|

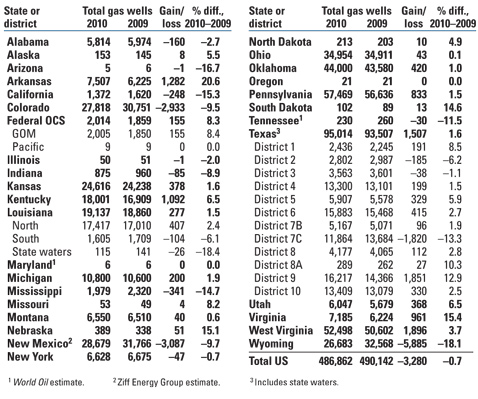

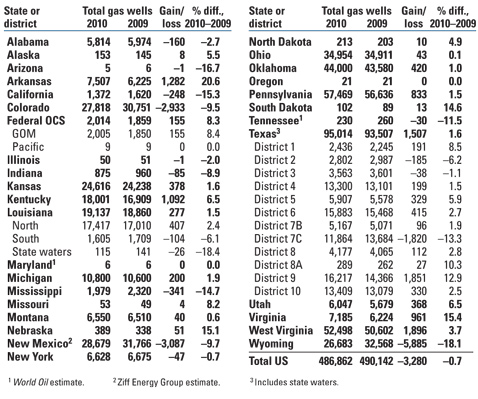

Low natural gas prices hovering around $4/Mcf, regulatory disputes over the environmental safety of fracing, and a large shift in rigs toward oil-directed drilling (in fact, the percentage of rigs drilling for gas decreased to 61% in 2010, from 74% the previous year), all contributed to a slight reduction in the number of producing natural gas wells in the US last year, the first decrease since 1999. The gas well count dropped 3,280 (0.7%) to end 2010 with a total of 486,862 wells, down from 490,142 in 2009.

More states saw gas well reductions than in previous years, and in other states, the gains were smaller than usual. The biggest well gains came in six states: West Virginia (1,896), Texas (1,507), Arkansas (1,282), Kentucky (1,092), Virginia (961) and Pennsylvania (833). It is not coincidental that these states all contain active unconventional resource plays: the Marcellus Shale in Pennsylvania and West Virginia, the Chattanooga/Ohio Shale in Virginia and Kentucky, Texas’ Haynesville, Barnett and Eagle Ford Shales, and the Fayetteville Shale in Arkansas.

| Estimated US wells producing gas at the end of 2010 |

|

Texas kept its title as the state with the most gas producers, totaling 95,014. District 9, in the heart of the Barnett Shale in North Texas, overtook East Texas’ District 6 as the state’s leader in gas producing wells, with 16,217 wells, a 12.9% increase from 2009. District 6, which contains traditional tight gas as well as Texas’ portion of the Haynesville, saw a 2.7% increase to 15,883.

Pennsylvania and West Virginia continue to hold second and third place, respectively. Pennsylvania had a well total of 57,469 wells at year-end 2010, and West Virginia had 52,498. Oklahoma maintained its fourth-place position with 44,000 wells, and Ohio was once again fifth with just under 35,000 wells, having gained 43 during the year. Arkansas boasted the country’s highest percentage gain in gas wells, 20.2% to 7,507.

|

Wyoming saw the biggest reduction in its gas well count, dropping 5,885 to end 2009 with 26,683 gas producers. This decrease probably reflects the shutting in of many of that state’s low-volume coalbed methane wells in response to low gas prices and aggressive competition in the shales. New Mexico and Colorado, whose San Juan Basin is also a major source of coalbed methane as well as conventional gas, also saw dramatic reductions in gas wells—3,087 in New Mexico and 2,933 in Colorado. Texas’ District 7C, located in the central-west part of the state, and District 2, in the lower Gulf region, saw losses of 1,820 and 185 wells, respectively.

Louisiana saw a net increase in its gas well count, with losses concentrated in its South district (down 104 wells) and state waters (down 26 wells), further solidifying the North district’s position as the state’s dominant gas-producing area. Despite the six-month deepwater drilling ban and slow permitting, the well count in the federal Gulf of Mexico saw an 8.4% increase (155 wells), for a 2010 total of 2,005 gas wells.

|