Although it was a difficult year politically for oil and gas in the US, 2010 also demonstrated the industry’s great resilience and adaptability. Challenges last year included stubbornly low natural gas prices, an EPA determined to regulate greenhouse gases, a White House bent on greatly increasing the industry’s tax burden, and growing state and local restrictions on fracing for shale gas production—and this was all before April 20.

The Deepwater Horizon explosion and subsequent oil spill launched a crippling deepwater moratorium and a powerful public relations backlash that threatened not just Gulf of Mexico drilling but all manner of E&P activity.

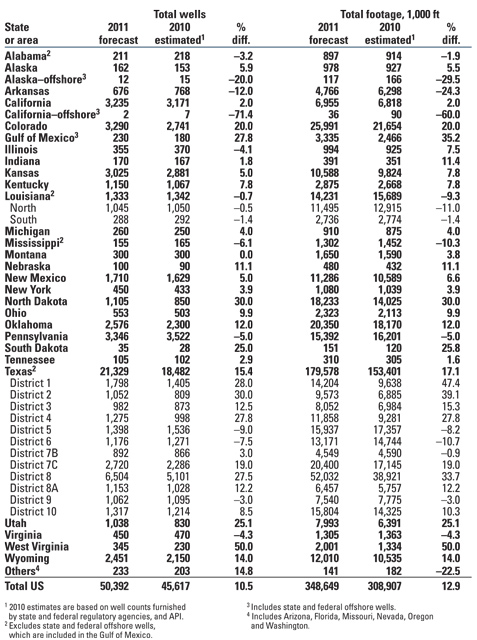

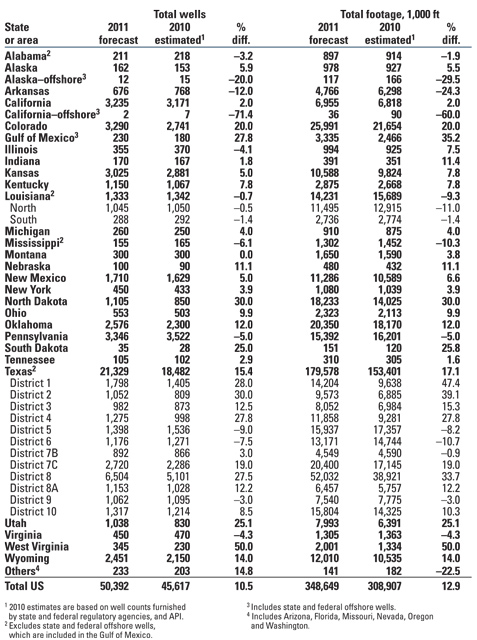

Given all these hurdles, it would not have been surprising to see activity decline or remain near the anemic post-financial meltdown levels of 2009. Instead, operators invested heavily and smartly in E&P last year, shifting operations dramatically from gas to oil both in conventional assets and in the burgeoning shale plays, where liquids-heavy prospects like the Bakken and Eagle Ford saw big increases. In all, operators drilled an estimated 45,617 new wells in the US last year, a 23% recovery from the 37,204 wells drilled in 2009, and almost 3,000 wells better than we had forecast last January.

As we enter 2011 with a friendlier Congress and steadily rising oil prices, World Oil’s forecast for 2011 shows:

• US drilling activity will grow an additional 10.6%, to 50,392 wells.

• The US rig count will average 1,773 rigs, up 15% from 2010.

• Canadian drilling will continue to recover at a modest 2.3%, to 11,163 wells.

US prices. With the International Energy Agency predicting global oil demand growth to 89.1 million bpd in 2011, investors are carefully watching oil prices, which just recently cleared the $90/bbl mark after averaging about $79.50 for 2010 (both West Texas Intermediate and Brent). Recent weeks have seen WTI decline to the $88/bbl range as a result of OPEC’s stated desire to increase production to meet rising demand in Asia, the Middle East and Latin America. Recent statements from OPEC representatives have implied a determination to avoid the $100/bbl psychological threshold.

| Forecast of 2011 US wells and footage to be drilled |

|

The US Energy Information Administration expects the price of WTI crude oil to average about $93/bbl in 2011, $14 higher than the average price last year. As for natural gas, EIA expects inventories to remain at or near record-high levels through most of 2011, offering no relief to gas producers. The agency projects an average Henry Hub spot price of $4.13/Mcf for 2011, 38 cents lower than the 2010 average of $4.51. World Oil is forecasting a less steep gas price decline, to $4.42/Mcf.

US operators’ survey. World Oil’s survey of 17 US major drillers (integrated companies and independents with large drilling programs) and 145 independents reports a total of 8,084 wells drilled last year, accounting for 18% of our total 2010 estimate of wells drilled. Majors reported 6,144 wells drilled in 2010, a number that is 459 lower in “hindsight” than last year’s respondents had originally forecast. Independents drilled 1,940 wells, down 31% from an exuberant 2010 forecast of 2,795 wells. It must be remembered that the respondents are not the same from year to year, which limits the usefulness of such comparisons.

In 2011, major drillers expect their programs to increase by a respectable 22% to 7,509 wells, of which over 8% will be wildcats. This is a greater percentage of exploratory wells than is typically forecast for the majors, and they are widely distributed throughout the US, with the highest number of wildcats—108—predicted for North Dakota.

