SHALE ENERGY: Developing the Barnett—Barnett activity continuing despite environmental tensions

Operators are sustaining gas production and exploring the oil window as EPA conducts a hearing on fracturing and permitting becomes more difficult.

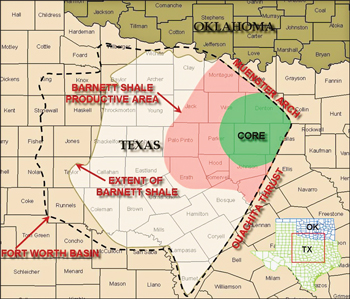

Operators are sustaining gas production and exploring the oil window as EPA conducts a hearing on fracturing and permitting becomes more difficult.Pramod Kulkarni, Editor The Barnett Shale gained the industry spotlight in the 1990s as the first unconventional shale gas play in the US. The strategy of drilling lateral wells and conducting multistage fracturing to release the gas was first tested and refined here through the pioneering efforts of George Mitchell of Mitchell Energy. The success of this strategy has been confirmed by the fact that the Barnett is currently the largest natural gas field in the US and is producing about 40% of total US shale gas output, according to Chesapeake Energy. The core area of the Barnett play is situated in the urban area of the Dallas-Fort Worth metroplex, Fig. 1. According to the Fort Worth Star-Telegram, the city of Fort Worth covers about 6% of the Barnett Shale, and there are more than 1,000 producing wells inside the city limits. Recently, XTO Energy, now a subsidiary of ExxonMobil, made an application to drill within the Dallas city limits. Suburban communities such as Flower Mound, Arlington, Denton and Lewisville are also contending with drilling permit requests from operators and protests from anti-drilling activists.

The Gulf of Mexico oil spill and accidents at a few shale drilling sites have made a difficult situation worse in the Barnett for permitting in the urban areas. Operators are also dealing with complaints about the alleged contamination of drinking water, air pollution and even earthquakes. GEOLOGICAL SETTING Located within the Bend Arch-Fort Worth Basin, the Barnett Shale consists of hydrocarbon-rich shale deposits of Mississippian age above the water-bearing Ellenberger Formation, Fig. 2. The play stretches about 5,000 sq mi below the Dallas-Fort Worth metroplex and 23 counties primarily to the west, Fig. 3.

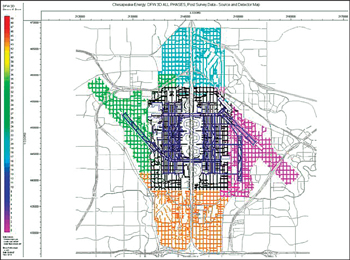

SEISMIC ACTIVITY The Barnett play has been subjected to numerous proprietary 2D and 3D surveys, but there is no currently available multiclient data. Dawson Geophysical has conducted numerous Barnett Shale 3D surveys, including a 2007 survey for Chesapeake Energy across Dallas Fort Worth (DFW) International Airport, Fig. 4. Chesapeake used the seismic data to plan a vertical disposal well as well as several horizontal wells. A natural gas pipeline on the north side of the airport made it convenient to tie well production to the pipeline. Additionally, EOG Resources is in the midst of a 3D survey over its acreage in the oil window in Montague County.

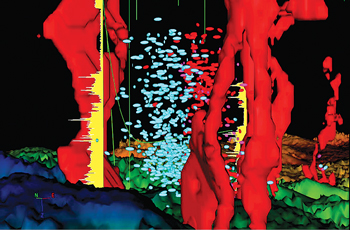

PETROPHYSICAL ANALYSIS Seismic data is useful, along with other formation data, in delineating sweet spots in the shale. It is possible to identify areas of higher total organic content (TOC), greater permeability and porosity, and higher fracture density, and to identify fracture orientation. Calculation of the stress state is useful in identifying the best areas for inducing hydraulic fractures. During well planning and completions, it is important to avoid drilling into the water-bearing Ellenberger Formation and avoid circular “collapse chimneys” of fractured rock that extend thousands of feet from the Ellenberger to the Caddo limestone. Macro- and microseismic interpretation can be useful for accurate well placement in the lower Barnett through velocity modeling and depth conversion, aligning the well path to major stress orientation through the analysis of velocity anisotropy, seismic curves and microseismic data, and avoiding fracture collapse chimneys, Fig. 5.1

With continuing low gas prices, several Barnett operators are now targeting the oil window in the northwest portion of the play in Clay, Montague, Cooke and Jack Counties, which is associated with energy density values greater than 1.4 Btu/Mcfe.2 DRILLING ACTIVITY Since the 1950s, operators have been producing oil and gas from sandstone formations in the Strawn sand, the Caddo limestone and conglomerate, and fractured portions of the Marble Falls and Forestberg limestones. Shale drilling began in 1982 at the insistence of George Mitchell, and the play took off in 2002 when Devon Energy acquired Mitchell Energy at a price of $3.1 billion. Shale gas drilling peaked in 2008 with an average of 190 rigs. As a result of lower gas prices, the drilling activity dropped to a low of 61 rigs in September 2009. Through the first half of 2010, the rig count has recovered to an average of about 80 rigs, Fig. 6. The current drilling activity is focused in Tarrant, Johnson and Wise Counties.

