JOHN L. KENNEDY, 21st Century Energy Advisors

|

| From left: The third phase of development at Kharyaga field, in the Timan Pechora basin of northwest Russia, involves the drilling of more production and injection wells, a process upgrade and installation of gas treatment facilities to sell gas and terminate flaring (photo by Svein Are Enes, courtesy of Statoil). Drilling is being conducted at Urengoy field in western Siberia by Achimgaz, a joint venture of Gazprom and BASF subsidiary Wintershall (Photo courtesy of BASF). Transocean’s Polar Pioneer, currently drilling at Skrugard field in the Norwegian section of the Barents Sea, features a fully enclosed drilling package and pipework to contain space heating (photo by Harald Pettersen, courtesy of Statoil). |

|

Facing the Arctic’s hostility is undeniably daunting. ExxonMobil recently listed the region’s unique challenges: remote location, changing ecology, icebergs, prolonged darkness, mobile pack ice, severe storms, permafrost, earthquakes, a sensitive environment and deep water. Regulatory caution resulting from the Macondo well blowout and significant new gas supply—especially due to the expansion of North American shale development—have further complicated the Arctic search. But the potential reward is as big as the challenge. The US Geological Survey estimates undiscovered Arctic reserves at 90 billion bbl of oil, 1,669 Tcf of natural gas and 44 billion bbl of natural gas liquids (NGLs).

The regulatory issues related to Arctic exploration and development will eventually be settled, prodded by rising oil and gas prices. And increasing demand will shrink today’s global gas cushion while Arctic gas is being developed, a job that will span decades. To fully exploit the Arctic’s resources, however, industry will need expanded access, continued technological advance and innovative operating procedures. And, of course, it will need capital in amounts that match the Arctic vastness.

RUSSIA: FINAL SHTOKMAN DECISION NEAR

In Russia’s Arctic territory, progress continues on a plan to develop the giant Shtokman gas discovery, estimated to hold 135 Tcf of recoverable gas. The field, 900 km north of the Arctic Circle in 320 ft of water in the Barents Sea, covers 1,600 sq km. Phase 1 will develop up to one-third of the reserves, half of which will be delivered to the European pipeline network while the rest is converted to LNG.

In April, the Shtokman consortium approved a development concept in which gas and condensate will be transported to shore through a 550-km, 36-in. two-phase pipeline. The consortium, called Shtokman Development AG (SDAG), is composed of Gazprom (51%), Total (25%) and Statoil (24%). Gazprom will market the gas.

In an article in the May 2011 issue of SDAG’s Shtokman Times newsletter, SDAG offshore process leader Pratik Saha said single-phase flow solutions were studied, but the two-phase option was chosen “to keep things as simple as possible without jeopardizing safety and operability.” The Shtokman well stream contains less than 0.2% liquid, so flow behavior will be similar to single-phase flow, Saha said. In the same report, K. S. Basniev of Gubkin Russian State University of Oil and Gas said Shtokman will be the longest two-phase pipeline yet.

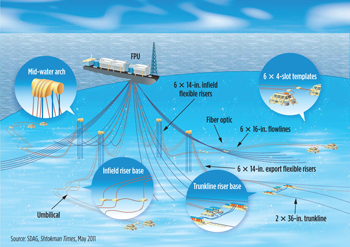

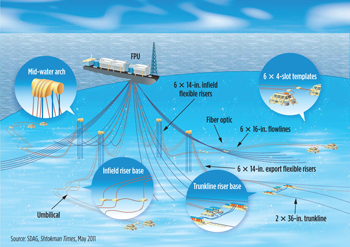

Other key components of the first-phase development are six subsea templates with four slots each; an ice-resistant ship-shaped floating production unit (FPU); and an onshore complex that includes a 7.5 million-ton/year LNG plant, Fig. 1.

SDAG expects a final investment decision by the end of this year; gas delivery to Europe via the Nord Stream pipeline could begin in 2016, and LNG deliveries could start in 2017.

Also in Russia, domestic independent gas producer Novatek—the country’s second largest after Gazprom—in March agreed to make Total a 20% partner on the $15–$20 billion Yamal LNG project. Novatek has stated that up to 49% of project shares may be sold to foreign companies, and has held talks with several companies in advance of other partner announcements expected later this year. The project will initially develop South Tambey field in the Yamal peninsula, which contains proved reserves of 14.8 Tcf of gas and 15 million tons of gas condensate. Startup of the first of three LNG trains in a 15 million-ton/year LNG plant is scheduled for 2016.

