in the world. Excluding North African countries such as Egypt, Algeria and Libya, and the Sub-Saharan Africa countries of Nigeria, Angola and Gabon, where exploration has been ongoing for decades, exploration in the rest of the continent has been minimal. This article looks at frontier offshore exploration in three key regions: Gulf of Guinea, West Africa pre-salt and East Africa.

LYDIA THEVANAYAGAM, THOM ALLEN and ALEX ELLIOTT, Deloitte Petroleum Services Group

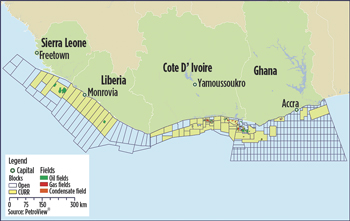

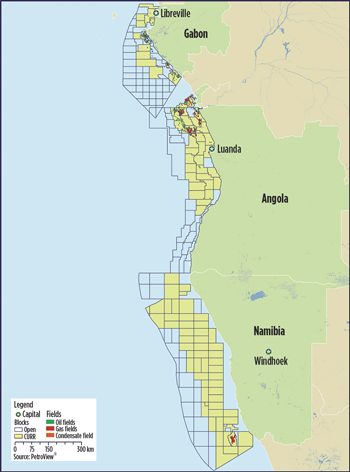

The vast African continent is considered to have some of the last remaining hydrocarbon frontiers in the world. Excluding North African countries such as Egypt, Algeria and Libya, and the Sub-Saharan Africa countries of Nigeria, Angola and Gabon, where exploration has been ongoing for decades, exploration in the rest of the continent has been minimal. This article looks at frontier offshore exploration in three key regions: Gulf of Guinea, West Africa pre-salt and East Africa. Each of the focus regions has its own unique geology and circumstances that have led to increasing levels of interest. In the frontier Gulf of Guinea, moving westwards from Benin to Sierra Leone, operators are chasing Upper Cretaceous Jubilee-type plays along the West African Transform Margin (WATM). Jubilee’s great success has encouraged oil companies to gain a foothold and explore some of the most frontier countries in Africa such as Benin, Togo, Liberia and Sierra Leone. West Africa is the most explored sub-region in Sub-Saharan Africa, with the production histories of Nigeria, Angola and Gabon extending back into the 1950s. Operators are now looking to deeper horizons and pre-salt exploration, which, until recent improvements in seismic data, had been difficult to image through the thick layers of salt deposited during the breakup of Gondwana and the creation of the southern Atlantic sediments. The success of Brazil in pre-salt exploration has led operators to look at analogous basins along the west coast of Africa including Gabon, the Republic of Congo, Angola and Namibia. Angola has already been successful in pre-salt drilling, paving the way for further pre-salt activity in adjacent countries. In the past, East Africa’s gas discoveries had led the industry to dismiss its interest in the east to focus on easier access to oil-bearing provinces in the west. With growing markets for gas in Asia, coupled with giant discoveries in the last few years offshore Mozambique and Tanzania, interest in East Africa has risen and successes have prompted offshore and deepwater exploration. GULF OF GUINEA The WATM, formed during continental rifting between Africa and South America, follows the coast along the Gulf of Guinea, Fig. 1. Oil and gas exploration and interest in the frontier Gulf of Guinea between Sierra Leone and Benin has been fairly limited until recent years. Early exploration in the 1970s and 80s resulted in a number of small oil and gas finds, such as Foxtrot (1981) in Cote d’Ivoire and Saltpond (1970) in Ghana.

In the last decade, however, exploration has picked up with many significant discoveries, with Ghana’s Jubilee field (2007) being the most notable as the largest oil discovery in the region. Further discoveries, spurred by Jubilee’s success, have led to a rapid increase in oil and gas investment in the region, with acreage surrounding these discoveries becoming highly sought-after by operators. Table 1 shows the top 10 companies ranked by gross acreage for each of these countries.

