David Wood, DWA Energy Limited, Lincoln, UK

The anticipated global LNG supply bubble materialized in 2010 but was largely absorbed by Asia, with Europe’s demand also holding up better than expected. Despite a fall in demand for LNG in the US, some analysts forecast that global LNG demand could double over the coming decade, with Asia continuing to dominate the market.

AUSTRALASIA DRAWS INVESTMENT

Australasia continues to be the powerhouse for gas liquefaction investment in 2010, with progress being made on several Northwest Shelf projects and LNG sales contracts to Asian buyers associated with them. These include the Gorgon and Wheatstone projects in Western Australia led by Chevron, in which Japanese utilities acquired minor equity stakes in 2010. The $20 billion Ichthys project in the Browse Basin off Western Australia has progressed from FEED to tendering stage in its plan to pipe gas 850 km to Darwin and produce some 8.4 million tonnes per annum (mtpa) from two trains at Blaydin Point along with 1.6 mtpa of liquefied petroleum gas (LPG). In July, Japanese operator Inpex announced a $40 billion share offering aimed primarily at financing its 76% share of Ichthys, owned with Total.

The single-train, 4.3-mtpa Pluto liquefaction plant operated by Woodside suffered labor strikes in 2010, delaying its startup date to August 2011. However, efforts continue to find sufficient gas to support a second-train expansion to that project.

Two of the four proposed coal seam gas- (CSG-) to-LNG projects led separately by Santos and BG Group gained national and Queensland state approval in 2010. In the case of BG’s Curtis project, this led to a final investment decision (FID) in October to sanction an 8.5-mtpa plant scheduled onstream in 2014. Santos diluted its position in its Gladstone LNG project to 30% with Total, Petronas and Kogas all taking significant equity interests late in 2010 and gearing up to an FID in January 2011 with expectation of a 7.2-mtpa facility coming onstream in 2015.

However, local communities have raised opposition to the thousands of wells required for the Queensland projects. A state ban on the use of aromatics in frac fluids, along with concerns over produced water handling and potential long-term interference with groundwater, caused the federal government to delay environmental approvals of the Pacific LNG project (owned by Origin Energy and ConocoPhillips) in December, which in turn has pushed back its FID. Traces of benzene were found in fluid samples taken from eight of Pacific LNG’s CSG exploration wells in Queensland in November.

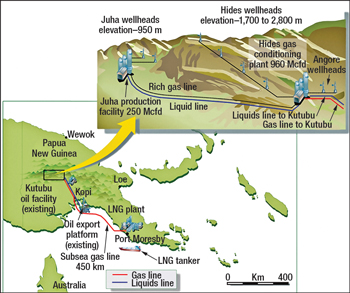

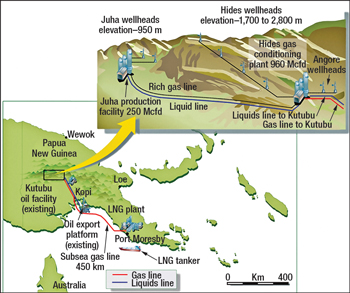

Papua New Guinea’s $15 billion PNG LNG project, led by ExxonMobil, made progress during 2010. Detailed engineering and construction commenced following the finalization of sale and purchase arrangements with gas customers, financing arrangements with lenders, and government legislation stabilizing the fiscal terms. The first phase, capable of producing 6.6 mtpa of LNG from two trains, is on track for completion in first-quarter 2014, Fig. 1. The project announced in December that it was also considering a fast-track expansion phase involving a decision on a third train in 2012. InterOil is making slower progress with partner Mitsui towards a potential second LNG project in the country based on gas supplied from their Antelope and Elk Fields. It is initially focusing on a condensate stripping plant and may advance an LNG project once revenue from condensate is generated. A 3-mtpa floating liquefaction (FLNG) project led by Daewoo, the Korean shipbuilder, won government approval late in 2010 associated with the development of an undisclosed gas field.

