Pramod Kulkarni, Editor

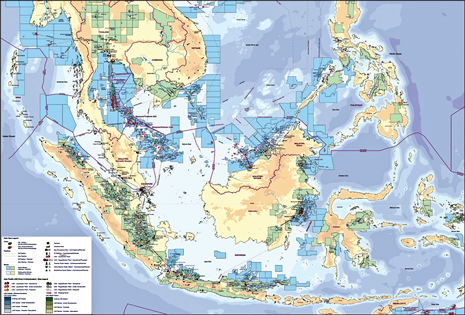

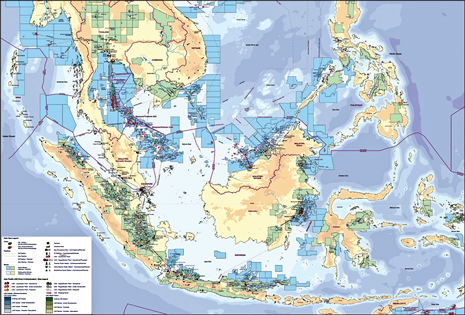

The deepwater news from Southeast Asia is neither as depressing as the chronicles of post-Macondo paralysis from the Gulf of Mexico nor as breathtaking as the stories of major discoveries and first-oil announcements from Brazil and West Africa. International oil companies and large independents are continuing long-term projects and signing new production sharing contracts, Fig. 1. National oil companies are taking greater interest in deepwater activities in Southeast Asia as well as making their presence felt in the international arena. Here is World Oil’s summary of drilling activity in the region followed by a country-by-country summary of the region’s deepwater E&P activities.

|

|

Fig. 1. Southeast Asia map showing leasing areas. Courtesy of Wood Mackenzie.

|

|

DRILLING ACTIVITY

Two drillships, three semisubmersibles and six tender-assisted rigs are currently drilling in deepwater Southeast Asia, Table 1. Eni is conducting exploratory drilling in the Makkasar Strait, and Marathon and Murphy Oil are active in the Java Sea. In the Philippines, ExxonMobil is drilling in the Sulu Sea and Shell in the South China Sea. Production-oriented drilling using tender-assisted rigs is underway in the Gulf of Thailand for Chevron and Thailand’s PTT Exploration & Production Company (PTTEP), Malaysia’s South China Sea for ExxonMobil and Shell, and on the Indian Ocean side of Malaysia for ConocoPhillips.

| TABLE 1. Deepwater rig activity in Southeast Asia |

|

INDONESIA

Indonesia’s oil production has plummeted from a peak of 1.6 million bopd in 1998 to about 965,000 bopd in 2010, according to BPMIGAS, the country’s oil and gas regulatory agency. The production declines resulted in Indonesia becoming a net oil importer in 2004. While Indonesia is a leading natural gas producer (9,365 MMcfd in 2010) and LNG exporter, the country is also facing declining natural gas production from older fields.

Production sharing contracts. To reverse the production declines, BPMIGAS offered 14 fields in a December 2010 auction, but attracted bids for only three fields. A consortium of Lundin Oil and Gas (60%) and Salamander Energy (40%) won South Sokang Field in the deepwater Natuna Sea with a total investment commitment of $9.3 million and $1.1 million in signing bonuses. Lundin plans to shoot 1,500 mi of 2D and 200 sq mi of 3D seismic during 2011 to delineate the field. Murphy Oil won Wokam II Field offshore West Papua with a $1.2 million signing bonus and a total commitment of $9.6 million.

Noteworthy agreements were signed by Pertamina in mid-December 2010 to form a consortium with ExxonMobil, Total and Petronas for the joint development of the deepwater Natuna Sea Alpha D Block. Discovered in the 1970s, this block has potential reserves of 46 Tcf. A 50/50 joint venture between Pertamina and ExxonMobil failed to achieve commercial production in East Natuna due to high CO2 content in the natural gas stream, resulting in termination of the contract in 2007. With the revival of the project, Pertamina plans to retain a 40% share, with 60% to be shared among the international partners. The specific shares awarded to each of the foreign companies is not yet determined. Over the next six months, the consortium will negotiate a PSC with BPMIGAS. The first gas from the $30–40 billion project is expected in 2021. Meanwhile, the West Natuna Gas Consortium, a joint venture consisting of Pertamina, Conoco, Premier Oil and ConocoPhillips, has been supplying gas from the West Natuna gas fields to Singapore by a subsea pipeline.