Sierra Leone. Exploration activity in Sierra Leone has increased in pace following the resumption of exploration efforts after the civil war ended in 2002. Following the first licensing round, Oranto Petroleum signed an agreement with the government to acquire Block SL-5, and Repsol YPF was awarded neighboring Blocks SL-6 and SL-7 in 2003. Woodside Energy subsequently farmed into Repsol’s acreage, and in 2008, Anadarko Petroleum acquired a 50% interest and operatorship from Repsol. The consortium was joined by Tullow Oil in 2009 and during the year, an extensive 3D seismic survey was carried out over the acreage. Anadarko spudded the first well in Sierra Leone for over 20 years in August 2009, resulting in Sierra Leone’s first oil discovery, Venus, near the border of Oranto’s Block 5. Oranto’s agreement over Block 5 was terminated in 2010, due to a lack of activity on the block, following legal proceedings which were launched after a portion of the block was assigned to Anadarko as part of a new agreement combining Blocks 6 and 7 to form Block SL-07B. In 2011, Oranto’s Block 5 was reinstated under a new license, SL-05-11, after it won its case at the International Court of Arbitration. The company soon farmed out 49% interest and operatorship to Russian major Lukoil, and 21% interest to Vanco Energy. Following these proceedings, Anadarko also signed a new license, SL-07B-11, which includes the Mercury and Jupiter oil discoveries made by Anadarko (following Venus) during 2010 and 2012, respectively. Approximately 41 m of net hydrocarbon pay were encountered at Mercury, 30 m at Jupiter and 14 m at Venus, proving significant potential in the area. During December 2011, the government of Sierra Leone opened a third licensing round covering nine blocks with an approximate area of 21,265 sq km. The round closed on March 30, 2012, and was reported to have generated great interest. However, as of June 2012, no further announcements have been made with respect to the awards. Exploration and appraisal activity is planned for much of the current acreage, including appraisal drilling of current discoveries, an extensive 3D seismic survey by African Petroleum over Block SL-3 and a one-well drilling commitment by 2013 on Lukoil’s Block, SL-05-11. Liberia. The nation’s early exploration history is much like that of neighboring Sierra Leone, seeing little exploration prior to 2003. Several large oil and gas explorers have entered the country in recent years, leading to a rapid increase in activity. The National Oil Company of Liberia (NOCAL) launched Liberia’s first licensing round in 2004, offering a total of 17 blocks. Acreage was awarded to Repsol (LB-16 and LB-17), Oranto (LB-11 and LB-12), Woodside (LB-15), Regal Petroleum (LB-8 and LB-9) and Broadway Consolidated (LB-13). A second Liberian licensing round, held between December 2007 and July 2008, made available the remaining open blocks. Anadarko and Oranto were successful, acquiring Blocks LB-10 and LB-14, respectively. Anadarko went to strengthen its foothold in Liberia in 2008 when it acquired an interest in Blocks LB-15, LB-16 and LB-17 from Woodside and Repsol. Following the acquisition of 3D seismic over these blocks, the consortium, joined by Tullow in 2009, drilled the Montserrado-1 well during 2011 on LB-15, resulting in a non-commercial oil discovery. The second round resulted in Hong Kong Tong Tai Petroleum being awarded the Block LB-6 and LB-7 licenses, which currently remain in negotiation with the government. In 2010, Chevron acquired operatorship and interests in LB-11, 12 and 14 from Oranto, which had undertaken 3D seismic acquisition during 2008. Recently, NOCAL rejected a bid by Peppercoast Petroleum to transfer its 100% interest in LB-13 to Canadian Overseas Petroleum Limited (COPL), with Peppercoast now planning to transfer 70% interest to ExxonMobil and 30% to COPL and NOCAL, which reportedly are more willing to accept this offer. African Petroleum acquired Regal Petroleum’s subsidiary, Regal Liberia, during 2009, giving it access to Blocks LB-8 and LB-9. Since this acquisition, over 5,000 sq km of 3D seismic have been acquired, and two wells have been drilled. Apalis-1, drilled in 2011, resulted in oil shows, and in early 2012, the Narina-1 well was reported to have made a significant oil discovery, with a total net pay of 32 m. The current pace of exploration in Liberia is expected to continue, with Chevron and Oranto planning a well on their acreage using the results of