PRODUCTION ACTIVITY Barnett Shale wells experience the high initial production (IP) rates and rapid decline profiles that are common to most shale plays, Fig. 7. Multistage fracturing is the key for generating high production rates. Some operators have conducted as many as 43 stages. Simultaneous fracing is also being used to frac two wellbores at the same time. Some operators are also turning to re-fracing to enhance recovery from a previously produced well. Fracturing fluid is primarily slickwater with gel added to create a viscous flow. A variety of proppants are in use, including sand particles of different sizes, fibers, rock salt and starch flakes. Low-weight resin-coated proppants may be used for stimulation treatment under high-pressure/high-temperature conditions.

COMPANY OPERATIONS The Barnett Shale’s leading operators are continuing their exploration and production operations at a steady pace. Some operators have shifted their attention to the other shale plays. A few others, such as EOG, are concentrating their activities on the oil window to improve their rate of return by producing higher-priced oil and gas condensates. Devon Energy announced its strategic plan in November 2009 to reposition itself as an onshore North American exploration and production company. As such, the Barnett Shale is a major component of Devon’s activities, as it has been since the acquisition of Mitchell Energy. Devon is the Barnett’s leading producer with 1.1-Bcfed net production through 4,300 wells. Devon has 510,000 leased acres in the primary area and additional net acres in the outlying emerging areas at a low average cost of $2,800 per acre. Devon is capable of processing 750 MMcfd of gas and owns 3,000 mi of gathering pipelines. Chesapeake Energy entered the Barnett Shale in 2004 following the success of Hallwood Energy, which was drilling near Cleburne, Texas. Chesapeake acquired Hallwood’s assets in late 2004 and 2005. Currently, Chesapeake is the Barnett Shale’s second-largest producer, most active driller and largest leasehold owner in Tarrant and Johnson Counties. The company is producing 530 MMcfed and anticipates drilling 275 net wells in 2010 with an average of 24 rigs. The company estimates 2.8 Tcfe of unproved reserves across its 305,000 acres of leased properties. EOG Resources has a 125,000 net acres under lease in what it calls its Barnett “combo/core” area with a resource potential of 370 million boe. In the combo area, which has a greater NGL component, a recent horizontal well was producing 1,800 bopd and 4 MMcfd. Due to higher revenue potential, the company is shifting its drilling and production strategy to the increased production of oil and condensates. In Montague County, EOG has produced about 500 bopd. During 2010, the company plans drill about 120 vertical and about 125 horizontal wells in the oil area. XTO entered the Barnett Shale play in 2004 with a small acquisition and currently holds about 280,000 net acres, of which about 55% is located in the core area. The Dallas City Council approved a lease to XTO and Trinity East Energy in 2008 and received a total signing bonus payment of about $34 million. The leased acreage includes five city-owned tracts on Dallas’ west side, with the largest tract at the Love Field airport. In July, XTO requested a permit to drill on the city acreage. Range Resources is producing 120 MMcfed net during 2010 and has 1.3 Tcf of unbooked potential. The company is focusing on drilling about 900 locations in its core areas in Tarrant, Denton and northwest Ellis Counties using one or two rigs for the remainder of 2010. Quicksilver Resources has 162,000 leased acres in the Barnett Shale core area and produces 250 MMcfd. Quicksilver is currently running three rigs to develop its Alliance and Lake Arlington projects. Further south, an additional rig is exploring a shale area that has oil and condensate prospects. In 2009, Quicksilver partnered with Italian operator Eni to secure $280 million in cash for debt reduction and to expedite development of its Barnett Shale properties, which account for most of its production. ConocoPhillips has 110,000 leased acres in the Barnett and limited production. The company has shifted its resources to the Bakken and Eagle Ford Shales and has not budgeted capital expenditure for drilling activity in the Barnett during 2010. Carrizo Oil & Gas currently produces 88 MMcfed and has planned drilling operations in 2010 using three rigs. A large portion of its 52,000 leased acres, with proved reserves of 570 Bcfe, is in the Barnett core area. The operator has 29 additional net wells waiting for frac and connections with an average IP rate of 68 MMcfed. Williams produces 62 MMcfed net and has 34,000 net acres. The operator is using four rigs to drill development wells primarily in southern Denton County to fulfill its lease obligations. Williams has more than 20 wells waiting on completion and connection. Topaz Resources has about 1,850 gross acres in the core area in Wise and Denton Counties producing dry gas and 950 gross acres in the oil window in Montague County. Topaz has drilled several vertical wells with IP rates of 100–200 bopd and 200–350 Mcfd. In its fields, the company expects properly stimulated vertical wells to ultimately produce up to 75,000–150,000 bbl of oil and 0.25 Bcf of gas. Topaz is planning to drill one to three additional wells in 2010 to exploit these resources. MERGERS AND ACQUISITIONS Numerous small players were acquired during the 1990s by US independents as the Barnett Shale play took off. On the other hand, recent M&A activity is driven by multinationals partnering with the independents to develop shale expertise, possibly to develop shale resources internationally. ExxonMobil and XTO. In December 2009, ExxonMobil announced its acquisition of XTO in a $41 billion transaction. In a conference call with the Fort Worth