Shale E&P activity continues to grow through strategic joint ventures designed to reduce risk and improve pipeline takeaway.

Pramod Kulkarni, Editor

Exploration and production activity in the Haynesville Shale play continues to grow at a sustained pace without the severe bust-and-recovery cycle that has characterized overall North American drilling since 2008. If estimates of technically recoverable reserves of 251 Tcf are realized, the unconventional gas play could become the largest gas resource in the US and the fourth largest in the world. Successes achieved by small US independents have attracted IOCs and pipeline and gathering entities to infuse cash and take ownership positions. Even the independents have formed joint ventures (Fig. 1), in the manner of large offshore developments, to reduce risk and bring in massive investments needed to acquire acreage, sustain drilling and production programs and build gas processing and pipeline segments to take the gas to market. A few operators have deferred drilling in some Haynesville acreage where meeting an internal rate of return of at least 20% is difficult under the current $4/Mcf gas price and well construction costs in the range of $7–10 million.

|

|

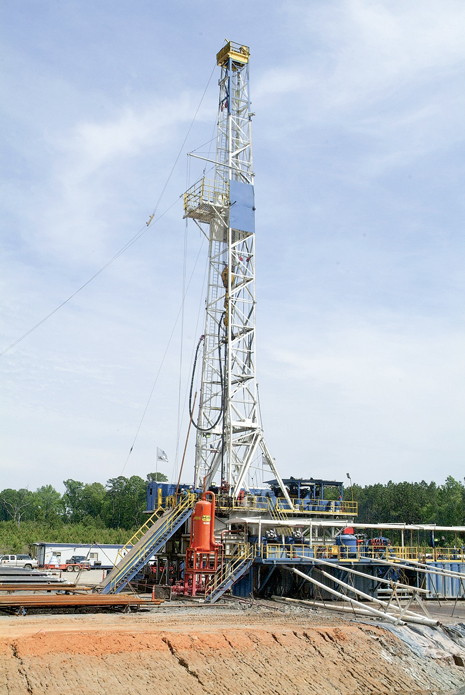

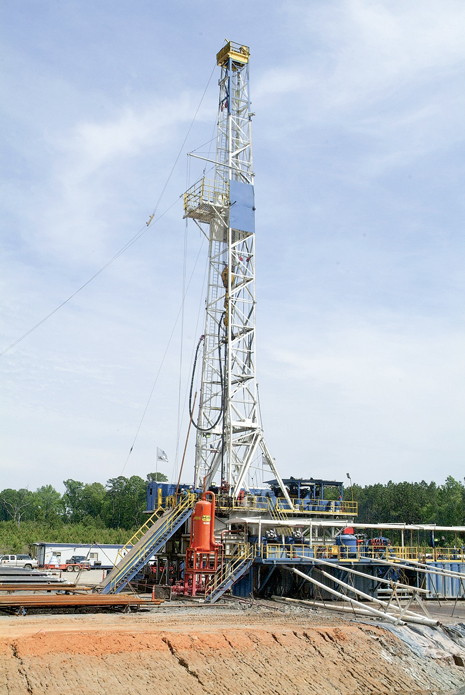

Fig. 1. The Griffith 1-H well, operated by Petrohawk and Mainland Resources, had an initial production (IP) rate of 23 MMcfd. Photo courtesy of Mainland Resources.