As usual, the independents are more optimistic than the majors, this year predicting a 34% jump in wells drilled, for a total of 2,607. The independents also continue to be more aggressive explorers than the majors, with 18% of their 2011 wells planned as wildcats, almost half of those in Texas. Combined, our major and independent respondents plan to drill 10,116 wells in 2011, accounting for 20% of World Oil’s US drilling forecast.

| What 17 US major drillers1 plan for 2011 |

|

US rigs. The Baker Hughes rig count average for 2010 saw a dramatic increase of 35% to 1,542 from 1,143 rigs the previous year. One big surprise was in the Gulf of Mexico where, even during the deepwater moratorium and shallow-water permitting deadlock, the count stayed in the 18-rig range, to finish the year with an average of 31, down less than a third from 2009 levels. With fewer new wells being drilled, many GOM rigs stayed busy by performing workovers and remedial operations on existing wells rather than remain idle.

Also of note was the rise in oil-directed rigs to nearly 40% of the 2010 rig count, continuing a trend first seen in 2009 after decades of domination by gas drilling. We think continued high oil prices will drive the rig count up an additional 15% this year, to an average of 1,773 units—and we will not be surprised if more than half of those rigs are drilling for oil.

|

Drilling details. Based primarily on rig counts and API drilling data, it appears that Texas has already bounced back into “boom” territory, with 18,482 new wells estimated for 2010. That’s not only an 88% jump since the previous year’s low of 9,843. It also actually exceeds the 2008 drilling level. This year, we expect another 15% increase for the state, to 21,329. The biggest drilling increases will be in District 8, home of the resurgent Permian Basin, followed by Districts 1, 2 and 4, where activity is heating up in the liquids-rich Eagle Ford Shale. This activity is coming at the expense of that venerable shale gas play, the Barnett (concentrated in Districts 5, 7B and 9), which is suffering from stubbornly low gas prices and the specter of increasing regulation at the state and local level.

| What 145 US independents1 plan for 2011 |

|

According to the Texas Alliance of Energy Producers, the Texas Petro Index rose steadily throughout 2010, reaching 229.9 in December from a trough of 188.3 a year earlier. The index is a composite of E&P indicators including oil and gas prices paid to producers, rig counts, drilling permits and well completions, volumes and value of production, and industry employment.

The shale buzz is not boosting drilling activity in the Haynesville, which like the Barnett is primarily a gas play, without the lucrative liquids windows found in the Eagle Ford, and which has much higher well costs due to the formation’s greater depth, temperature and pressure. Look for decreases in Texas’ District 6 and Louisiana’s North district. Taken as a whole, onshore Louisiana has been one of the most stable drilling states for years. Even during the 2009 slowdown, the state experienced a much less steep decrease than the rest of the country. This year, we expect the state to remain relatively flat with 1,333 new wells.

Oklahoma may actually be one state where conventional gas activity goes up. As Larry Nichols, the chairman of independent gas producer Devon, recently told lawmakers, the company spent nearly $1 billion last year to develop its energy reserves in Oklahoma, and it expects to do the same this year. The state is forecast to increase drilling by 12% this year, to 2,576 new wells.

Drilling in North Dakota, which was at just 617 wells in 2008, fell in 2009 like in most of the US, but has since rebounded to 850 wells last year. That’s more than a third greater than its pre-crash level, and it’s primarily due to the surge of rigs and investment into the state’s Bakken Shale oil play. We expect activity to increase an additional 30% this year, to 1,105 new wells.

Last year was a tough one for the Marcellus Shale, with activity falling 18% in the core state of Pennsylvania. Factors included a partial drilling ban, low gas prices, disputes over a possible gas extraction tax, and legal cases about claims of water contamination due to fracing operations. Another factor was the inevitable slowing of a trend we saw in 2009, where operators were drilling feverishly just to hold onto leases. In total, the state saw 3,522 wells drilled last year, and drilling is forecast to be slightly down again this year, to 3,346 wells.

Drilling in the Gulf of Mexico took a 54% dive in 2010 to an estimated 180 wells, thanks to a deepwater moratorium that lasted half of the year and a painfully slow pace to even shallow-water permitting that lasts to this day. Although the shape of the new regulatory regime in the Gulf is still far from clear, we believe that number will increase about 28% this year to 230 new wells, based on operator development plans and indications that permitting will ease in the second half.

| Rigs drilling in the US Gulf of Mexico as of February 2011 |

|

About these statistics. World Oil’s tables are produced with the aid of data from a variety of sources, including the American Petroleum Institute, IHS Energy, the Texas Railroad Commission, other state and federal regulatory agencies, as well as international agencies. Most importantly, operating companies with drilling programs responded to this year’s survey. Please note credits and explanations in the table footnotes. We thank all contributors for their time and effort in providing data and analysis for this report.

World Oil editors try to be as objective as possible in the estimating process to present what they believe is the most current data available. It is realized that sound forecasting can only be as reliable as the base data. In this respect, it should be noted that well counting is a dynamic process and most historical data will be continually updated over a period of several years before “the books are closed” on any given year.

|