Star-Telegram in early July, ExxonMobil CEO Rex Tillerson said XTO’s 3,300 employees would be retained and XTO’s headquarters in Fort Worth would become the company’s center for unconventional gas operations. ExxonMobil is planning to use XTO’s expertise in producing unconventional gas in Exxon’s 4.77 million acres of holdings in Canada, Europe, Indonesia and Argentina. Total and Chesapeake. In January 2010, Total made a $2.25 billion deal to acquire a 25% interest in Chesapeake’s Barnett Shale assets. The French major paid Chesapeake $800 million in cash at the closing. Additionally, between April 2010 and the end of 2012, Total will pay 60% of Chesapeake’s drilling costs, equivalent to $1.45 billion. ENVIRONMENTAL ISSUES A significant range of environmental issues have cropped up in the Barnett Shale region. These issues include possible effects of drilling and production on drinking water, air quality and even earthquakes. Drinking water. A typical well in the Barnett Shale uses about 3 million gallons of water for drilling and completion. Operators depend upon a variety of sources, including surface water, Brazos or Trinity River water, and stock tanks or ponds. Nevertheless, shale operators are relatively small consumers of local water. According to a 2007 study by the Tarrant Regional Water District, of the 131 billion gallons of water sold by the district in 2006, only 0.19% was used for fracturing operations. In 2006, 16 operators in the shale play formed the Barnett Shale Water Conservation and Management Committee to apply best practices for water use. Among the developments resulting from committee discussions is the use of mobile water purification units for treating produced water for reuse. On July 13, the US Environmental Protection Agency (EPA) held in Fort Worth its first of four public hearings regarding a proposed study of hydraulic fracturing. About 600 people attended the hearing to witness more than 80 anti-drilling activists and industry representatives make opposing arguments. Earthquakes. A team of researchers from the University of Texas at Austin and Southern Methodist University conducted a study on possible causes for a series of small earthquakes that occurred near DFW Airport from October 2008 to May 2009. The study concluded that there may be some correlation but no direct causal relationship between produced water injection operations and earthquakes. Air quality. There have been numerous public meetings in the region regarding possible benzene exposure due to shale operations. The Texas Commission on Environmental Quality has installed monitors near Eagle Mountain Lake and in Denton County. Thus far, the benzene levels have been below any health risk. Fracturing regulations. Legislative efforts are underway in the US Congress to force operators to reveal the chemical composition of fracturing fluids. To forestall such federal regulation of fracturing, Range Resources announced on July 16 that it will release the information on a well-by-well basis. Chesapeake is planning to adopt a similar disclosure policy. The Independent Petroleum Association of America (IPAA) is leading an industry effort toward more open disclosure. TECHNOLOGY DEVELOPMENTS Operators and service companies are making concerted efforts to improve the efficiency of shale drilling and production operations through the development of best practices and applying technology advancements. Extended reach drilling. One of the keys to prolific shale production is to drill long laterals. Weatherford helped Quicksilver Resources drill extended laterals more efficiently through its HyperLine drilling motors and associated HyperPulse MWD and gamma ray technologies. For a well in April, Quicksilver was able to drill 6,294 ft from the toe to the heel of the lateral in 38.1 drilling hours with an average ROP of 165 ft per hour. Another extended run took place in March when the operator drilled a 6,172-ft lateral in 36.3 drilling hours at an average ROP of 170 ft per hour. Real-time microseismic fracture monitoring. Schlumberger’s StimMap Live service involves the lowering of geophones into a nearby well to acquire acoustic data from microseismic events associated with a hydraulic fracturing operation. The real-time 3D data is transmitted to the operator’s offices to help staff engineers modify fracturing strategies as the job progresses. Recently, the service was used by Devon Energy during the re-frac of a well to improve reservoir contact. The well was then re-stimulated using fiber diversion media to divert the re-treatment from the original fractures and into sections of the reservoir that had not previously been stimulated. The engineers were able to make treatment changes on the fly. The combination of the two techniques resulted in a 400% improvement in production rate over the initial completion. Payout for the re-stimulation job was achieved in about 60 days. The ultimate recovery improved by 20%. FUTURE PROSPECTS As first US shale gas play, the Barnett has experienced initial euphoria, frenzied drilling and production activity, recessionary slowdown and, now, environmental strife. How the country balances the competing interests will be played out here over the upcoming years and decades.

LITERATURE CITED 1 Roth, M. and A. Thompson, “Fracture interpretation in the Barnett Shale using macro and microseismic data,” adapted from oral presentation at AAPG Annual Convention in Denver, Colorado, June 7–10, 2009.

|

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- U.S. producing gas wells increase despite low prices (February 2024)

- U.S. drilling: More of the same expected (February 2024)

- U.S. oil and natural gas production hits record highs (February 2024)

- U.S. upstream muddles along, with an eye toward 2024 (September 2023)

- Canada's upstream soldiers on despite governmental interference (September 2023)