JUSTIN SMITH, Offshore Editor

|

|

Pride International ultra-deepwater drillship Deep Ocean Clarion makes its way from South Korea to the US Gulf of Mexico, where it will commence a five-year contract with BP. The rig, delivered from Samsung Heavy Industries earlier this year, is capable of drilling to a total depth of 40,000 ft while operating in up to 12,000 ft of water.

|

|

Deepwater operators tend to follow the best-proven methods to accomplish their goals. However, as new requirements arise, new techniques and equipment are needed, especially as operators hunt for resources in deeper waters and more challenging locations.

The Arctic holds billions of untapped barrels of oil, and operators are chomping at the bit to access them, but a number of issues are hampering progress there. In addition to numerous environmental regulations, and activists attempting to board rigs in protest, there are very few rigs capable of working in ice-infested waters. However, new rig design solutions are in the works to address these challenges.

Also, for decades operators have been combating the high pressures often encountered when drilling, but the challenge is only further complicated when working in several thousand feet of water. Closed-loop drilling offers operators a way to help control downhole pressure while also helping to detect potentially dangerous changes in pressure.

Finally, in years past, operators thought they were as prepared as they could be for any possible spills, but the Macondo disaster in 2010 showed that new deepwater spill containment solutions were needed. The industry has responded, and two new companies are ready to respond to a crisis.

As deepwater exploration and production continues to grow, more equipment is needed. According to RigStar, World Oil’s offshore rig database, currently 81 deepwater-capable rigs are under construction, Table 1. Of these 81 units, 26 were ordered since the beginning of this year, and more are expected.

RIG DESIGNS

Making drilling units as versatile as possible is a rig design trend that is growing in popularity. One example that is already in place in the market is the portion of the global rig fleet that can handle the rough weather commonly experienced in the North Sea. While this weather forces operators in that region to use these higher-specification rigs, the deeper waters of the Arctic, with floating sheets of ice and extremely cold temperatures, require completely different solutions. Huisman’s new design, named JBF Arctic, looks to resolve the issues that are raised by working in Artcic conditions.

Weather is not the only factor influencing rig contractors to look to more versatile designs. Units that can perform more tasks than just drilling are inherently more versatile. Vantage Drilling-managed drillship Dalian Developer and Island Offshore-managed semisubmersible Island Innovator, both of which are currently under construction in China, each are designed to perform tasks beyond drilling, in these cases production and well intervention, respectively.

JBF Arctic. Very few rigs have been built to operate in the icy conditions of the Arctic year-round. The only existing Arctic-capable rig of note is Shell’s Kulluk, which is an older barge that can only operate in a few hundred feet of water. With a growing interest in the Arctic’s considerable oil reserves, newer rigs will be needed that are capable of working there.

Dutch engineering and manufacturing firm Huisman Equipment B.V. entered the offshore drilling market 10 years ago with a new type of drilling mast. Now the company has three complete rig designs, one for a drillship, HuisDrill 12000, and two for semisubmersibles, JBF 14000 and, most recently, JBF Arctic, Fig. 1.

|

|

Fig. 1. An artist’s rendering of the JBF Arctic surrounded by ice.

|

|

| TABLE 1. SELECT 10,000-FT-PLUS DRILLSHIPS UNDER CONSTRUCTION (Click to enlarge) |

|

According to a paper submitted to the 2011 Offshore Technology Conference by Huisman’s Alexei Bereznitski and David Roodenburg, when operators need to drill in deeper icy waters, reinforced drillships with dynamic positioning (DP) can be used, but they have their drawbacks. “Even though these vessels are properly reinforced for operating, or actually for transiting, in ice, their station keeping capability is very limited,” they wrote. “When a vessel cannot choose heading to meet the ice with its bow, DP or a mooring system can only withstand very light ice loads.”

However, Bereznitski and Roodenburg said that typical ice-capable rigs are conical in shape at the water line to break the ice, indicating that these are usually tall spar units or shorter cylindrical units, like Kulluk. They explained, “The seakeeping performance of the relatively short cylindrical units is quite poor since the natural heave period is well within the typical wave periods range. The spar type units have good seakeeping characteristics, but the ability to move between the drilling locations is very limited and the application of these units requires large water depths.”

The design of Huisman’s JBF Arctic drilling unit resolves these issues by allowing the rig to work at two operating drafts. In open waters, the JBF Arctic would operate at the same draft as any traditional semisubmersible. However, when operating in ice, the rig will ballast down to partly submerge the deckbox to protect the riser from ice, rubble and ice ridges.

