Pramod Kulkarni, Editor

India is mentioned in tandem with China by virtually every industry expert as the country where oil and gas demand is expected to skyrocket in the coming decades. But production has remained relatively flat in recent years, requiring increased imports to close the growing gap between supply and demand (Fig. 1), with imports in 2009 accounting for 72% of the country’s crude oil requirements.

India offers exploration opportunities onshore from Assam in the northeast to Rajasthan in the northwest and Gujarat in the west. The major offshore sectors are the west coast—which includes Bombay High Field, discovered in 1974—the newly discovered KG Basin fields on the east coast and the prospective Kerala-Konkan and Cauvery Basins off the southern coasts. India’s deepwater reach extends to the Andaman and Nicobar islands in the southeast. In all, India has sedimentary basins of 3.14 million sq km, but so far only about 30% of the area has been explored. The country has set a target to initiate exploration activity in all the basins by 2015. Exploration activity should receive a boost with the announcement in February of a historic partnership between BP and Reliance Industries.

NELP ROUNDS

Oil and gas operations in India take place under the direction of the Ministry of Petroleum and Natural Gas. The ministry has designated the Directorate General of Hydrocarbons (DGH) to coordinate licensing and regulatory affairs. As a major component of economic reforms in 2000, the DGH introduced a New Exploration Licensing Policy (NELP) to increase E&P by both domestic and international oil and gas companies.

Prior to NELP, India conducted its oil and gas exploration exclusively through public-sector companies such as the Oil and Natural Gas Corporation. ONGC is still the leading operator in India, but eight rounds of NELP licensing have opened up the country’s upstream business to additional public-sector companies (Indian Oil, Hindustan Petroleum, Gujarat State Petroleum Corporation) as well as new Indian private entrants (Reliance Industries, Essar), small international independents (Cairn Energy, Niko Resources, Hardy Oil and Gas), and a few international oil companies (British Gas, Eni).

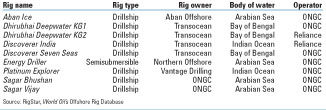

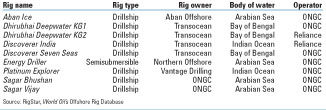

In October 2010, DGH launched NELP IX with bids due by March 18, 2011, for 34 exploration blocks, consisting of eight deepwater, seven shallow-water and 19 onshore areas, Fig. 2. DGH expects a better response than it achieved in NELP VIII, when only $1.1 billion was invested due to the global recession. As an incentive, the NELP winners will be accorded a seven-year profit-linked tax holiday.

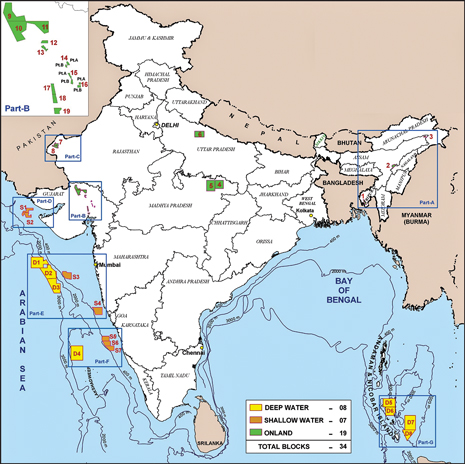

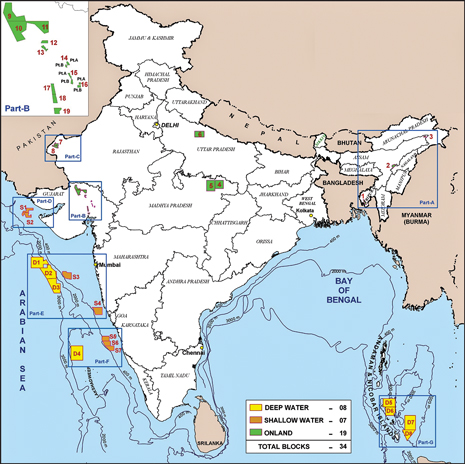

NELP has helped achieve significant additions to India’s oil and gas reserves. Field successes that are now in production include Reliance’s prolific KG-D6 gas field (about 2 Bcfd) on the east coast and Cairn’s Mangala Field (125,000 bopd) in Rajasthan. ONGC’s discoveries in the offshore KG Basin are scheduled to begin production later this year. High expectations abound for deepwater drilling that is currently taking place, Table 1.