In May 2010, a consortium of PTTEP and Talisman won the exploration rights for four blocks in the deepwater Makassar Strait: Malunda, South Mandar, Sadang and South Sageri. PTTEP will be the operator for Malunda and South Mandar Fields, and Talisman will operate Sadang and South Sageri Fields. During the first phase, the consortium will conduct a 3D seismic survey and drill at least one exploration well.

In a move parallel to its acquisitions in Brazil and West Africa, China is acquiring future production in Southeast Asia as well. In December 2010, China’s Sinopec acquired a minority stake in Chevron’s Gedalo-Gehem project in the deepwater Makassar Strait. When completed, the project is expected to produce up to 1.1 Bcfd of natural gas and 31,000 bpd of condensate. Chevron currently owns 80% of the project, with Eni and Pertamina holding the rest.

Seismic operations. In November 2010, seismic explorer TGS-Nopec announced a deepwater 2D seismic survey it will be conducting offshore southwest Sumatra in the forearc basin along the Sundaland Margin. The survey will add 1,700 mi of new 2D data to infill the existing 4,300 mi of multiclient data acquired in 2009. In 2009–2010, PGS completed a 286-sq-mi 3D survey over the East Natuna Sea Alpha D Block. Its ongoing 2D survey covers the North Makassar Basin.

Discoveries. In mid-December 2010, Eni announced that it had successfully drilled the Jangkrik-3 well, located in the Muara Bakau permit area offshore Borneo. Three wells drilled in the area confirmed Jangkrik Field as a gas discovery with recoverable reserves of 1.4 Tcf. Drilled 43 mi off the eastern Borneo coast at a water depth of 1,365 ft to a TD of 9,347 ft, the well encountered 60 m of net gas pay. Eni operates the Muara Bakau permit with a 55% share and has as its partner GDF Suez holding the remaining 45%. The produced gas will be supplied to the adjacent Bontang LNG plant.

Earlier in December, Marathon Oil Corporation announced that its deepwater Bravo-1 well, drilled in the northeastern portion of the Pasangkayu PSC in the Makassar Strait, did not yield commercial quantities of hydrocarbons. The well was drilled in 3,200-ft water depth and reached a total depth of 9,000 ft. Gas shows were recorded during drilling of the objective. Marathon is now planning to use Transocean’s GSF Explorer drillship to drill the Romeo prospect, located on the north-central portion of the Pasangkayu Block in a water depth of 6,200 ft, during the first half of 2011, Fig. 2.

|

|

Fig. 2. Marathon is using Transocean’s GSF Explorer for deepwater exploratory drilling in Indonesia’s Makassar Strait.

|

|

In October, London-based Premier Oil conducted a successful appraisal of Gajah Baru Field, located in West Natuna Block A. Based on test results, Premier expects the recoverable reserves from the field to be 325 Bcf. Gajah Baru Field is located 16 mi from the existing Anoa Field, which is also in the Premier-operated West Natuna Block A.

In late November, London-based Salamander Energy completed its Angklung-1 exploration well in the Bontang PSC, offshore East Kalimantan, as an oil and gas discovery. Salamander is operator of the Bontang PSC with a 100% interest. The Angklung-1 well was drilled to 9,350 ft TD and encountered 75–90 ft of net gas pay in a high-quality Lower Pliocene sandstone unit at 6,070 ft. Log evaluation indicates that the formation has porosity of up to 30% and permeability of 50 mD. A drillstem test conducted across a 100-ft interval of gas-bearing reservoir flowed at 24 Mcfd. In a deeper section, the well encountered 400 ft of oil-bearing sandstones.

Production. BP’s Tangguh LNG project began production in 2009 and is currently operating two trains after several delays and shut-ins. The LNG plant takes production from giant gas fields Wiriagar Deep and Vorwata and smaller, adjacent fields Roabiba, Ofaweri, Wos and Ubadari. BP is now planning to add a third train.

