Robert Curran, Contributing Editor, Canada

After activity fell in 2009 to levels not seen since the early 1990s, most industry observers looked ahead to 2010 with optimism—something that hadn’t been seen in the Canadian oilpatch since the heady days before the global recession.

Overall, the optimism was well-founded. Drilling and land sale activity recovered, results improved and spending increased. But the boom definitely isn’t back, either. High oil prices have provided some stability and confidence to producers with more oil in their production portfolios, but gas producers haven’t fared as well. In fact, spot gas prices fell to a 10-year low in December.

At the same time, the Canadian dollar continued to strengthen over the course of the year and ended 2010 above par with the American greenback. Two years ago, it was trading at approximately 80 cents US. For producers that predominantly ship their oil and gas south of the border, a high Canadian dollar can cut profitability substantially.

The benefits of strong oil prices could be seen across the Canadian industry. Share values recovered across the board, but particularly among junior and small explorers, many of which were able to tap previously uneconomic oil deposits through the use of multistage horizontal fracing technology.

But the outlook for gas producers has not improved much since a year ago, and many are predicting that there will be a prolonged period of soft natural gas prices across North America.

POLITICS

On the political front, there appears to be growing sentiment that Canada needs to develop a national energy strategy. Supporters believe that an effective strategy will allow Canada to realize the full benefits of its energy resources as it takes the lead globally in managing the technical and environmental challenges of a robust oil and gas industry.

In the meantime, groups opposing oil sands development have continued to voice concerns over impacts of the massive developments in northeast Alberta. However, the claims of anti-oil sands activists were dealt a significant blow in December, when the non-partisan RSC Academies of Arts, Humanities and Sciences of Canada (formerly the Royal Society of Canada) issued its assessment of the oil sands and their impacts. The panel’s findings indicated that although there are some concerns, the development of the oil sands has not led to significant impacts on human health, water quality or air quality in the area.

To the north, the C$16 billion Mac-kenzie Valley natural gas project received approval from the National Energy Board in December. The board stipulated that the project partners must make an investment decision by the end of 2013 and begin construction by the end of 2015. There are also more than 250 conditions. Final approval from the federal government for the 760-mile pipeline is expected to follow shortly. Of course, approvals may be the least of the project partners’ worries. With natural gas prices in a prolonged funk, the economics of shipping high-cost Arctic gas south may not justify the enormous investment.

SHALE GAS IMPACT

One of the big reasons for the North American gas price slump is the emergence of shale gas as a viable, economic source of natural gas across the continent. In fact, producers that have experienced success in shale gas deposits such as British Columbia’s Horn River and Montney plays have been so successful, low gas prices are expected to continue for several years, according to some analysts.

Nonetheless, shale gas prospects across Canada—in Alberta, Quebec and New Brunswick—have drawn interest from producers. In Alberta, it appears that it’s a matter of time until full-scale development occurs. On the other end of the scale, the New Brunswick and Quebec industries are in their infancy, in terms of both infrastructure and regulatory capability. The issue has become politically charged in Quebec, which held public hearings on shale gas last fall. There have been calls for a moratorium on any further development in “la belle province” until the risks and rewards are better understood.

HIGHER SPENDING

Meanwhile, capital spending plans clearly reflect the improved economy and overall optimism in Canada. According to Barclays Capital, Canadian spending should increase 4.8% in 2011, lagging an expected global increase of 11%.

Suncor Energy has bumped up its planned 2011 spending to C$6.7 billion, more than 20% higher than last year’s $5.5 billion. Expenditures for oil-sands activity are tagged at $4.2 billion, as the company plans to focus on Phases 3 and 4 of its Firebag in situ project, tailings reduction operations, the Voyageur upgrader, and its portion of the Syncrude operation, acquired in the takeover of Petro-Canada.

Canadian Natural Resources Ltd. has announced a more modest increase to its spending plans, targeting expenditures of C$5.6–$6 billion, compared to $5.6 billion in 2010. About $3.8 billion of the planned spending is directed to crude oil activity, and another $800 million to $1.2 billion will be spent at the company’s Horizon oil sands project, depending on market conditions.

OIL-DRIVEN ACTIVITY

EnCana Corp., with its heavily gas-weighted portfolio, is one company that has said it will reduce spending in 2011. The company has not yet released it final capital budget, but has said that it will be about US$4–$4.5 billion. The company has also shifted back into the oil business, signing joint ventures with several different partners across Western Canadas.