|

|

GEOLOGICAL SETTING

The Haynesville Shale play covers a surface area of about 9,000 mi2 across northeastern Louisiana, East Texas and southern Arkansas, Fig. 2. The most productive wells are located in Caddo, Bienville, Bossier, De Soto, Red River and Webster Parishes of Louisiana plus adjacent counties in southwest Arkansas and East Texas. The shale play is 150 ft to 400 ft thick at an approximate depth of 10,500 ft to 13,500 ft. The formation is black, organically rich shale with total organic content (TOC) in the range of 3–5%. About 80% of the gas is in the form of free gas, and 20% is adsorbed gas. The Haynesville was laid during the Upper Jurassic period below the Cotton Valley sandstones and above the Smackover limestone. It is at greater depth and higher pressure than the other US shale plays. The high pressure was created 150 million years ago when the organic matter in the shale broke down into gas, but remained trapped in the source rock because of impenetrable surrounding rock layers. As a result, Haynesville wells have very high initial production (IP) rates ranging from 10 to 20 MMcfd, with one well having a reported IP of over 30 MMcfd. A complementary shale formation, the Bossier, is located 200–400 ft above the Haynesville in portions of Louisiana and East Texas. Several operators are drilling for both Haynesville and Bossier targets simultaneously from one drilling pad.

|

|

Fig. 2. The Haynesville Shale play is located primarily in northeastern Louisiana and extends to East Texas and southeastern Arkansas.

|

|

LEASING ACTIVITY

In 2007, when the Haynesville had not made headlines, early operators, such as Mainland Resources, were able to acquire Haynesville leases at the rate of $200/acre before the high production rates were announced to the financial community. By mid-2008, lease costs had gone up as much as $25,000/acre with 25–30% royalty. Interestingly, many of the leases have stacked gas pays that can produce from several zones—Haynesville, Bossier and Cotton Valley. The properties are bought and sold with specific production rights for each of the zones.

OPERATOR ACTIVITY

Chesapeake is the largest leasehold owner in the Haynesville play with 530,000 net acres and total proved reserves of 351 Bcfe. In May 2010, Chesapeake’s production was 510 MMcfed, and the company anticipates exceeding 640 MMcfed by year-end 2010 and 810 MMcfed by year-end 2011. The company drilled its first well in the region in 2007 and is planning to drill 170 net wells in 2010 through a 35-rig program. Its peak production rates have been in the range of 23.7 MMcfed to 18.9 MMcfd. Three recent wells completed by Chesapeake in the Haynesville are the Sloan 4-12-13 H-1 in De Soto Parish, which achieved a peak 24-hour rate of 23.4 MMcfd; Johnson 21-13-13 H-1 in De Soto Parish, which achieved a peak 24-hour rate of 18.5 MMcfd; and Caspiana 14-15-12H-1 in Caddo Parish, which achieved a peak 24-hour rate of 18.4 MMcfd.

Encana acquired its first leases in the Haynesville play in 2005, drilled its first three vertical wells in 2006, and has been continually acquiring land. In 2007, Encana signed a 50/50 joint exploration agreement with Shell Exploration & Production. It holds 429,000 net acres, has about 0.5 Tcf of proved reserves in the play and produced 71 MMcfed in 2009 due to a production curtailment program, but plans to increase production to 325 MMcfd in 2010. In 2010, Encana is planning to spend 28% of its total $4.4 billion upstream capital budget in the Haynesville and plans to utilize 20–25 of its own rigs and seven to 10 rigs from Shell.

Petrohawk holds about 368,000 net acres in the Haynesville Shale at an average cost of $5,000 per acre. It also holds 122,000 net acres in the Lower Bossier Shale play. In the Haynesville, the company expects proved reserves of 15.4 Tcfe with an estimated EUR of 7.5 Bcfe and is currently producing 500 MMcfed. Based on increased drilling efficiency, Petrohawk reduced its 2010 drilling budget by $50 million to $850 million. With this budget, Petrohawk is operating a 15-rig program and plans to drill 110 wells in 2010 at an estimated cost of $8.5–9 million per well. Its EUR per well is 7.5 Bcfe. For three of these wells, Petrohawk has a 60/40 partnership with Mainland Resources.