In exploration, TGS announced that in early August it will begin acquisition of a new 7,700-km 2D survey in Russian Arctic waters. The Akademik Fersman vessel will first acquire 4,500 km in the Laptev Sea, then move to the East Siberian Sea to acquire an additional 3,200 km. The survey is expected to be completed early in the fourth quarter. Russian geophysical company Dalmorneftegeophysica (DMNG) will process the data, which should be available to clients late in the first quarter of 2012.

In late June, Russia’s Defense Minister Anatoly Serdyukov told reporters that two Army brigades would be deployed to protect territories beyond the Arctic Circle. Serdyukov said the Arctic forces may be stationed in the northern Russian cities of Murmansk and/or Arkhangelsk, but other locations are also being considered. According to news reports, Russia is pressing territorial claims on the underwater Lomonosov and Mendeleev ridges in the Arctic Ocean, which may hold significant oil and gas potential.

NORWAY: BARENTS SEA PROMISE

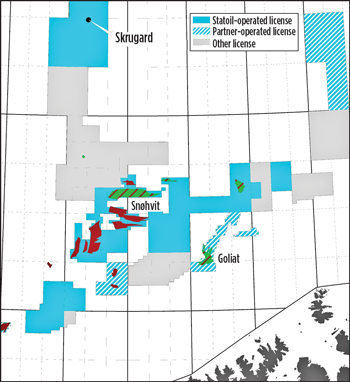

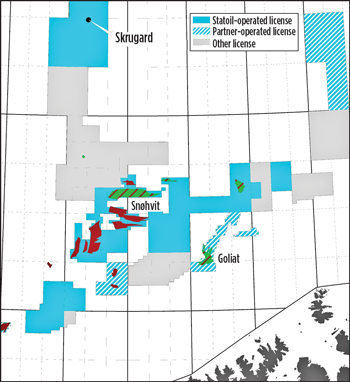

In April, Statoil announced an oil discovery on the Skrugard prospect (license 532) in the Barents Sea, 100 km north of Statoil’s Snøhvit development, Fig. 2. Located at a water depth of 1,200 ft, the well found a 110-ft gas column and a 300-ft oil column at a drilling depth of 4,100 ft. Estimated recoverable reserves are 150–250 million boe, and Statoil believes the license may contain an additional 250 billion boe. Statoil operates the license and holds a 50% share along with partners Eni (30%) and Petoro, a Norwegian state-owned company (20%).

|

| Fig. 1. The Shtokman development will include six subsea templates with four slots each and an ice-resistant ship-shaped FPU. |

|

In a statement, Tim Dodson, Statoil’s executive vice president for exploration, called the find “a breakthrough for frontier exploration in the Barents Sea,” confirming the company’s exploration model for the frontier region. Statoil plans to drill a new prospect in the same license next year, and may also drill an appraisal well at Skrugard.

In April, Statoil was awarded holdings in 11 new production licenses in the 21st licensing round on the Norwegian continental shelf (NCS). It will be the operator for four new licenses in the Barents Sea, including production licenses 614 and 615 in the Hoop area, about 200 km northeast of the Skrugard discovery. According to Statoil, more than 80 wells have been drilled in the southern Barents Sea, 60 of which the company operated.

|

| Fig. 2. With 150–250 million boe of estimated recoverable reserves, Statoil calls its Skrugard discovery “a breakthrough for frontier exploration in the Barents Sea.” Image courtesy of Statoil. |

|

In mid-May, Swedish independent Lundin Petroleum spudded its Skalle exploration well, also north of Snøhvit in the Barents Sea. The company estimates the Skalle prospect to contain unrisked gross prospective resources of 250 million boe. Lundin is the operator with a 25% interest; partners are RWE Dea (20%), Petoro (20%), Norwegian independent Spring Energy (17.5%) and Canada’s Talisman (17.5%). Also this year, Lundin was awarded—and will operate—a new exploration license on a 1,180-sq-km block immediately east of the block where the Skrugard discovery was made.