|

|

Fig. 1. The PNG LNG project will commercialize the Hides, Angore and Juha gas fields and associated gas from the currently operating Kutubu, Agogo, Gobe and Moran oil fields in Papua New Guinea. Courtesy of PNG LNG.

|

|

FLNG projects also made progress elsewhere in the region. In Australia, Shell’s Prelude project commenced its FEED study and Woodside made an FLNG proposal for the Sunrise project, though that plan was rejected by Timor Leste. Planning continued on other FLNG projects in Australia by GDF Suez and Flex LNG (now teamed up with Saipem). Indonesia approved the Inpex FLNG proposal for the Abadi gas field close to the Australian border, but in December scaled down the initial phase to 2.5 mtpa and delayed startup to 2016 or later.

ASIA DOMINATES DEMAND

Japan and South Korea continue to dominate the LNG import markets, Fig. 2. China continues to sign long-term contracts that are expected to substantially increase its LNG supply in the future. Through CNOOC it has three regasification terminals operational, in Shanghai (3.0 mtpa), Guangdong (6.7 mtpa) and Fujian (2.7 mtpa). In October 2010, construction commenced on a fourth terminal at Zhuhai, where 3.5-mtpa capacity is scheduled to start up in September 2013. China is also contemplating a floating storage and regasification unit (FSRU) for its Yangtze River LNG project to store and supply LNG to 12 cities along the river.

|

|

Fig. 2. Volumes of LNG imported by countries in 1996 and 2009 demonstrate the degree to which OECD Asia dominates global LNG demand. (US LNG imports peaked at 770 Bcf in 2007.)

|

|

LNG is well positioned to compete on a delivered-cost basis with pipeline gas from central Asia (Turkmenistan and Kazakhstan) and from Russia in the future. The Shanghai petroleum exchange began trading spot LNG (and LPG) contracts in December 2010. Spot trading is expected to help distribute available LNG supplies within the Chinese gas market. As LNG currently remains in short supply, spot trading is expected to start slowly, but it will build up over time.

Thailand’s PTT will start importing LNG in 2011 when its terminal in Map Ta Phut is completed. It expects initially to import 1.5 mtpa from Australia and the Middle East and later to expand to more than 5 mtpa. LNG is expected to make up 10% of Thailand’s total gas consumption in the next five years.

Bangladesh signed an LNG import agreement with Qatar last year. Malaysia and the Philippines are progressing LNG import terminals to be constructed over the next few years, primarily to avert power shortages. On the other hand, Pakistan delayed commitments to a terminal, preferring to focus on advancing gas import projects involving pipelines from Iran and Turkmenistan (across Afghanistan).

Singapore began its LNG terminal construction in 2010 and decided to expand its capacity to 6 mtpa in order to not only meet domestic gas demand but establish itself as an Asian LNG gas hub from 2013 onward. BG Group will supply the first 3 mtpa to the Singapore terminal. Growing interest from the shipping industry in LNG as a low-energy, low-cost bunker fuel is likely to benefit a Singapore LNG hub if there is sufficient uptake. Norway’s Det Norske Veritas unveiled LNG-fueled ship designs including a VLCC and a retrofitted container ship during 2010 and is strongly promoting this alternative bunker market for LNG.

Indonesia’s Pertamina and PGN reached an agreement with Golar LNG in October for a West Java FSRU, the first to be deployed in Asia. The initial 11-year contract consists of the lease of the vessel and associated mooring facility. Golar will convert one of its existing Moss LNG carriers to an FSRU in a similar scheme to that commissioned in Dubai last year.

DIVERSIFICATION CONTINUES IN EUROPE

In the UK, expansions of the South Hook (to 15.6 mtpa with send-out gas capacity of some 2.0 Bcfd) and Grain (to 14.9 mtpa with send-out capacity of some 2.1 Bcfd) regasification terminals were completed in 2010. Both terminals can berth Qmax vessels. The UK has become one of Europe’s major LNG importers, receiving substantial volumes from Qatar, Algeria, Egypt and Trinidad. High imports through these two terminals and the Dragon terminal in fourth-quarter 2010 played a significant role in averting high gas prices during the unprecedented cold spells the country experienced during December.