The deckbox has an angled, ice-strengthened structure to deflect or break ice. The unit would be strengthened for transit through broken ice, though an icebreaker would be needed to assist in the move. The design also calls for a double-activity derrick and dual remotely operated vehicle (ROV) stations.

The hull is similar to Sevan Marine’s vessels, such as the Sevan Driller, in that it is cylindrical with a round deck. However, where a Sevan unit will have essentially vertical sides, the JBF Artcic’s sides are angled inward from both the top and the bottom, with the bottom portion being made up of eight columns.

The 250-person JBF Arctic is designed to drill wells in sub-Arctic conditions where it can be moored in ice up to 5–6.5 ft thick. A 16-point wire-line mooring system is the chief station-keeping measure for ice-infested waters, with thrusters available to provide extra support. The unit is able to operate in water depths between 197 ft and 4,921 ft while drilling to a total depth of 40,000 ft.

To cope with the low temperatures and snowy conditions of the Arctic, the design includes a number of winterization features. Large sections of the rig are enclosed, including the derrick, working areas, lifeboats, life rafts, mooring windlasses, loading hose stations, ROV launching area, riser storage and pipe rack areas. The helidecks, exposed pipes, exposed door and hatch seals, and escape ways all have heat tracing. Snow covers can be found on escape ways and all exposed stairs and walkways. Insulation or heat tracing would be placed on all water piping that could freeze, while exposed tanks would come equipped with heating coils.

Dalian Developer. It is a logical move for the upstream industry to combine its two largest sectors, drilling and production, which, until recently, have always been kept separate. While the world’s first floating drilling, production, storage and offloading vessel (FDPSO) was put to use in August 2009 by Murphy Oil on Azurite field offshore the Republic of Congo, it was a converted tanker, not a new vessel.

The first actual design created from the ground up as an FDPSO is the MPF 1000 from the now defunct MPF Corp. Cosco Dalian Shipyard is building the first unit based on this design for Dalian Deepwater Development Ltd. at a cost of $500 million. The drillship, named Dalian Developer, is being managed by Vantage Drilling.

With a hull size of 955 ft 3 164 ft, the Dalian Developer is designed to drill in ultra-deep water, up to 10,000 ft, to drilling depths exceeding 30,000 ft. The rig will have a separate production moonpool, and its variable deckload capacity, deck space and cargo storage capacity will be the highest of any drillship ever built. The vessel, with 1 million bbl of crude oil storage capacity, will be upgradeable for enhanced well intervention capabilities, extended well testing and early production.

The hull of the vessel and certain onboard equipment were being built and installed by Cosco Dalian for MPF Corp., which had sought bankruptcy protection in 2008. The contract with Dalian became effective in July 2010, and now the vessel is scheduled for delivery in the third quarter of 2012. When completed, the DP3 rig will be equipped with Maritime Hydraulics-made topdrive, hydraulic roughneck and riser tensioners, and Wirth-made rotary table, mud pumps and drawworks. A six-ram, 15,000-psi Hydril blowout preventer will be paired with two Hydril 10,000-psi annular BOPs. The 180-person unit will also have eight Wartsila engines and thrusters.

Island Innovator. Well intervention is a common procedure, but using typical drilling rings to perform this task has its drawbacks. For one thing, modern rigs have larger BOPs than are generally necessary for well intervention work, which can inadvertently damage older wellheads. Also, rigs are expensive and can make simple well intervention work a costly endeavor.

With that in mind, vessels dedicated to well intervention are becoming a preferred option for many operators, but not many exist today. One unit of this type, the Island Innovator, which is owned by Marine Accurate Well and managed by Island Offshore, is being built to the Global Marine GM4000-WI design.

The rig is under construction at Cosco Zhoushan Shipyard in China and is scheduled for delivery in 2012. The unit can operate as a conventional drilling rig in up to 4,250 ft of water, but can perform through-tubing rotary drilling and heavy well intervention in up to 9,850 ft of water. It can drill to a total depth of 26,250 ft.

|

|

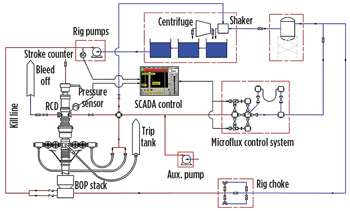

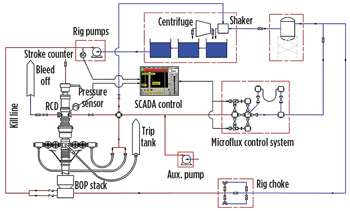

Fig. 2. Weatherford’s closed-loop drilling system.

|

|

The Island Innovator can accommodate four coiled tubing reels with a maximum size of 31/2 in. It is equipped with a 165-ton heave-compensated crane that can work in up to 6,650 ft of water. The harsh environment-capable rig can switch between coiled tubing, wireline and drilling operations in less than an hour.