the 2008 seismic survey. Anadarko is planning to continue interpretation of 3D seismic data, including integration of well data from its recent Montserrado well and evaluation of the recent 3D survey over LB-10. African Petroleum has recently signed a contract to drill two wells over its LB-8 and LB-9 acreage during second-half 2012, using the Erik Raude semi-submersible, which may add to its recent Narina discovery. Côte d’Ivoire. Esso carried out an exploration campaign during the 1970s and 1980s in the region, resulting in several discoveries, including Belier and Addax oil fields and Gazelle gas field. The country saw its first production from Belier, approximately 16.8 million bbl, from 1980 to 1992 before being shut in. Phillips Petroleum discovered the Espoir West and Espoir East oil fields in 1979, with total estimated P50 recoverable reserves of 93 million bbl of oil. Espoir was brought onstream in 1982 before being abandoned during 1989, due to declining production. The Foxtrot, Lion and Panthere gas fields were discovered by Phillips during the early 1980s. Agip discovered Kudu gas field in 1984, followed by the discovery of Ibex oil field by Esso in 1985. Many of these finds were not developed at the time, due to lack of commerciality or excessive development costs. During 1995, Afren brought the Lion and Panthere fields onstream as part of the same development. Production from Lion peaked at 14,000 bopd and 35 MMcfd of gas in 1999. Panthere peaked during 2007 at 62 MMcfd of gas. Ranger Oil discovered Baobab and Kossipo oil fields in 2001 and 2002, respectively. These fields have since been taken over by Canadian Natural Resources (CNR) and Svenska Petroleum. Baobab was brought onstream during 2005 and reached peak production during 2009 at an approximate rate of 29,000 bopd. Currently, phase three of the development plan for this field is being initiated, with five new wells planned. The Espoir fields were redeveloped in 2006 and brought back onstream by a consortium that includes CNR and Tullow. Production reached 30,000 bopd during 2006, and eight infill wells are currently planned to extend the field life. In 2008, Afren took over operatorship of the CI-01 license area, which contains Kudu, Eland and Ibex fields. During 2009, Afren announced a fast development of these fields, with gas being pipelined to shore. In 2010, Rialto Energy took a 75% stake in C & L Natural Resources, which at the time had operatorship of Gazelle and Addax fields. An Exclusive Exploitation Area (EEA) was granted over Gazelle field in 2012, and development has started with a three-well program. Recent new entrants include African Petroleum, which was awarded blocks CI-513 in 2011, and CI-509 in 2012, and Total, which entered Cote d’Ivoire in 2012 with the acquisition of three contiguous blocks, CI-514, CI-515 and CI-516. 3D seismic is planned for CI-513 during 2012. With regard to its acreage, Total has stated that the area may have similar prospectivity to offshore French Guiana, where Tullow recently discovered oil. During 2010 and 2011, the second Ivoirian civil war placed a large amount of exploration on hold, with some companies, such as Anadarko and Lukoil, temporarily declaring force majeure. The situation has since stabilized, and exploration activity has resumed pace. Ghana. The earliest Ghanaian discovery was made in 1970 by Signal Oil and Gas at the Saltpond oil field. Saltpond was brought onstream during 1978, marking Ghana’s first production, peaking at 2,500 bopd, and producing until 1985. The field was later redeveloped and brought onstream in 2003 by the Saltpond Offshore Production Company. Between 1970 and 1980, there was a series of small discoveries, including Tano North Oil, discovered by Volta Petroleum and Tano South Gas, and Tano South Oil and Tano North Gas fields, discovered by Phillips Petroleum. These fields remain undeveloped to date. In 2004, Kosmos Energy took operatorship of the West Cape Three Points license area, joined by Anadarko and Tullow in 2006. In the same year, Tullow took operatorship of the Deep Tano license area, with Anadarko and Kosmos joining the consortium. The Jubilee discovery was made in 2007 with the Kosmos-operated Mahogany-1 discovery well, which encountered 95 m of net oil pay. The field began development in 2009, with Tullow as operator of the Jubilee unit area. Jubilee came onstream in December 2010, representing a significant achievement as the fastest-ever deepwater development of its