British Columbia government incentives compensate for frontier challenges as operators acquire leases, assess play potential and start production.

Pramod Kulkarni

The search for shale gas bounty has taken operators from the urban setting of the Barnett to the diverse rural settings of the Marcellus, Haynesville, Eagle Ford and Bakken plays. The latest addition to this shale pantheon is the Horn River Basin in the far northern corner of Canada’s British Columbia province, Fig. 1. The frontier region is handicapped by a short drilling season, extreme cold winters and the lack of adequate infrastructure. These logistical difficulties can add as much as $1.00 to $1.50 to the cost of each MMBtu of natural gas production. However, royalty incentives, government policies that encourage oil and gas development, and the relative absence of anti-drilling activists have drawn operators, both large and small, to this frontier play. To be sure, operators do not have free rein in the region. The provincial government is protective of its natural assets and insists on strict environmental standards. Operators are working within the logistical and regulatory constraints and are encouraged by the play’s potential yield. In addition to the Horn River, shale gas development is underway in the Montney and Big Horn plays to the south and leasing activity is heating up in the Liard Basin to the west.

|

|

Fig. 1. The Horn River Shale play extends from the northeastern corner of Canada’s British Columbia province into a southern portion of the Northwest Territories province.

|

|

GEOLOGICAL SETTING

The Horn River Shale play encompasses 2 million acres (3,000 sq mi) in British Columbia about 40 km north of Fort Nelson, with slight overhang into the Northwest Territories province. The Horn River Formation is a stratigraphic unit of Devonian age in the Western Canadian Sedimentary Basin. It underlies the Fort Simpson Formation and overlies the Pine Point Formation.

From top to base, the Horn River Shale consists of three members: Muskwa, a bituminous, radioactive shale; Otter Park, a gray calcareous shale; and Evie, a black silty limestone. These three zones form a 200-m-thick section of over‐pressured, organic‐rich, siliceous shales at depths of 2,400 to 2,700 m and holding about 370 Tcf of natural gas. Table 1 lists the Horn River’s reservoir characteristics.

| TABLE 1. Horn River Basin reservoir profile |

|

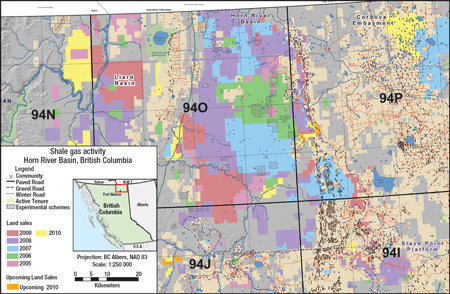

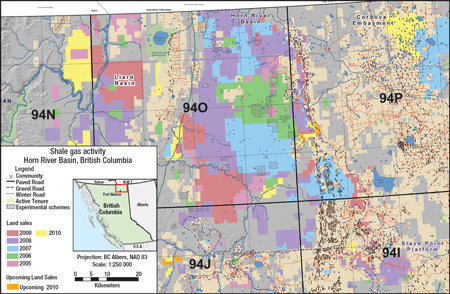

LEASING ACTIVITY

About 90% of the petroleum and natural gas rights in the Horn River Shale play are owned and administered by the Crown. Leasing rights are sold by monthly sales through public tender. Operators can request parcel postings and can sign variable tenure agreements encompassing permitting, leasing and drilling. Leasing activity began in earnest in 2005 and peaked in 2009 as most of the leases in the core area were taken up. In 2010, the leasing interest is in the southern portion of the Horn River Basin and the adjacent Liard Basin, Fig. 2.

|

|

Fig. 2. Leasing activity in the Horn River Basin began in earnest in 2005, and most of the prime areas in the basin have been leased. Upcoming sales are relatively small parcels in the south and southeast

|

|

COMPANY OPERATIONS

The operator scene in the Horn River Basin involves large independents, majors working through their subsidiaries, and joint venture partnerships.

An Apache-EnCana joint venture has an interest in 425,000 gross acres, the leading acreage position in the play. The JV is ramping up its activity during 2010 by drilling 34 wells, completing 55 and producing from 44. The drilling is taking place from seven multi-well pads. Due to the remoteness of some of the drilling locations, Apache has invested more than $10 million in sensors at the wellsite and supervisory control and data acquisition (SCADA) systems to allow experts at a central location to monitor critical performance and safety data from multiple wells.