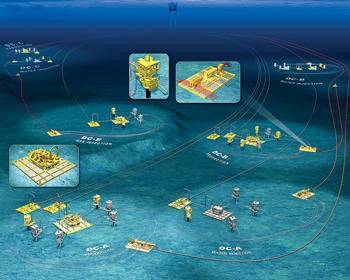

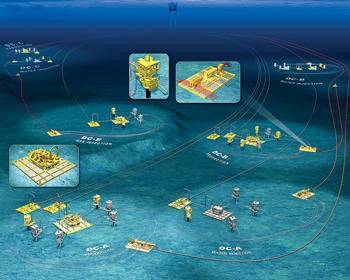

In December 2010, Chevron announced the award of major FEED contracts for the Gendalo-Gehem natural gas development offshore East Kalimantan, Fig. 3. The Gendalo-Gehem project is located in the Makassar Strait in water depths of about 6,000 ft. The project will include two separate hub developments, each with its own floating production unit (FPU), subsea drill centers, export gas and condensate pipelines and an onshore receiving facility. Natural gas from the project will be used domestically and converted to LNG at the Bontang LNG facility in Indonesia for export. The maximum production from the project is expected to be 1.1 Bcfd of natural gas and 31,000 bpd of condensates.

|

|

Fig. 3. Chevron is currently in the FEED stage for its Gendalo-Gehem production facilities offshore East Kalimantan in Indonesia.

|

|

MALAYSIA

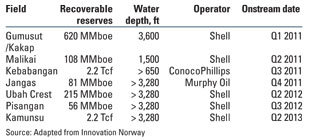

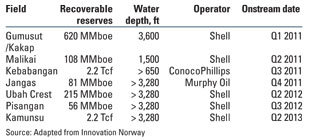

Business Monitor International is forecasting a 6.14% decrease in Malaysian oil production, with crude volumes peaking at 770,000 bpd in 2011–2012. On the other hand, gas production is expected to rise from an estimated 2.5 Tcf in 2010 to 3.5 Tcf by 2019, providing an LNG export capability up to 2.3 Tcf by 2019. State-owned Petronas is responsible for all oil and gas production in partnership with IOCs under various production sharing contracts through its E&P subsidiary, Petronas Carigali. The leading IOCs operating in Malaysia are ExxonMobil, Shell, Chevron and BP. Independent operators in the region include Murphy Oil, Newfield Exploration and Lundin Petroleum. Murphy Oil started production from the country’s first deepwater field in 2007—Kikeh, 70 mi off the Sabah coast. Shell’s Gumusut and Kakap Fields are slated to start production in 2012, followed by Malikai, Kebabangan and Jangas Fields. Table 2 lists the deepwater projects in Malaysia and their expected schedules.

| TABLE 2. Deepwater fields offshore Malaysia and corresponding onstream dates |

|

Production sharing contracts. Malaysia awarded four new PSCs during 2010. These are Block 2008 PSC offshore Peninsular Malaysia, Block SK320 PSC offshore Sarawak, and Block SB309 and Block SB310 PSC offshore Sabah, and they bring the total number of PSCs in operation to 75. Of these, 16 are deepwater PSCs. A new player in Malaysia, MDC Oil & Gas, a subsidiary of Abu Dhabi’s Mubadala Development Company, was awarded Block SK320 jointly with Petronas Carigali. Petronas is now considering service contracts as an alternative production solution.

In June 2010, Lundin Petroleum signed a new PSC with Petronas for Blocks SB307 and SB308, offshore Sabah, covering an area of about 2,400 sq mi. The blocks contain one oil discovery that will be the subject of further evaluation to determine if it can be commercially developed. In addition, several prospects and leads have been identified in the blocks from previous 2D and 3D seismic campaigns.

In November 2010, Total signed an agreement with Petronas to acquire an 85% interest in Block SK317B. The 2,700-sq-mi block is located 60 mi offshore Sarawak, in water depths ranging from 650 to 3,200 ft.