kind. The consortium aims to ramp up production to 120,000 bopd during 2012, and there is also a planned $1-billion gas project that will eventually transport gas to shore. In 2011, Tullow acquired EO Group’s Ghanaian interests, including a 1.75% stake in Jubilee, for a total of $305 million. In the West Cape Three Points acreage, east of Jubilee, Kosmos also made the Mahogany East oil discovery, which is planned to be developed as a single FPSO project with the 2011 Akasa and Teak oil discoveries. In the Deep Tano Block, west of Jubilee, Tullow made the Tweneboa gas and condensate discovery in 2009, followed by the Enyenra oil discovery in 2010 and the Ntomme oil, gas and condensate discovery in 2011. These three discoveries are currently undergoing appraisal. Tweneboa is estimated to contain 250 million bbl of recoverable condensate, and Enyenra 200 million bbl of recoverable oil. The Ntomme-2A appraisal well encountered 39 m of net oil pay in early 2012. Tullow and its partners are looking to develop these three fields together as an FPSO project under the name TEN (Tweneboa, Enyenra and Ntomme). Hess made its first Ghanaian discovery in 2011 with the Paradise-1 well, which encountered 149 m of net pay over three intervals. This was the first discovery in the Hess-operated Deep Tano Cape Three Points (Deep Tano CTP) acreage and followed the unsuccessful Ankobra well in 2008. These wells fulfill Hess’ work commitments on the block. However, exploration efforts have continued on Deep Tano CTP following the recent Statoil farm-in. Hess and Statoil spudded the Hickory North-1 well in April 2012. Eni has also entered Ghana in recent years, initially farming into the Offshore and South Cape Three Points blocks as operator. The company has strengthened its position in Ghana by farming into the Keta Block, where it partners with Afren. With the discovery of Sankofa and Gye Nyame gas fields in the Offshore Cape Three Points acreage during 2011, LNG development plans are reportedly being considered. Other areas of exploration. Elsewhere in the frontier Gulf of Guinea, there has been interest in Togo, with Eni taking operatorship of the only two offshore blocks in the country during 2010. Benin has also seen an increase in activity, with Signet Petroleum taking operatorship of Block 3 and Oranto taking operatorship of Blocks 5, 6 and 7. Further west along the WATM in Mauritania, the Tullow-operated exploration campaign is ongoing. Two of Tullow’s Production Sharing Contracts (PSCs) were replaced in 2011 by a single PSC known as C-10, which holds the Banda, Tevet and Tiof discoveries. Tullow has been given an 18-month extension on C-10 to allow for completion of appraisal and development activities. In recent months, Kosmos has also applied for three large deepwater exploration areas adjacent to the Tullow acreage, and Chariot Oil and Gas has been awarded the C-19 exploration area to the far north. Total has also been awarded Block C-9 offshore Mauritania. The WATM area is relatively politically stable with the exception of the recent Ivoirian civil war. Functioning democracies exist in Ghana, Liberia and Sierra Leone, and the situation in Cote d’Ivoire is reportedly stable. There is some risk regarding the borders of offshore acreage. In 2011, Cote d’Ivoire announced a series of new blocks, forming a wedge located entirely within Ghana’s exclusive economic zone. These blocks cover the proposed Tullow-operated TEN development and a large proportion of Hess’s Deep Tano Cape Three Points Block. This dispute has yet to be resolved. WEST AFRICA PRE-SALT Deepwater pre-salt plays offshore central and southern West Africa are rapidly being established as a new province of frontier exploration, Fig 2. Interest in these plays has been fueled by the large discoveries of high-quality crude in rocks below salt layers (pre-salt) offshore Brazil in the Santos and Campos basins. Salt deposits, which exist off both South America and West Africa, were deposited in the restricted marine environments that existed during the breakup of the Gondwana supercontinent and the formation of the southern Atlantic basin. Several salt basins exist offshore West Africa. However, the Aptian aged ‘post-rift’ salt deposits, which extend from Cameroon to northern Namibia, are most analogous to the discoveries in Brazil. Currently, most interest in West African pre-salt is focused on Angolan, Namibian and Gabonese blocks, where exploration drilling of pre-salt targets has begun.