The DP3 rig is being equipped with a five-ram, 15,000-psi Cameron BOP and VetcoGray risers and diverter. National Oilwell Varco is supplying much of the other equipment on the 120-person rig, including the derrick, main lifting assembly, topdrive, mud pumps and cranes. The unit will be powered by six Wartsila diesel generators.

ALUMINUM DRILL PIPE

While not as complicated as entirely new rig designs, the use of aluminum drill pipe has had a positive impact on offshore drilling operations. While not quite as strong and a little more expensive, aluminum pipes have a big advantage over their traditional steel counterparts: They are considerably lighter. That said, Alcoa’s aluminum alloy drill pipe also happens to have the highest strength-to-weight ratio of any drill pipe.

The lighter weight of the pipe allows offshore rigs to increase their maximum drilling depth capability, both because the drillstring is lighter and because a rig’s capacity to hold pipe will increase by 50–100%.

Traditional equipment that is already installed on rigs can handle these pipes without any modification required. Besides improving the speed and efficiency of horizontal and directional drilling, the enhanced elasticity and resiliency of aluminum drill pipe can result in lower lateral wall forces while reducing abrasive wear on tool joints and the pipe body. Also, since the strength of aluminum pipe is still high while the entire assembly is lighter, less energy is required for rotation the overpull maragin is improved.

CLOSED-LOOP DRILLING

Originally designed as a way to aid in the efficiency of managed pressure drilling, closed-loop systems are growing increasing popular due to the fact that they can assist in the detection of possible well control situations. Following the Deepwater Horizon disaster, deepwater operators in particular are showing an interest in any technology that can help prevent a similar incident from occurring, especially when the technology can also make drilling operations more efficient.

Managed pressure drilling has been in use for decades, with a rotating control device (RCD) being implemented in 1968 to create the first closed-loop system. However, it wasn’t until 2004 that managed pressure drilling was first put to use offshore on a jackup rig in the US Gulf of Mexico.

Later that same year, managed pressure drilling broke the floating rig barrier off the coast of Malaysia. Four years later, Weatherford’s Microflux system aided in drilling HPHT wells in the Mediterranean Sea offshore Egypt in an area where the five previous wells had failed to reach total depth.

Weatherford’s closed-loop drilling system employs three key pieces of technology: an RCD, a drilling choke manifold and a coriolis flowmeter. Each of these elements can be used separately, and have been in the past, but Weatherford engineers David Pavel and Brian Grayson explained that it works much better when built as a complete system from the beginning, especially when grouped with their Microflux control system, Fig. 2.

As Pavel and Grayson stated in a paper presented with fellow Weatherford engineer Said Boutalbi to the 2011 SPE/IADC Drilling Conference and Exhibition, “Most of the technology that comprises a closed-loop system is common, readily available oilfield rig equipment that has been used for decades. The exception is the proprietary computerization used to integrate the equipment as a single system for monitoring, analyzing and managing wellbore pressure.”

The RCD is situated on top of the BOP, although for deepwater operations it is part of the upper riser, situated below the tension ring. According to Grayson, getting the RCD to be positioned below the tension ring was a “huge” breakthrough, because that step allowed the system to work in rougher seas. To date, Weatherford has performed eight closed-loop drilling operations from floating rigs, and is currently at work on two floating rigs, one offshore Brazil and another in Indonesia. The company is currently working to adapt the RCD to work when attached to the subsea BOP, which Pavel said would make the system even more efficient.

In a closed-loop system, the RCD’s job is to direct drilling fluids, cuttings and hydrocarbons from the drill pipe-casing annulus via a bearing assembly and elastomeric sealing elements, which provide a barrier between the drillstring and the wellhead. Through this assembly, drilling fluids and cuttings are circulated without impacting drilling operations.

According to Pavel and Grayson, closing the loop of fluids creates a circuit of incompressible drilling fluid that is capable of detecting a minute change in bottomhole pressure. Since the fluid cannot be compressed further, a small change in pressure—as little as a few gallons, from either an influx or loss—is transmitted through the fluid in seconds.