Imperial Oil is Canada’s largest petroleum company, with ExxonMobil being its majority shareholder. Imperial has been acquiring leases in the Horn River Basin with a 50/50 ExxonMobil partnership since 2007 and thus far holds 309,000 acres. During 2008–2009, the company participated in a 3D seismic survey, and it drilled its first test well in late 2008. During the first season, Imperial drilled four delineation wells, and it is planning to drill 11 wells during the 2009–2010 season, including a production pilot. Through the first two seasons, Imperial has acquired formation data, including core samples, optimized casing design and reduced drilling days.

Devon Canada has 170,000 acres in the thickest section of the basin. The company planned to drill seven horizontal wells during 2010 to support early stages of derisking and satisfy the minimal drilling required to hold acreage. Devon has a 27% working interest in the Cabin gas processing plant. The company is drilling an eight-well pad and intends to progress to an 18-well pad.

EOG Resources is in the midst of a three-year development program for its 157,500 net acres with likely reserves of 9 Tcf, including 850 Bcf booked at the end of 2009. The company is in the process of completing 10 wells drilled during the winter season.

Quicksilver Resources holds 130,000 net acres in the Horn River Basin. The Texas-based company has drilled four wells with initial production (IP) rates up to 11 MMcfd and needs to drill six additional wells to validate all of its licenses. Two of Quicksilver’s wells have shown significant mobile oil saturation upon analyses of core samples, Fig. 3. The company expects to exploit 10 Tcf potential from its leases over a 10-year development span.

|

|

Fig. 3. Quicksilver Resources has found significant mobile oil saturations in analysis of core samples from its recent wells.

|

|

Nexen holds 88,000 acres in what it considers the core Dilly Creek region of the Horn River Basin with IP rates of 2.1 MMcfd with just two frac stages. It is in the midst of an eight-pad well program of which five are producing about 15 MMcfd. When the eight wells are completed in early 2011, the production is expected to reach 50 MMcfd. Next, Nexen will use an 18-well pad with 1,800-m laterals and 18 fracs per well to support the 100-MMcfd capacity of its gas processing facility. The company expects to drill 500–700 wells on its leases with the expectation of 3–6 Tcf of contingent recoverable resources.

ConocoPhillips added 22,400 acres in the Horn River area during 2009. Combined with previously held land, the company holds in excess of 100,000 acres in the play.

Petrobakken holds 75,000 acres in the Horn River Basin. The company expects prospective zones in these leases to contain between 30 and 300 Bcf of OGIP per section, providing a total resource potential of 2.5 to 25 Tcf of OGIP with recoveries expected to range between 20% and 30%.

MERGERS AND ACQUISITIONS

International oil companies have cast their eyes on the Horn River Shale and have sought entry through a variety of joint ventures with independent operators that have served as pioneers in the frontier region. ExxonMobil has provided 50/50 funding for leasing activity of its Imperial Oil division. The IOC is planning to apply knowledge learned in the Horn River and Barnett Shale plays to develop its extensive properties in Eastern Europe. The second leading joint venture in the Horn River is being run by EnCana and Apache. The leading independents are operating multi-well pads and are learning from each other’s successes.

Three oil companies from the Eastern Hemisphere are gaining entry in the Horn River: China’s CNPC, Korea Gas (Kogas), and India’s Reliance Industries. In June, CNPC and EnCana announced plans to jointly develop unconventional gas resources in the Horn River and Montney prospects. EnCana spokesman Alan Boras expects the joint venture to generate as much as $2 billion to accelerate field development.

In a similar arrangement, Kogas pledged $1.1 billion over the next five years to develop Horn River, Montney and Cutbank Ridge properties with EnCana. Kogas will invest C$164 million from 2010 to 2013 to earn a 50% interest in the acreage. In June 2009, Kogas had committed $20 billion to the Kitimat LNG terminal. Kogas will acquire about 40% of Kitimat LNG’s production for 20 years with an option to acquire an equity stake in the terminal. In July, Reuters reported that India’s Reliance Industries was in talks with Quicksilver Resources concerning a possible buyout or a joint venture agreement.

ROYALTY INCENTIVES

Realizing the reluctance of operators to invest in a frontier shale play, British Columbia offers lucrative royalty schemes to secure a competitive edge over the relatively more mature US shale plays. These include net profit royalty (NPR) schemes with a 2% gross revenue royalty until capex plus 30% is recovered, 20% net revenue royalty until capex plus 105% is recovered and 35% net revenue royalty thereafter. The provincial government also offers monetary incentives to build roads and other facilities that could be used by the local communities as well.

COLLABORATIVE DEVELOPMENT

In 2007, a group of 11 operators formed the Horn River Shale Gas Producers Group to work with the local community and government agencies. “Our primary objective is to ensure rational development of the basin and not have pipelines and facilities everywhere,” explained Kevin Screen of Apache, who is co-chair of the Producers Group Operations Committee. “We are cooperating on infrastructure and building joint pipelines, roads and facilities where possible.”