OPERATOR ACTIVITY

Operator activity in India extends from wildcat drilling to appraisal and field development operations for enhanced oil recovery to reverse production declines.

|

|

Fig. 1. India is accelerating its E&P activity in light of rising oil consumption and relatively flat domestic supply.

|

|

| India’s deepwater activity |

|

ONGC. During 2010, ONGC added 21 new discoveries, 11 new prospects and three pool discoveries. Additionally, continuing output from existing fields has enabled the public-sector oil firm to maintain production levels since 2007 between 60.74 and 61.76 million metric tons of oil equivalent per year—equivalent to 452–459 million boe—both within and outside India (conversion factor of 7.44 bbl/metric ton estimated for India by the US Energy Information Administration). ONGC’s reserves replacement ratio was 1.74 in 2010, the highest level in two decades. Since 2001, ONGC has embarked on an EOR/IOR campaign by investing $8 billion to achieve a cumulative gain of 56 million metric tons (about 420 million bbl), Fig. 3.

ONGC’s greenfield projects include Daman Main and Daman North Fields in the western offshore sector, which have estimated recoverable gas reserves of 1.5 Tcf. Currently, land acquisition is underway for the onshore gas processing facility. In the KG Basin, ONGC has four cluster-type gas projects underway with production scheduled to begin in late 2012 through 2013. ONGC drilled the first shale gas well in Asia in September 2010 in Damodar Valley. ONGC Videsh Ltd., ONGC’s international division, has 40 E&P projects in 15 countries, including the Sakhalin-1 project in Russia, the Carabobo heavy oil project in Venezuela and the BC-10 development in the Campos Basin, offshore Brazil.

Reliance. An Indian conglomerate with extensive holdings in textiles, petrochemicals and retail, Reliance Industries entered the upstream in 2000 by winning the bid in NELP I for the KG-D6 Block as a 90% partner with Niko Resources of Calgary. In 2002, the company announced India’s biggest gas find in three decades. Reliance started producing oil from MA-D6 Field in 2008 using an FPSO and began KG-D6 gas production in 2009. The fields are current producing 32,000 bopd and about 2 Bcfd.

KG-D6 gas production was hampered due to a gas price dispute between Chairman Mukesh Ambani and his brother Anil Ambani, who plans to use a portion of the KG-D6 gas for electric power. The brothers reconciled in 2010, but the plants have not been built and the government is yet to allocate the gas.

During 2010, Reliance made one discovery in the offshore KG-V-D3 Block and submitted proposals for commercial development of 11 blocks along the east coast. The risky nature of wildcat drilling was evident when the company relinquished Blocks KK-V-D1 and KK-V-D2 due to their poor prospectivity and had to abandon drilling of the KG-D9-B3 well. The well was drilled to a total depth of 12,560 ft by the Transocean drillship Discoverer India in a water depth of 9,670 ft. Despite these setbacks, Reliance is using two drillships to continue its deepwater exploration and appraisal drilling, Fig. 4.

In February, Reliance Industries and BP announced a partnership across the gas value chain in India. BP will acquire a 30% stake in 23 Reliance oil and gas production sharing contracts, including the producing KG-D6 Block, and the two will form a 50/50 joint venture for the sourcing and marketing of gas in India for an investment of $7.2 billion. The 23 blocks together cover about 270,000 sq km. Reliance will continue to be the operator under the production sharing contracts.