Eni’s Goliat will be the first oil field developed in the Norwegian sector of the Barents Sea. According to the company, two subsea wells will be linked to the cylindrical Sevan 1000 FPSO, currently under construction, Fig. 3. First production is expected in late 2013.

|

| Fig. 3. Goliat, the first oil field developed in the Norwegian sector of the Barents Sea, will use subsea wells linked to a cylindrical FPSO. Image courtesy of Eni Norge. |

|

US: OFFSHORE DELAY, A CANCELLED PIPELINE

After spending five years and more than $50 million pursuing air permits for its drilling rig to operate in the Beaufort Sea, failure to obtain those permits caused Shell to abandon its planned 2011 offshore Alaska drilling program early this year. In May, Shell submitted to the US Bureau of Ocean Energy Management, Regulation and Enforcement (BOEMRE) revised plans for drilling in the Beaufort and Chukchi Seas during the summers of 2012 and 2013. In 2012, the company would drill up to two wells in the Beaufort Sea using Noble Drilling’s conical Kulluk drill barge, and up to three wells in the Chukchi Sea using the Frontier Discoverer drillship.

“We’re cautiously optimistic that the revised plans will be approved,” Shell Alaska spokesman Curtis Smith told World Oil. “Right now, we like the conversations we are having with officials and regulators” about being able to drill in 2012.

In early June, the new plans were undergoing a “completeness review” at BOEMRE prior to being made available for public comment. A key feature is provision for the use of an Arctic capping system similar to that which ultimately stopped the flow of oil at Macondo. “Though it has not been engineered yet, we’ve committed to have that in the theater before we begin drilling,” Smith said.

Late last year, another Alaska project was delayed. BP decided to slow construction of the rig at its Endicott satellite drilling island in the Beaufort Sea “to allow the project team to take the time necessary to evaluate construction of key systems,” the company said in a release. Development of Liberty field is planned from the island using ultra-extended reach drilling, which will allow production from the field, some five miles offshore, without building a remote offshore island and pipeline.

Shale gas victim. In May, BP and ConocoPhillips announced that they would withdraw their Federal Energy Regulatory Commission pre-file application to build the planned 1,700-mile Denali gas pipeline from Alaska’s North Slope to Canada and “close out its operations.”

In a statement, the Denali partnership said its open season efforts did not draw enough customer commitments to justify continued work on the project, estimated to cost about $35 billion.

“Since Denali began its efforts in 2008, the North American gas market has changed significantly, primarily as a result of the development of shale gas resources,” the statement said.

The rival team of TransCanada and ExxonMobil are still in negotiations with suppliers for their $42 billion gas pipeline project, but have been unable to secure agreements to date. Meanwhile, the state is considering a cheaper in-state pipeline as an alternative for North Slope gas.

Progress, too. The Alaska Arctic activity story is not entirely about delay and cancellation. In February, Eni began oil production at Nikaitchuq field, located offshore the North Slope in about 10 ft of water. The Italian major’s first operated Arctic project, it is 100% owned and has recoverable oil reserves estimated at 220 million bbl. Production, expected to peak at 28,000 bopd, will be shipped through the Trans-Alaska oil pipeline. Nikaitchuq’s full development will comprise 26 oil producers, 21 water injectors and five water source/disposal wells.

In March, Spain’s Repsol announced a joint venture for North Slope exploration with two Denver, Colorado-based companies: 70 & 148 (a subsidiary of Armstrong Oil and Gas) and GMT Exploration. Repsol agreed to invest $768 million and collaborate on exploration and development in leases held by 70 & 148 and GMT that cover an area of 2,000 sq km near large producing fields. Repsol’s working interest will be 70%. Exploratory work is planned for next winter.

CANADA: MACKENZIE OK, OFFSHORE REVIEW

New shale gas supplies could help, rather than hurt, the future of Arctic gas, according to Robert R. McLeod, the minister of industry, tourism and investment for Canada’s Northwest Territories.

In the case of the Mackenzie gas project (MGP), “the abundance of shale gas will benefit the pipeline,” McLeod told World Oil. “MGP is a long-term project—it won’t deliver gas until 2018—and the current gas oversupply won’t last forever.”

“Indeed, the low cost and ample supplies of natural gas from all sources are expected to provide a level of comfort and acceptance in the North American market” that will benefit future natural gas markets. According to McLeod, the territories’ onshore and offshore ultimate recoverable potential is about 7 billion bbl of oil and over 81 Tcf of gas.

At the end of last year, Canada’s National Energy Board (NEB) recommended that the MGP proposal be allowed to proceed, and the federal government approved the project in March of this year. MGP owners are now “re-engaging in the project and will develop a fiscal framework that allows the project to be re-staffed,” Pius Rolheiser, a spokesman for Imperial Oil, told World Oil. The project owners, of which Imperial is the largest with a 34.4% share, aim to make a decision on construction by the end of 2013.