Seismic operations. In 2009, Total acquired a 640-sq-mi 3D survey over Block PM303 after having signed a PSC in 2008. The operator is planning to advance to the drilling phase during 2011 under high-pressure/high-temperature conditions.

Production. Among the projects nearing first oil is the Shell-operated Gumusut/Kakap Fields, straddling Blocks J and K. Located at water depth ranging from 900 to 1,200 ft, the fields will be developed using 19 subsea wells with oil exported via a pipeline to a new oil and gas terminal, which will be built in Kimanis Sabah, Fig. 4. First oil was expected in 2010, but the project has been delayed to sometime in 2011. The production system will have a capacity of 135,000 bpd when peak production is achieved in 2014. Associated natural gas will be re-injected into the reservoir to help improve oil recovery.

|

|

Fig. 4. Shell’s Gumusut/Kakap Fields in Malaysia will have 19 subsea wells with oil piped to the Kimanis terminal.

|

|

BRUNEI

The most significant news to emerge from Southeast Asia is the end to the field development dispute between Brunei and Malaysia with the December 2010 signing of an agreement to jointly develop two oil areas off Borneo. The agreement will enable the national oil firms of Malaysia and Brunei take part in exploration and production of the areas over the next two years. Brunei had awarded exploration rights in one offshore block to Total and another to Shell. Simultaneously, Petronas had awarded the same blocks to Murphy Oil and Petronas Carigali.

In October 2010, Total drilled a major gas and condensate discovery in Block B offshore Brunei. Total’s Well ML-5, located about 53 mi from the coastline at a water depth of 200 ft, was drilled 5 mi to the south of Maharaja Lela/Jamalulalam Field in a new, deep fault panel. It discovered natural gas with condensate in a 2,600-ft-thick, high-pressure/high-temperature hydrocarbon bearing formation. With a TVD of 18,600 ft, the well is the deepest ever drilled in Brunei. The well produced 10 MMcfd of gas and 220 bpd of condensate during the test from a limited zone at 17,550-ft depth. This is the deepest successful test to date in Southeast Asia.

THAILAND

Chevron and Coastal Energy are two of the international operators with E&P activity in shallow waters of the Gulf of Thailand. Chevron is on schedule to start up its Platong 2 gas project in July 2011 after the expected installation of the production platform in April. The initial delivery will begin at 330 MMcfd and may increase to a full capacity of 400 MMcfd. In 2010, Coastal Energy made several oil discoveries in the Songhkla Field at 80-ft water depth.

VIETNAM

Petrovietnam, the state oil company, has been carrying out exploration and production operations in Vietnam via exploration contracts signed with international operators. Tertiary basins on Vietnam’s continental shelf that are producing oil and gas through PSCs are Cuu Long, Nam Con Son, Malay-Tho Chu and Song Hong Basins. A joint venture between Russia and Vietnam, Vietsovpetro, is currently in its 28th year of operations.

Seismic surveys. In March 2010, Salamander Energy acquired a 50% interest in and operatorship of Block 101-100/04 from Santos. The block is located in the Hanoi Trough, offshore northern Vietnam. The company has acquired 200 sq mi of 3D seismic and is planning to drill the first exploratory well in 2011.

Australia-based Neon Energy completed 2D seismic acquisition in Block 120 and Block 105-110/04 offshore Vietnam in June 2010. The 2,378-mi seismic campaign was intended to improve term subsurface imaging over a vintage 1993 survey. In December, CGGVeritas signed an agreement with Petrovietnam Technical to operate 2D and 3D marine seismic vessels, primarily in Vietnamese waters.

Discoveries. In September 2010, Total announced the discovery of oil in the Lac Da Vang prospect, located in the southern part of its offshore block. The exploration well is located about 80 mi east of the city of Vung Tau, about 40 mi off the coast. During tests, the well produced up to 3,500 bopd of 43°API oil.

Production. Premier Oil discovered Dua Field in 2006 in Block W, which is located in the Nam Con Son Basin about 250 mi from Ho Chi Minh City. The block is close to the maritime border with Indonesia and has geology similar to that in the West Natuna Sea. Premier installed the wellhead platform in 2010 and is currently conducting development drilling. The company proposes to use an FPSO to produce the field starting in 2011.