Like ONGC, Reliance is also exploring international prospects through participation in 13 blocks in countries ranging from Oman and Iraq to Colombia. In 2010, the company entered into joint ventures to develop US unconventional resources with Atlas Energy and Carrizo Oil & Gas in the Marcellus Shale and Pioneer Natural Resources in the Eagle Ford Shale. Reliance expects to become a development operator in certain US shale acreage in the near future.

|

|

Fig. 2. The NELP IX licensing round is inviting bids for 34 onshore and offshore blocks.

|

|

|

|

Fig. 3. ONGC’s EOR/IOR campaign has yielded significant gains since 2001 for both the onshore and offshore sectors.

|

|

Cairn Energy. A Scottish independent, Cairn Energy has working interests in 10 Indian blocks and one block offshore Sri Lanka and has made more than 40 discoveries in India over the last decade. In 2004, Cairn discovered oil at Mangala Field in Rajasthan state, the largest oil discovery by any company in India since 1985. Currently, the field is producing 125,000 bopd. The waxy crude is pumped via a continuously insulated and heated pipeline to a terminal on the west coast for transport via tankers to refineries in south India. The company expects to ramp up production with additions from adjacent Bhagyam and Aishwariya Fields to about 175,000 bopd by 2013.

Priding itself as a frontier exploration company, Cairn has added offshore Greenland to its prospects and has a deal pending to sell 40–51% of its Indian assets to a London-based mining company, Vedanta Resources. The government approval depends upon the resolution of an excess royalty payment issue with ONGC, the minority partner. ONGC is currently paying 100% of the royalties for Mangala Field, even though its stake is 30%.

British Gas is active in India through a 30% interest with ONGC and Reliance as partners in the Mid-Tapti and South Tapti gas fields and the Panna/Mukta oil and gas fields since 2002. The Panna-K area started production in 2009, and the Panna-L installation is scheduled for first production this year. In 2009, the combined fields produced net 13.7 million boe. The total gas from the Mid- and South Tapti complex peaked at 450 MMcfd and 7,000 bpd of condensate. Current production is down to around 300 MMcfd and 4,100 bcpd. BG is in the midst of a well intervention and infill drilling program to reverse the decline rate.

Through NELP VI and VIII, BG has acquired minority interests in several offshore blocks on India’s east coast. It is also participating in retail gas sales from the PMT fields (Panna, Mukta and Tapti) in the western states of Gujarat and Maharashtra.

|

|

Fig. 4. The Dhirubhai Deepwater KG2 ultra-deepwater drillship, owned jointly by Transocean and Pacific Drilling, is designed to drill in water depths up to 12,000 ft and construct wells as deep as 35,000 ft. The rig is under a five-year contract with Reliance.

|

|

.CATCHING UP WITH DEMAND

The Digboi oil field in India’s northeast corner was discovered in the late 19th century. It remains the world’s oldest continuously running field. It produced 7,000 bopd at its peak during World War II and is currently producing 240 bopd. India has had numerous creditable discoveries since then, including Bombay High in 1974 and the recent Mangala and KG-D6 Fields. The country, however, needs many new Bombay Highs, Mangalas and KG-D6s to catch up with galloping consumption.

|

|

SAGAR SAMRAT: INDEFATIGABLE WORKHORSE

Raj Kanwar, Contributing Editor

After gaining independence from British rule in 1947, India placed a high priority on discovering oil within the country. Many experts had predicted that India did not have significant oil reservoirs other than the small Digboi oil field in Assam. ONGC was set up in 1956 as a national oil company amid this widespread skepticism. The company belied these predictions, making its first discovery in the Cambay Basin in September 1958, followed by the Ankleshwar oil discovery in May 1960 and a third discovery near Rudrasagar in Assam state in December 1960.

After achieving this hat-trick of discoveries on land, ONGC embarked on offshore exploration. Bombay High Field off the west coast had already been identified as a potential reservoir, but the problem was to find an offshore drilling rig and drilling expertise, which neither ONGC nor its Soviet consultants then possessed. ONGC’s acting chairman, B. S. Negi, known as being tight-fisted, defied expectations by ordering a self-propelled jackup drilling rig from Mitsubishi at the then-princely price of $282 million in February 1971. The rig was built with Transocean assistance and delivered two years later. Christened Sagar Samrat (Emperor of the Seas), it commenced drilling operations on Jan. 31, 1974. Three weeks later, oil was discovered in a limestone reservoir.

This old workhorse has drilled 130 wells to a total depth of 891,336 ft over a 28-year lifespan and has been instrumental in discovering 14 major structures and adding more than 3 billion metric tons of oil and gas reserves. Now the jackup has been refitted and is being used for accommodation and power backup facilities.

|

|

|