The Fos Cavaou regasification terminal on France’s Mediterranean coast (Fig. 3), much delayed in commissioning, finally operated at its full 6 mtpa beginning in September 2010, when authorities lifted a restriction to 20% of operating capacity. The terminal’s capacity remains fully in control of French companies (72% GDF Suez, 28% Total). Meanwhile two proposed LNG receiving terminals in northern France suffered investment decision postponement last year: Independent electricity and gas provider Poweo has been unable to find equity partners for its Le Havre terminal in Normandy, while Électricité de France and Total postponed FID on their 9.5-mtpa Dunkirk project to mid-2011.

|

|

Fig. 3. Commissioned at 20% of its capacity on April 1, 2010, the Fos Cavaou LNG terminal received approval on Aug. 31 to operate at full regasification capacity, equal to about 800 MMcfd. Courtesy of GDF Suez.

|

|

Japan’s Osaka Gas bought a 20% interest in Spain’s Sagunto regasification terminal, with European Commission approval, which will enable it to participate more easily in LNG redirection from Asia into Europe when market price differentials are beneficial.

The 9-mtpa Gate terminal in the Netherlands added compression last year and is on schedule to be commissioned in 2011. That facility also closed a 10-year deal with Dong (Denmark) and Iberdrola (Spain) for about 35 Bcf/year as its first long-term supply contract. Many expect Rotterdam to become a significant European gas hub influencing pipeline gas prices from Russia, continental Europe and the UK and competing with Belgium’s Zeebrugge gas hub for LNG supplies.

Poland’s plans for a regasification terminal in Swinoujscie, close to the German border, got a boost in October when Germany dropped its environmental objections to the plant. Construction of the 4-mtpa terminal is expected to start soon, and the first LNG shipments from Qatar are due to arrive in second-half 2014. Poland is building the terminal to reduce its dependence on Russian gas, which accounts for 90% of the country’s imports.

FID was delayed on the Adria LNG facility, planned since 2007 for Croatia, by its joint venture owners (Eon, OMV, Total and Slovenia’s Geoplin) from 2011 to 2012. This pushed startup to 2017, and the Croatian government is reportedly looking for new partners for the project to accelerate its development.

Snøhvit, the troubled (and Europe’s only) gas liquefaction plant, had another difficult year requiring turnarounds to resolve ongoing technical problems. Operator Statoil postponed plans to replace a large heat exchanger until second-quarter 2011, so the plant continues to operate suboptimally. Much of the high-cost LNG produced from that high-latitude plant is committed under long-term contract to be landed by Statoil at the Cove Point terminal, where it is sold into the US market indexed to Henry Hub prices. This has not been a profitable supply chain at 2010 prices.

Some progress was made with Russia’s Arctic LNG projects in 2010. CB&I was awarded a FEED study for storage and loading facilities at the Terriberka seaport for the Shtokman project, in which Total and Statoil are supporting Gazprom under service contracts. The development project consists of production, treatment, transportation, liquefaction, storage and shipping of natural gas and natural gas liquids from the 100-Tcf Shtokman Field, located 600 km north of the Kola Peninsula in the Barents Sea.

Shell, Total and India’s ONGC Videsh Ltd. entered negotiations with operator Novatek for stakes in the Yamal LNG project. CB&I Lummus is expected to complete a concept development plan for a 16-mtpa Yamal plant in second-quarter 2011. Due to the Yamal Peninsula’s remoteness and extreme conditions—including permafrost, ice loading and environmental sensitivity—this is considered one of the world’s most challenging energy projects. It is the large reserves associated with these Arctic projects that are attracting the attention of the major companies. Work during 2010 also suggested that an Arctic LNG sea route from these projects to the most lucrative Asian LNG markets could be feasible.

LNG has also raised its head as a competitor in the supply of Caspian gas to Europe, with a proposed project to export LNG from Azerbaijan via Georgia across the Black Sea to Ukraine and Bulgaria. Such a supply chain would require building a liquefaction plant in Georgia and regasification plants in Ukraine (Odessa) and Bulgaria. Challenges include political opposition from Russia and the EU, which favors the Nabucco pipeline option, and the difficulty of securing investment in such a politically volatile region.