One of the roads developed jointly is the Coles Lake Road located at the 112-km point of the Liard Highway. This 16-km all-season road was built by Stone Mountain Resources for access to wells drilled in 2008 and 2009. EOG and Quicksilver helped fund construction of the road, and both companies use the road to access their own projects. All three companies will maintain the road in the future. In addition, several companies cooperated on pipeline construction in the northwestern Horn River area. Stone Mountain constructed a 12-in., 24-km pipeline that transports gas to the Maxhamish leg of the Spectra Energy facilities. Quicksilver tied in its initial exploratory wells to this pipeline to avoid constructing a new system.

Another project that began in 2009 is a wildlife sighting program. Field staff working throughout the development area are given cards listing local species and asked to check off the ones they see. The Horn River area is home to many animals including deer, moose, caribou, elk and bears. Data from the project is tracked by the producers and submitted to the British Columbia provincial government.

DRILLING ACTIVITY

Prior to shale gas exploration, drilling for deep Mississippian and Devonian conventional carbonate reservoirs began in the late 1950s, with about 300 wells drilled in the area. Horizontal drilling activity took place on the eastern edge and southeastern flank of the Horn River Basin. These wells targeted the carbonate plays of the Mississippian Debolt to the Middle Devonian Keg River/Pine Point. Drilling activity began its upward movement in 2007 and is continuing to escalate, Fig. 4. A majority of the wells drilled are horizontal. During the first quarter of 2010, a total of 41 wells were drilled, including 19 horizontal wells. A total of 80–100 wells are expected to be drilled by year-end.

|

|

Fig. 4. Horn River drilling activity has surged since 2007. In the first quarter of 2010, operators drilled a total of 41 wells.

|

|

Shale gas operators are now at different stages of development, Fig. 5. Some operators, such as Imperial Oil, Quicksilver, Suncor, Pengrowth and ConocoPhillips, are drilling test wells as part of an exploratory program, while EnCana, Apache, Nexen, Devon, EOG and Stone Mountain are planning multi-well drilling programs with practical production objectives.

|

|

Fig. 5. Drilling activity has been split between experimental and production-type wells, with EnCana and Apache leading the pack.

|

|

Short drilling season. The topography of the area consists of low-lying swamps that cannot be accessed during the summer months. Much of exploration and development work has been on winter roads when the muskeg is frozen and there is frost on the ground. On the other hand, winter temperatures of −40˚F complicate slickwater fracturing operations.

Multi-well pad drilling. To reduce the environmental footprint and costs, the wells are drilled in batches from multi-well pads. Completion operations begin once drilling operations from a single pad are complete, thus allowing room for the extensive fracturing equipment to service the entire pad and achieving cost efficiencies.

COMPLETION OPERATIONS

Due to multi-well pad drilling and completions, hydraulic fracturing operations can be massive. Each lateral can have 14 or more fracture stages. A typical fracturing job can involve a field team of 280 workers and an extensive fleet of pressure pumpers, wireline trucks, cranes and coiled tubing service rigs. On a recent fracturing project, Apache and Sanjel took 111 days to complete three fracture jobs per day. The completions team performed 274 fracs on a 16-well pad, using 50,000 tons of sand and 6.2 million bbl of water. In 2011, Apache expects to complete two more pads with 25–28 wells and bring an additional 42–45 wells on production.

Petrophysical evaluation. Careful analysis of the formation is critical for efficient fracturing operations. Since the Horn River play consists of three members, it is important to note that the fracture behavior and production of each member is different.

“A well’s deliverability is dependent on which facies is being targeted,” explains Keri Yule, senior petrophysicist with BJ Services, now a Baker Hughes company, Fig. 6. “It’s important we don’t group them all together. The members’ thickness varies with geography, which is why cores and careful log analysis are critical to achieving good stimulation designs and results.”

|

|

Fig. 6. BJ Services is conducting slickwater fracs in the Horn River with an Arctic twist: friction reducers that hydrate quickly in cold (about 5°C) water.

|

|

Simultaneous operations. On a recent completion project, Schlumberger worked closely with the operator’s completion team on a 103-stage program that averaged more than three hydraulic fracturing jobs per day over the last two-thirds of the campaign. Wireline pumpdown plug setting and perforating using streamline cable took place on one well, while at the same time the well services team fraced another well and used the company’s StimMAP Live service to monitor acoustic data in real time to optimize the frac during pumping. Once the frac job was done, the crews then switched over to the previously perforated well and conducted the next frac while the wireline team worked on perforating the next stage on another well. This synergy between services allowed for safe and efficient operations.