Angola. The results of a pre-salt licensing round, covering the Kwanza basin, were announced in January 2011, with licenses signed for 11 deepwater blocks at a ceremony in Luanda, Angola. Successful bidders comprised a host of majors, including BP, ConocoPhillips, Eni, Repsol, Statoil and Total, as well as the mid-cap U.S. independent, Cobalt International. Cobalt, which is 19% owned by Goldman Sachs, already held two blocks in the Kwanza basin prior to the licensing round, which it picked up in early 2010. Other existing acreage holders in the basin included Maersk Oil and Svenska Petroleum, with two blocks awarded to Maersk in 2006. Petrobras was also awarded two blocks in 2006. Petrobras was joined by BP in December 2011 after farming down its interest in Block 26 in the Benguela sub-basin. Bob Dudley, CEO of BP, which picked up two blocks in the licensing round, was quoted in the local press as saying that he believed that “pre-salt in the Benguela and Kwanza basins has the potential to increase the life of Angola’s oil industry from 20 years to half a century.” Table 2 shows the top 10 companies in Angola’s portion of the Kwanza basin ranked by net acreage positions.

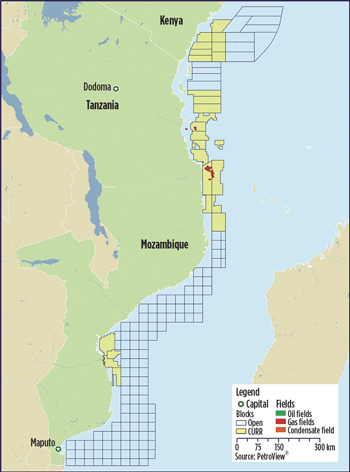

Although some pre-salt discoveries had already been made onshore, only a handful of offshore wells had previously reached the pre-salt in the Kwanza basin. These include Marathon Petroleum’s Denden-1 (1983), drilled on Block 9 that penetrated a syn-rift section, and Baleia-1 (1996), drilled by Mobil on Block 20, which encountered oil shows. However, while the new licenses were being negotiated, drilling began on the earlier licensed blocks in the Kwanza basin. Maersk was the first to target pre-salt objectives in the Angolan deepwater, with its Azul-1 well on Block 23. Spudded in June 2011 at a 923-m water depth, the well was announced as a discovery in early 2012, having recovered two good-quality oil samples in a mini-drillstem test (DST). Although well conditions prevented a conventional flow test, Maersk reports that initial results indicated a potential flow capacity greater than 3,000 bopd. The Maersk well was soon followed by Cobalt’s Cameia-1 well on Block 21. Cobalt originally spudded a well on its Bicuar prospect but, after encountering over-pressured water sands after drilling a few hundred meters, it was forced to abandon the well and move to the Cameia well site. Drilled in a 1,682-m water depth, the Cameia-1 well was completed in February 2012 after encountering a 360-m gross oil column with a net-to-gross ratio of over 75%. A DST flowed at an un-stimulated sustained rate of 5,010 bpd of 44° API gravity oil, reportedly restricted by the testing equipment. Cobalt has followed its discovery with the Cameia-2 appraisal well that was still drilling as of June 2012. The operator anticipates that the well will help define the aerial extent of the discovery as well as test the deeper syn-rift targets not drilled by Cameia-1. Cobalt also plans to re-drill the Bicuar-1 well in the second half of 2012. Pre-salt potential also extends into Angola’s southern offshore with the continuation of the Aptian salt into Angola’s unexplored Namibe basin, which currently remains unlicensed. Namibia. Pre-salt potential exists where the Namibe basin extends south from Angola into the northern portion of Namibia’s offshore. The Namibe basin is touted as a mirror image of Brazil’s prolific Santos basin, both having been adjacent to one another prior to the opening of the southern Atlantic. In Nambia, acreage covering the Namibe basin is fully licensed. Energulf Resources operates License 0017, covering Blocks 1711A and 1711B, over which a two-year extension has recently been approved. Chariot Oil and Gas also operates a Namibe