Russia has three times cut off gas supplies to Ukraine over the past five years—most recently in January 2009—also causing disruption of gas supplies to other countries in Europe. This is the main motivation for Ukraine and Bulgaria to build LNG terminals—to reduce dependence on Russia as their only gas supplier. Ukraine is currently engaged in an LNG regasification terminal feasibility study to be completed at the end of 2011 and working toward a completed facility by 2015.

MIDDLE EAST ADDS CAPACITY

Yemen LNG started its second liquefaction train in March 2010, raising capacity to 6.7 mtpa. The Qatargas-3 liquefaction train (68.5% Qatar Petroleum, 30% ConocoPhillips, 31% Mitsui), built adjacent to existing trains at Ras Laffan, exported its first cargo to the Canaport terminal in Eastern Canada in November. Qatargas-2 delivered the first LNG to Dubai via the Shell-operated, permanently moored FSRU Golar Freeze at the Jebel Ali port in December.

Kuwait continued to buy spot LNG from a number of suppliers through its LNG import facility commissioned in 2009. In March 2010, the Excelerate-operated Explorer shipboard regasification vessel (SRV) docked in Kuwait with an LNG cargo from Trinidad and remained there for several months, receiving periodic cargoes via ship-to-ship transfers and regasifying the LNG for send-out.

The LNG shipping sector remained in oversupply, with the 25th and final large Qmax and Qflex vessels delivered to Qatari shipper Nakilat. Questions remain as to when it will be able to operate this impressive fleet at full capacity.

Iran terminated liquefaction project negotiations with Total, Shell and Repsol on separate projects to develop phases of South Pars Field. These negotiations have been ongoing for almost a decade. Iran cited sanctions as the main reason, but Total stated that Iran’s unrealistic commercial terms were the main barrier.

The Iran LNG plant is under development without the involvement of international oil companies (IOCs) at Tombak Port, about 50 km north of the Assaluyeh port. Civil works and construction of port facilities commenced in 2009 for this project, and in December 2010 Iran reported that the facility was 40% complete. At the same time, Iran LNG referred to a letter of intent signed between Iran and Venezuela, under which Tehran will help Caracas to build an LNG plant in the Delta Caribe area, and Venezuela through a 10% interest in Iran LNG will cooperate in building another, 5.4-mtpa liquefaction plant in Venezuela. Most in the industry are skeptical that either country has access to the technology and know-how to build and operate a modern gas liquefaction plant efficiently without IOC cooperation.

AFRICA SLOWLY ADDS LIQUEFACTION CAPACITY

The construction by Bechtel of a $9 billion one-train liquefaction plant of 5.2-mtpa capacity continues close to Soyo in northern Angola, with operator Chevron expecting commissioning in 2012. Analysts are interested to see where the LNG ultimately produced from that plant will be delivered, as its original customers when the project was sanctioned were mainly in the US, where the market for LNG has subsequently evaporated.

Elsewhere in West Africa, community unrest in Nigeria and fiscal uncertainty over its long-awaited Petroleum Industry Bill continue to delay planning and development of new LNG terminals and expansions to the existing Bonny terminal. LNG Japan was reportedly negotiating an interest in the planned Brass LNG terminal. In neighboring Cameroon, Foster Wheeler commenced a FEED study in June 2010 for GDF Suez on its proposed 3.5-mtpa liquefaction project at Kribi. Subject to approvals, this plant is expected to commence construction in 2011 and be completed in 2014.

Several impressive deepwater gas discoveries off Mozambique and Tanzania last year led to preliminary plans for a liquefaction terminal in East Africa that would further diversify supply in the Indian Ocean.

It is not all about LNG exports in Africa. Eskom, which generates about 95% of South Africa’s electricity, and PetroSA, the country’s national oil company, had planned to build an LNG import terminal and power plant at Coega industrial development zone. This was to involve leasing two FSRUs with an objective of easing power shortages during peak demand periods. However, the environmental impact assessment process was terminated least year when the project was determined to be uneconomic in its planned form.