Fracture monitoring. Baker Hughes and VSFusion recently completed one of the largest microseismic hydraulic fracture monitoring surveys for Apache. Geophone strings were deployed simultaneously in two observation wells for over 30 days. Microseismic events were recorded for hydraulic stimulations in 13 wellbores adjacent to the observation wells. More than 75 separate hydraulic stimulations were recorded. The project used a variety of deployment geometries in both the horizontal and near-vertical sections of the observation wells to optimize hydraulic fracture imaging in the reservoir. Operations were conducted 24 hours a day, and VSFusion provided real-time display of recorded microseismic events, both on the wellsite and in Apache’s offices in Calgary and Houston. Monitoring and analysis of microseismic information during operations provided the completion team with the ability to optimize the hydraulic stimulation by modifying the fracture stage design while pumping into the formation. At one point, the data showed an absence of growing microseismic activity, alerting Apache to switch from pumping proppant to flushing the well with water to avoid a potentially costly sanding-off of the fractures.

Multidisciplinary completion services. Weatherford’s completion services in the Horn River range from detailed fracturing studies to openhole wireline logging, geomechanical wellbore stability analysis and microseismic fracture monitoring. The company has completed the most pump-down stages in the area as well as completing frac flowbacks and drilling out bridge plugs on coiled tubing.

WATER USAGE

The British Columbia Oil and Gas Commission administers water usage from source to injection and disposal wells. Operators must report water withdrawals, injections or disposals into associated wells on a monthly basis. The commission does not allow surface discharge of produced or fracture flowback water. Produced water is often reinjected into the oil and gas formation to maintain reservoir pressure. The remaining water is either recycled or disposed of by injection into deep subsurface formations, Fig. 7. The depth of potable water wells for domestic consumption in northeastern British Columbia is between 18 and 150 m, far above the depth of a typical oil and gas producing zone of 800 to 3,200 m.

|

|

Fig. 7. There is significant separation between the aquifer for domestic water wells and the producing gas and water injection formations.

|

|

Since the Horn River wells require up to 33,000 bbl of water per frac, the Horn River Shale Gas Producer’s Group, in partnership with the British Columbia provincial energy ministry and an industry-led group called Geoscience BC, has funded an aquifer characterization project to locate deep subsurface aquifers to serve as sources and sinks so as to avoid the use of surface water sources and surface disposal of produced water. The project has identified three subsurface units with aquifer potential: a Mississippian carbonate platform, the Mattson Formation and Cretaceous sandstones. The waters are saline, but suitable for fracturing operations.

TRANSPORTATION AND MARKETS

Previous conventional exploration and production operations in the Horn River play have provided a few basic pipeline networks and gas processing facilities. Operators and pipeline companies are now active in expanding these networks and increasing capacity to support rising production.

Pipeline and gas processing activity. EnCana is investing $400 million to expand the capacity of its Cabin gas plant to enable processing of 400 MMcfd. In addition, TransCanada has committed $340 million to build a pipeline to Edmonton, Alberta. This is a 96.3-mi, 36-in./24-in. pipeline that extends the Alberta system into the Horn River Basin. The project consists of constructing 44.7 mi of 36-in. pipeline and related facilities, as well as the purchase of the existing 24-in. Ekwan Pipeline from EnCana. The project has an anticipated in-service date of 2012. To date, shippers have signed initial contracts of 503 MMcfd with expected future potential reaching 1.6 Bcfd.

Kitimat LNG terminal. The most ambitious gas transportation plan is to build an LNG terminal that will convert Horn River gas into LNG for shipment to markets in South Korea, Japan and China. Located at Bish Cove near the Port of Kitimat about 405 mi north of Vancouver, the terminal has planned capacity of about 700 MMcf of gas, equivilant to 5 million metric tons of LNG per year. Kitimat LNG received its provincial environmental certificate for the liquefaction terminal in December 2008 and its federal environmental certificate in January 2009. In January 2010, Apache Canada agreed to acquire 51% of the export terminal, and it has also reserved 51% of capacity in the terminal. In May, EOG Resources acquired the terminal’s remaining 49% capacity.

BETTING ON THE FUTURE

Apache and EOG have placed major financial stakes in the future of the Horn River Shale play with their joint ownership of the Kitimat LNG terminal. Additionally, the engagement of majors, such as ExxonMobil and ConocoPhillips, as operators and the investments of China’s CNPC and Korea’s Kogas as joint venture partners suggest that the Horn River is indeed a shale play that will have a decisive impact on North America’s energy sector in the coming years and decades.

|