Evaluations were performed to find the most cost-efficient well configuration.

Ross Schweitzer* and H. Ilkin Bilgesu, West Virginia University

Information on well and completion designs for the Marcellus Shale is rather vague and kept close to the chest by operators. This information plays a key role in the production of these shale wells and can determine whether or not they are economical.

In this study, simulations have been conducted with several wellbore configurations for gas production from the Marcellus Shale. Parameters included lateral wellbore length, propped half-length and the number of fracture stages. Economic evaluations were performed to determine the most cost-efficient configuration. The average present-day completion costs and projected sale price of gas were used in the calculation process.

BACKGROUND

According to estimates generated by Deutsche Bank, the range of internal rate of return (IRR) for the Marcellus Shale is 72–100%.1 IRR is a capital budgeting metric used by firms to decide whether they should make investments. It is an indicator of the efficiency or quality of an investment, as opposed to net present value (NPV), which indicates value or magnitude. The IRR is greater for the Marcellus than for other US shales, they concluded, because of premium natural gas pricing due to location and relatively low royalties in Appalachia. In addition, the Marcellus is estimated to have the lowest break-even price ($3.17) when compared to the Haynesville, Barnett, Fayetteville and Woodford Shales. The next-closest break-even price was $4.73 in the Haynesville. These break-even prices come from the NYMEX natural gas prices required to drive the individual plays’ returns down to a 10% weighted average cost of capital. Notably, this study states that the five plays analyzed represent the “best of breed” among US shale plays, and one would not expect most other shale and tight gas plays to compare to these strong metrics.

Woodford, Fayetteville and Haynesville gas production is currently increasing greatly while the Marcellus Shale is not predicted to really take off until about 2010.1 The slower transition in the Marcellus is due to the difficult terrain, uncertain regulatory environment and lack of infrastructure and proper equipment.2

The problem with typical Marcellus Shale wells is the lack of gathered information and information that is commercially available to the public. The Marcellus Formation is a relatively new play; details involving ways to maximize production through well and fracture design have yet to be published.

As often happens, different companies have different ideas about the best way to produce the Marcellus Shale. The best method to drill in the Marcellus is the primary question. Maybe the Marcellus requires vertical wells or maybe horizontal wells; it could possibly require a combination of both. Maybe some areas will be better suited for verticals due to geology. Either way, these shale wells need stimulation to increase the permeability. The pore spaces in shales are typically not large enough for even tiny methane molecules to flow through easily. Shales may contain natural fractures due to stress from overlying rocks. Shale gas has long been produced when natural fractures are present. In recent years, however, there has been more development of gas shales due to the use of hydraulic fracturing techniques.

Where shale formations are naturally fractured, they are made up of two distinct porous media—a shale matrix and a fracture network. Gas can be stored in the molecular-size micropore space of the shale; it can also be absorbed on the surface of the shale, or it may be dissolved in the organic content of the shale. The shale matrix contains most of the gas stored in the reservoir, but possesses a low permeability. The fracture network has a high permeability, but a low storage capacity. It is believed that natural gas is stored in the Devonian shales as both conventional “free” gas and as adsorbed gas (gas that is physically attached to the surface of the shales by Van der Waals-type forces).3 These natural fractures and adsorbed gas have to be accounted for in the reservoir modeling.

APPROACH

The study was conducted using a reservoir modeling software package to investigate the gas production from the Marcellus Shale. The objective was to compare and contrast the gas production in vertical and horizontal wells with varying fracture half-lengths and horizontal lateral lengths. The reservoir modeling and simulation were conducted using Marcellus Shale properties to calculate gas production rates to determine economic feasibility. Prior to runs with Marcellus Shale properties, a Barnett Shale well was modeled using the same software and the results were compared to field production data, to validate the model setup. Once all of the production data was simulated, an economic analysis was conducted to determine the optimal designs for the parameters studied.

A cash flow model was constructed for all of the simulated runs. Once the cash flow charts were constructed, NPVs were calculated along with IRRs. These two values were used to analyze the economic feasibility of the design parameters considered. All equations used in the economic analysis were based on published theory.4,5 The main parameters needed were capital and operating expenses, interest rate and gas price.

The capital expenses used in the economic analysis for drilling horizontal wells of varying lateral lengths and a vertical well, along with the costs of fracture treatment per stage depending on the fracture half-length employed, are shown in Table 1. All cost values used are general averages based on personal communications with operators.

| TABLE 1. Drilling and completion costs |

|

Operating costs were assumed to remain constant at $30/day per well. A fixed interest rate of 15% is used throughout the economic study. A constant gas price of $3/Mcf was also used in this study, followed by a constant price of $6/Mcf. This may have been a very conservative number for gas price, but the gas price at the time of the study was $3.33/Mcf. Thus, the $6 cost was used to analyze the difference between the two values (based on the futures gas price at the time). While the price of gas is projected to increase at some point in the next 10 years, a conservative economic analysis is used to prevent overestimation of costs for the project. In addition, a 12.5% royalty tax was taken out of the total gas revenue. For all cases, the same parameters were used and the economic results were calculated for the first 10 years of the well’s life.