The fact that a closed-loop system gathers pressure and flow data in real time gives engineers a better understanding of what is taking place in the wellbore, improving traditional mitigation and MPD methods. Weatherford attains a high level of pressure control by using its Microflux control technology, which is an automated system that identifies pressure changes in real time and diagnoses the causes of those changes. Pavel and Grayson call this technique “fingerprinting.”

Through fingerprinting, the system can quickly differentiate between common activities like wellbore breathing and ballooning, and more serious situations like a kick or loss, and then make the proper response. By manipulating annular backpressure, the system lets drillers almost instantly change downhole pressure while simultaneously providing a faster way to detect a potential kick, which the system can then cycle out or, if necessary, alert the crew to a more serious well control situation. This allows rig crews to avoid spending too much time resolving minor issues, which can be quite valuable when using high-end deepwater rigs that regularly cost well over $500,000 per day.

WELL CONTAINMENT

In the year since the Deepwater Horizon caught fire and sank in the US Gulf of Mexico, the offshore oil and gas industry has placed an intense focus on developing a system dedicated to containing spills. One of the primary problems that led to millions of gallons of oil being released into the Gulf was the industry’s inability to cap and subsequently collect oil in a timely fashion.

In an attempt to prevent a situation similar to the Mancondo oil spill, when BP was unable to cap the well for several months, the US Bureau of Ocean Energy Management, Regulation and Enforcement (BOEMRE) issued new rules regarding containment. According to NTL 2010-N10, “For operations using subsea BOPs or surface BOPs on floating facilities, BOEMRE will evaluate whether each operator has submitted adequate information demonstrating that it has access to and can deploy surface and subsea containment resources that would be adequate to promptly respond to a blowout or other loss of well control. ... BOEMRE will evaluate whether each operator has provided adequate information in its current [oil spill response plan] describing the types and quantities of surface and subsea containment equipment that the operator can access in the event of a spill or threat of spill, and the deployment time for each.”

As a result, two companies have emerged with BOEMRE-approved solutions to possible future deepwater well containment emergencies: the Marine Well Containment Company (MWCC) and the Helix Well Containment Group (HWCG). Both firms are building off of the experience their constituent companies gained last year when they responded to the Macondo spill, although the two solutions have some differences.

Of the 10 deepwater drilling permits BOEMRE has issued since lifting the moratorium, six of the operators have chosen to sign on with Helix, while the remaining four operators have said they would use MWCC in the event of a spill.

Helix. HWCG is a consortium of 22 deepwater operators in the Gulf of Mexico, each of which has committed to a mutual aid agreement. The agreement allows any member to draw upon the collective technical expertise, assets and resources of the group in the event of an incident.

The two largest pieces of the Helix Fast Response System are well intervention vessel Q4000 and floating production unit (FPU) Helix Producer I, both of which are owned by Helix Energy Services and were put to use during the Macondo spill response. These vessels work in union with a crude tanker as well as a subsea cap and collection system, which are kept in the Gulf of Mexico region at all times.

The Q4000 is a dynamically positioned vessel specifically designed for well intervention and construction in extreme water depths. The ship is equipped with a multi-purpose derrick, two cranes with lifting capacities of up to 400 tons and seabed access to 10,000 ft, a 73⁄8-in. intervention riser system, two heavy-weather ROVs, an overall deck capacity of 4,400 tons, and a 39-ft 3 21-ft moonpool. In the case of an emergency, a well test skid and burner will be installed to burn 10,000 bpd of oil and 15 MMcfd of natural gas.

The Helix Producer I is a dynamically positioned FPU capable of processing 60,000 bpd and flaring 80 MMcfd. The vessel is able to rapidly disconnect from subsea facilities, allowing it to seek shelter from severe weather. It is equipped with facilities necessary to connect to a tanker for side offloading while providing a water curtain against heat radiation from continuous flaring.

Tied to the disconnectable transfer system on the Helix Producer I is a flexible 5-in. riser that departs from its buoy keel in a U-shape catenary configuration to connect to the Q4000 side offtake. It provides a conduit for transferring oil and gas from the Q4000 to the Helix Producer I. A 1,575-ft, 12-in. Manuli-type H3006 FF PU hose departs from the offloading skid on either side of the Helix Producer I and connects to the tanker’s side-loading skid for offloading.