“Despite current conditions in the gas market, we are still of a view that North American natural gas demand will continue to grow through the rest of this decade and beyond,” he said. “That demand growth, combined with declines in conventional gas production, positions the MGP—which would come onstream late in this decade at the earliest—as a significant new supply source for the longer-term North American market.”

Imperial’s Taglu field represents half of the almost 6 Tcf of discovered gas resources that “anchor” the project; as now configured, it would support production of about 500 MMcfd. The other anchor fields for the project are Parsons Lake and Niglintgak. A 457-km pipeline would carry NGLs from the town of Inuvik to an existing oil pipeline at Norman Wells, both within the territories. The 1,196-km Mackenzie Valley pipeline would stretch from the Beaufort Sea to northwestern Alberta. In 2007, Imperial estimated the project would cost $16 billion.

Regulatory review. In response to the Macondo well blowout, Canada’s NEB is reviewing its safety and environmental requirements for offshore drilling. Operators have responded to the agency’s call for information, and the report is expected late this year. A key issue is whether companies should be required to show they can drill a relief well in the same operating season if primary blowout prevention measures fail. Some operators have said the requirement is not practical and suggest that more attention should be placed on prevention equipment and technology. The same-season replacement well requirement is particularly daunting in the deep part of the Beaufort Sea, where the drilling season lasts only about 28 days.

“Pack ice is moving farther back, leaving more open water,” McLeod said. “But operators still have to deal with ice, and it hasn’t yet been proven that you can clean up oil under the ice.”

Licensing activity. In July last year, the owners of two large Beaufort Sea parcels established a joint agreement with Imperial as operator of the combined block. Imperial and ExxonMobil acquired one of the parcels in 2007; in 2008, BP acquired an adjacent, similar-sized block. Located about 120 km offshore, each block covers about 500,000 acres in water depths ranging from 300 ft to 4,000 ft.

The companies have conducted seismic surveys and other exploratory work, but no wells will be drilled until the NEB’s review of offshore drilling regulations is completed, Rolheiser said.

Late last year, Northwest Territories-focused MGM Energy agreed to sell 20% of the Umiak license (significant discovery license 131) to South Korea’s state-run company Kogas for $30 million. The agreement called for $20 million to be paid on closing and $10 million upon the decision to construct the Mackenzie Valley pipeline or any other project to commercialize production from SDL 131. The sale closed earlier this year.

|

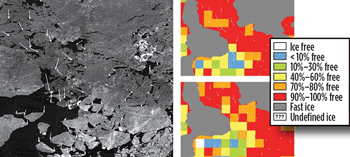

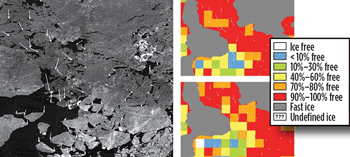

| Fig. 4. Satellite imagery can be used to provide ice drift updates as well as ice concentrations. Image courtesy of Fugro NPA. |

|

Also, MGM recently acquired four exploration licenses covering more than 290,000 hectares (about 720,000 acres) on the Mackenzie delta and one license in the central Mackenzie corridor. According to its website, the company has “a number of exploration prospects and leads, some drill-ready, on these licenses.”

In February, Canada’s Aboriginal Affairs and Northern Development Ministry called for bids on 11 parcels in the central Mackenzie Valley covering about 897,888 hectares (2.22 million acres), and three parcels in the Beaufort Sea and Mackenzie Delta covering about 386,267 hectares (954,000 acres). At the end of June, bids were being reviewed, but results had not been announced, according to a ministry representative. The term of an exploration license issued for these regions is nine years, consisting of consecutive periods of five and four years.

GREENLAND: TWO LICENSING ROUNDS

Planned licensing rounds in Arctic waters offshore northeast Greenland were announced in Houston in early April by Jørn Skov Nielsen, director of the country’s Bureau of Minerals and Petroleum. The US Geological Survey estimates the area to contain 31 billion boe of undiscovered hydrocarbon resources.