basin License 0014, which covers blocks 1811A and 1811B, and both AlphaPetro and Mibia Energy hold ultra-deep Blocks 1710 and 1810, respectively. Canadian junior PetroViking Energy has entered into an agreement to acquire an interest in both AlphaPetro’s and Mibia’s acreage. Chariot spudded the first well in a Namibian drilling program on its Tapir South prospect, one of a number of pre-salt targets indentified on its 1811A and 1811B blocks. The well, 1811/5-1, was drilled in a water depth of 2,018 m and given a 25% chance of success by the operator, but failed to encounter any significant hydrocarbons. The primary Cenomanian-Turonian source rocks were shallower than predicted and therefore immature, forcing Chariot to re-assess the remaining prospectivity on the block. The well was only the second one drilled in the Namibe basin, highlighting a region of frontier exploration. Although there are no pre-salt plays south of the Namibe basin, the rest of Namibia’s offshore region remains frontier with 13 exploration wells drilled and only a single discovery, the Kudu gas field, made in 1974. Despite this, Namibia’s offshore has recently attracted a large amount of licensing activity with players such as BP and Petrobras, and the Brazilian firm HRT Oil & Gas, which now operates 10 individual blocks. Repsol recently announced plans to enter License 0010, which covers three blocks and is currently held by Farahead Holdings and Tower Resources. Exploration and appraisal work is ongoing throughout Namibia’s offshore, with a number of seismic operations in progress. Petrobras, with partners Chariot and BP, will next drill the Kabeljou well (2714/6-1) on the giant Nimrod prospect on Block 2714A. HRT has recently signed a rig for its upcoming drilling campaign, which is anticipated to begin during fourth-quarter 2012/first-quarter 2013. Deepwater pre-salt wells are also planned in Gabon, where Cobalt has identified several pre-salt targets on its Diaba block, including the Mango and Mango South prospects. Gabon already has proven onshore pre-salt discoveries, such as Rabi-Kounga field. In 2010, Gabon was due to launch its 10th licensing round focused on deepwater pre-salt plays, but the round was delayed and eventually cancelled pending the passage of new petroleum legislation. The government instead indicated that it would enter into direct negotiations with interested companies. The success of the initial pre-salt wells in Angola’s Kwanza basin is very encouraging for West Africa’s pre-salt potential. Looking forward, despite the challenges that remain from deepwater drilling and seismic imaging below salt, further pre-salt wells can be expected. Exploration is likely to gain pace, particularly offshore Angola after its successful licensing round. Further potential also exists in other countries such as Congo (Brazzaville) and Equatorial Guinea. In addition, outside the Aptian Salt basin, there are a number of older, more isolated salt basins offshore Morocco, Mauritania, Senegal, Gambia and Guinea-Bissau that were formed during the continental rifting (syn-rift) in the Late Triassic to Early Jurassic. Although not directly analogous to the discoveries offshore Brazil, these basins are attracting interest from such companies as Total, Chariot and Kosmos. EAST AFRICA Historically, exploration in East Africa has been limited to onshore and coastal regions following the discoveries of Pande (1961) and Temane (1967) in Mozambique and Mnazi Bay (1982) and Songo Songo (1974) in Tanzania. These gas discoveries, ignored at the time due to the lack of domestic markets and infrastructure, fueled the theory that offshore East Africa was gas-prone. Blocks offshore Mozambique, Tanzania and Kenya are currently driving operator interest, Fig 3.