Talisman Energy is keeping spending relatively flat this year, at US$4 billion. Of that, $1.7 billion will be spent in North America, including $800 million in Pennsylvania’s Marcellus Shale. Up to $500 million is slated to be spent in Western Canada, primarily in Montney (British Columbia) Chauvin (Alberta) and Shaunavon (Saskatchewan) projects.

MERGERS AND ACQUISITIONS

Many Canadian companies are also setting aside substantial portions of their capital budgets to acquire assets in 2011, building on a trend established in 2010. Overall merger and acquisition totals decreased to C$35 billion in 2010, compared to $47 billion the year before. However, the total in 2009 was higher due to the C$27 billion value of Suncor’s acquisition of Petro-Canada.

According to Calgary-based Sayer Energy Advisors, the action shifted from corporate transactions to asset sales in 2010, with 72% of the value coming from property sales. Sayer expects to see more corporate acquisitions occur in 2011.

Oil sands once again led M&A activity, as another Asian player, Sinopec International Petroleum Exploration and Production Company, paid US$4.65 billion to acquire ConocoPhillips’ stake in the Syncrude oil sands mining project in June. In July, BP, in the aftermath of its disastrous Gulf of Mexico blowout, sold an array of Canadian assets to Apache Canada for $3.25 billion. BP is reportedly on the verge of also selling its Canadian natural gas liquids assets as it looks for ways to pay its $30 billion tab from the Gulf disaster.

South Africa’s Sasol Limited stepped into the fray in December, purchasing a 50% interest in Talisman Energy’s Farrell Creek Montney Shale gas assets for just over C$1 billion. On the corporate side, Crescent Point Energy Trust took out Shelter Bay Energy for C$1.1 billion last May. Other notable sales included Nexen’s C$975 million disposition of heavy oil assets in Western Canada to Northern Blizzard Resources in June and Husky Energy’s acquisition of oil and gas properties in Alberta and northeast British Columbia from ExxonMobil Canada for C$860 million in November.

BOOST IN DRILLING

Bolstered by a very busy fourth quarter—in which 4,080 wells were drilled—Canadian drilling totals reached 12,145 wells in 2010, up 45% from 8,377 wells drilled in 2009, according to Daily Oil Bulletin records. The turnaround was led by big increases in oil drilling (about 50% of wells drilled) and horizontal drilling, which accounted for more than 40% of the total.

In Alberta the well count increased over 40% to 8,176, compared to 5,773 in 2009. Drilling activity in Saskatchewan jumped 56% to 2,766 versus 1,770 a year earlier. In British Columbia, the number of wells drilled rose by 16%, to 652 from 563, and Manitoba set a new annual record with 518 wells drilled, up almost 120% over the 237 wells drilled in 2009. The previous annual record was 481 wells drilled, in 2006.

For 2011, the Canadian Association of Oilwell Drilling Contractors (CAODC) is predicting that drilling activity will decline slightly to 11,811, with an average rig fleet utilization of 45%. However the Petroleum Services Association of Canada is more bullish, calling for 12,250 wells to be drilled this year, a slight increase. Calgary-based Peters & Co. is more in line with CAODC, predicting that Canada’s well count will reach 11,500 this year, while spending should be about C$22 billion for drilling, casing and completions.

|

|

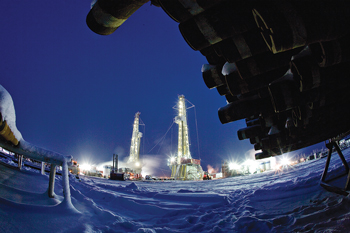

Nabors rigs drill for shale gas for Nexen in the Dilly Creek area of the Horn River Shale in British Columbia.

|

|

OIL SANDS ISSUES

The black gold contained in Canada’s oil sands may have become a black eye at times for both industry and the governments of Alberta and Canada over the past several years, as aggressive anti-oil sands activists have consistently targeted the massive development in northeast Alberta in a series of publicity stunts and ad campaigns. Despite these efforts, polling has consistently shown that most Canadians support the responsible development of the oil sands.

At issue are claims made by some that oil sands activity is causing air and water pollution at an alarming rate, compromising the environment and human health. Unfortunately there has been virtually no credible evidence to support or refute these claims, until very recently, thanks to the RSC Academies of Arts, Humanities and Sciences of Canada.