The Greenland Sea offering will include a pre-round open to members of the Kanumas group, which conducts seismic surveys offshore Greenland, and an ordinary round open to any company or group. The two rounds together will include 50 blocks covering 50,000 sq km. The application deadline for the pre-round of 30,000 sq km is Dec. 15, 2012; cutoff for the ordinary round of 20,000 sq km is Oct. 15, 2013. The Kanumas group, whose members are ExxonMobil, Statoil, BP, Japan National Oil Corp. (JNOC), Chevron, Shell and Greenland’s state-owned Nunaoil, was formed in 1989 to assess hydrocarbon potential offshore northwest and northeast Greenland.

Cairn Energy, the largest acreage holder and most active operator in Greenland, drilled three wells there last year. Cairn holds 11 offshore Greenland blocks out of 20 currently licensed.

In late May, the company announced that its 2011 exploration program, estimated to cost about $600 million, calls for up to four exploration wells. Above the Arctic Circle, one well will be drilled in each of the Napariaq and Eqqua blocks in the southern Baffin Bay west of Disko island. The Delta prospect in Napariaq has 530 million bbl of estimated prospective oil resources, while Eqqua’s Gamma prospect holds prospective oil and gas resources of 1.84 billion boe. The company also announced plans for three 3D seismic surveys of 1,500 sq km each starting in June to support drilling activity.

Spectrum and Petroleum Geo Services (PGS) announced early this year that they have reprocessed 7,357 km of 1980s-vintage 2D seismic data offshore southeastern Greenland. This area includes the southern part of the East Greenland rift basin. The reprocessed seismic data are now available as a final pre-stack, time-migrated product from both Spectrum and PGS.

ICELAND: OFFSHORE OFFERING

The second lease offering will open Oct. 3 for the Dreki area east and northeast of Iceland, where studies have indicated a thick continental crust that may include Jurassic and/or Cretaceous source rocks. The deadline for applications will be April 2, 2012.

“Exploration in the Dreki area is generally accepted favorably by the public,” Þórarinn Sveinn Arnarson, oceanographer and exploration manager for Iceland’s National Energy Authority, told World Oil. “We are keeping a close eye on changes to safety regulations in the neighboring countries and the EU, and will maintain the safest standards.”

Another prospective area, Gammur, is much closer to shore and in shallower water just north of Iceland, and indications have been found there for the presence of gas, Arnarson said. He added that Iceland’s Parliament recently approved new research in the Gammur area, which “will at first most likely consist of shallow coring and geochemical measurements to look for possible presence of thermogenic hydrocarbons.”

MANAGING ICE, RISK, COST

While producing an estimated 40 billion bbl of oil and 1,000 Tcf of gas from the Arctic since 1963, the industry has successfully adapted tools and techniques used in less severe environments to meet many of the region’s harsh demands. But significant technological advances—perhaps even a few “game changers”—are still needed.

Watching ice. Since ice is at the root of most Arctic challenges, adequate ice monitoring is key to an ice management program that will minimize operating risk and cost. Traditional ice monitoring solutions offer relatively low-resolution, generalized data on ice fields, leads and pack ice movements over large regions. Though these systems helped plan safe access and configure operating schedules, available image repetition rates restricted their capability, according to satellite mapping specialists Fugro NPA.

Fugro offers enhanced ice monitoring services in the polar areas and frozen seas using the recently completed four-satellite Cosmo-SkyMed (CSK) constellation, which allows repeat images to be acquired in hours rather than days, according to the company.

The satellite sensors operate in daylight and darkness and image directly through cloud cover, Fig. 4. The satellites collect data in modes ranging from 200-km scenes with 100-m resolution to 10-km scenes with 1-m resolution.

Collaboration on tech challenges. Because the reservoir targets are not too deep, pressures are moderate, and much of the water is shallow, Arctic well design and construction are relatively straightforward.

“But drilling costs are still a challenge,” Tony Doré, Statoil vice president for global new ventures, told World Oil. Drilling costs increase significantly when moving from an area with seasonal ice to an area that combines seasonal ice and deep water, for example. At the highest point on the drilling cost curve is a project that requires a “two-season well.”

“Drilling costs are an important issue, but they are an order of magnitude below development costs,” Doré said. “To optimize project economics, industry must identify technology gaps and cooperate to share costs. Some things are better done collaboratively.”

And it is not only technology that can benefit from collaboration, Bill Schoellhorn, Statoil’s exploration director for Alaska, told World Oil. “There are opportunities for Arctic operators to cooperate on many levels, including oil spill response and relief well drilling.”