Mozambique. Acreage has traditionally been awarded through competitive bidding rounds, of which there have been four to date. The second round, launched in July 2005, has been the most successful, awarding all five blocks on and offshore the Ruvuma basin to a group of companies, including Anadarko Petroleum, Petronas, Eni and Artumas (now Wentworth Resources). Mozambique’s National Oil Company, Empresa Nacional de Hidrocarbonetos E.P. (ENH), has a 10-15% participating interest in all assets. The offshore acreage position and operating companies in Mozambique have remained fairly constant since the award of the second round in March 2006 (Table 3) with only Anadarko farming down to smaller companies, including Mitsui E&P, Bharat PetroResources, Videocon Energy and Cove Energy in Area 1, and ENI farming down to Korea Gas Corporation and Galp Energia in Area 4.

The early discoveries of Pande (2.2 Tcf) and Temane (1.1 Tcf) onshore gas fields were not appraised until the late 1980s and early 1990s. In 2000, Sasol took over operatorship of the acreage and began an intensive drilling campaign, which led to the discovery of Inhassoro (379.3 Bcf) in 2003. Pande and Temane fields were jointly developed and began producing in 2004, with the gas being piped to the Secunda petrochemical plant in South Africa. In early 2010, Anadarko began its exploration drilling campaign offshore in Area 1 with the Windjammer well. Windjammer was announced as a gas discovery in March, followed by Ironclad, which was plugged and abandoned with oil and gas shows. Ironclad was the first well offshore East Africa to discover the presence of liquid hydrocarbons. Anadarko has continued to make discoveries in Area 1, and in October 2011, Eni announced the discovery of a giant new gas field, Mamba South, in its neighboring block, Area 4. Now renamed the Prosperidade Complex, the finds in Area 1 are thought to contain between 17 and 30+ Tcf of recoverable reserves and include the Windjammer, Barquentine, Lagosta and Camarao discoveries. The Tubarao discovery is part of a separate play to Prosperidade, located south of the complex. The latest Area 1 drilling successes, Golfinho and Atum, are giant gas accumulations, which are geologically distinct from the Prosperidade complex and located entirely within Area 1, unlike Prosperidade and Mamba. Golfinho is currently estimated to hold between 7 and 20+ Tcf of recoverable reserves, and the recently announced Atum encountered “more than 92 m of natural gas pay in two high-quality Oligocene fan systems,” Anadarko announced in June 2011. In Area 4, ENI’s Mamba Complex, which includes Mamba South, North and North East, is thought to contain reserves of between 47 to 52 Tcf of gas-in-place following the addition of the Coral discovery in May 2012. Accelerated appraisal drilling and testing is ongoing in Area 1 with the Anadarko-led consortium now operating two rigs on the block, Belford Dolphin and Deepwater Millennium. Further exploration north of the block is expected, including the completion of Atum and spudding of the Ocra, Trawler and Barracuda prospects. ENI is also planning to drill an additional five wells in Area 4 to fully evaluate the block’s potential. Both ENI and Anadarko are working toward exporting the gas reserves discovered in the offshore Ruvuma basin to the Asian market. Anadarko is planning a multi-train LNG development, initially two 5 MMtpa trains, with the capacity to expand to six trains, for which a final investment decision is expected in 2013 and first gas is anticipated in 2018. Tanzania. The Tanzanian Petroleum Development Corporation (TPDC) has awarded acreage both directly and through competitive licensing rounds. There have been three official licensing rounds held since 2000 for offshore acreage, and remaining on and offshore acreage has been awarded directly since 2006. Currently, there are PSCs over eight offshore blocks operated by a range of consortiums. Since 2010, before the start of exploratory drilling offshore, a number of large players entered the upstream scene. In Block 2, Statoil farmed down interest to ExxonMobil in March 2010. BG Group entered Ophir’s Blocks 1, 3 and 4 in June 2010, and, following successful exploration drilling, BG assumed operatorship of the blocks, effective from July 2011. Petrobras farmed out interest in Block 6 to Shell in October 2011, and Ophir, after acquiring Dominion in February 2012, farmed out interest in Block 7 to Mubadala Oil and Gas. The Songo Songo and Mnazi Bay shallow-water gas discoveries were considered non-commercial at the time of discovery, due to a limited gas market and, therefore, poor prospects for a commercial deal. It wasn’t until industrialization in Dar es Salaam and other cities that these fields became commercially viable. Songo Songo supplies gas to the domestic market, primarily industrial consumers in and around Dar es Salaam, and Mnazi Bay supplies gas to the 12-MW power plant at Mtwara. In September 2010, following the discoveries announced in Mozambique, the Tanzanian operating consortia began exploration drilling offshore. By early 2011, the discoveries of Pweza, Chewa and Chaza had been made by Ophir Energy on Blocks 4 and 1. The fourth well, drilled by Petrobras in Block 6, was dry but was followed by success in Block 1 with the Jodari well drilled by BG in early 2012. The discoveries made on Block 4 and Block 1 total gross recoverable resources of 7 Tcf of gas. Most recently, the BG/Ophir consortium announced the Mzia-1 gas discovery on Block 1, which “intersected a 178-m gas-bearing column and 55-m net pay in the Upper Cretaceous,” Ophir stated. Statoil has also discovered up to 5 Tcf of gas-in-place with its Zafarani discovery and an additional 1 Tcf of gas-in-place following side-track drilling in Block 2. Statoil’s recent Lavani-1 well has also been successful. Lavani has a “preliminary resource estimate of 3 Tcf of gas-in-place. The Lavani well has encountered 95 m of excellent quality reservoir sandstone with high