Exco has 163,000 net acres in the Haynesville with proved reserves of 0.8 Tcfe and production of 209 MMcfed from 102 wells. The company expects to spend $482 million in 2010 to drill 102 wells. Its first 36 wells in De Soto Parish have averaged IP rates of 23 MMcfd. The company expects to produce 795 MMcfd by December 2010. Exco plans to drill seven wells to test the Bossier Shale in De Soto Parish. To support pipeline takeaway, Exco has completed a 36-in., 29-mi header system with throughput of 1.5 Bcfd and is constructing treating capacity of 1 Bcfd.

EOG Resources holds 160,000 acres in the Haynesville/Bossier area with proved reserves of 3.8 Tcf. The company’s production from its own Haynesville acreage is 68.4 MMcfd with 29.7 MMcfd from the Bossier. EOG plans to conduct intensive drilling activity during 2010–2012 because of expected lease expirations.

Plains Exploration & Production (PXP) has 111,000 net acres in the Haynesville and operates 51 rigs, 38 in partnership with Chesapeake. Its current production is 70 MMcfed. Its stated cost per well is $7.5 million, and EUR per well is 6.6 Bcfe.

XTO holds about 100,000 net acres and was producing 45 MMcfd from its Haynesville properties in September 2009 with a projected increase in 2010 to 60–70 MMcfd. The company has six rigs drilling in the region.

Marathon has 25,000 net acres in the Haynesville. The company drilled only one well in 2009 with an IP rate of 15 MMcfd and plans to drill three to four wells in 2010.

MERGERS & ACQUISITIONS

Mergers and acquisitions in the Haynesville describe the emergence of a new field through the bold efforts of small independents and the entry of larger independents, multinationals and even midstream companies to bring in the financial inflow needed to extend E&P activity and build processing and gathering infrastructure.

Chesapeake-PXP JV. In 2008, Chesapeake created an 80/20 partnership with PXP for $2.3 billion. During 2009, PXP paid about $390 million of Chesapeake’s drilling costs in the Haynesville. In August 2009, Chesapeake and PXP amended their joint venture agreement to accelerate the payment of PXP’s remaining joint venture drilling carries as of Sept. 30, 2009, in exchange for an approximate 12% reduction in the total amount of drilling carry obligations due to Chesapeake. As a result, Chesapeake received $1.1 billion in cash from PXP, and beginning in the 2009 fourth quarter, Chesapeake and PXP each began paying their proportionate working interest costs on drilling. Chesapeake’s leasehold investment in the Haynesville has been about $5.3 billion, of which about $2.8 billion, or 52%, has been recouped by selling a 20% interest in the company’s leasehold to PXP.

Goodrich-Chesapeake JV. In 2008, Chesapeake also entered into a joint venture with Goodrich Petroleum to develop Goodrich’s Haynesville Shale acreage in Bethany-Longstreet and Longwood Fields of Caddo and De Soto Parishes. Chesapeake paid Goodrich $178 million for 10,250 net acres for a 20% working interest in about 25,000 net acres in Bethany-Longstreet Field and a 50% working interest in about 10,500 net acres in Longwood Field. Chesapeake has also agreed to purchase 7,500 net acres of deep rights in Bethany-Longstreet Field from a third party, bringing the ownership interest in the deep rights in both fields after closing to 50% each for Goodrich and Chesapeake.

Exxon acquires XTO. In December 2009, ExxonMobil announced its acquisition of XTO Energy in a $41 billion all-stock transaction. The acquisition brings the world’s largest oil company into the Hayneville play. Besides contributing to the further development of the shale play, the transaction provides the multinational access to shale technology and best practices to explore and develop shale plays in the international sector.

April 2010 was a particularly busy time period for mergers and acquisitions in the Haynesville Shale play.

Exco, BG acquire Common Resources. Exco announced its acquisition of Common Resources jointly with the multinational BG Group for $446 million. The assets include producing properties with more than 12 MMcfd of production from seven producing wells and about 29,200 net acres prospective for the Haynesville and Bossier Shales.