London-based Soco International is conducting development drilling on its Te Gia Tang development. Preliminary log analysis of the third well, TGT-H1-3P, drilled northwest of the field, indicates that the well encountered the top of the target reservoir horizon as expected, based on the reprocessed pre-stack depth-migrated seismic data. Four additional development wells are being batch drilled, and the reservoir section for all four wells will be drilled in mid-January 2011. All of these wells will become producers upon startup in mid-2011. Production during this first phase of development is forecast to be 55,000 bopd.

PHILIPPINES

Philippines National Oil Company (PNOC) is the state-owned firm responsible for the country’s oil and gas operations. PNOC is encouraging production growth through service contracts for lease blocks. The deepwater success story in the Philippines is the gas-to-power Malampaya project. The field is located 50 mi off the coast of Palawan Island. The project is being operated by Shell with Chevron and PNOC as its partners. The deepwater subsea wells are at a water depth of 2,700 ft and tied back over a distance of 20 mi to a production platform in 140 ft of water. The distance from the production platform to the onshore plant is 313 mi.

Another major field in the Philippines is Galoc, located 37 mi northwest of Palawan in Block SC 14. Water depth at Galoc ranges from 950 to 1,300 ft with the oil located in a turbidite sandstone reservoir at a depth of about 6,890 ft below the sea surface. Production began in the third quarter of 2008 through an FPSO. In late October 2010, production was shut in temporarily due to Typhoon Meji.

Exploration surveys. Electromagnetic Geoservices ASA (EMGS) received a contract from Shell in November 2010 to conduct an electromagnetic survey of Block SC 60. The survey is being performed by the 3D EM vessel BOA Galatea. In April 2010, PGS completed a 3D seismic survey for Otto Energy on offshore Block SC 55. Additionally, Otto has acquired over 920 sq mi of 3D and 472 mi of 2D seismic during 2010 via surveys conducted during the first quarter of 2010 over Block SC 55 in the ultradeep Palawan Basin and Block SC 69 in the shallow-water Visayan Basin.

Exploratory drilling. In May 2010, Shell began exploratory drilling in Malampaya Field to seek additional gas supplies. The wells are being drilled using the Atwood Falcon semisubmersible. Exploratory drilling was also begun in 2010 to increase recoverable reserves from Galoc Field after production decline reduced output by 43%.

During 2010, ExxonMobil drilled three exploratory wells in Block SC 56 in the South Sulu Sea. The block covers an area of 3,200 sq mi about 560 mi southwest of Manila in water depths to 9,800 ft. The wells were drilled using semisubmersible West Aquarius to an average total depth of 15,000 ft. The Philippines’ Energy Department estimates the potential reserves at 750 million boe. ExxonMobil and its partners BHP Billiton and Mitra Energy are currently evaluating the well data to plan future E&P activities.

Production sharing. In October 2010, Shell farmed into a 45% interest in Australia-based Nido Petroleum’s 60% share of Block SC-54B in the deepwater Northwest Palawan Basin. Nido will remain the operator and plans to drill its Gindara-1 exploration well using the drillship Frontier Phoenix. To earn its production share, Shell will contribute up to $24 million toward drilling of the exploration well and subsequent seismic surveys to delineate the field. Gindara is 31 mi south of the Shell-operated Malampaya gas field in Block SC 38, the largest discovery made in the Philippines to date and currently on production. In September 2010, Nido had revealed encouraging results from analysis of deepwater seabed core samples from the prospect.

Earlier, Tap Oil was not able to secure a farmout partner for its Block SC 41 in the Sulu Sea, and therefore relinquished the exploration block. According to the PSC terms, Tap Oil would have had to begin drilling an exploratory well by May 2011.