porosity and high permeability,” Statoil announced. Petrobras, Statoil and BG are planning to drill further wells offshore Tanzania this year and BG, along with partner Ophir, is considering a two-train onshore LNG facility. Screening for a suitable location and Environment Impact Assessments (EIAs) is ongoing. Tanzania is also looking to launch a fourth offshore licensing round in September 2012, offering eight blocks. The blocks have been created from partially relinquished areas of current acreage. TPDC also anticipates a future round, where newly demarcated deepwater acreage will be offered. Kenya. Unlike its southerly neighbors, Tanzania and Mozambique, Kenya offers upstream acreage through direct negotiation. The oil and gas industry in Kenya is governed by the National Oil Corporation of Kenya (NOCK), which has signed PSCs for 18 offshore blocks, a number that has steadily risen in recent years. Exploration in Kenya has been focused onshore, particularly following the rift success in Uganda, with operators looking at the Lamu Embayment following the drilling of Bogal-1 (2009, CNOOC) and the most recent Turkana Rift basin well, Ngamia-1 (2012, Tullow), which discovered oil. Success seen in the neighboring countries has had a positive impact on upstream activity in Kenya, primarily reflected in the acquisition of acreage and M&A activity. Looking at offshore acreage, the first major entrants include Anadarko, which acquired operatorship of five offshore blocks, L-5, L-7, L-12, L-11A and L-11B, in June 2009. Apache followed suit, gaining an operated position in Block L-8 in June 2011. BG acquired two blocks with its consortium partners, Premier Oil, Pancontinental and Cove Energy. Total is the latest major to enter Kenya, partnering with Anadarko, which holds a 40% interest. Most recently, in March 2012, eight new deepwater blocks were gazetted, and companies such as Camac and Total have already laid claim to some of these blocks. Offshore Kenya, most companies are in their first phase of exploration. Offshore drilling is expected from this year forward. Apache has announced its intention to spud the Mbawa-1 prospect in third-quarter 2012 using the Deepsea Metro rig. Total, Ophir and BG are anticipating their first Kenyan wells in 2013. Interest in offshore East Africa has been spurred by the recent successes seen in Mozambique and Tanzania. As a result, the three focus countries have demarcated and made available further deepwater acreage to be offered directly and in future licensing rounds. Kenya and Tanzania have also applied to extend their maritime boundaries. Outside of these countries, operators are looking to acquire and explore throughout the East African Indian Ocean, and countries such as the Seychelles and Madagascar are seeing a renewed interest in activity. The Comoros Islands have also recently awarded a license to Kenyan company, Bahari Resources. FRONTIER CHALLENGES Frontier exploration comes naturally with its challenges. The LNG option could be a game-changer for the countries of East Africa. There are many issues to consider with LNG exports regarding long-term price risk. LNG projects in East Africa, likely to reach FID in the next few years, will add to a growing number of existing LNG projects across the globe that are already underway. Working offshore Africa has always been risky in terms of the security issues. The waters of both East and West Africa are affected by piracy, and the offshore discoveries of oil and gas add additional bounty for pirates seeking ransom. Many African boundaries are not officially ratified by the United Nations (UN) and boundary disputes will continue to cause further issues between countries, particularly when there are hydrocarbon discoveries at stake. Since the Macondo disaster in 2010, there has been an increasing focus on the environmental impact that deepwater exploration poses, this being cited as one of the main reasons for the delay of the Gabonese deepwater licensing round in 2010. Environmental Impact Assessments (EIAs) are becoming more important offshore, particularly for deepwater exploration. Capital gains tax issues have arisen in the past few years, particularly in East Africa. Frontier countries looking to promote their hydrocarbon potential should consider addressing the issue of capital gains taxes in their law that governs hydrocarbon exploration to avoid later disputes. The divestment of Heritage Oil’s Ugandan assets to Tullow in 2010 was claimed to be subject to capital gains tax by the Ugandan government. This was disputed by Heritage, and as of June 2012 was still unresolved. The future sale of Cove Energy was also announced by the Mozambican government to be subject to capital gains tax. A 12.8% tax was subsequently written into law before any transaction could take place. Less political, fiscal and tax uncertainty will encourage future transactions and further exploration activity. CONCLUSION Frontier offshore exploration has so far been successful in the three focus regions of this article. Jubilee’s success in Ghana has encouraged exploration in neighboring under-explored countries, which is proving to be fruitful. West Africa is seeing renewed interest in more challenging environments in deepwater pre-salt, spurred by the discoveries in Brazil. East Africa is attracting large interest with the recent gas discoveries offshore Tanzania and Mozambique, plus further deepwater potential.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

- Advancing offshore decarbonization through electrification of FPSOs (March 2024)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- Driving MPD adoption with performance-enhancing technologies (January 2024)

- Digital transformation: A breakthrough year for digitalization in the offshore sector (January 2024)

- Offshore technology: Platform design: Is the next generation of offshore platforms changing offshore energy? (December 2023)

- 2024: A policy crossroads for American offshore energy (December 2023)