Petrohawk-Kinder Morgan. Petrohawk sold a 50% interest in its natural gas gathering and treating business to Kinder Morgan for $875 million in cash. Petrohawk’s assets consist of more than 170 miles of pipeline currently in service, which are expected to increase to about 375 miles of pipeline with projected throughput of over 800 MMcfd by year-end 2010. Additionally, the system’s amine treating plants will have a projected capacity of about 2,635 gal/min. by year end. After a short transition period, a new company, KinderHawk, owned 50/50 by Petrohawk and Kinder Morgan, will assume operations. The joint venture ultimately is expected to have about 2 Bcfd of mainline throughput capacity.

Regency increases Haynesville share. Regency Energy Partners acquired approximately 7.0% of Chesapeake’s Haynesville joint venture from an affiliate of GE Energy Financial Services for approximately $92 million. Regency’s total ownership interest in the joint venture is now about 49.99%.

Mainland-Exco. Mainland Resources sold its Haynesville Shale assets to Exco for $28 million. Mainland continues to hold a 100% interest in the Cotton Valley, Hosston and Upper Bossier zones. The company intends to use the proceeds of the sale to fund the drilling of an initial well in Mississippi to test prospective Bossier/Haynesville formations as well as commence development drilling on the Hosston and Cotton Valley Formations in East Holly Field, and to retire its debt to Guggenheim Partners. According to available well logs, the Bossier/Haynesville Shale is over 2,500 ft thick with pressure exceeding 20,000 psi. A Chevron well in the area was still in the Bossier/Haynesville Shale when drilling operations were discontinued due to high pressures. The density neutron log from the previous drilling shows good average porosity from 12% to 15%.

SEISMIC

In May 2009, Dawson Geophysical conducted a 70-mi2 3D/3C seismic survey for BP using Ion Geophysical’s FireFly wireless data acquisition system. The Haynesville Shale was the primary target, with the Cotton Valley and Smackover as secondary targets. BP geophysicists are evaluating the data to develop appropriate drilling and production strategies.

Two multiclient seismic surveys are currently underway in the Haynesville with the intention of helping operators place their horizontal laterals in organically rich sweet spots within the shale. CGG Veritas began acquiring its Tri-Parish Line 3D multiclient survey in July 2009, Fig. 3. The 677-mi2 wide-azimuth survey is being acquired using two separate 7,000-channel crews. The configuration of the wide-azimuth survey is designed to enhance fracture detection and analysis. In addition, Global Geophysical is acquiring its multiclient Elm Grove 3D survey of approximately 762 mi2 in northwest Louisiana.

|

|

Fig. 3. CGG Veritas is acquiring its Tri-Parish Line 3D seismic survey in the Haynesville.

|

|

DRILLING

Drilling activity in East Texas and northeastern Louisiana in previous decades has focused on shallower Cotton Valley targets through vertical wells. As such, Haynesville Shale operators can depend on existing oil and gas infrastructure. However, since Haynesville drilling requires depths of 10,000 ft and more, horizontal laterals in the range of 3,000–5,000 ft, and high-pressure and high-temperature (HPHT) downhole conditions, the operators have had to upgrade their drilling rig fleet to a new generation of heavy-duty units.

The Haynesville rig count has climbed steadily despite the downturn. Encana first drilled the Haynesville Formation in 2005, but the play gained prominence when Chesapeake announced results of high initial production rates in 2008. Figure 4 shows the number and type of wells running in the shale portion of northern Louisiana. The rig count in the Haynesville play, including Louisiana, Texas and Arkansas, was at 179 in May. Chesapeake was the leading operator with 32 rigs, followed by Petrohawk (16), Exco (14), EOG (13) and XTO (12). Through 2010, operators such as Petrohawk have reduced time to drill Haynesville wells from about 70 days to about 45.

|

|

Fig. 4. Drilling and production activity in the Louisiana portion of the Haynesville Shale shows steady growth during 2009–2010. Courtesy of the Louisiana Department of Natural Resources.