One solution could be an “ArcticStar” program—modeled after the successful DeepStar consortium of Gulf of Mexico operators—that would drive an R&D effort to address Arctic challenges. DeepStar, a multidisciplinary industry program founded in 1992 to solve GOM deepwater challenges, is an example of how collaboration can pay big dividends, Doré and Schoellhorn agree.

“At the moment, there is not a formal ‘ArcticStar’ proposal,” Doré said. “The only forum we know about is the Arctic Offshore Technology Development Collaborative Group, a discussion group run by ConocoPhillips.”

But there are ad hoc discussions and individual instances of collaboration occurring among Arctic players, Schoellhorn said.

ATC concepts, solutions. At the Arctic Technology Conference held in Houston early this year, ideas were presented for coping with both onshore and offshore Arctic challenges. Following are some highlights from conference presentations.

Pipeline construction. Offshore pipelines in the Arctic face risks of ice gouging, upheaval and buckling, channel migration, scour and permafrost thaw settling, according to Syed Jafri of MCS Kenny. Construction operations can face special emissions and noise regulations.

According to Jafri, existing plows can lay pipe as large as 60 in. in diameter in waters as deep as 1,000 m; trenchers with a pipe size limit of 60 in. can work in up to 2,500 m of water depth and execute shore approaches; and dredgers are available for installing pipe up to 60 in. in water depths to 150 m for seabed slopes and shore approaches. Equipment for deeper water is needed, he said, as well as the ability to bury pipelines from 3 m to 12 m deep in areas where ice gouging occurs. New approaches to mobilization and demobilization that will allow a multiple-season campaign also are needed, Jafri said.

Horizontal directional drilling can be used to install pipelines in the Arctic, according to John Hair of J.D. Hair & Associates. The technique is not for all applications; solution cavities and unstable permafrost cannot be drilled, but pipe of almost any diameter can be installed this way, Hair said. The process is limited to a drill length of about 7,000 ft since the drillstring has to be advanced by compression, but a project might be drilled from both ends to boost capability to about 12,000 ft.

Offshore drilling and production. For Arctic exploration and development, an icebreaker converted to a drillship, combined with an ice management program, could be the best solution, said Nicolas Pilisi of Blade Energy Partners. For production, a polar-class non-ship-shaped icebreaker FPSO is an option. Russia’s Shtokman will use the first floating platform in ice conditions, a ship-shaped disconnectable FPU.

Another option is a disconnectable Arctic spar that could withstand high ice loads and disconnect in 15–30 min., according to Anil Sablock of Technip. The concept features a two-piece hull with a detachable keel buoy that remains in place when the spar is disconnected. It would have a conical profile with a reinforced neck at the water line. Mooring exits would be well below the ice, and risers would be contained in a center well.

For shallow Arctic waters of 15–35 m, prefabricated barges with equipment installed onshore could be an economic alternative to artificial islands, spray islands, ships and gravity-based structures, according to Kenton Braun of PND Engineers. A typical application might involve four barges held in place with piles inserted through the hull and grouted. An inclined perimeter would serve to break ice and reinforce the hull.

Protecting subsea equipment. In western Greenland and Labrador, Canada, it is necessary to protect subsea systems against ice gouging, said Arash Zakeri of C-Core, an R&D corporation associated with Newfoundland’s Memorial University. Currently, “glory holes,” depressions in the seafloor where the wellhead can be installed below the mudline, are used. But icebergs can still contact the wellhead and deform conductor pipe, making it impossible to shut in the well.

Two other protection options are being tested, said Zakeri: a truncated protection cone and a subsea protection box in which production equipment would be installed.

Harmonization. The interest in harmonization of design standards for Arctic and other cold-region structures is especially important because of the several nations that operate in cold weather areas. ISO 19906: 2010 is a step in that direction. It was accepted by participating countries unanimously in December, and provides data on ice types and morphology found in more than a dozen seas, bays and inlets adjacent to Norway, Russia, China, Denmark, Canada and the US. All companies operating in these waters are likely to adopt the standard.

ISO 19906:2010 specifies requirements and provides recommendations and guidance for the design, construction, transportation, installation and removal of offshore oil and gas structures in Arctic waters and cold regions with similar conditions.

THE AUTHOR

|

|

JOHN KENNEDY, president of 21st Century Energy Advisors Inc., analyzes oil and gas technology, markets and issues for a variety of clients. He has an engineering degree and has covered global petroleum activity for several decades.

|

|