NORTH AMERICA: FROM IMPORTS TO EXPORTS

In the US, several planned regasification plants were scrapped due to falling demand for gas imports and a growing consensus that abundant shale gas supplies now obviate the need for LNG imports in the longer term. Little progress was made in the long-running planning dispute over the proposed Bradwood Landing regasification terminal in Oregon, and it seems unlikely now that the West Coast will get LNG import capability in the foreseeable future.

On the East Coast, the Neptune LNG receiving terminal did become operational in June. The deepwater LNG port, located 10 miles off Gloucester, Massachusetts, is operated by GDF Suez with plans to be serviced by two shuttle and SRVs built for the project, Fig. 4. These vessels house regasification equipment on board, allowing the gas to be pumped directly into a submerged offshore buoy connection. Each Neptune SRV has an average capacity of 400 MMcf. Analysts are keen to know how many LNG cargoes will actually be delivered through this system going forward.

|

|

Fig. 4. Tugboats escort the GDF Suez Neptune SRV on its inaugural voyage into the Boston Harbor in January 2010. The vessel services the offshore Neptune LNG regasification terminal and the associated onshore facility in Everett, Massachusetts. Courtesy of the Center for Liquefied Natural Gas.

|

|

The Golden Pass LNG terminal (70% Qatar Petroleum, 17.6% ExxonMobil, 12.4% ConocoPhillips) near Port Arthur, Texas, received its commissioning cargo from Qatar in October, about one year behind schedule. The terminal includes two shipping berths, five 5.47-MMcf LNG storage tanks and two gas vaporization trains. Its full operational capacity is 15.6 mtpa with a 2-Bcfd send-out capacity. Expectation is that many cargoes originally scheduled for delivery to Golden Pass will, over the next few years at least, be diverted to higher-price LNG markets and that the terminal will not operate at full capacity.

El Paso, meanwhile, continues construction of the 1.3-Bcfd Gulf LNG terminal at Pascagoula, Mississippi. The terminal’s capacity is fully allocated under 20-year contracts with a planned 2011 startup. This terminal may well be the last LNG import terminal to be built in the Lower 48 for several years due to the impact of domestic shale gas supplies and consequent low prices.

Perhaps the development that best underscores the LNG sector’s flexibility, and highlights where it can frequently outperform pipeline competition, is the proposed turnaround of several US Gulf of Mexico LNG receiving terminals into export terminals. The Sabine Pass, Freeport and Cameron terminals all chose this route last year in preference to sitting idle. The first LNG cargo owned by Total was re-exported to the UK from Sabine Pass in November. Such re-exports offer idle or under-utilized US LNG terminals an arbitrage opportunity. The month-ahead premium of UK ICE futures over US NYMEX gas prices in mid-November was some $3.40/MMBtu, which when adjusted for the cost of shipping still yielded a significant arbitrage value.

ConocoPhillips holds some of the capacity at the Freeport, Texas, terminal and sold a cargo for re-export to Japan in September. Operations commenced in June 2008 with capacity to unload and vaporize about 2.0 Bcfd equivalent of LNG. In December 2010, the owners announced plans to construct a 1.4-Bcfd liquefaction plant to convert the facility into a bidirectional import/export LNG terminal. The proposed liquefaction facility includes four trains of about 330-MMcfd liquefaction capacity each. Commercial operations are expected to begin in early 2015, upon receipt of necessary governmental approvals.

Cheniere Energy’s Sabine Pass LNG terminal in Louisiana re-exported a cargo of LNG to Asia in October, one of several re-export deals in fourth-quarter 2010 from the US. Chevron, which also holds capacity at Sabine Pass, applied in October for a license to re-export up to 72 Bcf over a two-year period from that terminal.

