Vol. 232 No. 11

DR. WILLIAM J. PIKE, EDITORIAL ADVISORY BOARD CHAIRMAN

|

Gas everywhere

|

|

If someone asked you to name the United States’ most promising stash of natural gas (or the world’s, for that matter), your first reaction would probably be “shale gas.” That’s a good answer based on the explosion of shale gas activity in the US and globally, but it is wrong. The US Energy Information Administration puts the volume of proved US gas reserves at just over 272 Tcf, with shale gas making up about a quarter of the total at a smidge more that 60 Tcf. That is a lot of gas, but the figure pales when compared with estimates for methane hydrate resources in the US, which run from 100,000 to 370,000 Tcf. A study a few years ago from the (then) Minerals Management Service estimated Gulf of Mexico methane hydrate resources at 21,000 Tcf. That’s nearly 100 times current estimates for total US proved gas reserves. Any way you look at it, the resource is immense.

For such an enormous resource, methane hydrates remain commercially untouched. That may be about to change. This winter, the US Department of Energy (DOE), the Japan Oil, Gas and Metals National Corp. (JOGMEC) and Conoco-Phillips will work together to test innovative technologies for producing methane gas from hydrate deposits on the Alaskan North Slope.

The tests will use the Ignik Sikumi (Inupiaq for “fire in the ice”) gas hydrate test well, a fully instrumented borehole drilled by ConocoPhillips and the National Energy Technology Laboratory (NETL) earlier this year in the Prudhoe Bay area. Included in the tests will be an initial field trial of a technology that injects carbon dioxide into the hydrate formation, displacing the methane. If successful, this would be a win-win situation, resulting in the production of methane and the sequestration of CO2. The trial is an extension of laboratory tests of the technology conducted by Conoco-Phillips and the University of Bergen. According to NETL literature, those lab tests observed that “the process appears to dissociate and re-form hydrate at very fast rates and on a micro-scale in such a manner that there is no free water formed or significant heat-of-reaction issues.”

Following completion of the trial using CO2 to displace the methane, the research team will conduct a one-month evaluation of an alternative production method called depressurization, which involves removing fluids from the borehole, lowering the pressure and allowing the methane to disassociate from borehole water. The method was successfully tested by Japan and Canada in 2008 in a well. In total, the tests will span 100 days, running from January to March 2012.

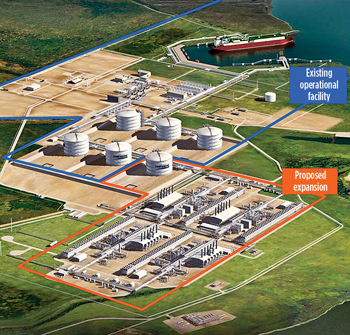

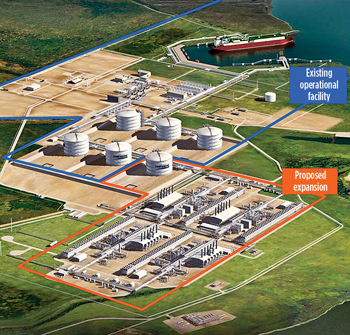

Any commercial production of gas from methane hydrates would certainly hasten the total transformation of the global natural gas market. Perhaps that transformation is nowhere more evident than here in the US. Only 10 years ago, before the explosion of shale gas, there were plans and/or permits for the construction of more than 60 LNG import/regasification facilities in the US. These have virtually all disappeared. Instead, the US is now looking to export natural gas, a scenario no one envisioned 10 years ago. Specifically, a recently inked deal between US energy firm Cheniere and BG Group, worth an estimated $8 billion, would see cheap US shale gas liquefied and sent to countries in Asia and Europe, including the UK. That makes good sense, and presages development of a much larger US LNG capability when you consider that natural gas in the US is a quarter of the price of gas in Asia and about half the price of gas in the UK. Under the deal, Cheniere will sell about 3.5 million tonnes of LNG a year to BG for 20 years at 115% of the US gas price, plus $2.15 per million Btu. Even including shipping costs, the US gas will be cheaper than gas in Asia or Europe, analysts say. If Cheniere begins construction next year, exports could flow as early as 2015.

Look for more of the same as shale gas plays continue to develop, not just in the US but in shale-rich areas like China and the Middle East. I think, over the next 10 years, the global trade in natural gas will alter dramatically. And, that’s without methane hydrate production. Throw that into the mix and it is hard to envision what the gas market might look like.

|

| A proposed expansion would transform Cheniere Energy’s Sabine Pass LNG regasification terminal in Louisiana into a bidirectional import-export facility—and perhaps transform the global gas market. |

|

|

william.pike@ib.netl.doe.gov / Bill Pike has 43 years’ experience in the upstream oil and gas industry and serves as Chairman of the World Oil Editorial Advisory Board. He is currently a consultant with Leonardo Technologies, Inc, and works under contract in the National Energy Technology Laboratory (NETL), a division of the US Department of Energy. His role includes analyzing and supporting NETL’s numerous R&D projects in upstream and carbon sequestration technologies.

|

|

|