As for the subsea equipment, Helix has an intervention riser system (IRS), which includes a 135⁄8-in., 10,000-psi connector. The IRS has a hydraulic cutting gate valve, a maximum bore diameter of 73⁄8 in. plus a well barrier and two spring-assist fail-safe-closed gate valves of the same size. Remotely controlling the IRS functions is a pilot-line hydraulic control system that was originally capable of operating in up to 5,600 ft of water; an upgrade to a multiplex control system and the use of 8,500 ft of electric cable and ½-in. hydraulic supply line have extended its reach to 8,000 ft.

The final piece of the Helix Fast Response System is the ROV-operable well cap, which is comprised of an 18¾-in., 10,000-psi hydraulic wellhead connector and a 135⁄8-in., 10,000-psi dual ram block with an 18¾-in., 10,000-psi mandrel (profile up). The cap has a 135⁄8-in. bore and 41⁄16-in., 10,000-psi side outlets with BX-155 seals. Flowrate and pressure can be regulated through two 33⁄16-in. vents.

MWCC. In July of last year, four operators came together to create MWCC as a non-profit organization to operate and maintain a rapid response system to capture and contain oil following a deepwater blowout. With ExxonMobil leading the way, Chevron, ConocoPhillips and Shell committed $1 billion to fund the initial costs of the system.

Since its inception, the company has grown to 10 members as Anadarko, Apache, BHP Billiton, BP, Hess and Statoil have joined. The member companies will each have access to the containment systems, but non-member firms will also have access to the systems through a service agreement and fees.

While Helix’s solution uses equipment that the company already uses for other tasks, MWCC is building its system around components that are strictly for use in oil containment situations. MWCC’s equipment is stored at various locations along the Gulf coast in Texas and Louisiana.

When BP joined MWCC in September, the operator made available to the consortium the equipment it used in containing the Macondo well. This equipment makes up part of MWCC’s interim containment system.

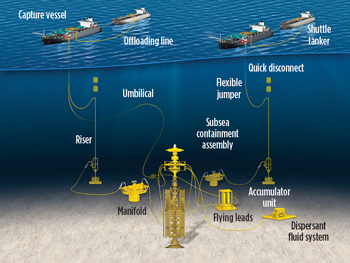

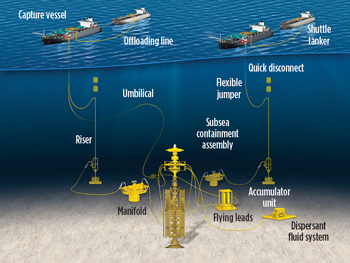

|

|

Fig. 3. The MWCC expanded containment system.

|

|

The dual-shutoff interim system is designed for use in water depths up to 8,000 ft. It has the capacity to contain 60,000 bpd of liquids and 120 MMcfd of gas, with potential for expansion. It includes a 15,000-psi single-ram capping stack and dispersant injection capability.

While the interim system is in place now, MWCC is working on an expanded system (Fig. 3), which is scheduled for launch in 2012. MWCC has contracted Technip to design dedicated subsea well containment equipment, including the containment assembly, manifold, control umbilicals, accumulator, dispersant injector, risers and flowlines.

When completed, the expanded system will be capable of operating in up to 10,000 ft of water with a 15,000-psi, three-ram stack and a dispersant injection system. It will have the capacity to contain 100,000 bpd of liquids and 200 MMcfd of gas, although using additional vessels could increase capacity.

The expanded system will have a new subsea containment assembly that will create a permanent connection and seal to prevent oil from escaping. The assembly, which is designed to prevent hydrates from forming, will have adapters and connectors so it can interact with the wellhead, BOP stack, lower marine riser package and/or casing and strings that are used by operators in the US Gulf.

Capture caisson assemblies will also be built to close off a damaged connector or leak that is outside the well casing. Once installed, the caisson will create a seal with the seabed to prevent seawater from entering.

Captured oil will flow through a flexible pipe to a riser assembly. If more than one capture vessel is required, a manifold will distribute oil from the subsea assembly to multiple riser assemblies. The risers and umbilicals will be able to quickly disconnect from capture vessels should they need to get out of the path of a hurricane.

The extended system will also include modular process equipment that will be installed on the capture vessels. The process equipment will separate oil from gas, flare the gas, and store oil until it can be offloaded to shuttle tankers.

Deployment of the system will begin within 24 hours of an incident. MWCC will make the equipment available to the incident operator, who is separately responsible for securing the required capture vessels.

|