|

|

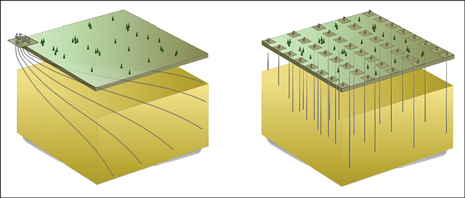

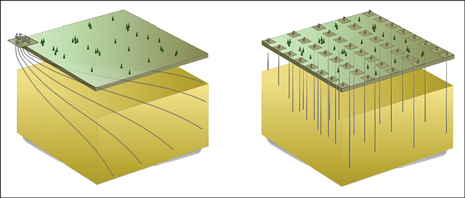

Pad drilling. In the new low-gas-price environment, operators such as Encana are using pad drilling and introducing manufacturing processes to build “gas factories” with the view of reducing costs, Fig. 5. Since 2008, Encana’s drilling, completion and takeaway costs per well have dropped from $15.6 million to about $9 million. Exco is also investigating pad drilling and tighter spacing to improve recovery and reduce costs.

|

|

Fig. 5. Six pad drilled wells (left) replace 48 conventionally drilled vertical wells. Courtesy of Encana.

|

|

Improving drilling economics. Camterra Resources, with services provided by Schlumberger Drilling & Measurements, Schlumberger K&M Technologies and Huffman Petroleum Engineering Services, has progressively improved the economics of drilling in the Haynesville Shale since 2008. To date, eight wells have been successfully completed, with services being provided in the curve and lateral. Schlumberger has been providing MWD/LWD, directional services and drilling optimization services to Camterra since 2008. Camterra and Schlumberger have been consistently decreasing the number of days to TD for their Haynesville wells. The most recent success was the Audubon 27-2 well. Schlumberger used only one BHA to drill the entire curve and lateral in the 6¾-in. hole. The drilling interval was 4,979 ft and took 106.3 drilling hours, resulting in 46.8 ft/hr average ROP with only eight days on location. The progressive improvement was achieved through the deployment of appropriate drilling technology, followed by changes to take advantage of lessons learned, Fig. 6.

|

|

Fig. 6. Progressive improvement reduced drilling days from as many as 50 to eight.

|

|

FORMATION EVALUATION

In shale plays, formation evaluation is useful for understanding mineralogy and geomechanical properties to identify sweet spots within the shale and to develop effective perforating strategies. A suite of openhole logs (acoustic, nuclear magnetic resonance, density-neutron and mineralogy) can help provide the means for estimating both reservoir quality and geomechanical properties. A Baker Hughes team has developed a mineralogy-based approach using information from such log data to improve the understanding of the fracturing potential of a Haynesville Shale zone in order to optimize a completion.1

COMPLETIONS

Completions in the Haynesville Shale must overcome the challenges of bottomhole temperatures up to 380°F, bottomhole pressure exceeding 12,000 psi and treating pressures up to 15,000 psi. The higher pressures and temperatures require the use of premium casing and high-strength proppants. Wells are typically completed with three sets of casing: 9⅝-in. surface casing, 7-in. intermediate casing to the kickoff point and a cemented 4½-in. production liner across the lateral. Typically, the “plug and perf” method is used to isolate the frac stages.

Hydraulic fracturing. Multistage fracturing of long horizontal laterals is the key to unlocking the gas potential of the Haynesville low-permeability reservoir. GMX Resources and Carbo Resources recently published the results of their fracturing program for two Haynesville Shale wells.2 The completion team established a goal that each frac drain an 80-acre area with a half-length of 600–800 ft and fairway width of 300–400 ft. The team tested several different proppant types and sizes and used microseismic mapping to confirm the frac geometry and drainage efficiency.