DISCUSSION OF RESULTS

The results of the economic analysis for all $3/Mcf wells showed 18 of the 74 cases studied to be economic designs. The final results showed that no single-fracture-treated horizontal or vertical wells were economic. Only the 1,000-ft fracture half-length with three fracture stages was economic regardless of lateral length or spacing. The same was true with five fracture stages, except that, in those cases, 750-ft and 1,000-ft half-lengths were economic regardless of lateral length and spacing. As for seven and nine fractures, 500-, 750- and 1,000-ft half-lengths were economic regardless of lateral lengths. Wells with larger numbers of fracture stages had higher IRRs. In addition, well designs with the same number of fracture stages had higher IRRs with longer fracture half-lengths; yet, when the different lateral lengths were considered, the shorter lateral lengths actually had higher IRRs with the same number of fracture stages.

The results for all $6/Mcf cases differ quite a bit from the $3 gas pricing results. Due to the price change, 24 more of the original well and fracture designs became economical. Now vertical wells become economical with 750- and 1,000-ft fracture half-lengths regardless of the number of stages. Also, three- and five-stage fracture treatments now become economical in all fracture half-lengths except 250 ft. Once again, the well designs with larger numbers of fracture stages had higher IRRs. Also, for well designs with the same number of fractures, higher IRRs were found with longer fracture half-lengths. Yet, when analyzing the different lateral lengths, the shorter lateral lengths actually had higher IRRs.

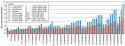

Figure 1 shows the economic evaluation of the NPV values. From left to right, the number of fracture treatments increases, and for each number of fracture treatments, the half-length increases from left to right. It can easily be seen that the larger the number of fracture stages and the greater the fracture half-length, the larger the profit and the more economical the well. The red bars indicate wells studied at the $3/Mcf gas price, and the blue bars indicate $6/Mcf. This figure shows the large difference in the NPV values for the two gas prices.

The results are shown in Table 2 for wells with seven fracture stages. As discussed earlier, for wells with seven fractures, the only economical results were with half-lengths of either 500, 750 or 1,000 ft regardless of length of the wellbore for $3 gas pricing. All of the wells with seven fracture treatments were economical at $6/Mcf. As seen in Fig. 1, as the number of fractures and half-length increase, the IRR and NPV values increase as well. As for the difference in lateral lengths, it is very small, but it actually doesn’t pay to drill the extra 1,000 ft of wellbore if you are not going to add additional fracture stages. This actually made the shorter wellbores more cost-efficient over the time period studied.

| TABLE 2. Seven-fracture economics for $3 and $6 per Mcf gas pricing |

|

|

|

Fig. 1. Comparison of NPV for $3/Mcf and $6/Mcf gas prices for seven-fracture well designs studied.

|

|

CONCLUSIONS

Horizontal wells were found to be more economic when compared to vertical wells. Vertical wells were found to be economic in the higher gas pricing scenario. In general, the optimal designs had a fractured half-length of 1,000 ft and the maximum number of fracture stages (nine in this study). As far as the lateral length was concerned, it was not cost-efficient to drill longer laterals if the number of fracture stages was not going to be increased, but it was cost-efficient if more fracture stages were added.

As expected, much higher IRRs were found with the higher gas pricing. Higher gas prices allow more exploration in vertical wells or smaller-scale horizontal wells due to the lower initial cost. There was no direct trend, but some IRRs and NPVs increased dramatically due to the gas price change. Ultimately, in the Marcellus Shale, the more money spent up front with larger fracture jobs, the more economic the results appear to be.

* Mr. Schweitzer now works for Devon.

ACKNOWLEDGMENT

This article was prepared from SPE 125975 presented at the SPE Eastern Regional Meeting held in Charleston, WV, Sept. 23–25, 2009.

LITERATURE CITED

1 Nome, S., “From shale to shining shale: A primer on North American natural gas shale plays,” Deutsche Bank, Red Orbit News, July 7, 2008.

2 Perkins, C. K., “Logistics of Marcellus Shale stimulation: Changing the face of completions in Appalachia,” SPE 117754-MS presented at the SPE Eastern Regional/AAPG Eastern Section Joint Meeting, Pittsburgh, Pa., Oct. 11–15, 2008.

3 Lane, H. S., Lancaster, D. E., Holditch, S. A. and A. T. Watson “Estimating gas desorption parameters from Devonian shale well test data,” SPE 21272 presented at the SPE Eastern Regional Meeting, Columbus, Ohio, Oct. 31–Nov. 2, 1990.

4 Newman, D. G., Engineering Economic Analysis, 3rd Ed., Engineering Press Inc., 1988.

5 Ikoku, C. U., Economic Analysis and Investment Decisions, John Wiley & Sons, 1985.

|

THE AUTHORS

|

|

Ross Schweitzer is a Drilling Engineer for Devon Energy working in the Barnett Shale near Oklahoma City. He previously worked as an intern with Range Resources. Mr. Schweitzer holds a BS degree in civil and environmental engineering and an MS degree in petroleum engineering from West Virginia University.

|

|

|

H. Ilkin Bilgesu is an Associate Professor of petroleum and natural gas engineering at West Virginia University. Previously, he worked for the Turkish Petroleum Corp. and taught at the South Dakota School of Mines and Technology. Dr. Bilgesu holds a BS degree in petroleum engineering from Middle East Technical University, an MS degree in chemical and petroleum refining engineering from the Colorado School of Mines, and a PhD degree in petroleum engineering from Pennsylvania State University.

|

|