The RSC, Canada’s oldest association of scientists, formed an expert panel to address many of the health and environmental concerns about oil sands development, including claims that cancer rates were elevated downstream from mining operations.

The panel’s findings included the following:

• Reclamation is not keeping pace with the rate of land disturbance, but reclamation is achievable and should be able to support traditional land uses.

• There is currently no credible evidence of environmental contaminant exposures from oil sands at levels expected to cause elevated cancer rates.

• Current industrial water use demands do not threaten the viability of the Athabasca River system.

• Oil sands developments are not a current threat to aquatic ecosystem viability in the area.

• Ambient air quality data shows minimal impact from oil sands development on regional air quality.

The panel also found that technology to reduce tailings and reclaim tailings ponds have been developed but not implemented, that monitoring of the aquatic ecosystem may be insufficient and that increasing greenhouse gas emissions remain a challenge.

For the first time, solid evidence has been brought forward by a credible scientific source that refutes claims of impacts on water quality and human health, but still points out areas of concern without the emotionalism or personal attacks that have become hallmarks of the anti-oil sands campaigners.

In response, both federal and provincial authorities have announced plans to improve environmental monitoring in Alberta’s Athabasca region and have committed to creating a world-class system, building on the programs already in place.

In addition, seven oil sands producers—Canadian Natural, Imperial Oil Limited, Shell Canada, Suncor, Syncrude, Teck Resources and Total—announced in December that they plan to work together to improve tailings management and collaborate on tailings research and development.

In the meantime, industry continues to proceed with plans to develop mining and in situ prospects, with an estimated C$16 billion in spending potentially on the table. In 2010, spending was approximately $13.5 billion. Leading the way is Suncor, with C$4.2 billion targeting oil sands projects. Other notables include Syncrude ($2.8 billion), Canadian Natural ($2.5 billion), Cenovus ($1 billion) and MEG Energy ($900 million at Christina Lake).

Total SA also recently received approval for its C$7–$9 billion Joslyn North mining project from a joint provincial/federal panel. The company plans to begin operating the 100,000-bopd project in 2017.

The negative news in 2010 pertained to events that occurred far from oil sands operations. In June, Syncrude was found guilty of causing the deaths of some 1,600 ducks in April 2008. In October of last year, the company was fined C$3.2 million, the single largest fine for an environmental conviction in Canadian history. The money will be directed to avian research and purchasing waterfowl habitat. In December, Suncor was fined C$200,000 for two incidents that occurred in June and August 2008. The company pled guilty to charges that effluent from the sedimentation ponds entered the Steepbank River, located north of Fort McMurray.

|

|

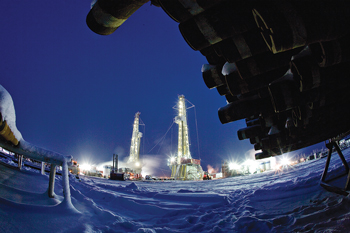

ExxonMobil is applying both water and gas injection to recover up to 60% of the hydrocarbons from Hibernia Field’s faulted reservoir formations. The field is located in the Jeanne d’Arc Basin, 196 mi east of St John’s, Newfoundland.

|

|

LAND SALE RECOVERY

Land sale revenues collected by Western Canadian governments showed considerable improvement in 2010, as producers spent just over C$3.73 billion, up 112% over $1.76 billion in 2009, and the third-highest total ever. The recovery was led predominantly by Alberta ($2.41 billion), where producers have responded favorably to changes made by the provincial government to its royalty regime. The amount spent in Alberta in 2010 is second only to the record $3.43 billion that flowed into provincial coffers in 2006.

In British Columbia, land sales generated $844 million, down 5.5% from the $893 million collected in 2009. The Saskatchewan government took in its second-highest total ever, $463 million, up a whopping 292% over the meager $118 million collected in 2009.

Land inventories are one of the most consistent indicators of future drilling activity, and any uptick in land sale volumes is a strong indicator that a recovery is underway in Canada.

PROVINCIAL SPOTLIGHTS

British Columbia. These are interesting times on Canada’s West Coast. Despite the North American gas glut that has pummelled commodity prices, activity has been brisk in British Columbia, even though almost 90% of wells drilled in the province target gas.