Reliable isolation device. Haynesville wells require an isolation device that can be deployed at high speeds yet withstand the high temperatures and pressures. The isolation device then needs to be quickly and cost-effectively removed so the well can be placed onto production. Baker Oil Tools worked with a Haynesville operator to develop its 360 Gen 3.0 Quik Drill ball-type composite frac plug capable of withstanding temperatures up to 350°F and differential pressures up to 10,000 psi. In a recent well, each plug was run on wireline at 185 ft/min. in the horizontal section of the well. Once each plug was set, the zone above was immediately perforated, and the wireline BHA was removed from the wellbore. Fracturing operations then commenced. A total of 11 stages were fracture stimulated. After fracturing operations were completed, all plugs were drilled out in one trip. Drill-out times ranged from 20 to 25 min. per plug, and the cuttings recovered at surface were very small and did not plug any surface equipment. After all plugs were drilled out, the well was put on production. The improved deployment and drill-out performance of this plug helped the operator to improve well economics by reducing completion time and cost by eliminating the need for tubing-deployed isolation devices.

Water usage. Water requirements for fracturing Haynesville wells in multistage treatments are typically among the highest in the shale plays. According to ALL Consulting, a Haynesville Shale well requires 1 million gallons for drilling and 2.7 million gallons for fracturing. In October 2009, Louisiana’s Office of Conservation issued a groundwater use advisory to discourage taking water from the Carrizo-Wilcox reservoir and recommended the Red River alluvial aquifer system, which is continuously recharged by the Red River. Some operators have received permits to pump water directly out of the Red River.

The Office of Conservation is developing rules to allow Haynesville operators limited reuse of exploration and production wastewater resulting from multistage fracturing operations. In an another effort to conserve water resources, International Paper Co.’s Mansfield Mill and Exco are conducting a trial run that repurposes the paper mill’s processed water for use in hydraulic fracturing.

PRODUCTION

Haynesville Shale wells are characterized by a high IP rate with a rapid decline, Fig. 7. Petrohawk estimates a 10-year life for its wells starting with an IP rate of 18 MMcfd and EUR of 7.5 Bcf. Most operators use a 24⁄64-in. choke for producing their wells. Petrohawk introduced a pilot program in 2009 with a narrower 14⁄64-in. choke to achieve higher permeability by stabilizing bottomhole pressure. The results for two wells show more stable and higher cumulative production, Fig. 8. As a result, Petrohawk is planning to restrict all wells to either 14⁄64-in. or 18⁄64-in. chokes except in wells with the highest cumulative production.

|

|

Fig. 7. Haynesville production rate, cumulative production and EUR over a 10-year period. Courtesy of Petrohawk Energy.

|

|

|

|

Fig. 8. Higher and more stable cumulative production through the use of a restricted choke. Courtesy of Petrohawk Energy.

|

|

EVOLUTIONARY GROWTH

Since the first well targeted the Haynesville Shale in 2005, the play has evolved into one of the leading US gas resources. While potential reserve estimates have been hyped to as much as 300 Tcf, high IP rates and the opportunity to simultaneously target Haynesville, Bossier and Cotton Valley zones have attracted the attention of IOCs such as ExxonMobil and BG. Shell and BP are also evaluating potential opportunities. Midstream majors such as Kinder Morgan have taken ownership positions in gas treating and pipeline infrastructure. Operators have optimized drilling and production strategies to achieve a high internal rate of return despite the low-gas-price environment. As such, the Haynesville Shale play will continue to play a leading role in the US natural gas supply chain in decades to come.

LITERATURE CITED

1 LeCompte, B., Franquet, J. A. and D. Jacobi, “Evaluation of Haynesville Shale vertical well completions with a mineralogy based approach to reservoir geomechanics,” SPE 124227 presented at the 2009 SPE Annual Technical Conference and Exhibition (ATCE) held in New Orleans, Oct. 4–7 2009.

2 Pope, C., Peters, B. and T. Benton, “Haynesville Shale—One operator’s approach to well completions in this evolving play,” SPE 125079 presented at the SPE ATCE, New Orleans, Oct. 4–7 2009.

|