OTHERS

Formerly known as Burma, Myanmar is one of the oldest oil provinces in the world, with first production starting in 1853. Myanma Oil and Gas Enterprise (MOGE) was set up in 1963 for oil and gas E&P. In 1988, Myanmar passed legislation to allow the entry of international operators and capital to revive its oil and gas industry. While some Western oil companies are reluctant to enter Myanmar due to human rights issues associated with the country’s military regime, operators active in offshore production include Total, Petronas Carigali, and a host of Indian, Chinese and Russian oil companies. Offshore production comes principally from Yadang and Yetagun Fields at about 180,000 boepd.

Cambodia’s National Petroleum Authority (CNPA) was formed in 1998 as that country’s governmental agency to oversee upstream and downstream petroleum activities. The country has chalked out six offshore exploration blocks in the Gulf of Thailand with rights granted to Chevron (Block A), PTTEP (Block B) and CNOOC (Block F). PGS recently acquired a 675-sq-mi 3D seismic survey over Blocks B, C, D and E. Chevron has drilled 24 wells in its block and is expected to produce first oil from the Apsara Field by the end of 2012.

Oil and gas activity in Papua New Guinea is regulated by the Investment Promotion Authority. Australia-based Oil Search Ltd. is the leading exploration company. It contracted PGS to acquire the first phase of a 1,822-sq-mi 3D seismic survey over offshore Blocks PPL 234 and PPL 244 during April–May 2010. This data is now being processed and the remainder of the survey was schedules to be acquired later in 2010. Oil Search plans to conduct exploratory drilling based on the interpretation and tie production from the offshore fields to the LNG liquefaction plant that ExxonMobil is building near Port Moresby.

TECHNOLOGY CHALLENGES

Deepwater operators in Southeast Asia are contending with numerous challenges associated with subsurface imaging, flow assurance, drilling and production.

Methane hydrates. The presence of methane hydrates can result in a very poor seismic response. As a solution, WesternGeco conducted the first commercial coil-shooting full-azimuth 3D survey over Eni’s Tulip discovery in Bukat Block offshore Kalimantan using a single multi-streamer vessel. The very high azimuthal fold and illumination were beneficial in attenuating diffracted multiples, improving the overall signal-to-noise ratio and providing a more complete subsurface image.1

Flow assurance. The deepwater West Seno Field offshore East Kalimantan is plagued with a flow assurance problem due to a sodium soap emulsion. The emulsions form when carboxylic acids in crude oil react with sodium chloride-, acetate-, and bicarbonate-rich produced water. The result is the formation of a brown slurry of fine clays and sand. The most effective chemical treatment is phosphoric acid-based demulsifiers.2

Geohazards. At the deepwater Gumusut/Kakap Fields offshore Malaysia, Shell encountered a number of seafloor geohazards, including subsurface gas hydrates, steep seafloor slopes, seafloor expulsion, shallow faulting, low seismicity, shallow gas and shallow water flow. The Shell team conducted a deeptow survey and a 3D seismic survey, and employed geotechnical methods and well logging to characterize the geohazards. An innovative method was the analysis of gas hydrate dissociation caused by heat flux from production wells.3

GENERATIONAL DEVELOPMENT

Oil and gas development in deepwater Southeast Asia is progressing at a steady pace. As older projects such as Kikeh are declining, new fields are coming onstream, such as Gumusut/Kakap, and production sharing contracts are being signed for fields such as those in the East Natuna Sea. While local governments would like the NOCs to take a greater role of field development, the authorities are realistic in understanding the role of small independents in taking initial risks, and larger international oil companies in farming into viable project with massive financial investment and technical resources.

LITERATURE CITED

1 Buia, M., “3D coil shooting on Tulip field: data processing review and final imaging results,” presented at the SEG Annual Meeting, Denver, Colo., Oct. 17–22, 2010.

2 Gallup, D., Vitus D. and C. Khandekar, “Inhibition of sodium soap emulsions, West Seno, Indonesia Field,” SPE 130506 presented at the SPE International Conference on Oilfield Scale, Aberdeen, UK, May 26–27, 2010.

3 Hadley, C., Peters, D., Vaughan, A. and D. Bean, “Gumusut-Kakap project: Geohazard characterization and impact on field development plans,” SPE 12554 presented at International Petroleum Technology Conference, Kuala Lumpur, Malaysia. Dec. 3–5, 2008.

|