Activity in British Columbia was highlighted by news from the Horn River Basin, including news that the National Energy Board had approved Nova Gas Transmission’s proposed C$307 million Horn River project, which will allow Horn River gas to be shipped into Nova’s Alberta system. There are two primary components to the project: Nova’s acquisition of the NEB-regulated Ekwan pipeline from EnCana, and construction of 74 km of new pipeline.

On a related note, EnCana is looking to sell its Cabin gas plant project, also in the Horn River area. The successful buyer would have to complete construction on the 800-MMcfd facility, which is currently in the first phase of construction. Phase 1 is scheduled to be completed in 2012, with processing capacity of 400 MMcfd.

One of the reasons gas development continues to attract interest in the province is the possibility that Asian markets could eventually open up to British Columbia gas if the applied-for Kitimat gas liquefaction terminal (with project partners Apache Canada and EOG Resources) should receive approval.

Alberta. Although Alberta has gained international attention for its oil sands deposits, interest remains high in its more conventional resources. In fact, producers paid C$2.39 billion to the province for non-oil sands mineral rights in 2010, dwarfing the previous record of C$1.83 billion set in 2005. Interest was high in the Deep Basin and Bakken plays.

The renewed interest in more conventional development has been attributed to the Alberta government’s efforts to provide a more competitive business environment for industry. Changes to the provincial royalty regime and efforts to streamline the regulatory framework have been cited as positive developments by industry.

The government subsequently announced it would establish a single regulator in Alberta in late January, further eliminating overlap between the province’s regulatory agencies. The single-regulator concept was recommended by a regulatory enhancement task force established by the government to assess regulatory duplication and barriers in the province. The announcement came on the heels of the surprise resignation of Alberta Premier Ed Stelmach just days earlier. The premier’s resignation was followed quickly by the resignation of Finance Minister Ted Morton, who announced he would once again seek to become leader of Alberta’s ruling Progressive Conservative party.

Saskatchewan. Strong oil prices and horizontal drilling have proved to be an ongoing boon for Saskatchewan, as activity remains strong in the prairie province. A record 1,531 horizontal wells were drilled in 2010, sparking a new single-year record of 2,730 oil wells drilled. The Bakken play once again drove activity, but companies also pursued prospects in the Shaunavon, Lower Shaunavon and Viking plays.

The government of Saskatchewan has been a vocal supporter of Alberta’s oil sands industry, and the province also remains optimistic that its own oil sands deposits—just across the border with Alberta—will also be developed in time. The area currently lacks the infrastructure necessary to produce the resource, which is too deep to allow for mining.

In August, Oilsands Quest announced it was shelving its Axe Lake in situ project, and in September, the company announced plans to divest its Eagles Nest oil sands lease. Meanwhile, Petrobank Energy and Resources is currently testing its THAI (toe-to-heel air injection) in situ technology at a number of Alberta locations, technology that could be applied in Saskatchewan.

In the southeast, accusations were recently made that Cenovus Energy’s Weyburn project was leaking CO2 into a local famer’s field. Any problems at Weyburn, the world’s largest geological CO2 sequestration project, could potentially have had repercussions for the fledgling carbon capture and storage industry in Canada. Fortunately, investigations determined that the problems were not caused by the project, which is currently producing some 15,000 bopd, net to Cenovus.

East Coast. Canada’s East Coast provides a snapshot of North American market conditions, featuring Nova Scotia’s Sable and Deep Panuke gas plays, Newfoundland’s Hibernia, Terra Nova, Whiterose and Hebron oil reserves, and shale gas and oil deposits throughout the region, including New Brunswick, which does not have the offshore potential of its East Coast neighbors.

In Nova Scotia, the Sable project, operated by ExxonMobil, has recently been producing about 330 MMcfd, well below its capacity of 400–500 MMcfd. The reduction was attributed to planned maintenance. It also produces 20,000 bpd of NGLs. It is owned by ExxonMobil, Shell, Imperial Oil, Pengrowth Energy Trust and Mosbacher Operating Ltd.

Meanwhile, EnCana’s Deep Panuke project remains on track to begin production this year. The company has to construct 3 km of pipeline and facilities to tie production into the Maritimes and Northeast pipeline system.

In Newfoundland, high oil prices have proven a boon to the local economy and government coffers. Oil production was 100.7 million bbl in 2010, up 3.1% relative to 2009, according to the provincial government. The increase is attributed to production from the AA Blocks at Hibernia and the startup of North Amethyst Field at Husky’s Whiterose project.

|