Following the lead of the Sabine Pass and Freeport terminals, Sempra, owner of the Cameron LNG terminal at Hackberry, Louisiana, in September requested authorization from the Federal Energy Regulatory Commission to re-export for a two-year period up to 250 Bcf as LNG. Sempra expects to be able to do so by February 2011. A turnaround in the opposite direction—export to import—is being considered for the vintage Kenai plant in Alaska to supply Anchorage with gas in the absence of progress on the long anticipated gas pipeline from the North Slope following two open seasons last year.

Progress has also been made with plans to export LNG from a planned 5-mtpa plant at Kitimat on Canada’s west coast. Ownership of this project changed hands in 2010 from Calgary upstart Galvaston Energy to Apache (51%) and EOG Resources (49%), both large US independents active in Canada’s nearby Horn River Shale gas play. The $3 billion liquefaction facility is expected to be able to process some 700 MMcfd, and an engineering and design study is underway.

Concerns over rapidly declining gas exports from Canada to the US are prompting operators holding gas reserves in Canada to consider developing LNG export routes to the more lucrative Asian markets. Shale gas developments in Western Canada are likely to provide key reserves to support these emerging supply chains in the long term.

SOUTH AMERICA AND CARIBBEAN DIVERSIFY

The 4.4-mtpa Melchorita liquefaction plant in Peru was the only greenfield LNG facility commissioned last year. Four companies form Peru LNG: Hunt Oil Co. (US, 50%), SK Energy (South Korea, 20%), Repsol-YPF (Spain, 20%) and Marubeni (Japan, 10%). The plant processes up to 620 MMcfd and, at a cost of $3.2 billion, represents the largest investment ever in a single project in Peru. It is integrated with a 408-km pipeline and a marine terminal. LNG cargoes loaded in 2010 were delivered to destinations including Spain, Brazil, Canada and the US.

Other receiving terminals in South America that made progress toward construction during the year and will further diversify the LNG industry include an FSRU each in Uruguay and Argentina. The continent’s steady increase in regasification capacity, particularly in the southern cone, is adding further competition to Bolivia’s gas reserves and lowering the price that country will be able to command in the future through pipeline projects. LNG from West Africa, Trinidad and Qatar reached South American terminals during 2010.

The Bahia Blanca LNG receiving terminal in Argentina took Excelerate less than 12 months to design, permit and construct. In September 2010, Excelerate announced plans for a second facility, the Puerto Escobar FSRU, with a schedule to bring it onstream in May 2011 to deliver up to 500 MMcfd into the Argentine gas grid. The LNG terminal planned for Montevideo, Uruguay, is likely to be smaller but to supply gas to both Uruguay and Argentina and be onstream in 2012 or 2013.

In the Caribbean, Exmar was contracted to build an FSRU in Jamaica and Valero is contemplating importing LNG to power its refinery in Aruba. An LNG receiving terminal forms part of Cuba’s announced Cienfuegos refinery expansion and modernization project, which reportedly involves Chinese finance and aspires to be operational by 2013. Supply is expected to come from Venezuela if and when that country is in a position to construct a liquefaction plant. In December, Iran announced that Cuba and Argentina would be priority LNG export markets once the Iran LNG facility is completed. Many are skeptical that this will happen in the next few years.

The Caribbean market for LNG is likely to be supplied initially by existing liquefaction plants in Trinidad. However, this should not be taken for granted, as once an LNG terminal is built it is possible to secure supply at the best price from around the world. It is instructive in this regard that Kuwait has not taken its LNG from nearby Qatar.

CONCLUSIONS

Important developments around the world last year demonstrate how diversified, robust and flexible the LNG industry has become. In the face of global economic recession and in some regions (e.g., the US) gas surplus, the industry has rapidly redirected supplies and reconfigured facilities to exploit emerging opportunities. The appetite for LNG is growing globally, and major pipeline suppliers to Europe particularly are beginning to realize just how significant this resource’s impact will be in terms of future supply and pricing.

|

THE AUTHORS

|

| David Wood is an international energy consultant specializing in the integration of technical, economic, risk and strategic information to aid portfolio evaluation and management decisions. His research concerns a wide range of energy-related topics, including project contracts, economics, gas and LNG, gas-to-liquids, portfolio and risk analysis. |

|